1/ Couple of quick stats on the Avax ecosystem:

- TVL has just peaked ATH at $2.6b since the parabolic run-up when Avalanche Rush was announced

- TVL has increased ~10x since the announcement and continues to climb.

- TVL has just peaked ATH at $2.6b since the parabolic run-up when Avalanche Rush was announced

- TVL has increased ~10x since the announcement and continues to climb.

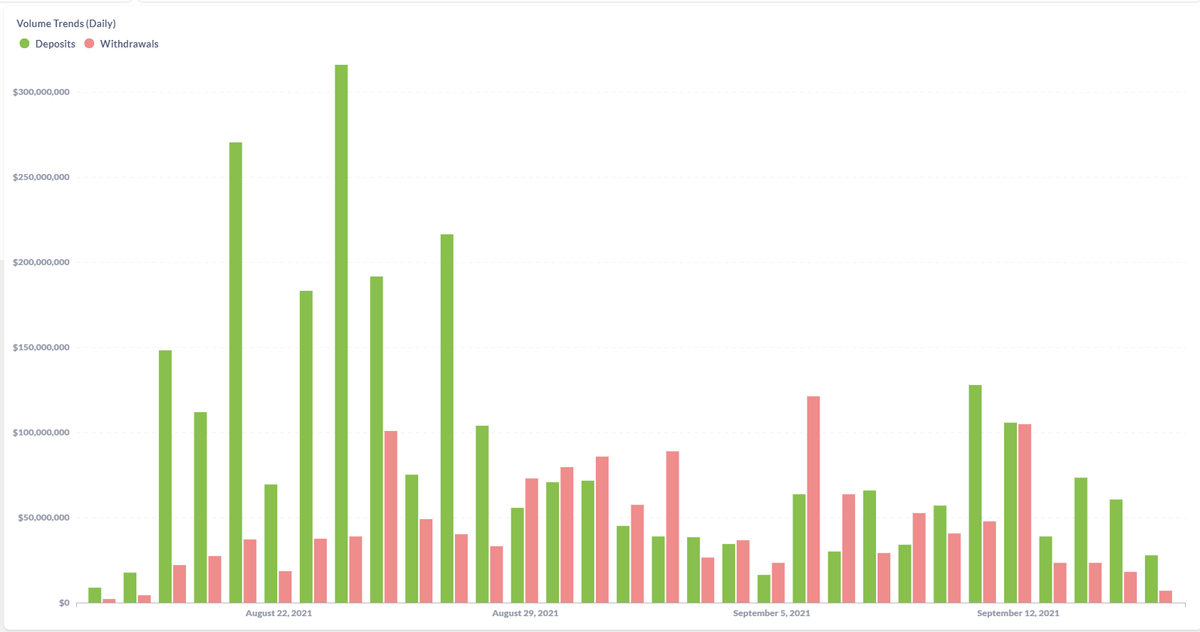

2/ Bridge inflows:

- Over the past 30 days, there's been $1.35b net inflows from the ETH bridge

- 20 of the 30 days have recorded net inflows

- Last 7 days have recorded inflows > outflows leading up to Avalanche Rush

- Over the past 30 days, there's been $1.35b net inflows from the ETH bridge

- 20 of the 30 days have recorded net inflows

- Last 7 days have recorded inflows > outflows leading up to Avalanche Rush

3/ DEX flows:

- Trader Joe continues to remain the dominant DEX after surpassing Pangolin earlier this month.

- Trader Joe past 7D Volume: $1.1b

- Trader Joe TVL: $618m

- Pangolin past 7D Volume: $685m

- Pangolin TVL: $376m

analytics.traderjoexyz.com

info.pangolin.exchange/#/home

- Trader Joe continues to remain the dominant DEX after surpassing Pangolin earlier this month.

- Trader Joe past 7D Volume: $1.1b

- Trader Joe TVL: $618m

- Pangolin past 7D Volume: $685m

- Pangolin TVL: $376m

analytics.traderjoexyz.com

info.pangolin.exchange/#/home

4/ Avalanche Rush:

- 10m AVAX tokens (~$600m) carved out for a multi-month incentive program

- Touted to go live in a week, with Aave / Curve / Sushi / Pangolin / Joe deployment offering AVAX incentives

- 10m AVAX tokens (~$600m) carved out for a multi-month incentive program

- Touted to go live in a week, with Aave / Curve / Sushi / Pangolin / Joe deployment offering AVAX incentives

https://twitter.com/CryptoSeq/status/1434500180536086530?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh