1/X Some Implications To Equities, Yields As The US Treasury (And The Fed) Navigate Through The US Debt Ceiling

Full presentation at Seeking Alpha:

seekingalpha.com/instablog/9103…

Full presentation at Seeking Alpha:

seekingalpha.com/instablog/9103…

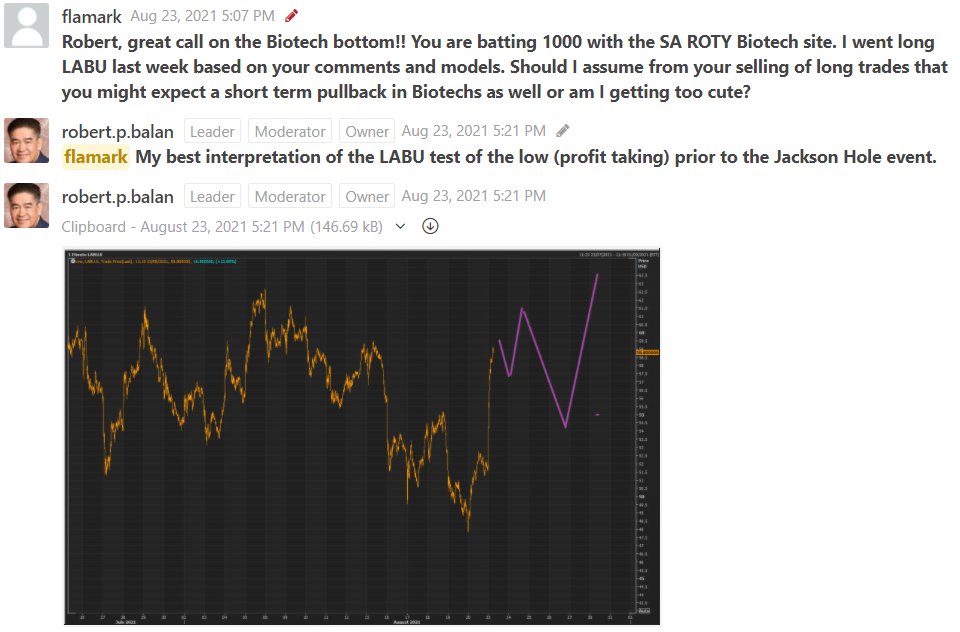

3/X My reply:

If one reads carefully Rafa -- that's adding to the TGA at circa year end. ZH calls it tightening (but they have targeted the wrong asset class) -- it is actually adding the kind of liquidity that really matters to risk assets (e.g., equities) --

If one reads carefully Rafa -- that's adding to the TGA at circa year end. ZH calls it tightening (but they have targeted the wrong asset class) -- it is actually adding the kind of liquidity that really matters to risk assets (e.g., equities) --

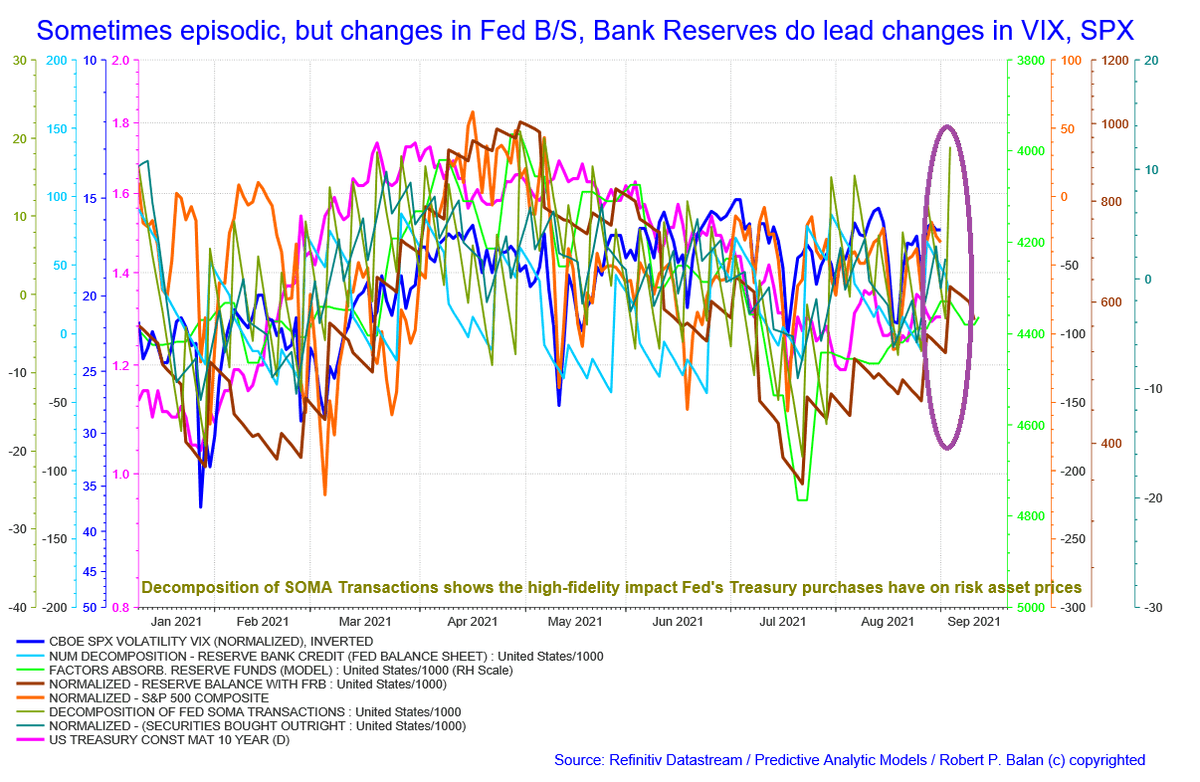

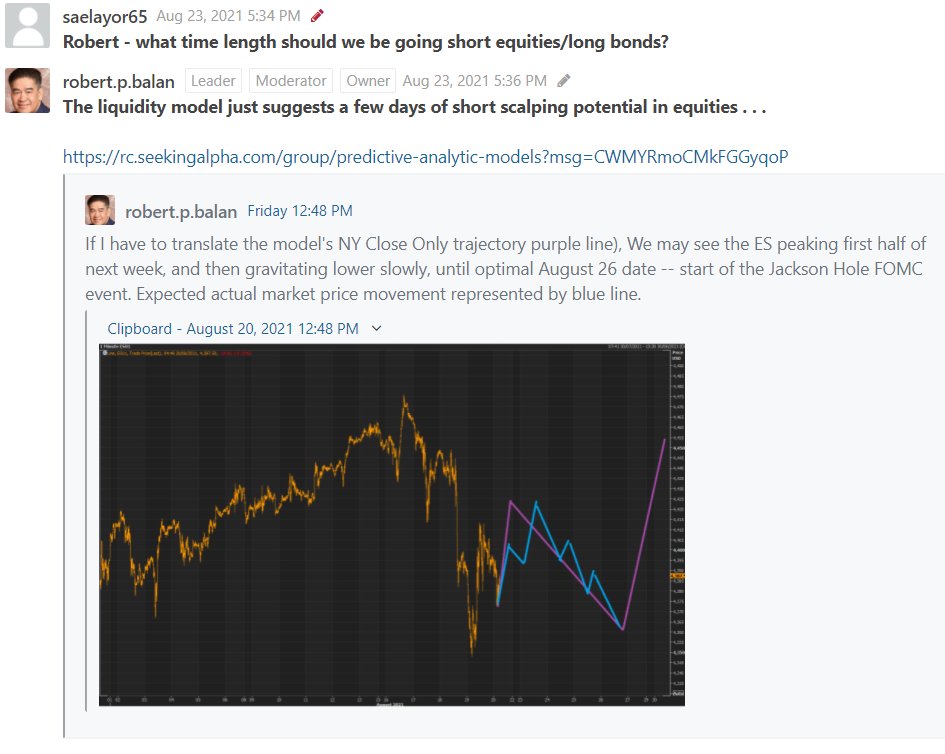

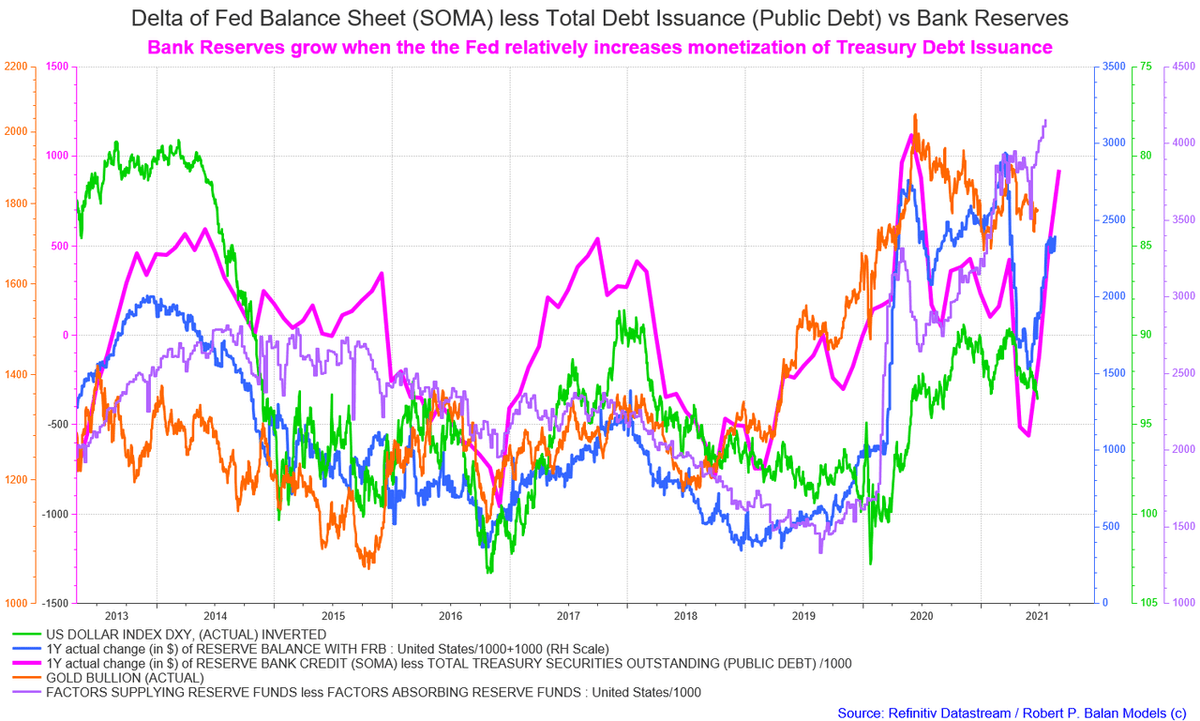

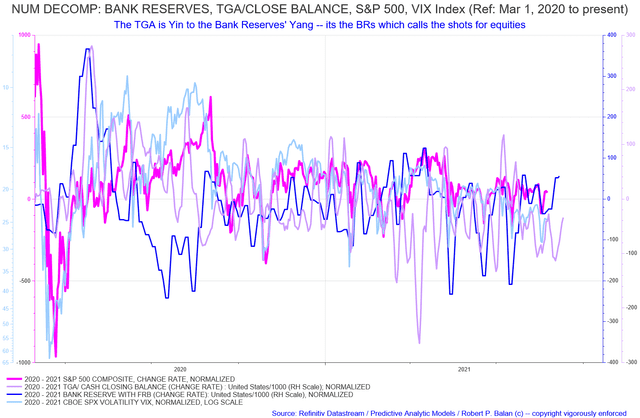

4/X --- the Bank Reserves at the FRB system. Equities hew to the changes in Bank Reserves, more than they do the changes in the TGA.

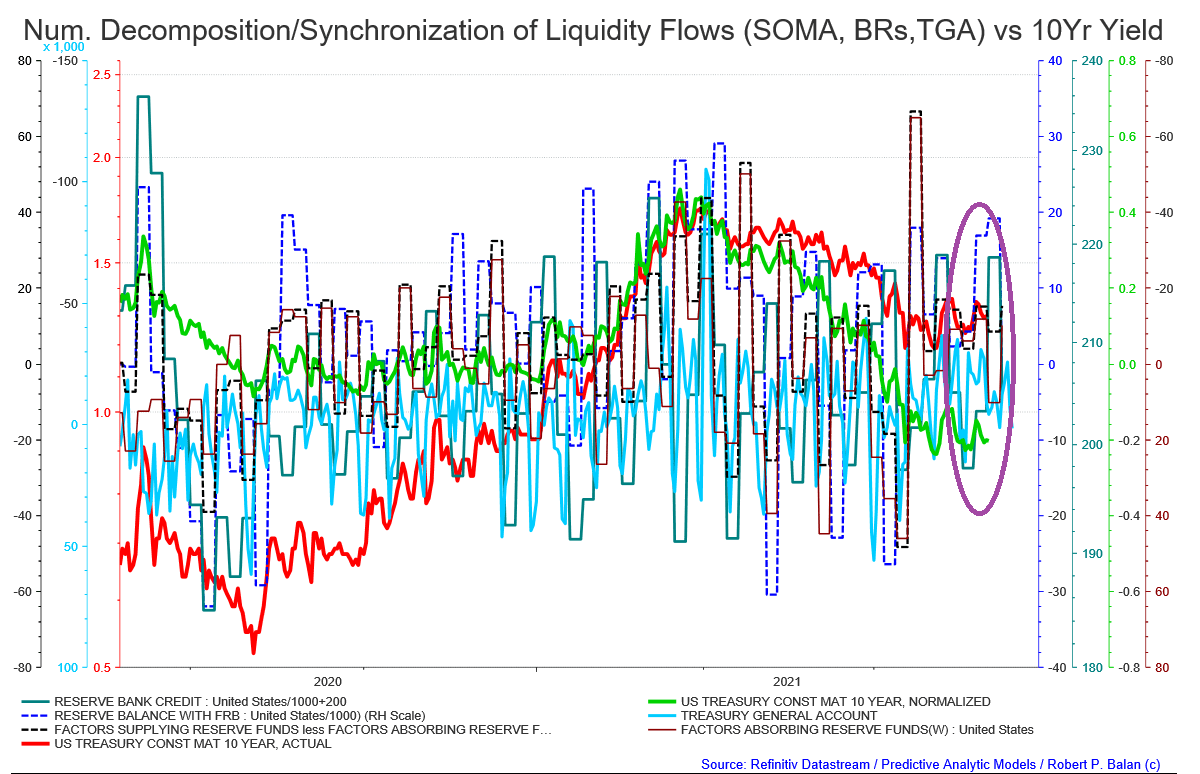

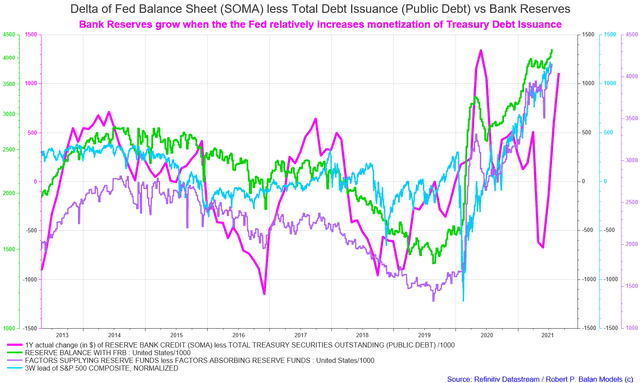

5/X Although both follow the general trend of Debt Issuance, the weekly changes in BRs and the TGA are frequently diametrically opposite, by virtue of the Fed balance sheet asset-liability framework. . .

6/X . . . The TGA sits on the Fed's balance sheet as a liability, along with Bank Reserves. ... so a drop in the TGA must see a rise in bank reserves, and vice versa.

7/X From the ZH story:.

The reason: after dropping to a post-covid low of $450 billion, the Treasury's cash balance would first drop to $300 billion, and then continue declining for the duration of the debt ceiling negotiations (which will conclude successfully at some . . .

The reason: after dropping to a post-covid low of $450 billion, the Treasury's cash balance would first drop to $300 billion, and then continue declining for the duration of the debt ceiling negotiations (which will conclude successfully at some . . .

8/X . . . in the next 2 months despite days of theatrical posturing as the US will not default) before surging to $800 billion by year end.

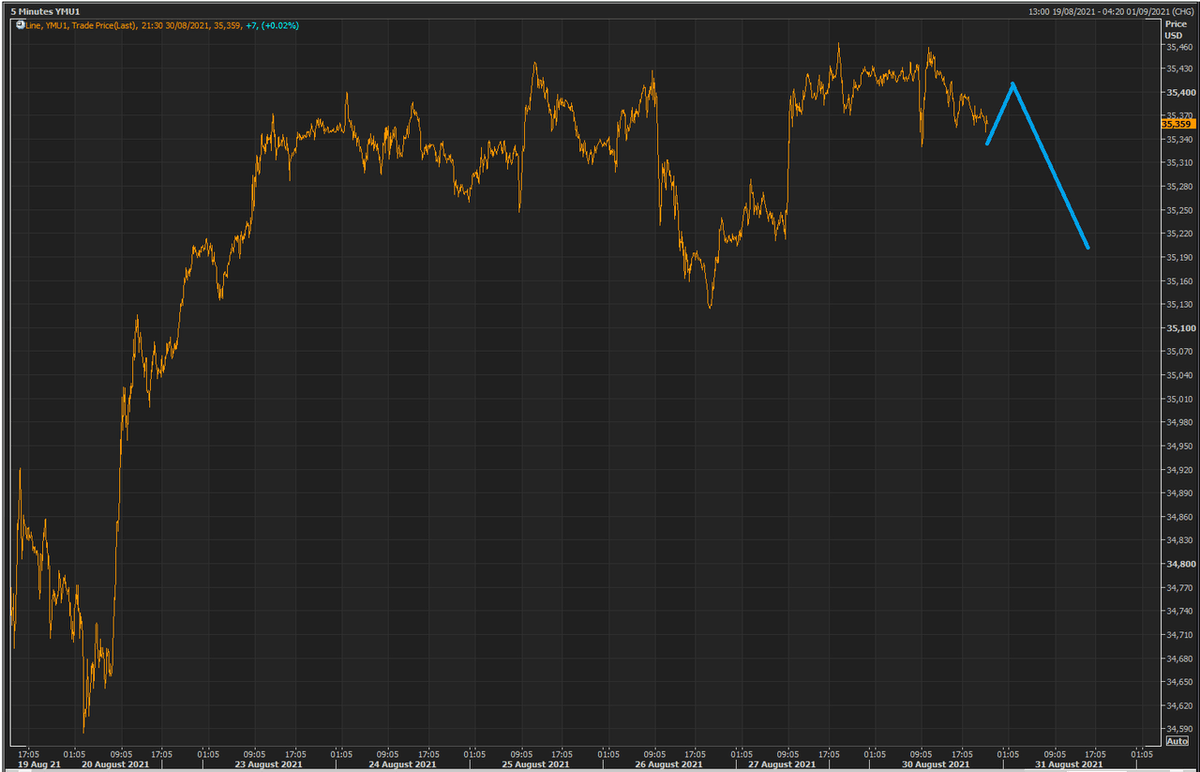

9/X The ZH story is slightly alarmist. The reality is that we will have a liquidity flood for the next three months, as the TGA is drawn down to zero, freeing more Bank Reserves, adding to systemic liquidity that matters to risk assets.

10/X The Treasury will also be issuing less debt, and that widens the delta between Fed SOMA Transactions and Treasury Debt Issuance -- which effectively improves the creation of Bank Reserves (by definition).

11/X We already see the delta's future growth in the difference between Factors That Supply Bank Reserves and Factors That Absorb Bank Reserves (purple line, chart above).

12/X CBO estimates that the Treasury Department could exhaust its ability to borrow money to pay for government operations in October or November. So expect the debt ceiling to end sometime before that happens.

nymag.com/intelligencer/…

nymag.com/intelligencer/…

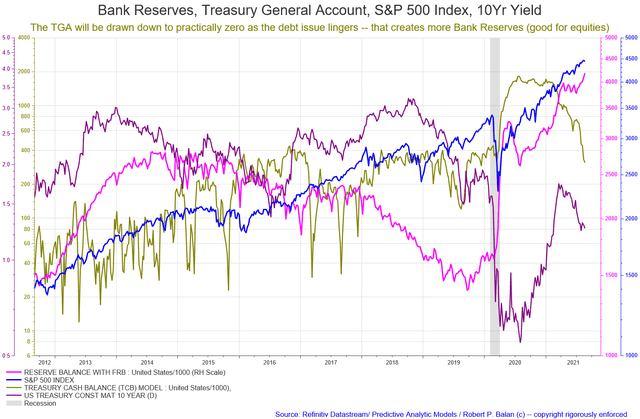

13/X Meanwhile the TGA will be drawn down to practically zero, and Yellen will have to do some shuffling of cards around govt expenditures. While this is going on, Bank Reserves will continue to build -- and that's really friendly for equities.

14/X Also don't expect the Fed to do any form of QT (raise rates, taper QE purchases) while the debt ceiling is an issue. If Mr. Powell allows that to happen, he would have lost his chance of reappointment to second term as Fed Chair, by February, when his term expires.

15/X SUMMARY:.

The TGA will build again .. no question about it -- and it will build rapidly once started. The Biden administration has huge spending plans, and so the TGA will build accordingly.

The TGA will build again .. no question about it -- and it will build rapidly once started. The Biden administration has huge spending plans, and so the TGA will build accordingly.

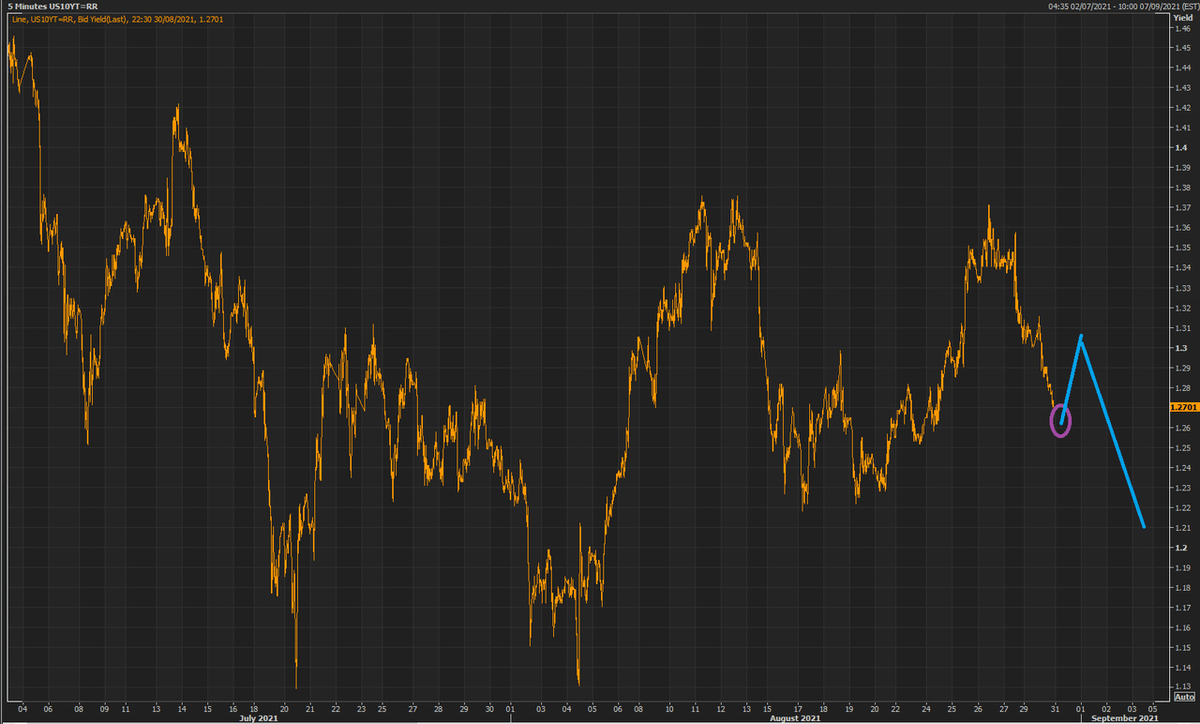

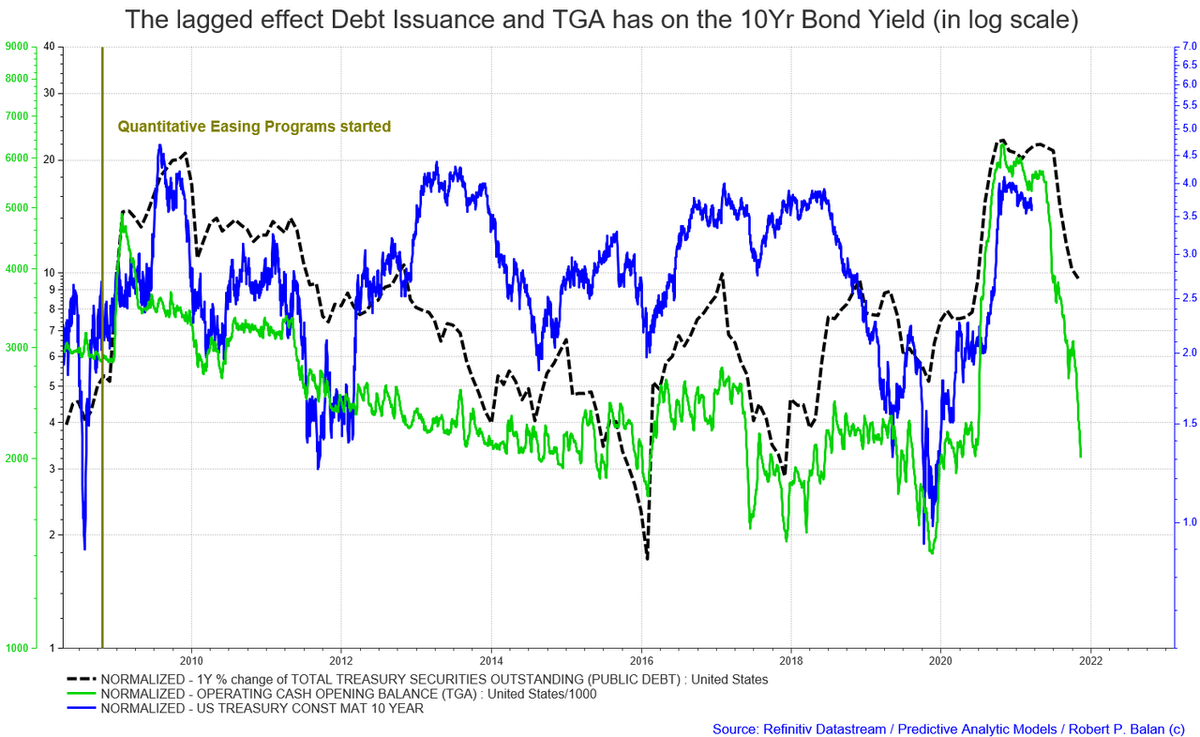

16/X There's a positive, but lagged, relationship between Debt Issuance/Treasury General Account, and the long bond rates. Therefore, the 10Yr Yield will likely likely follow a lagged trajectory relative to changes that happened in Debt Issuance/Treasury General Account recently.

17/17 If we got the lagged relationship between Debt Issuance/TGA correctly, the long bond yield should be making serious inroads to the downside sometime in Q4 this year. We will finetune this lead relationship and its impact on changes in the long bond yield, as we go along.

18/18 Moreover, US GDP growth has slowed down, as shown by the Citi Economic Surprise Index, and we do fear that Q3 and Q4 2021 growth will recede. That should also figure significantly in the lowered trajectory of the 10Yr Yield until early 2022.

• • •

Missing some Tweet in this thread? You can try to

force a refresh