Alright, the koala didn't have to do this but some of you don’t seem to have figured this out yet, so let's have some eucalyptus tea:

The Professor is playing chess and Sprott/uranium squeeze crowd are playing checkers

1/n

The Professor is playing chess and Sprott/uranium squeeze crowd are playing checkers

1/n

Let’s look back at a few forward curves:

YE19

Spot ~$25.12

Dec20 $26.60

Dec21 $28.63

Dec22 $29.87

YE20

Spot ~$30.25

Dec21 $31

Dec22 $32.25

Today

Spot ~$49.75

Dec21 $49.75

Dec22 $50

Dec23 $50.38

Dec24 $51

2/n

YE19

Spot ~$25.12

Dec20 $26.60

Dec21 $28.63

Dec22 $29.87

YE20

Spot ~$30.25

Dec21 $31

Dec22 $32.25

Today

Spot ~$49.75

Dec21 $49.75

Dec22 $50

Dec23 $50.38

Dec24 $51

2/n

Funny what $400MM & 10MM pounds in one month does to a spot market. Since you know, spot market by definition represents SPOT demand and supply...3/n

Now, there is a Sprott brigade out there saying Cameco is bad/stupid. Couldn't be further from the case. Let's go climb a little higher into the eucalyptus tree, you know how there are traders and a carry trade got formed in uranium in the past decade? 4/n

Well Cameco came along to utilities & said we need a certain price/producer economics in contracts, and utilities said, "yea well, we remember Cigar Lake, and we have regulators to answer to, and there is this thing called a forward curve, why should we pay you a premium?" 5/n

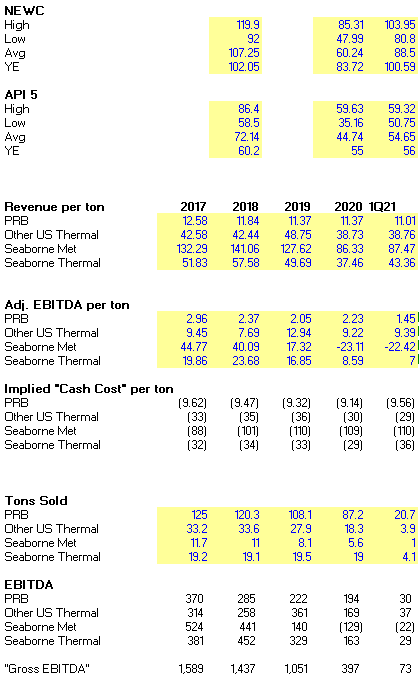

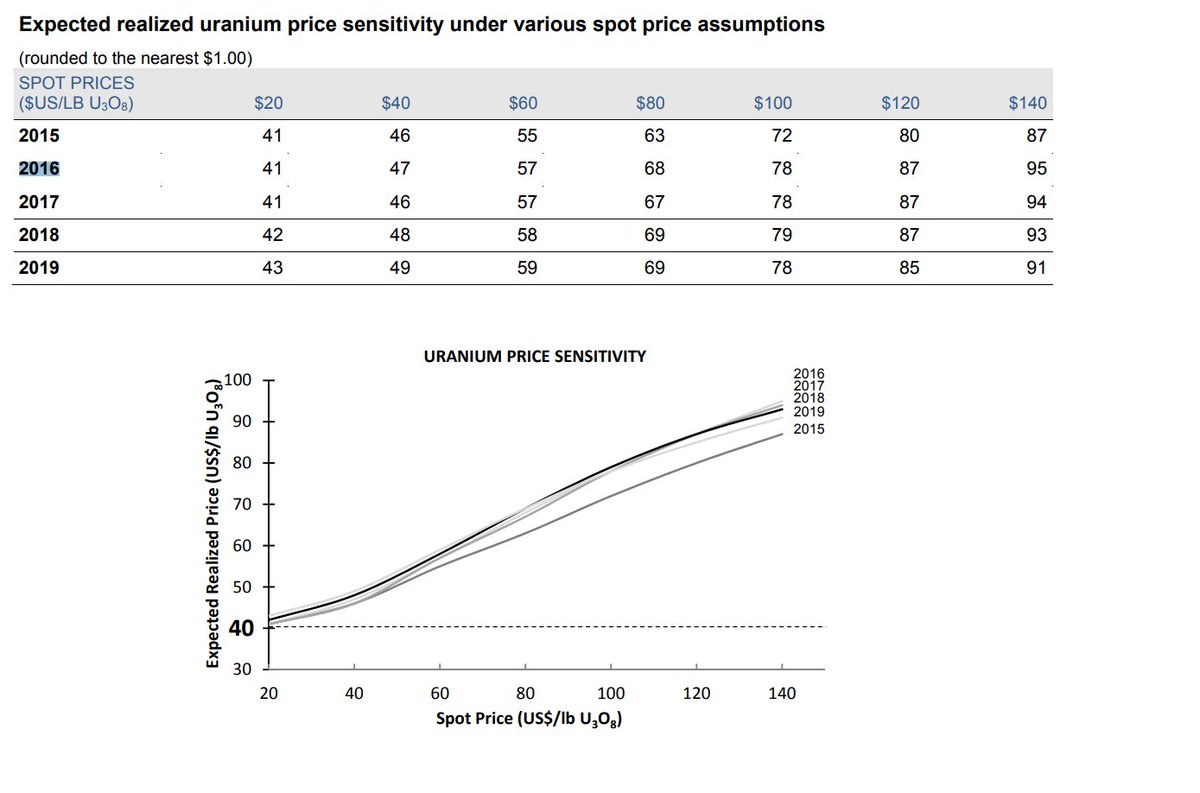

And you know what? The utilities had a point! These trading houses all have excellent credit ratings, low cost of capital, & well let's see how that was going for the contract book: 4Q15, 3Q17, 2Q21...take one guess which is which (look at $20 and $40 columns in particular) 6/n

So the Sasktoon crew had a problem with the market so overwhelmingly supplied creating the opportunity for a carry trade, mining the spot market was more rational then mining McArthur River. So when the labor contract stopped in 2017, MR was idled. 7/n

And Cameco looked at the big and evergrowing pile of spot market material and said as any good mining company would, "time to start digging to prosperity"

But this is not a costless endeavour 8/n

But this is not a costless endeavour 8/n

You see, Cameco could produce from McArthur for ~$23/lb including D&A and make a profit. And yet they are, and have been basically since mid-2018 buying spot instead for higher to deliver into contracts.

Oh, and MR on C&M is costing Cameco ~C$80-100MM per year 9/n

Oh, and MR on C&M is costing Cameco ~C$80-100MM per year 9/n

So what does Cameco need? Oh if only the fwd curve rose to a point where utililties could economically justify signing a contract w/ Cameco INSTEAD of a trader who is chained to carry trade economics! But that could take yrs of mining the spot mkt to achieve. Wait... 10/n

An idea, hear it out...equity investors believe uranium is coming back eventually at some point & spot is way below where it eventually will be the long term. Maybe investor interest help mine the spot market and pull forward salvation? 11/n

After all, 10MM pounds (so far) is close to a year of Cameco purchases in the spot market. And it has all been concentrated in one month further excacerbating the effect. But the forward curve is now in the zone...12/n

Not going to get into the details & all the inside baseball here but all the dots are there to be connected, who is the biggest winner of this Sprott/uranium move...Cameco in every possible way 13/n

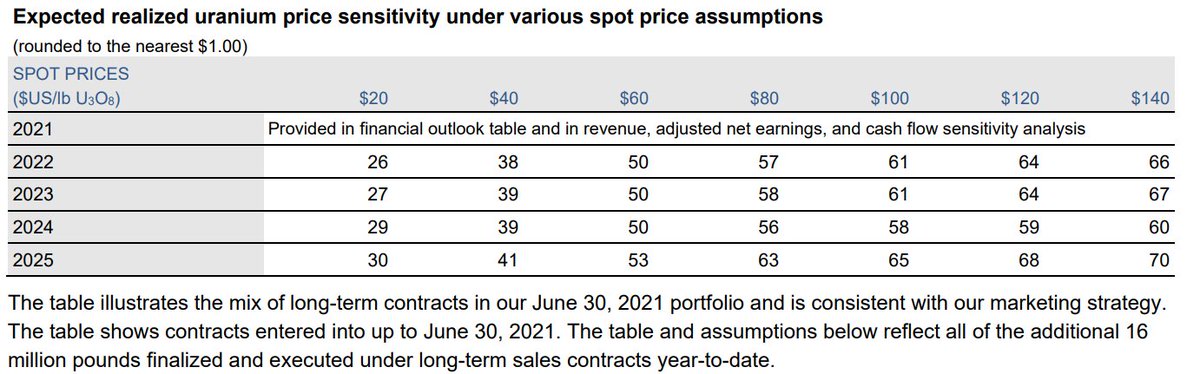

That contract book can now get replenished with a treasure trove of index-linked contracts with soft $40 floors and soft $60-70/lb ceilings, (though maybe harder floors then the old contracts) as utilities look to finish covering 2024+ requirements. 14/n

This is the integral calculus v. differential calculus

Sprott uranium mania has potentially pulled forward by MULTIPLE YRS the return of McArthur River, probably saving Cameco close to C$0.5Bn in C&M & created massive NPV uplift from the pull forward 15/n

Sprott uranium mania has potentially pulled forward by MULTIPLE YRS the return of McArthur River, probably saving Cameco close to C$0.5Bn in C&M & created massive NPV uplift from the pull forward 15/n

Now for the highest level part of this move...how much capital will chase the uranium trade? Maybe $1Bn? $2Bn? Well most of it is getting absorbed by Sprott. Will it work long term? Maybe, but its capital that won't be there when say...Arrow is looking to get financed 16/n

And that's important because Arrow lingers out there as a Sword of Damocles over the uranium mining industry. It will be needed, but well into the 2030s, not the 2020s. Capital going into Sprott is not going into Nexgen. And if there is enough capital to finance Arrow? 17/n

Well then, will Arrow be fully contracted? There will have to be a lot of incremental demand to absorb the full size of Arrow (so again, the koala thinks 2030s). Because if its not, well we have seen what an oversupplied spot market does...18/n

And then, and this day is a long way away, the Cameco bid for Nexgen can come while Cameco is contract protected and able to be a scavenger. But that is assuming after this Sprott squeeze the capital will be there to fund Arrow. 19/n

So the long & short of it: Cameco is doing integral calculus while playing chess, laughing as this Sprott uranium squeeze plays out. Sprott just got encouraged to come in and pick up a pick axe & shovel, accelerating by years what Cameco was already doing 20/n

So before throwing stones at Saskatoon, remember in any market eventually supply comes from producers and is consumed by consumers, in this case utilities. The CCJ / utilities relationship is like X/CLF with automakers or US met coal with X/CLF 21/n

The annual steel price for auto is a negotiated contract (b/c GM/F can't change price of a car everyday based on steel px), so while CLF & X are upstream integrated on iron ore, they negotiate an annual coal contract so they aren't matching fixed revenue w/ floating costs 22/n

Which, funny & sadly enough, we saw the tail risk of that potential mismatch during the vortex in Texas and are seeing right now in UK electricity markets...utilities can't just push through a higher spot price of uranium. 23/n

To be clear, besides providing a storage acct at Port Hope, the koala believes Cameco has no involvement with the Sprott U Trust. But no one is capturing more value from its creation than CCJ, not Sprott, not Trust shareholders. 24/n

So whomever came up with the idea originally, or encouraged it, had a really really ridiculously smart idea from the perspective of a Cameco shareholder.

If Sprott squeeze succeeds/continues, Cameco biggest long term winner by far

25/25

If Sprott squeeze succeeds/continues, Cameco biggest long term winner by far

25/25

• • •

Missing some Tweet in this thread? You can try to

force a refresh