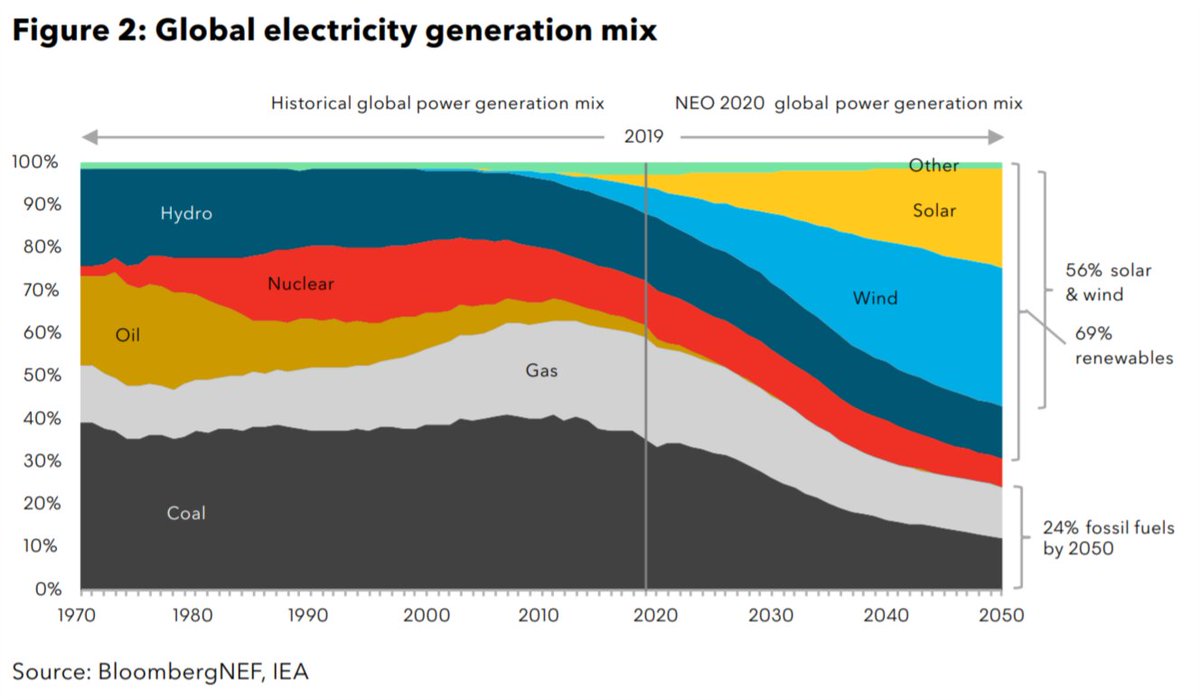

It’s important to remember that from a climate perspective, nuclear and renewables are not in competition. There will be enough growth in electricity demand to support significant expansion of every zero-carbon power generation technology. bloomberg.com/news/articles/…

Nuclear could even wind up being essential to deep decarbonization in other sectors. One @BloombergNEF scenario for 0-carbon 2050 features massive deployment of modular nuclear reactors designed to complement wind, solar, and battery tech bloomberg.com/news/articles/…

Still, getting nuclear power back on the growth curve is a decade-long process. The best time to have done it would have been 10 (or 20) years ago. The second-best time is right now. bloomberg.com/news/articles/…

We should hope that the two lines on this nuclear and renewables power generation chart get closer again. We would all be better off for it. bloomberg.com/news/articles/…

• • •

Missing some Tweet in this thread? You can try to

force a refresh