All over Europe there will be a rush to order new nuclear plants. We are just on the cusp a nuclear power revolution. The demand growth for #uranium will take all market pundits by surprise. thetimes.co.uk/article/energy…

The world needs to dramatically cut coal power output while trying to shift to electric vehicles. Power prices are going to continue to blow out and the public will vote with their wallets. We have zero choice in the matter and must ramp up nuclear power output, warp speed

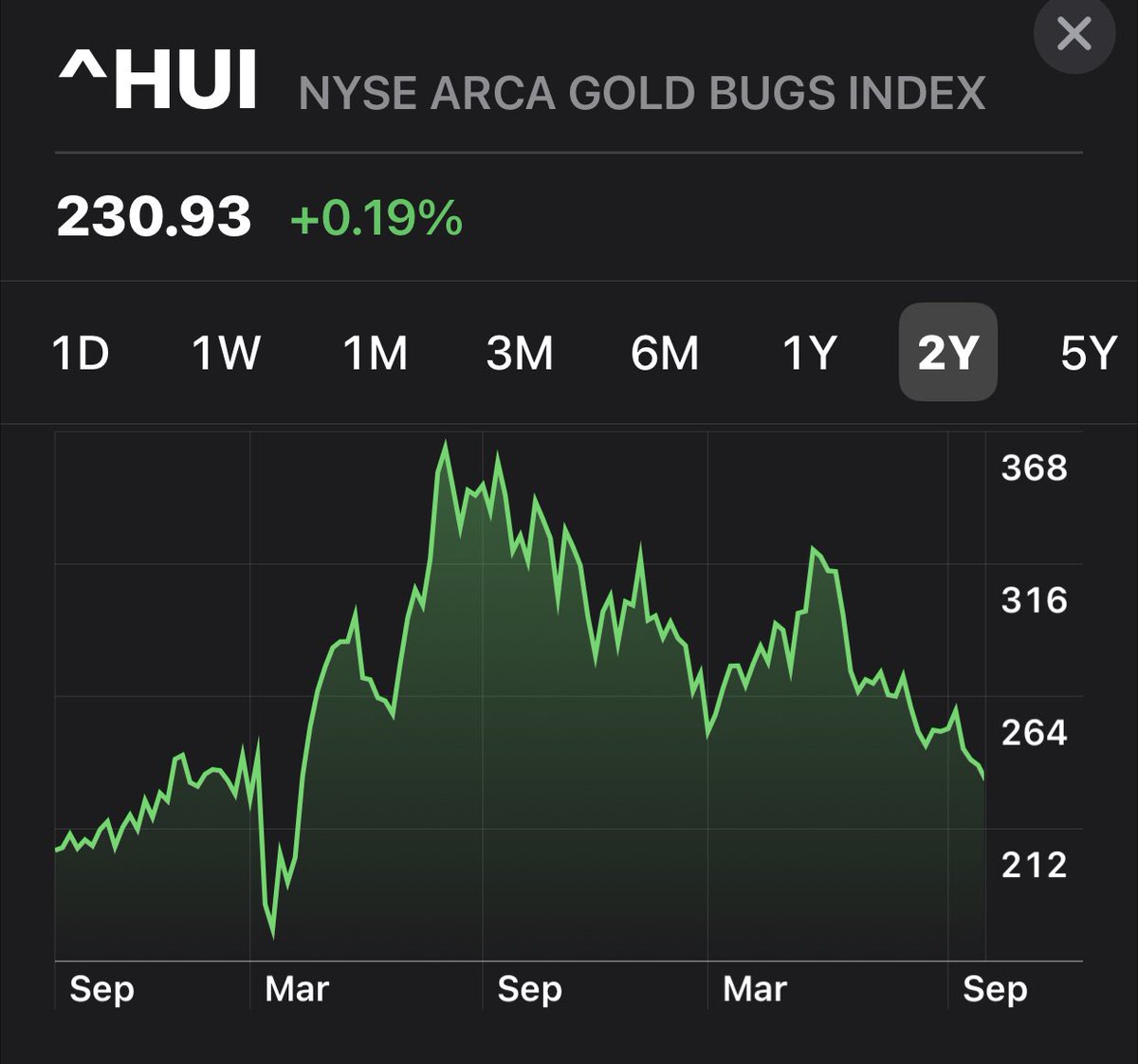

The correction we’ve had in the #uranium space is a gift for new investors.

For those already in, we’ve learned a lot about the volatility and should be prepared for a lot more. We’ve seen how easily the #uranium price ramps up when SPUT $u.un is issuing shares at a premium

For those already in, we’ve learned a lot about the volatility and should be prepared for a lot more. We’ve seen how easily the #uranium price ramps up when SPUT $u.un is issuing shares at a premium

We’ve also seen how quickly uranium equities can double and triple when there is also inflows in the $ura and $urnm.

But, we’ve also learned that #uranium investors absolutely crap there pants when the premium on sput goes away for a couple days.

But, we’ve also learned that #uranium investors absolutely crap there pants when the premium on sput goes away for a couple days.

I think another big reason for the correction is that capital was flowing $cco $ccj and some of the speculators that were buying calls realized that Cameco’s contract book is… well…less than ideal if you’re betting on a spike to $150/lb uranium

I expect that etfs like $ura may consider rebalancing as they have a huge weighting in $cco. I suggested $urnm long and shorting out it’s ~12% weighting cco position and adding more $u.un

I think we will see more focus on $u.un going forward as the sector leader

I think we will see more focus on $u.un going forward as the sector leader

A core position in physical and a basket of quality uranium juniors with overweight past producers that can restart. Also, most importantly avoiding companies that have over contracted and will take years to realize the strong uranium pricing environment that’s coming.

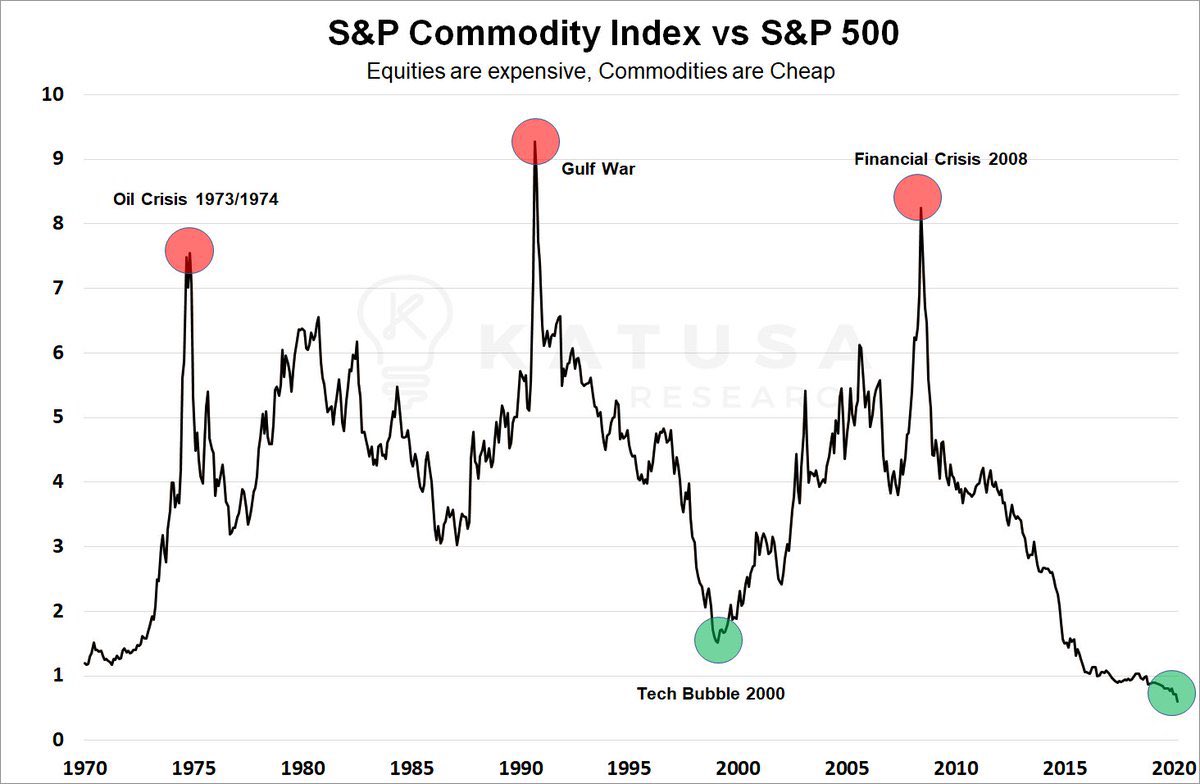

The market is going to prove to be incredibly tight for years as the restarts and new builds just keep piling up. The transition from coal to nuclear for baseload power, while trying to double the grid by 2040 is the most significant energy market change in 100 years.

The climate change crisis is only going to intensify as we aren’t about to see a slow down in the rising global temperatures. It will continue to gain more and more media attention and political support. The one thing nearly everyone will soon agree on is nuclear power

We could easily see demand for #uranium increase by 4x-6x by 2040. A 6 fold increase would have us move only from 10% to 30% nuclear while doubling the grid to feed electric vehicles.

I’m in Ontario and we are 58% nuclear as an example. Should be a goal for the globe!

I’m in Ontario and we are 58% nuclear as an example. Should be a goal for the globe!

• • •

Missing some Tweet in this thread? You can try to

force a refresh