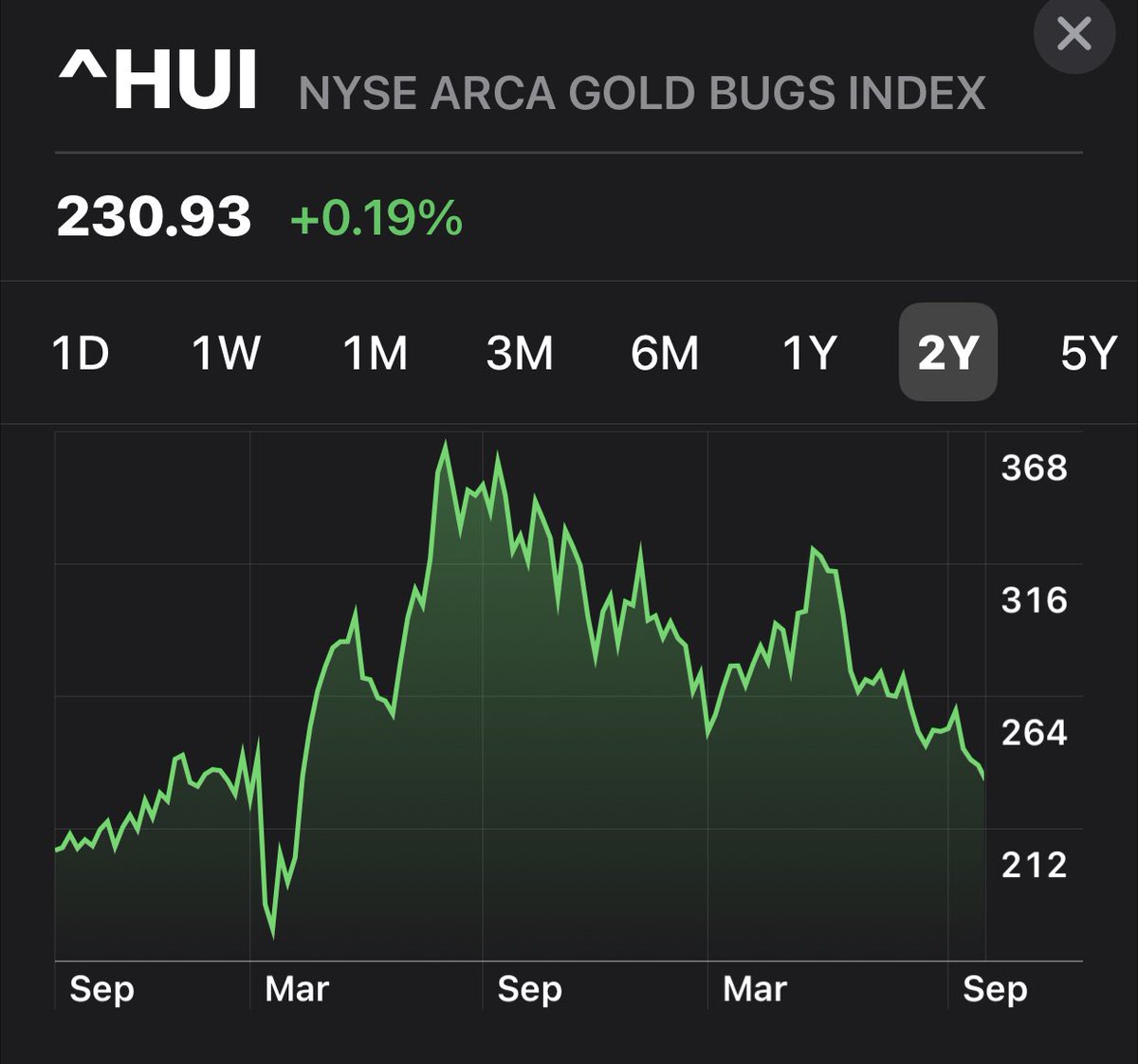

Likely the relative strength today and also the larger ‘Butterfly Gartley’ pattern forming on the 2yr chart. While not perfect do in part to the huge volatility back in March 2020. It’s close enough

This pattern has made me more money over the years than any other TA. Not always the .786 often the .618. Works especially good to time adds in bull markets, at moving averages and with positive RSI divergences

Buying aggressively on the second leg down of a pull back in a bull market works extremely well because it is also a major shake out point for those that lack real conviction. It’s often a puke point for the fragile investor.

My belief is that it works so well because of the psychology of most investors. Bull markets often have nice sustain runs and investors get used to the typical ups and downs and can handle them. Similar to walking up a flight of stairs.

It’s not a big deal if you reach the top of a flight of stairs and have to take one step down. But if you’re expecting the next step to be back up and it’s down most will panic and tumble. Result, the second break is a great entry point for those with an eye on the long term

• • •

Missing some Tweet in this thread? You can try to

force a refresh