1/X Crypto, China Equities, Commodities -- The Total Social Financing Connection; Previous Lower China Gov't Expenditures Exacts Its Pound Of Flesh

Full presentation at Seeking Alpha:

seekingalpha.com/instablog/9103…

Full presentation at Seeking Alpha:

seekingalpha.com/instablog/9103…

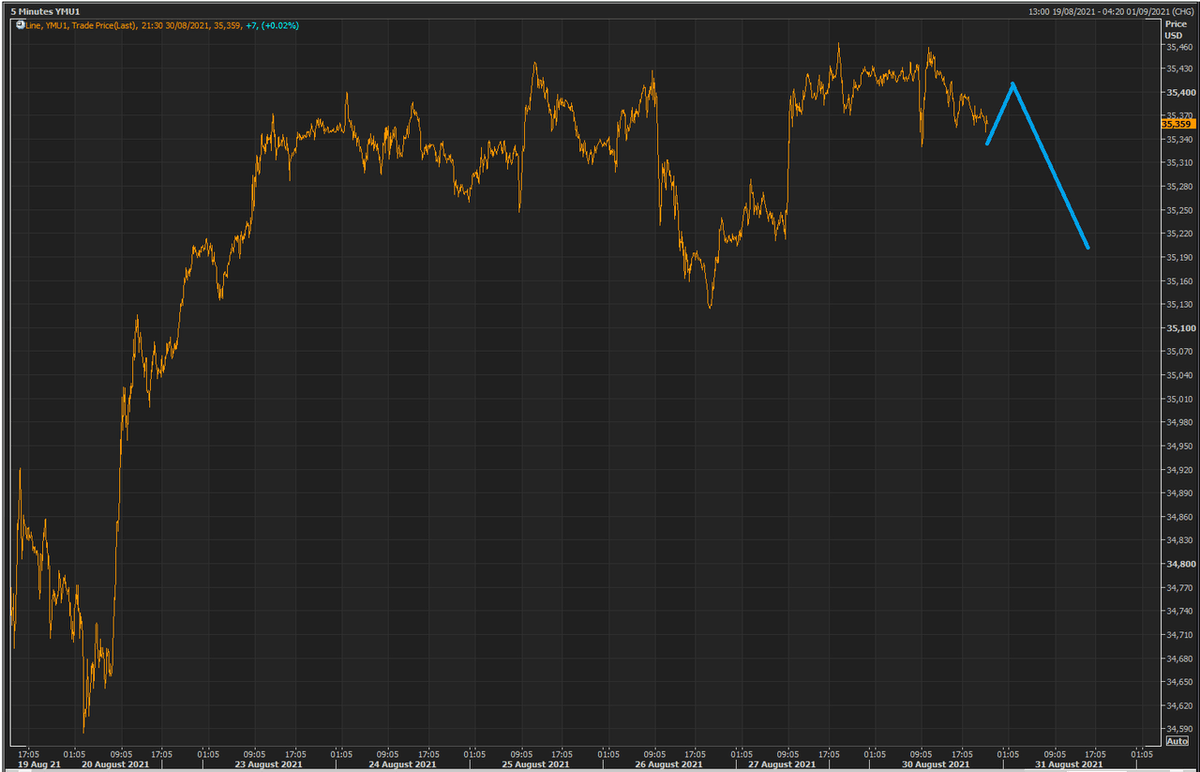

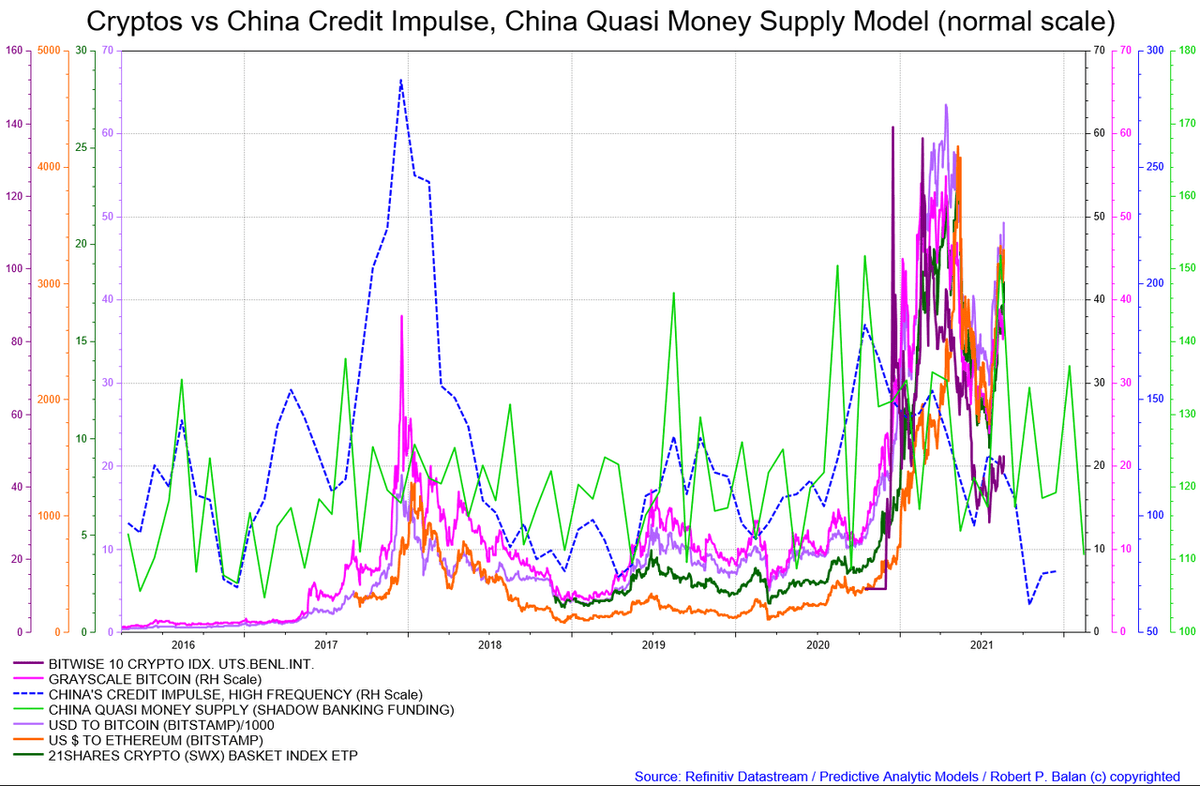

2/X It's again "quaking-in-my-boots time" for the Crypto Universe. I suggest you side.step a few weeks (2 to 4 weeks) of lower prices. We buy again sometime in September (maybe the 1st weeks, but we will fine-tune that). Bossman also itching to go back to the fray.

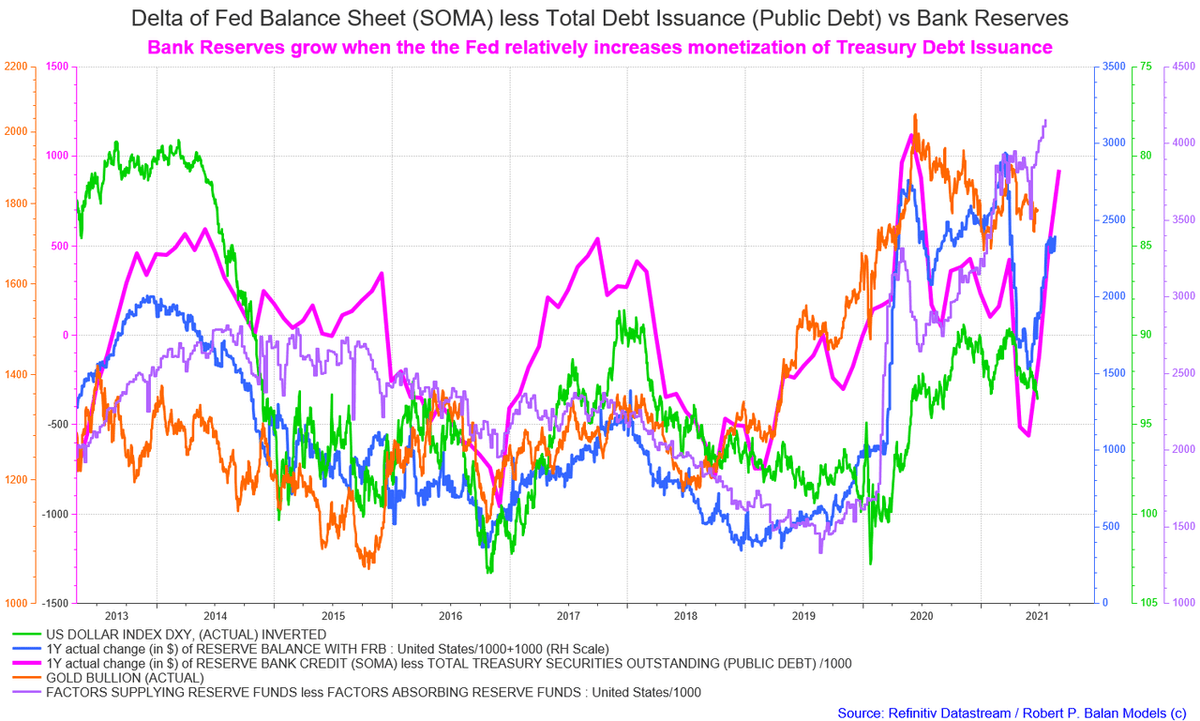

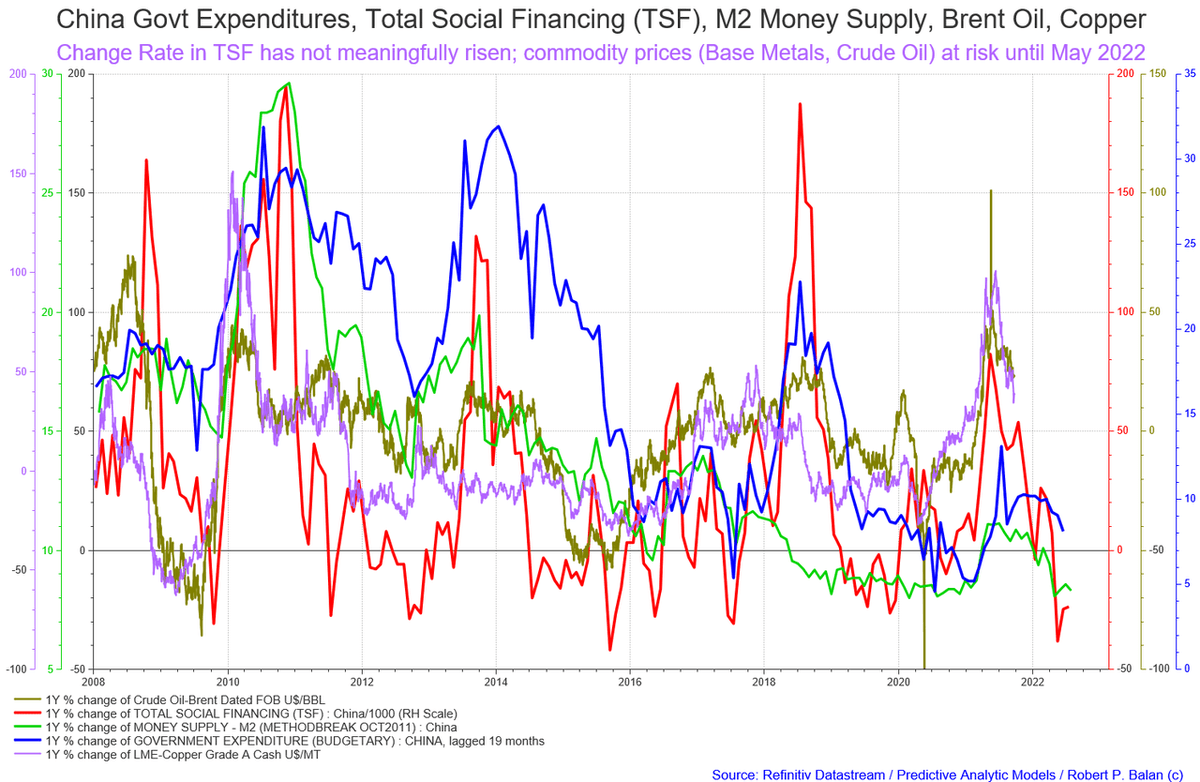

3/X Change Rate in TSF has not meaningfully risen; commodity prices (Base Metals, Crude Oil) at risk until May 2022. China Govt Expenditures, Total Social Financing (TSF), M2 Money Supply, Brent Oil, Copper

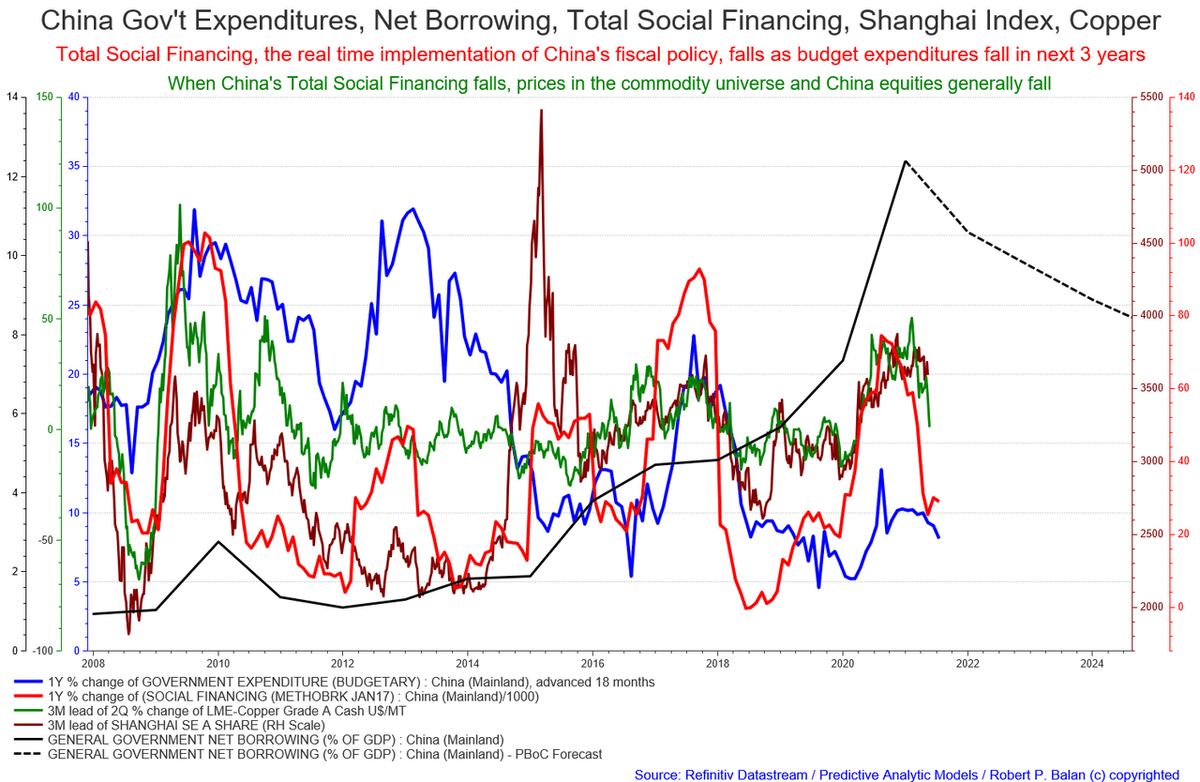

4/X Total Social Financing, the real time implementation of China's fiscal policy, falls as budget expenditures fall in next 3 years When China's Total Social Financing falls, prices in the commodity universe and China equities generally fall.

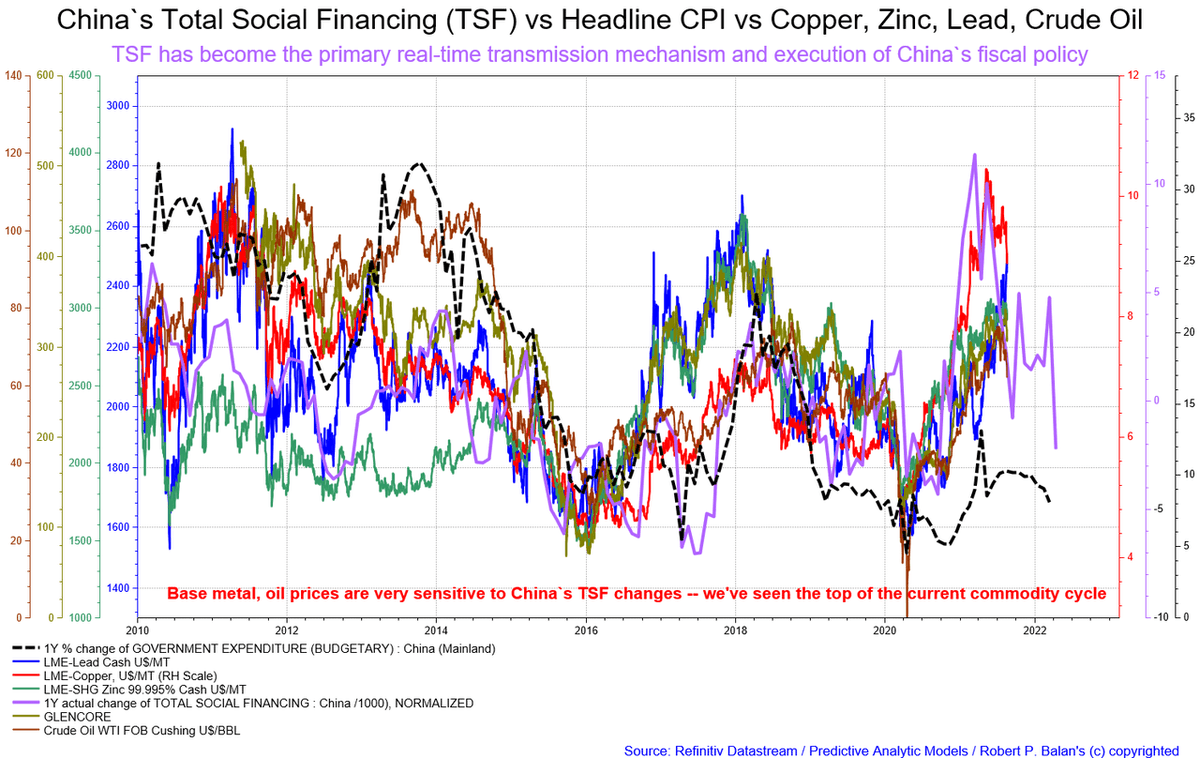

5/X TSF has become the primary real-time transmission mechanism and execution of China`s fiscal policy

Base metal, oil prices are very sensitive to China`s TSF changes -- we've seen the top of the current commodity cycle

Base metal, oil prices are very sensitive to China`s TSF changes -- we've seen the top of the current commodity cycle

6/X SUMMARY:

The commodity bull phase is retracing -- the much-vaunted reflation phase is taking a pause. This may take a while; it may persist until Q2 2022. China's Total Social Financing, also called China's Credit Impulse, is unlikely to turn up significantly higher . . .

The commodity bull phase is retracing -- the much-vaunted reflation phase is taking a pause. This may take a while; it may persist until Q2 2022. China's Total Social Financing, also called China's Credit Impulse, is unlikely to turn up significantly higher . . .

7/7 SUMMARY:

. . . until then. One important point: the crypto universe is unlikely to prosper until this Credit Impulse is on the upswing again.

. . . until then. One important point: the crypto universe is unlikely to prosper until this Credit Impulse is on the upswing again.

• • •

Missing some Tweet in this thread? You can try to

force a refresh