1/X AUGUST 23, 2021.

PRE NY CLOSE BRIEF:.

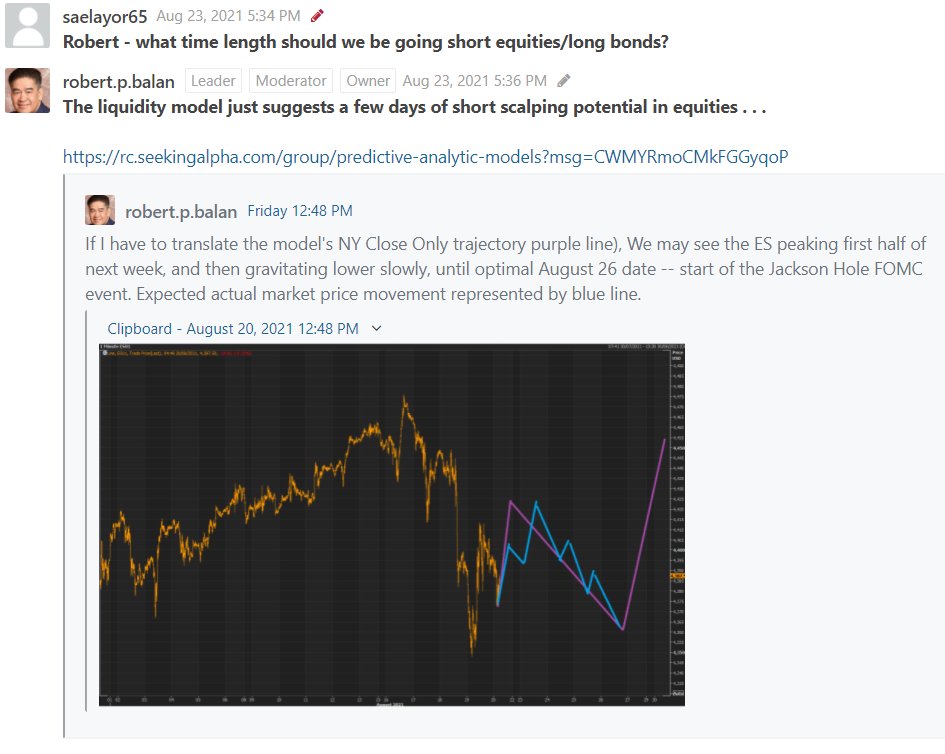

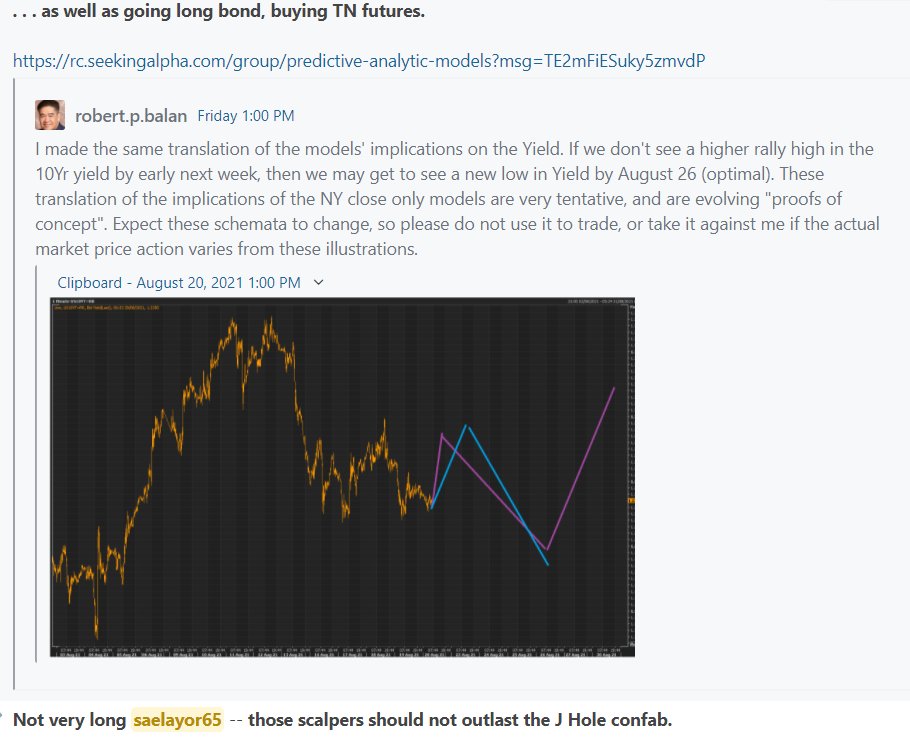

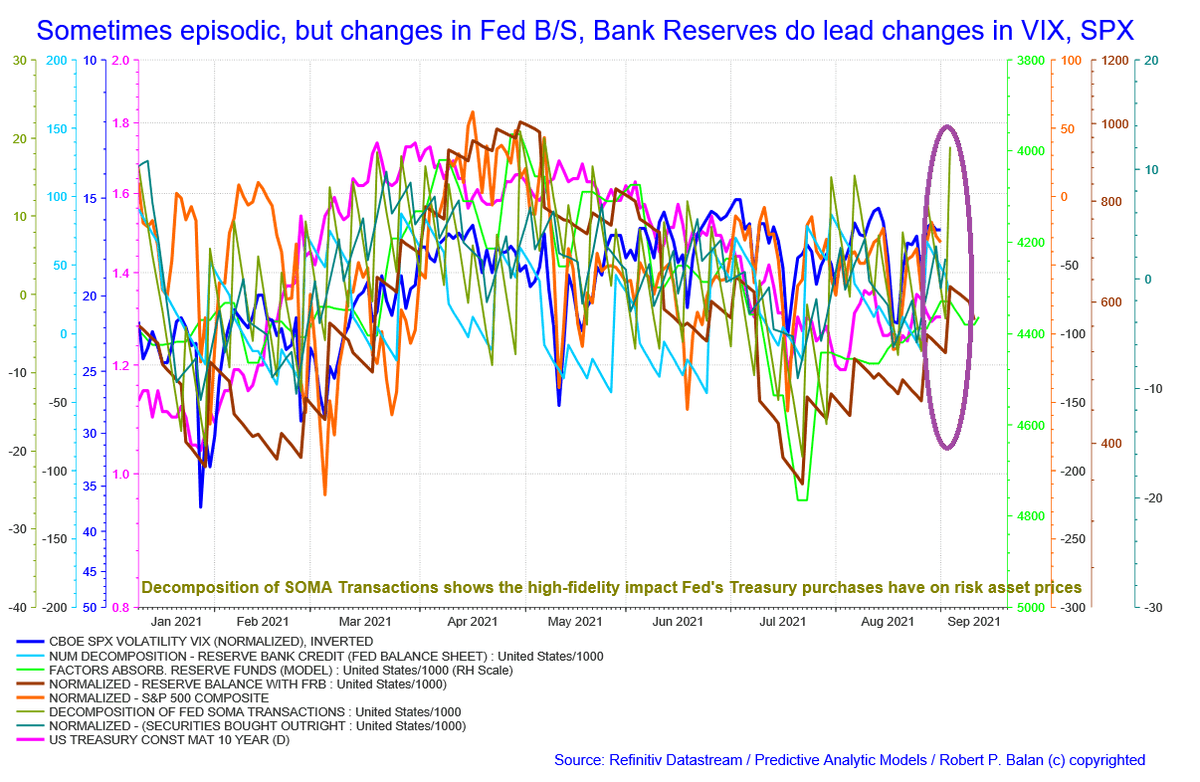

The Bond Yield Rally Missing One Final Uptick Before Move Lower Into J Hole Event; Equity Futures May Therefore Make One Final Uptick Into Late Europe Session Tuesday

Article at Seeking Alpha:

seekingalpha.com/instablog/9103…

PRE NY CLOSE BRIEF:.

The Bond Yield Rally Missing One Final Uptick Before Move Lower Into J Hole Event; Equity Futures May Therefore Make One Final Uptick Into Late Europe Session Tuesday

Article at Seeking Alpha:

seekingalpha.com/instablog/9103…

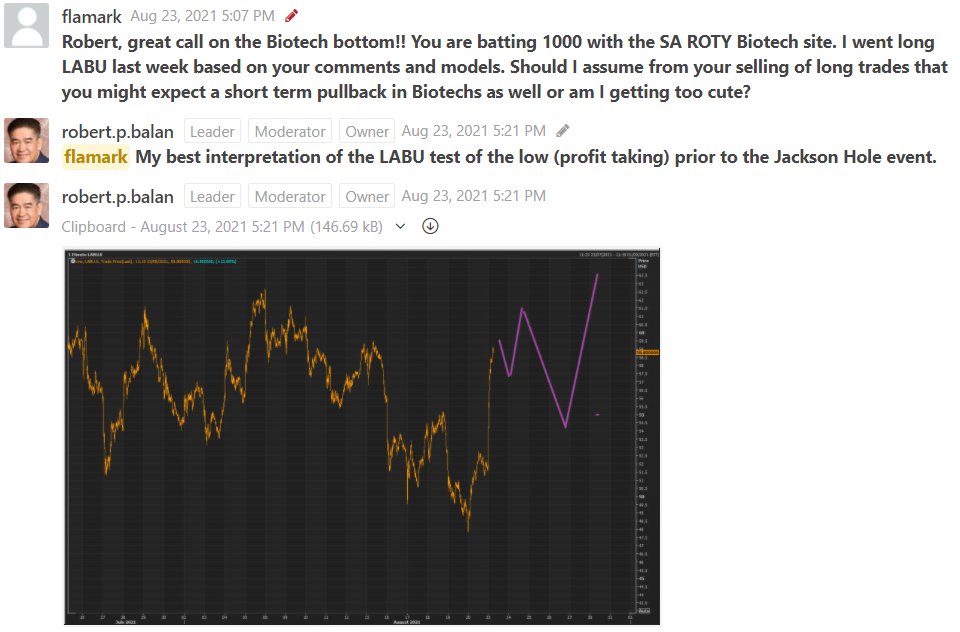

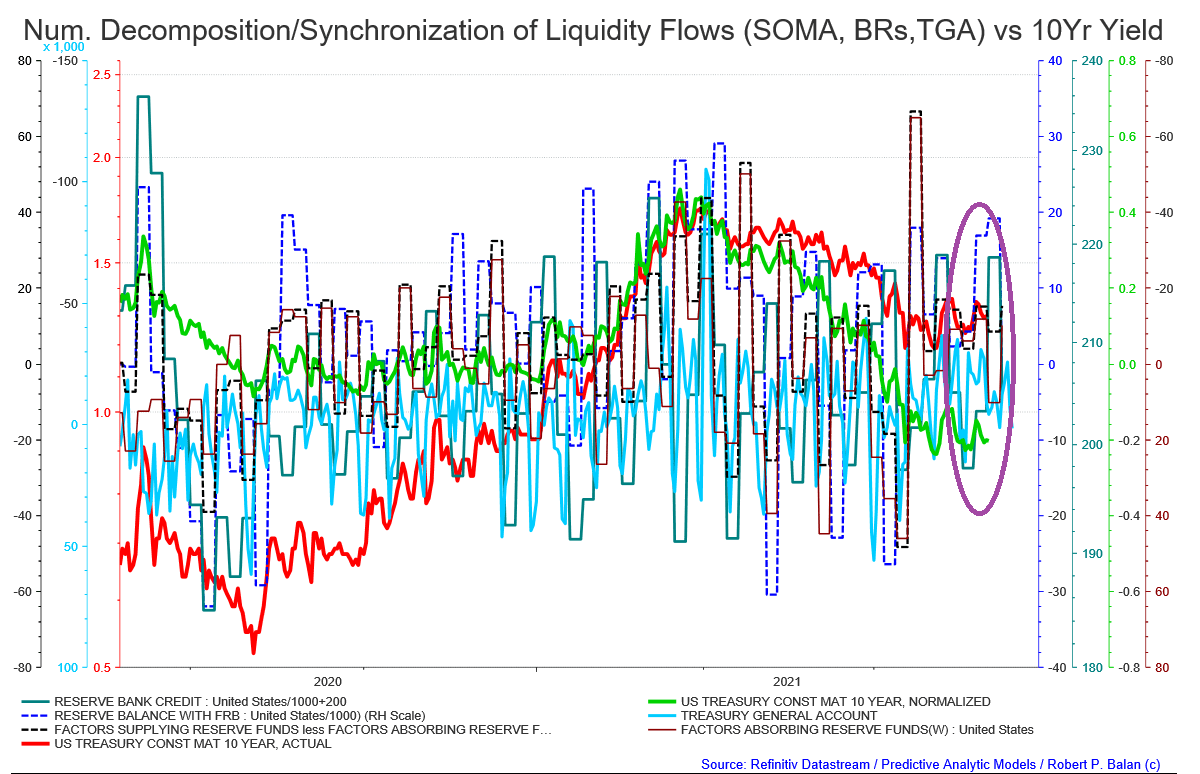

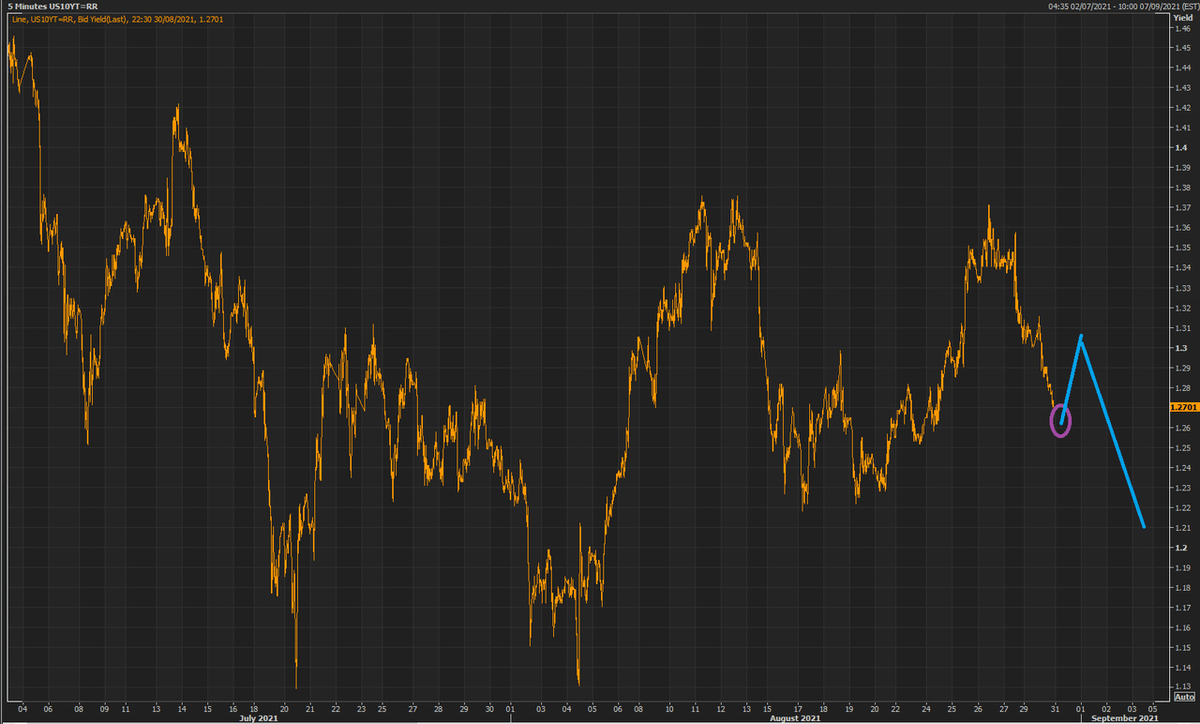

5/X There is a missing downtick in TN (uptick in the 10Yr yield cash), before yields are coming down.

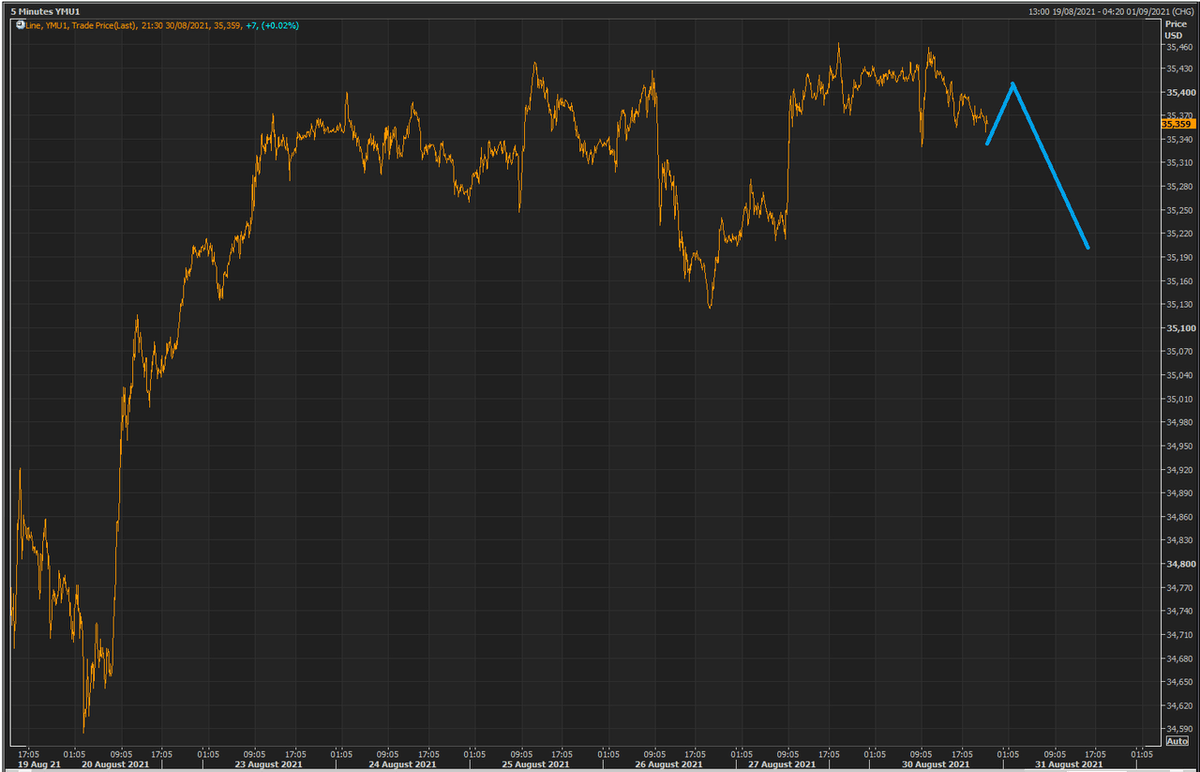

7/7 We will likely see that final uptick during Asian/Europe trade. That means if we wait for the rebound from the initial sell off after a top, we could be selling sometime during early NY session, Tuesday tomorrow.

👌 11

👌 11

8/8 Tim and I believe that breach of these lines should trigger equity selling, and bond buying (yields falling). These purple support lines correspond to important support levels for ES, YM, NQ. However, we prioritize ES, YM, and RTY. NQ tends to get a lift from falling yields.

• • •

Missing some Tweet in this thread? You can try to

force a refresh