As promised, here is PART 1 of my }#BTC price target thread. This thread is for my BASE CASE price target for #BTC on this #bull market. It is a time based, condition based target, which blends multiple forms of analysis. Think of it as a moving target.

Thread:

👇👇👇

Thread:

👇👇👇

Disclosure: this is my opinion. This is not financial advice, DYOR. I am keeping my proprietary methods private, as I have spent years researching and refining my analysis. Thank you for understanding. With that said, let’s jump in.

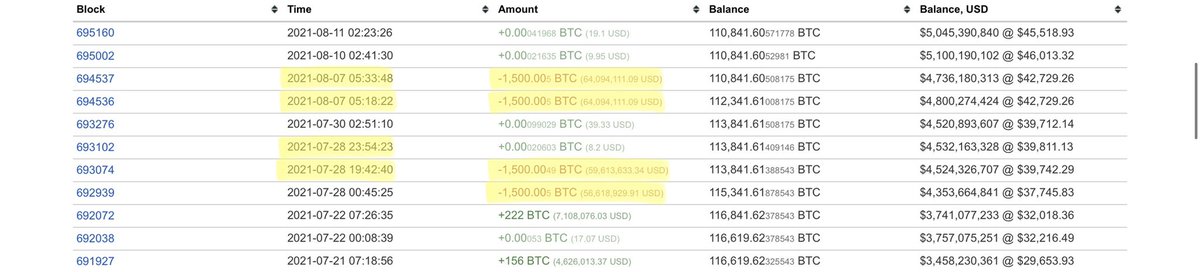

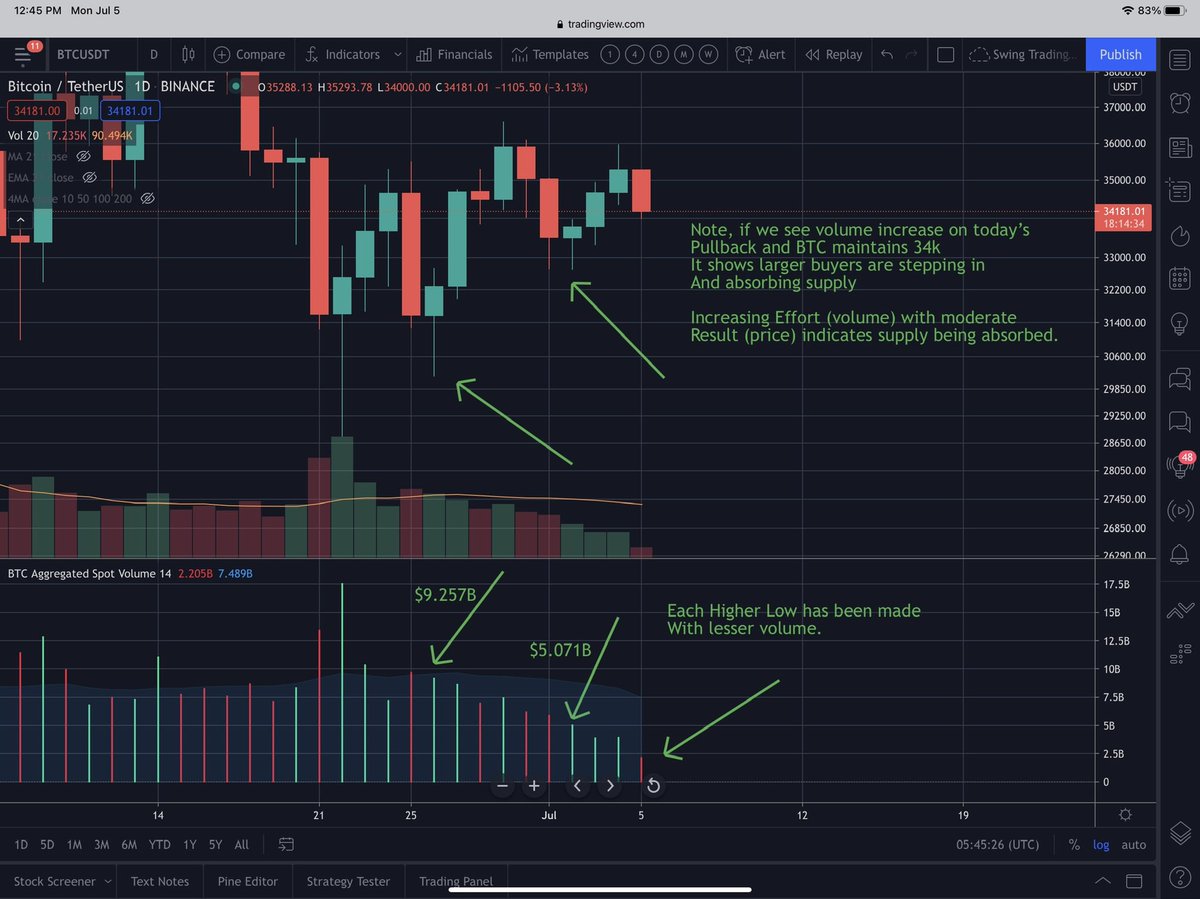

I use a variety of technical indicators and have my own proprietary methods to chart out highly confluent technical targets to the upside. I also apply sentiment indicators and onchain to help identify signals of euphoria and incoming selling pressure.

This is heavily condition based, so if there’s major sell signals flashing Onchain, and BTC is at or near my confluent technical targets to the upside, the probability of a top increases.

My BASE CASE target: $96k by December 2021. Given the supply shock continues and there is no major onchain sell signals flashing when BTC is testing ATHs, I can see BTC reaching my base case scenario of 96k by late December 2021.

If BTC peaks earlier in December, the target could be in the lower 90s. This is just my base case estimate.

This is a very conservative estimate in my opinion. I do think its possible the bull market extends into Q1 or Q2 2022 given the longer than expected consolidation and ongoing recovery process for BTC.

If the bull market extends in to early 2022, my base case can reach the next highly confluent targets between 110k to 115k.

The base case targets give BTC a total market cap of $2 trillion to $2.4 trillion dollars, which I think is reasonable.

Hint, this is not the scenario I am expecting. I am much more #bullish. My next thread will cover my BULL CASE price targets using the same form on analysis. You don’t want to miss the next post.

Call me a bear, I don’t care. I think BTC is going to $500k to $1,000,000 this decade. I’m just analyzing this particular cycle, using all the data I can possibly find.

If you enjoy my analysis, make sure to share it with the community, and make sure to follow me for more updates!

• • •

Missing some Tweet in this thread? You can try to

force a refresh