ZoomInfo $ZI 2Q21 Earnings

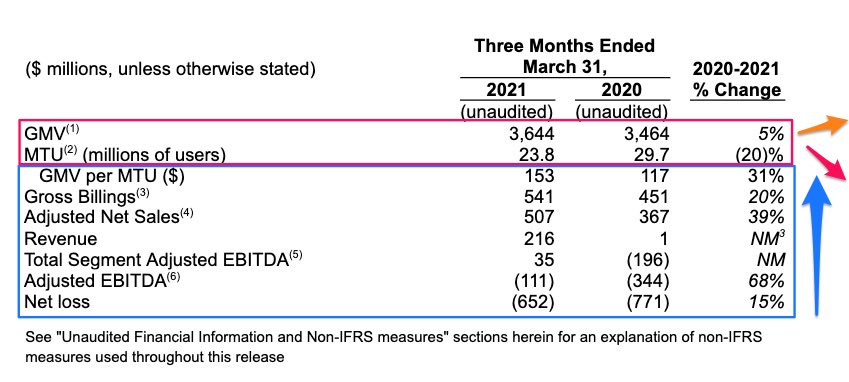

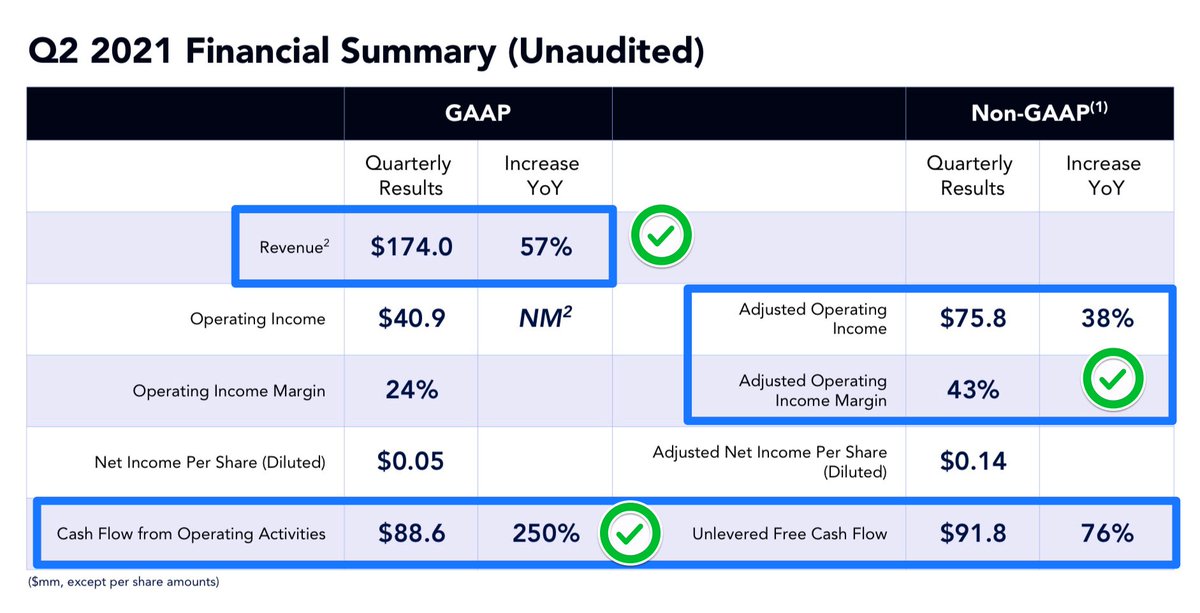

- Rev $174m +57% ↗️

- Gross Profit $144m +87% 🚀

- NG EBIT $76m +43% ↗️ margin 44% -603bps ↘️

- NG Net Income $56m +109% 🚀 margin 32% +807bps ✅

- OCF $89m +250% 🚀 margin 51%⭐️ +2810bps ✅

- FCF $92m +76% 🚀 margin 53%⭐️ +569bps ✅

- RPO >$1.1b

- Rev $174m +57% ↗️

- Gross Profit $144m +87% 🚀

- NG EBIT $76m +43% ↗️ margin 44% -603bps ↘️

- NG Net Income $56m +109% 🚀 margin 32% +807bps ✅

- OCF $89m +250% 🚀 margin 51%⭐️ +2810bps ✅

- FCF $92m +76% 🚀 margin 53%⭐️ +569bps ✅

- RPO >$1.1b

➡️ "ZoomInfo delivered another record quarter, including the highest levels ever for both retention activity and customer engagement, and accelerating revenue growth, as customers in all industries continue to choose ZoomInfo to transform their go-to-market motion.”

➡️ “ZoomInfo is the only company delivering a modern go-to-market platform that brings together best-in-class intelligence with comprehensive data management, workflow, and engagement software.”

Final Thoughts on ZoomInfo $ZI:

➡️ Early stage in large & growing opportunity, with strong business model solving a still inefficient problem of sales & marketing, delivering growth & profitability at scale.

➡️ Early stage in large & growing opportunity, with strong business model solving a still inefficient problem of sales & marketing, delivering growth & profitability at scale.

• • •

Missing some Tweet in this thread? You can try to

force a refresh