This year marks the 50th anniversary since Nixon suspended the convertibility of the USD into Gold.

This began the era of global fiat money debt-fueled economy.

Since then, crises are more frequent but also shorter and always "solved" by adding more debt and printing.

This began the era of global fiat money debt-fueled economy.

Since then, crises are more frequent but also shorter and always "solved" by adding more debt and printing.

Since the end of the gold standard, massive debt build and risk-taking have made financial crises more frequent albeit shorter.

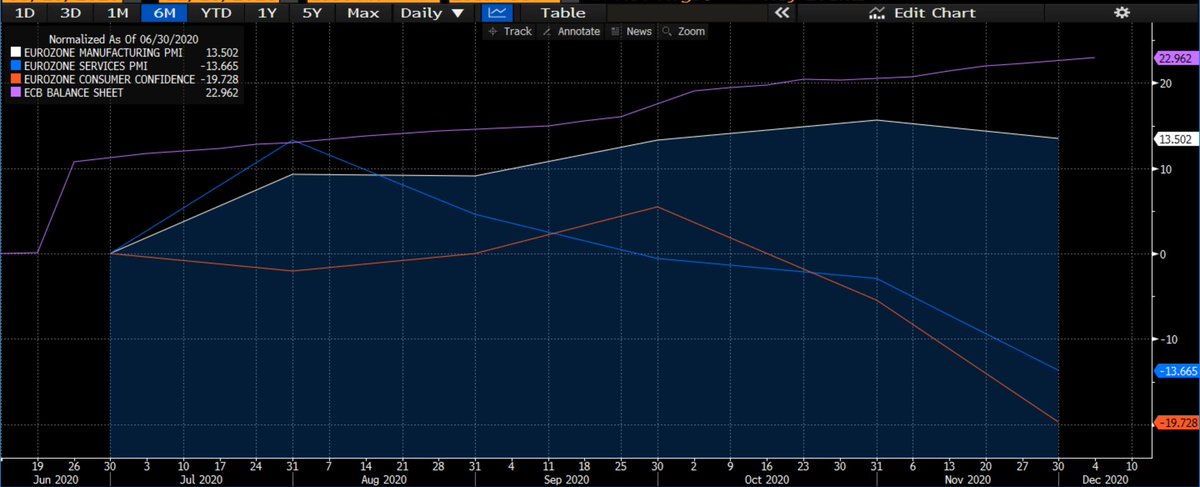

The balance sheet of central banks has soared to unimaginable levels, disguising risk but not eliminating it.

Interest rates have been artificially depressed and more countries implement negative rate policies and financial repression measures.

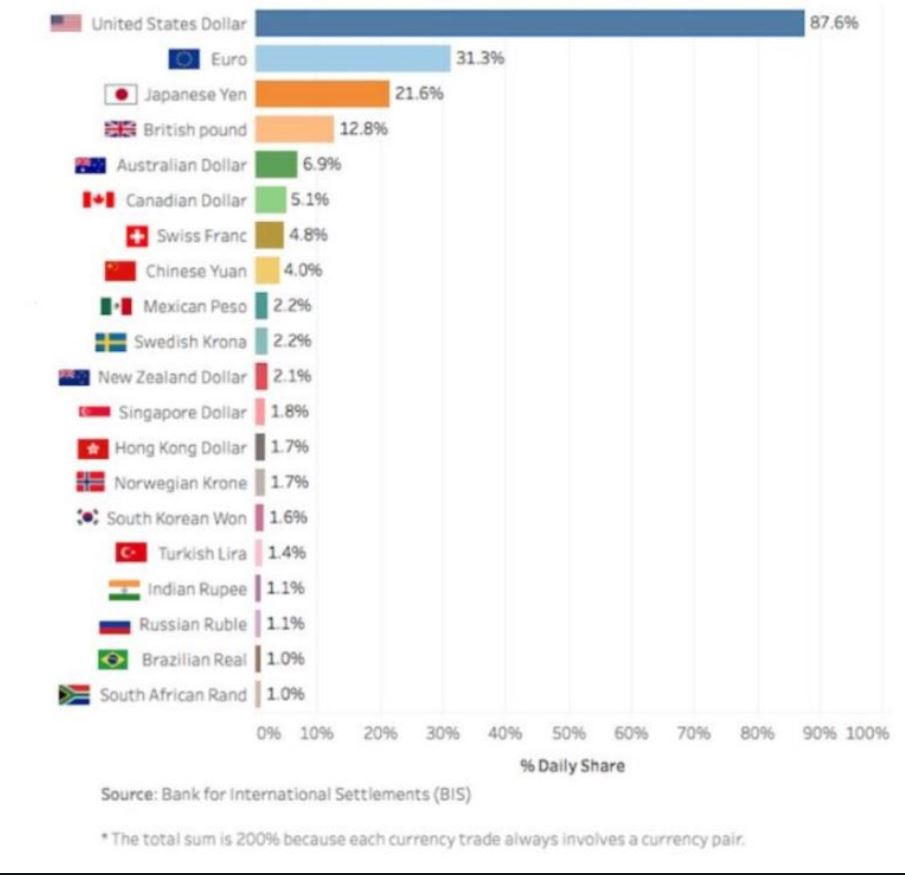

The suspension of the gold standard was a catalyst to trigger credit expansion and cement the position of the US dollar as the world's reserve currency that de facto substituted gold as the reserve of the main central banks.

The gold standard was a limit to the monetary and fiscal voracity of the states, and breaking it brought more indebtedness and the perverse incentive of the states to pass on the current imbalances to future generations.

• • •

Missing some Tweet in this thread? You can try to

force a refresh