1/X AUGUST 31, 2021.

ASIAN SESSION BRIEF:

10Yr Yield Ready For A Decent Pullback Higher; Expect YM, RTY To Retrace Higher As Well; NQ And ES Should Respond Lower

Article at Seeking Alpha:

seekingalpha.com/instablog/9103…

ASIAN SESSION BRIEF:

10Yr Yield Ready For A Decent Pullback Higher; Expect YM, RTY To Retrace Higher As Well; NQ And ES Should Respond Lower

Article at Seeking Alpha:

seekingalpha.com/instablog/9103…

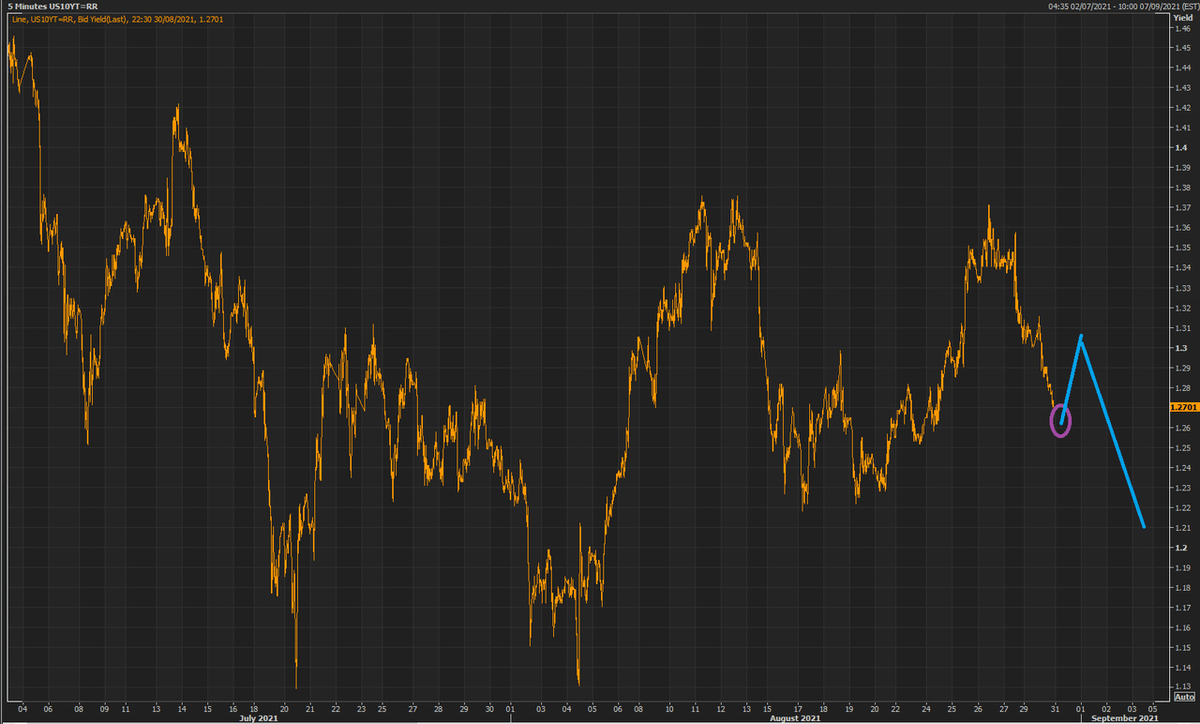

2/X Tim and I expect the yield, which is just completing a five-series, to ratchet higher on a normal pullback probably circa 40 pct of the Yield decline from August 26, then resumes the downward trend.

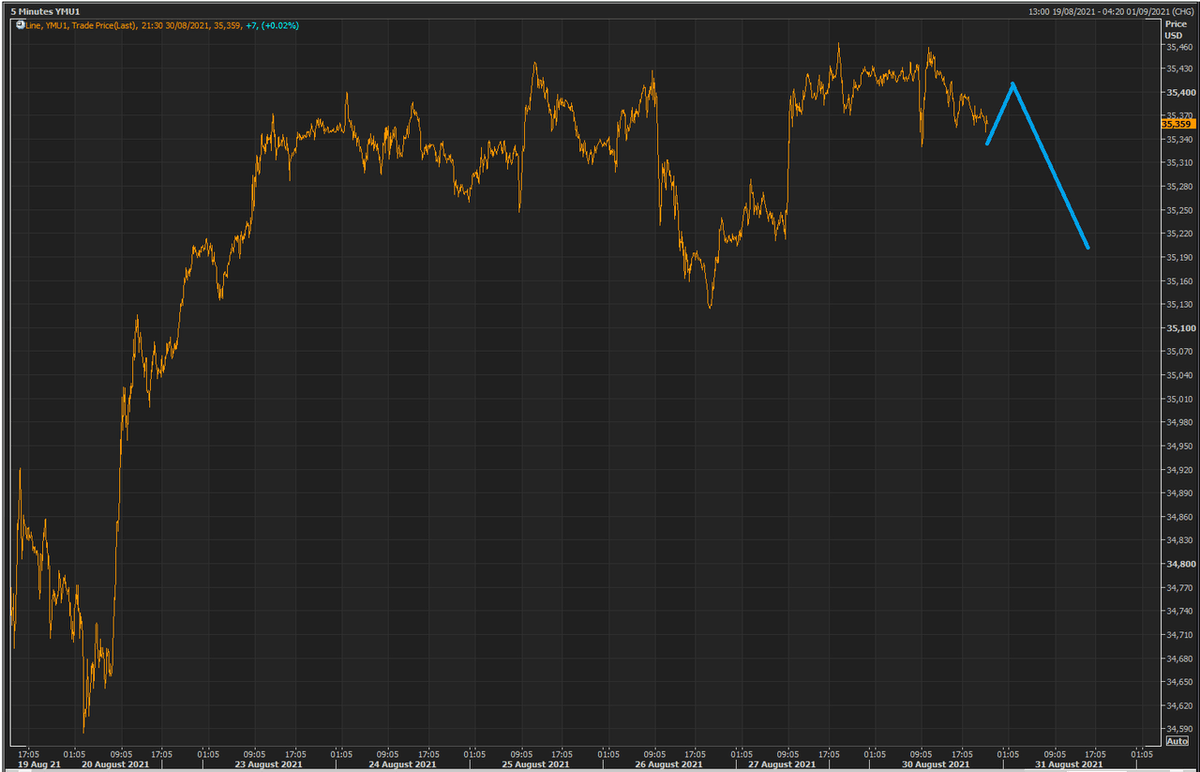

3/X That should trigger a ratchet higher in YM of at least 50% of the fall from 35,456 top, then also resumes the downward trend.

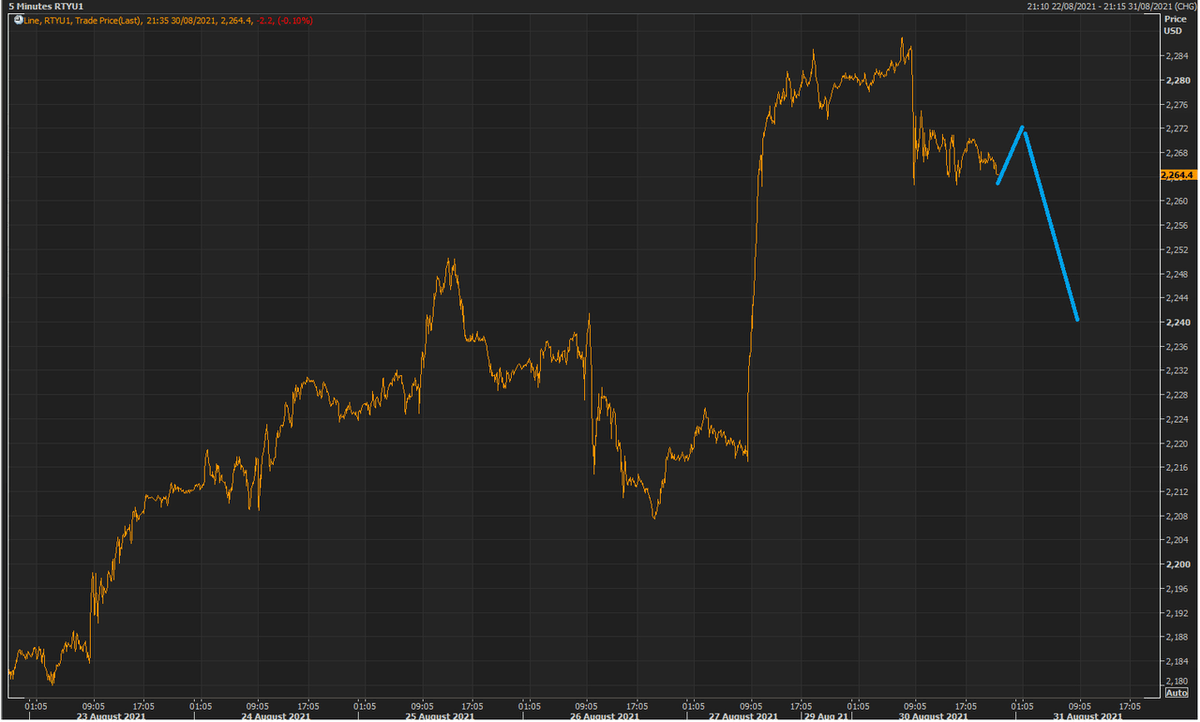

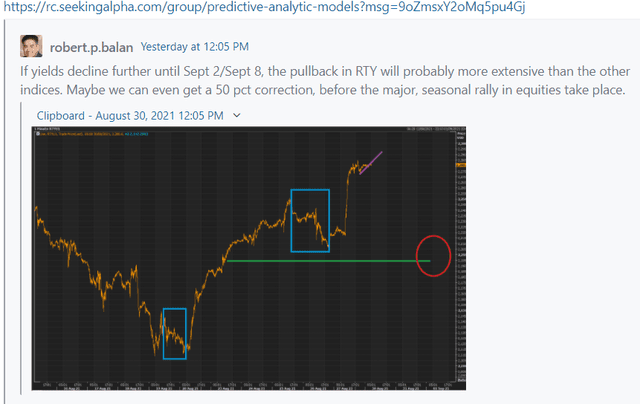

4/X That may also launch a rebound higher in RTY of at least 50% of the fall from 2287.3 top, and downtrend trend resumes thereafter.

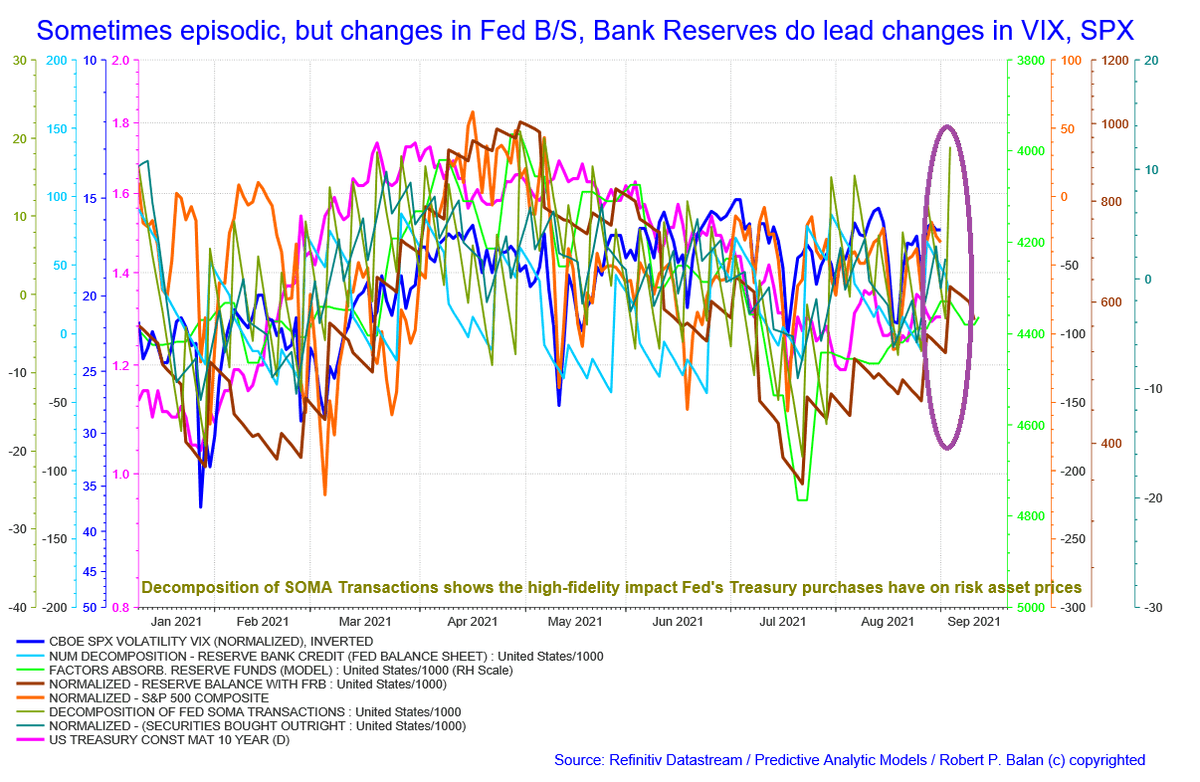

5/X The TGA-Yield Num Decomp models gets some confirmation of likely Sept 2/Sept 8 lows insofar as 10Yr yield is concerned.

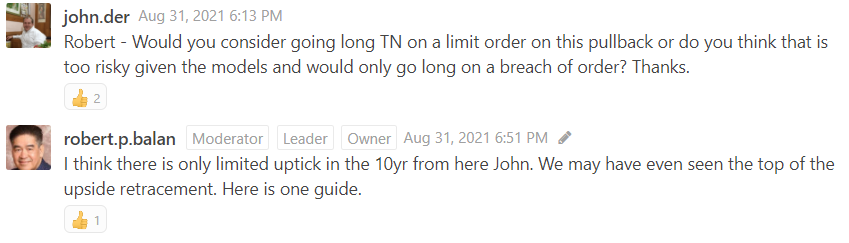

6/X Our standard, shown-daily liquidity model still points for lower SPX (higher VIX) over the next few days.

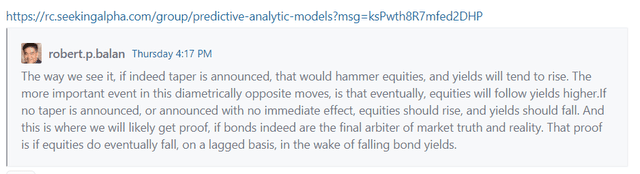

7/X This process (see inset) will now take place, as equities start to synch their movements again. However, it may take a few days to the yield-equities covariance to fully become positive again. But from here on, a yield decline may also be accompanied by a fall in equities.

8/X We hope that the correction lower in RTY will go as much as a 50 pct retrace of the previous five-series, bull phase (see inset).

9/9 We will have to track this correction lower in real-time to get a feel for how much further this brief correction will take place. Stay tuned.

11/11 The irregular in ES is almost done, and completes with a final uptick in the 10yr. The the yield falls again, and the ES falls alongside.

12/12 -- Same outlook for NQ -- getting set for a 3rd series or C wave sell-off. Maybe 3rd series likely.

• • •

Missing some Tweet in this thread? You can try to

force a refresh