THE INTERPRETATION OF 364% UPSIDE⁉️

$LUNA surged by 364% since the JUNE Dip while $BTC only recovered 44%⁉️ Does it simply follow the move of #BTC or $LUNA experience market correction👀

Check out the thread below🔥

@terra_money $LUNA #TERRA $UST $ANC $MIR @stablekwon #crypto

$LUNA surged by 364% since the JUNE Dip while $BTC only recovered 44%⁉️ Does it simply follow the move of #BTC or $LUNA experience market correction👀

Check out the thread below🔥

@terra_money $LUNA #TERRA $UST $ANC $MIR @stablekwon #crypto

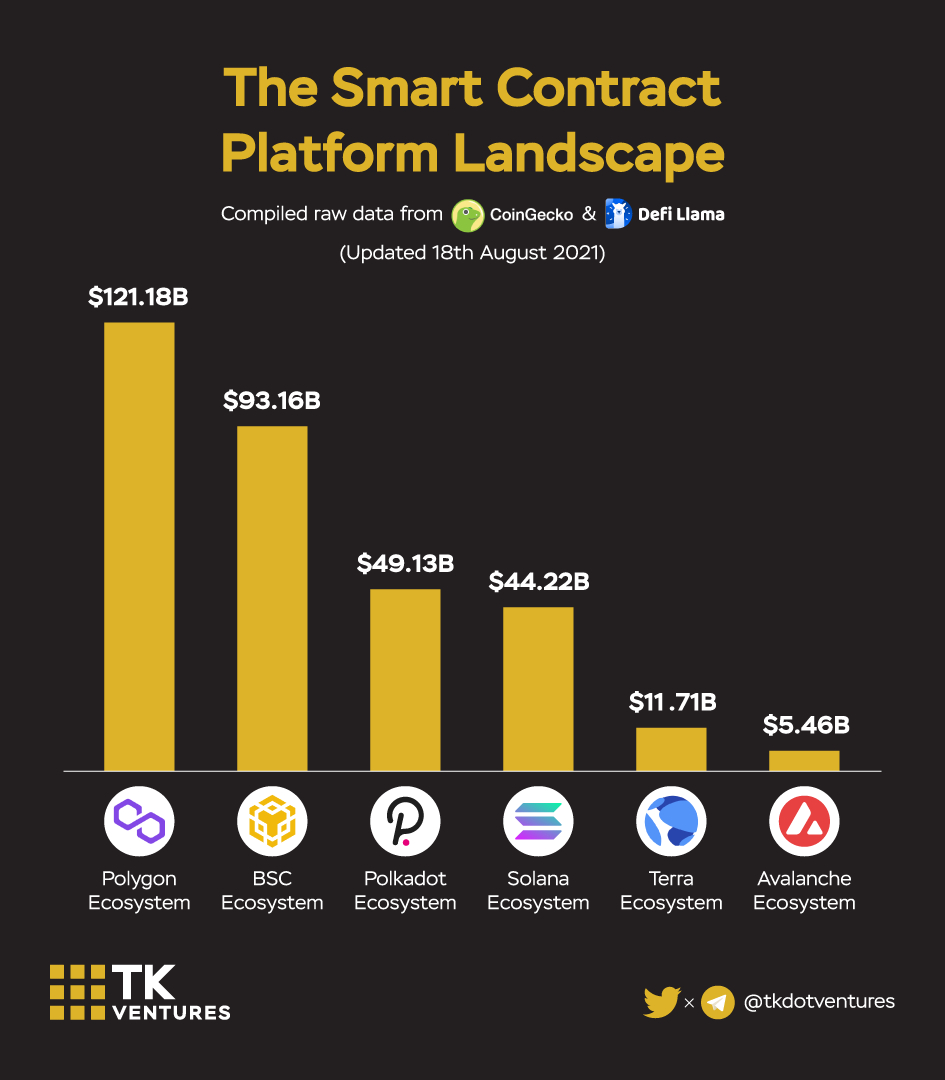

@terra_money @stablekwon 1/ In term of macro view, $LUNA surged by 364% after the June dip which just broke ATH in last Monday, while from the general perspective, Terra ecosystem is now $11.7M.

@terra_money @stablekwon 1.1/ Operated in the last six months, its TVL accounted for 3.6% and just surpassed the phenomena layer 2 Polygon to take the third place whereas other competitors launching in the same period found it difficult to attract capital flowed in their ecosystem.

@terra_money @stablekwon 2/ Terra ecosystem encapsulates three primary foundations to operate the whole ecosystem, and capture value for $LUNA as well, in other words, the business model refers to the closed cycle.

@terra_money @stablekwon 3.1/ Terra is roughly different to other blockchains, the on-chain activity of Terra basically depends on three main foundations: stablecoin (UST), synthetic (Mirror Protocol) & Lending/Borrowing (Anchor). Particularly, algorithmic stablecoin UST is directly associated with...

@terra_money @stablekwon 3.2/ Luna through the arbitrary motive, contraction & seigniorage (monetary policy). Therefore, accompanied by the illustration in the diagram and the historical growth of user adoption, the UST supply has to grow to meet the needs of users. Under the forecasted growth...

@terra_money @stablekwon 3.3/ ... of stablecoin industry, UST supply will seemingly grow at 70% CAGR (RBF Capital 2021) associated with the decrease in LUNA supply, thus, scarcity takes place which experiences the surge in LUNA price. In other words, stable coin demand-supply increases, result, LUNA gain

@terra_money @stablekwon 4/ If users want to pay merchants by UST, they have to use the customized off-chain payment like Chai, a native built application where the total CHAI users are now more than 2.4M whereas the Korean daily payment reached more than KRW 1.7B (~$74K) (Chai 2021)

@terra_money @stablekwon 5.1/ Furthermore, with the goal of building an on-chain ecosystem, the Terra ecosystem gradually evolved with more than 50 Dapps now operating. The bridge to other ecosystems as wormhole v2 will seamlessly bring tremendous capital flow to the Terra ecosystem and UST as well.

@terra_money @stablekwon 5.2/ Besides the native main players in synthetics & L&B sectors, the ecosystem has shifted their focus in the missing pieces as DEX named out a few potential upcoming projects as Loop Finance, Astroport (DEX).

@terra_money @stablekwon 5.3/ Terra ecosystem will be even more explosive when dynamic DEX is finished which opens the gateway for the upper layers such as asset management & yield aggregator, tracker tools or even, native insurance protocol.

@terra_money @stablekwon 6.1/ Mentioning about the ecosystem, following the July bull run, Terra’s TVL has surged dramatically by 55% compared to April ATH accompanied by the 364% $LUNA rise. Taking a closer look, the market share LIDO sharply narrowed when Terraform Lab launched Mirror & Anchor.

@terra_money @stablekwon 6.2/ While in the recent period, under the capital injection package from Terraformlab, Anchor expand its share more than ever which becomes the top protocol by highest TVL due to the recent launch of bETH on Anchor which allows ETH stakers in Lido ...

@terra_money @stablekwon 6.3/ ...can now convert their stETH to receive bETH, and collateralize bETH in Anchor. Just a quick note, the market size of stETH in Lido Finance is 765k worth $2.5B.

@terra_money @stablekwon 7.1/ Terraform Lab did build Mirror Protocol as synthetic to mimic the price index of real-world assets which acted as the vital element to bridge the real world’s assets to the blockchain.

@terra_money @stablekwon 7.2/ To meet the goal of raising the demand for UST, issuers are forced to lock up >150% current asset value in Terra stablecoins or collateral Luna asset as collateral, as usual, if the value rises above the collateralization threshold, the position will be liquidated.

@terra_money @stablekwon 8.1/ Beyond the general volatile money market, Anchor was introduced to be a stable saving protocol on the Terra ecosystem that offers yield powered by yield-generating assets. Acting as the leader in the ecosystem that accounted for a large portion of UST supply & maintaining...

@terra_money @stablekwon 8.2/.. APY, Terraform Labs continuously supports the protocol by recent UST 70M capitalizing in the stability reserve fund (Anchor twitter 2021). In July, Anchor announced a partnership with InsurAce Protocol to provide crypto insurance among users in order for risk hedging

@terra_money @stablekwon 9/ What’s next for Terra? The complete $150M fundraising from prestigious investors to fuel the DEFI space ecosystem boost Terra even further under the name of “Ecosystem Fund” which help to accelerate the growth through various hackathons...

@terra_money @stablekwon 9.2/ ...The arrays of new Dapps are ready to launch, Orion Money, the big name in DeFi Connected Hackathon officially launched Private Farm Orion to IFO its token & Starterra also plan to launch their token $STT, while ecosystem fund is waiting for bootstrapping potential player

@terra_money @stablekwon 10/ Lastword: There are numerous exciting things to cover about Terra, but we believe that we cover three major foundations to explain the extraordinary rise of $LUNA. The thread is limited, but the potential of terra is limitless. What do you think about massive gain of $LUNA?

@terra_money @stablekwon Disclaimer: The analysis toward the ecosystem is our POV and must not be considered as advice, please invest at your own risk.

• • •

Missing some Tweet in this thread? You can try to

force a refresh