#Juventus 2020/21 accounts cover a COVID impacted season when they finished 4th in Serie A, won the Coppa Italia and were eliminated in the Champions League last 16. Head coach Andrea Pirlo was replaced by Massimiliano Allegri after the season ended. Some thoughts follow.

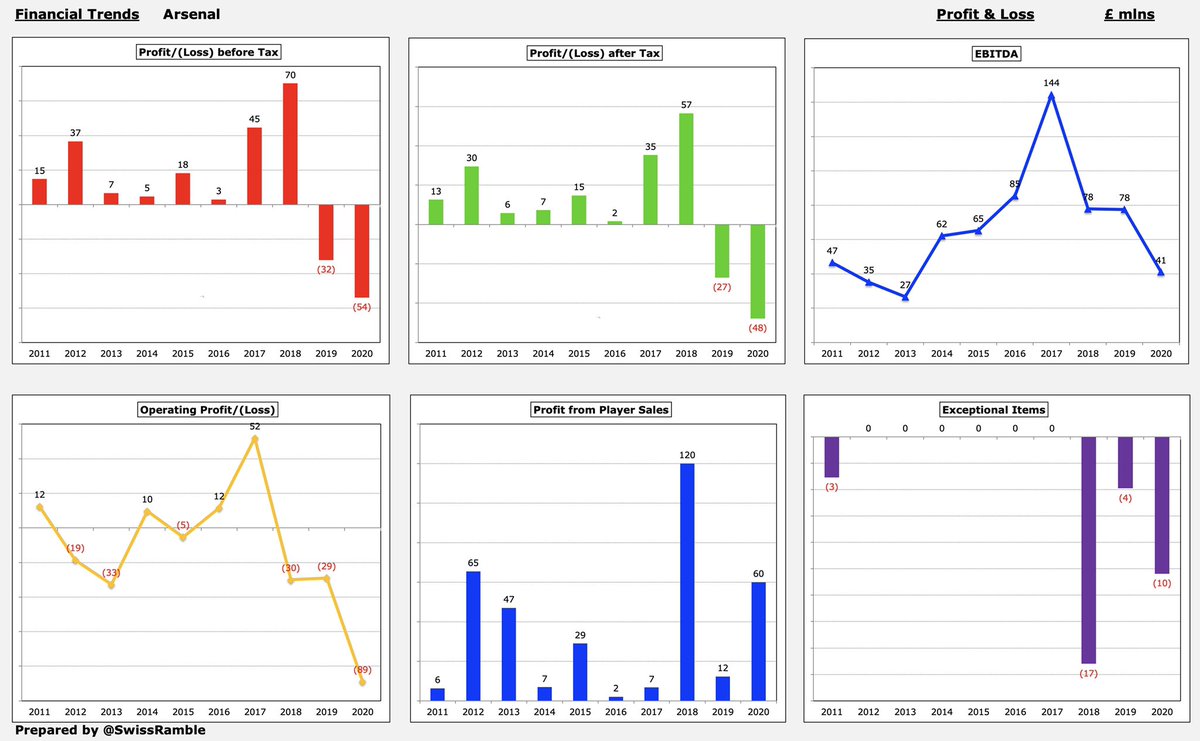

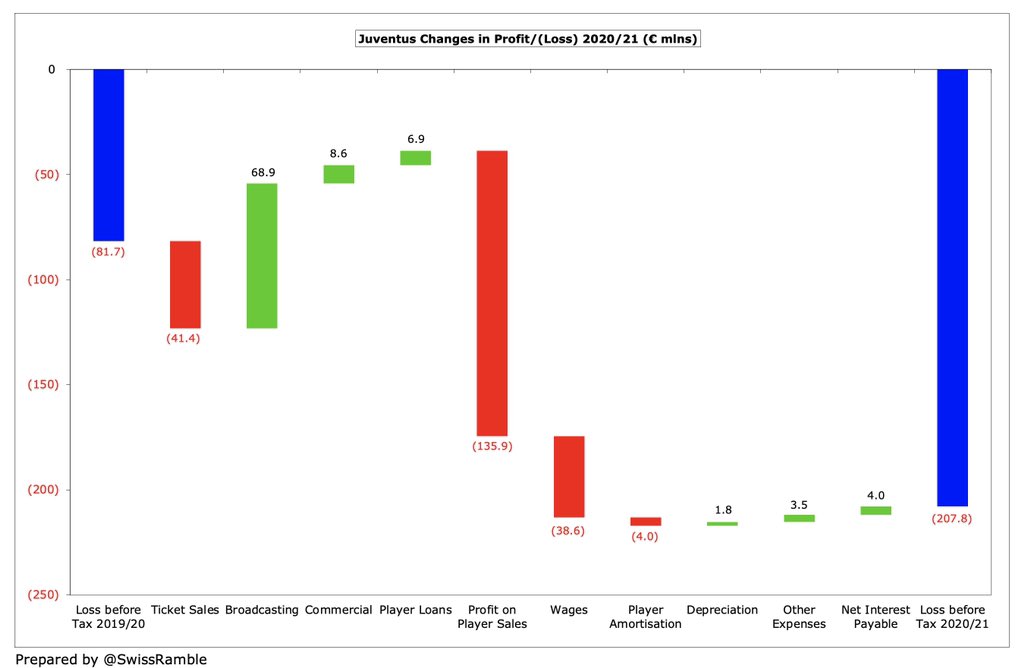

#Juventus pre-tax loss more than doubled from €82m to €208m (€210m after tax), despite revenue rising €43m (11%) from €407m to €450m, mainly because profit on player sales fell €136m from €167m to €31m. Operating expenses also increased by €37m (6%).

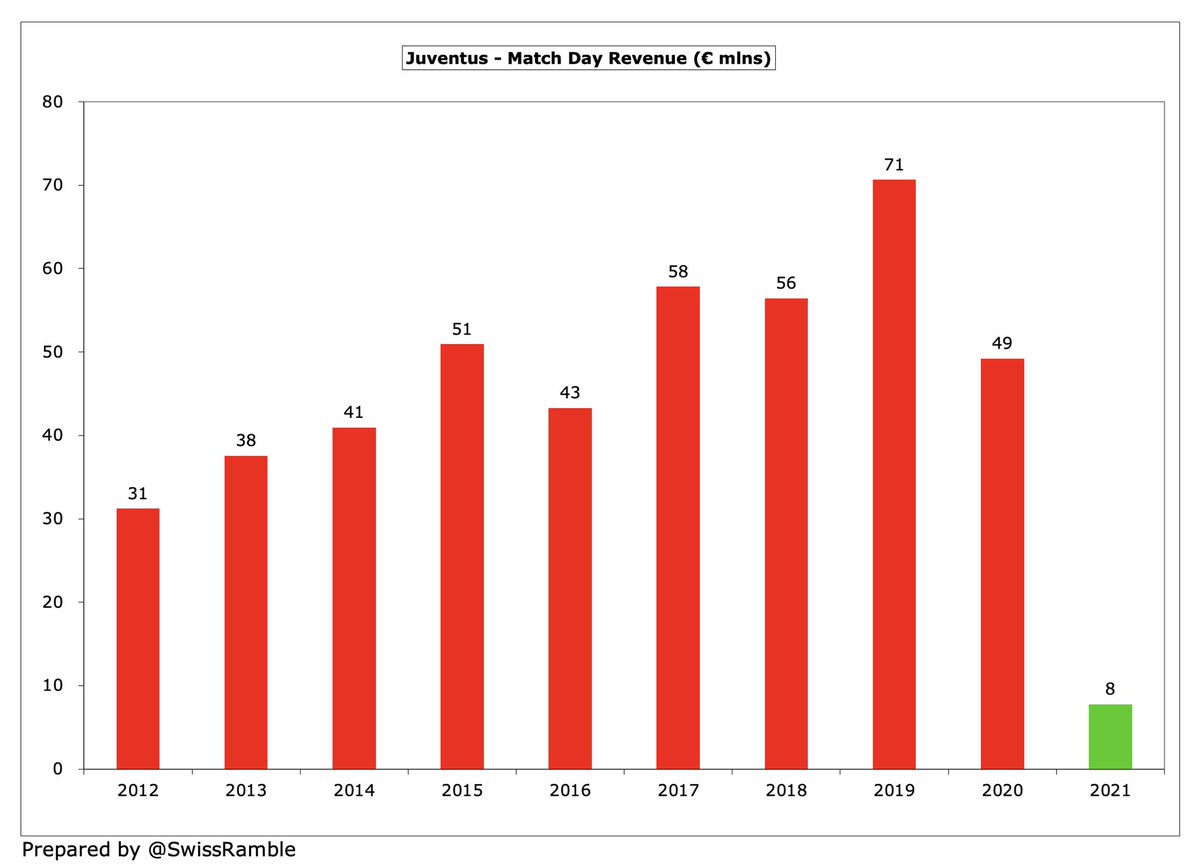

Broadcasting income rose €69m (41%) to €235m, mainly revenue deferred from 2019/20 accounts, though commercial and player loans were also higher, up €9m (5%) to €194m & €7m to €12m respectively. Compensated for COVID driven reductions in match day, down €41m (84%) to €8m.

As a technical aside, this international definition of #Juventus €450m revenue is different to the one used in the club accounts, which also includes €31m gain on player sales, giving revenue of €481m, which decreased €93m (16%) from prior year’s €573m.

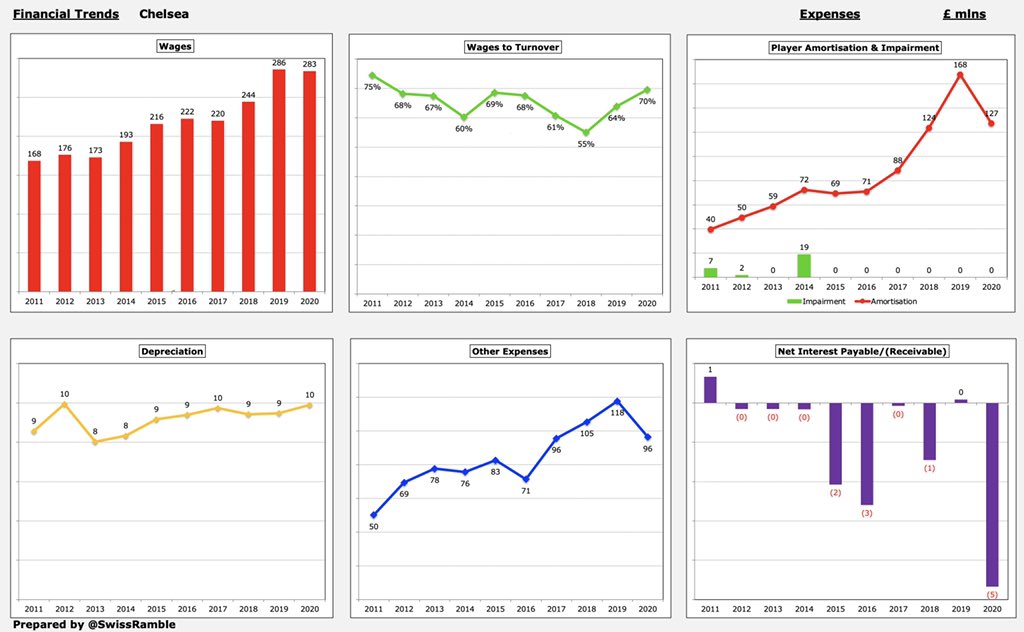

#Juventus wage bill rose €39m (14%) from €284m to €323m, while player amortisation (including write-downs) increased €4m (2%) to €197m. On the other hand, other expenses were cut €4m (3%) to €126m, depreciation/provisions fell €2m and net interest was down €4m to €11m.

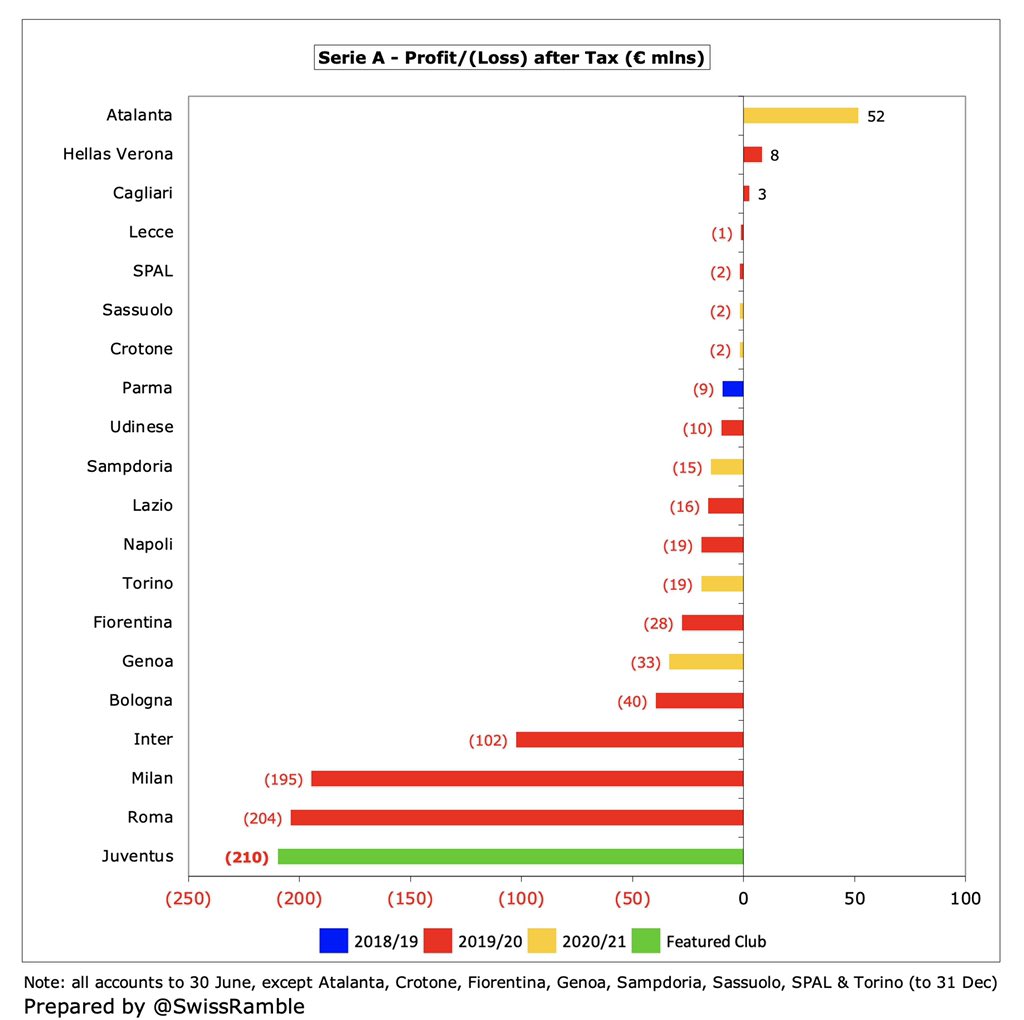

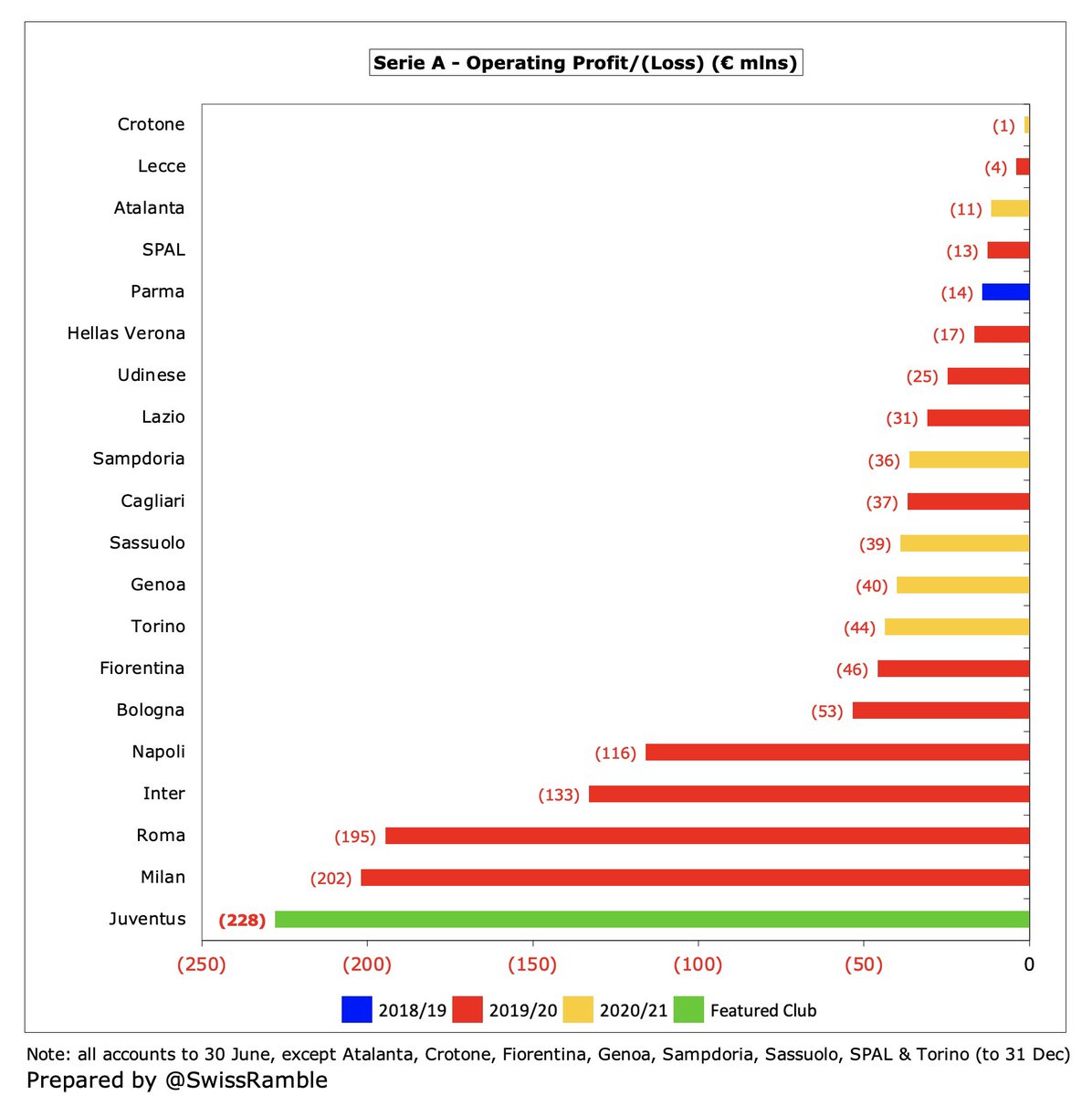

Unsurprisingly, #Juventus huge €208m pre-tax loss is the worst in Italy, though their figures are the only ones to include a full year of the pandemic, as some clubs have a December year-end. This is the case for Atalanta, but their €74m profit is still pretty impressive.

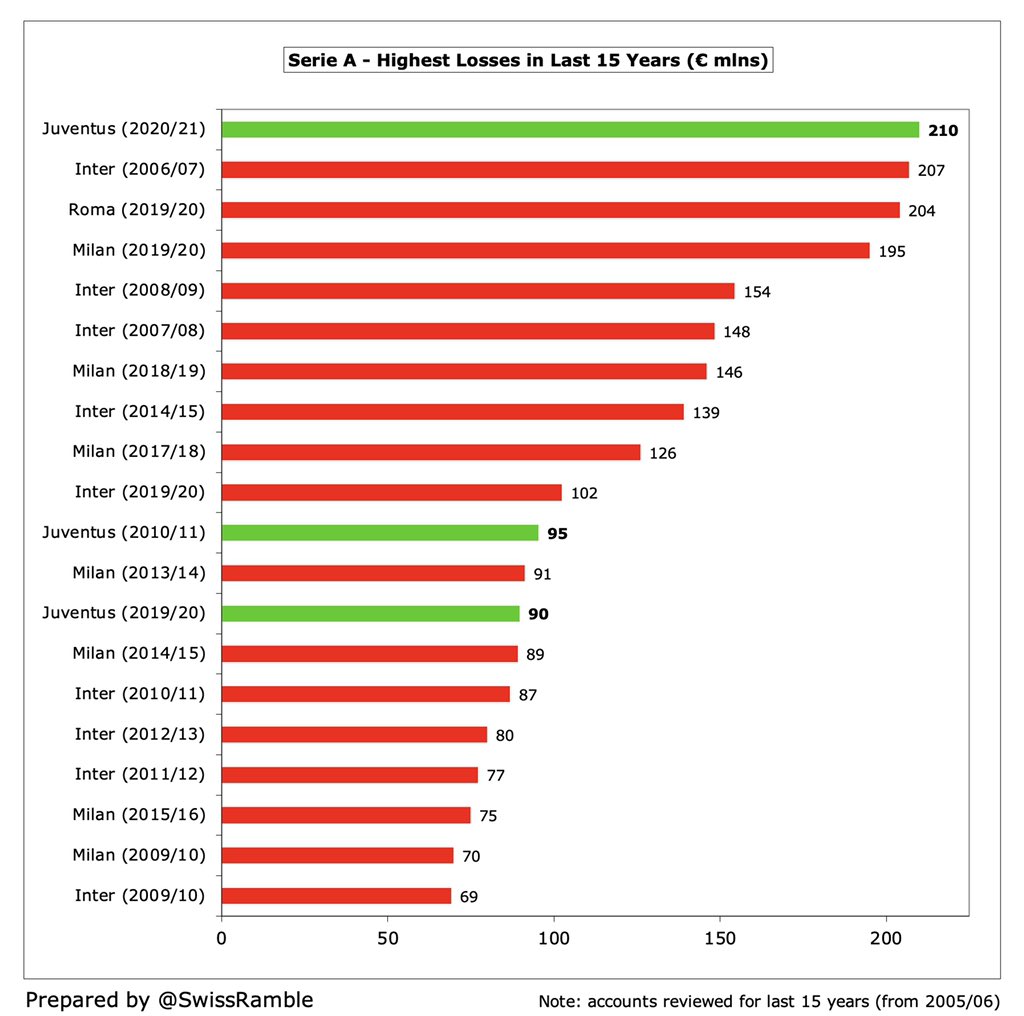

In fact, #Juventus €210m post-tax loss is the highest ever in Italy, ahead of #Inter €207m in 2006/07, followed by two substantial losses from the 2019/20 season: #ASRoma €204m and #Milan €195m. In fairness, Barcelona have announced a barely credible €481m loss for 2020/21.

#Juventus estimate the impact of COVID on 2021 revenue as €70m (match day and retail sales), while overall loss for 3-year period between 2020 & 2022, including lower player sales from less liquid transfer market, will amount to hefty €320m (assuming gradual recovery in 2022).

#Juventus profit on player sales slumped from €167m to €31m, the club’s lowest since 2015. In the prior year Juve had by far the highest profit from player trading in Italy, largely from sales of Pjanic to Barcelona, Cancelo to #MCFC, Kean to #EFC and Can to Dortmund.

After four years of profits up to 2017, #Juventus have now reported losses four years in a row, adding up to a €326m deficit in that period, including €289m in the last two years alone. COVID has exacerbated their losses. Club expects 2021/22 to also show a “significant loss”.

COVID has impacted #Juventus ability to make big money from player sales. In the 4 years up to 2020 they averaged annual €132m profit from this activity, but only managed to realise €31m in 2021. This season will include €14m book loss from sale of Cristiano Ronaldo to #MUFC.

The importance of player trading to #Juventus business model is illustrated by them making €563m profit from player sales in the 5 years up to 2020. This is nearly €200m more than the next best performer in Italy, namely Roma €372m, followed by Napoli €325m and Inter €226m.

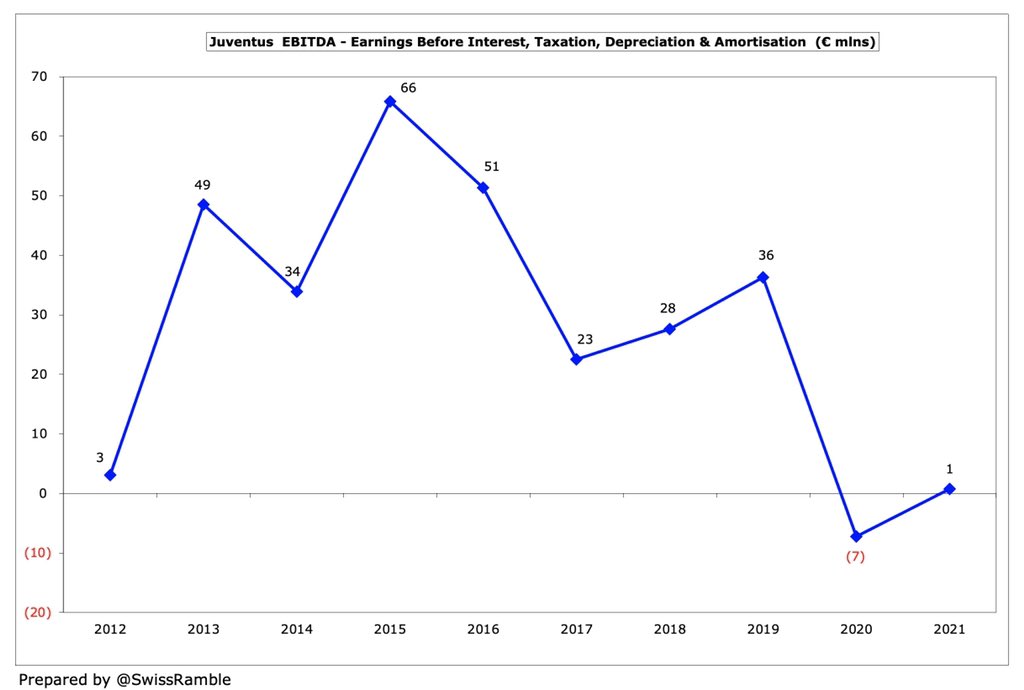

#Juventus EBITDA (Earnings Before Interest, Tax, Depreciation & Amortisation), a proxy for underlying profitability, as it excludes once-off items like player sales, rose from €(7)m to €1m. This is one of the best in Italy, though much lower than the club’s €36m two years ago.

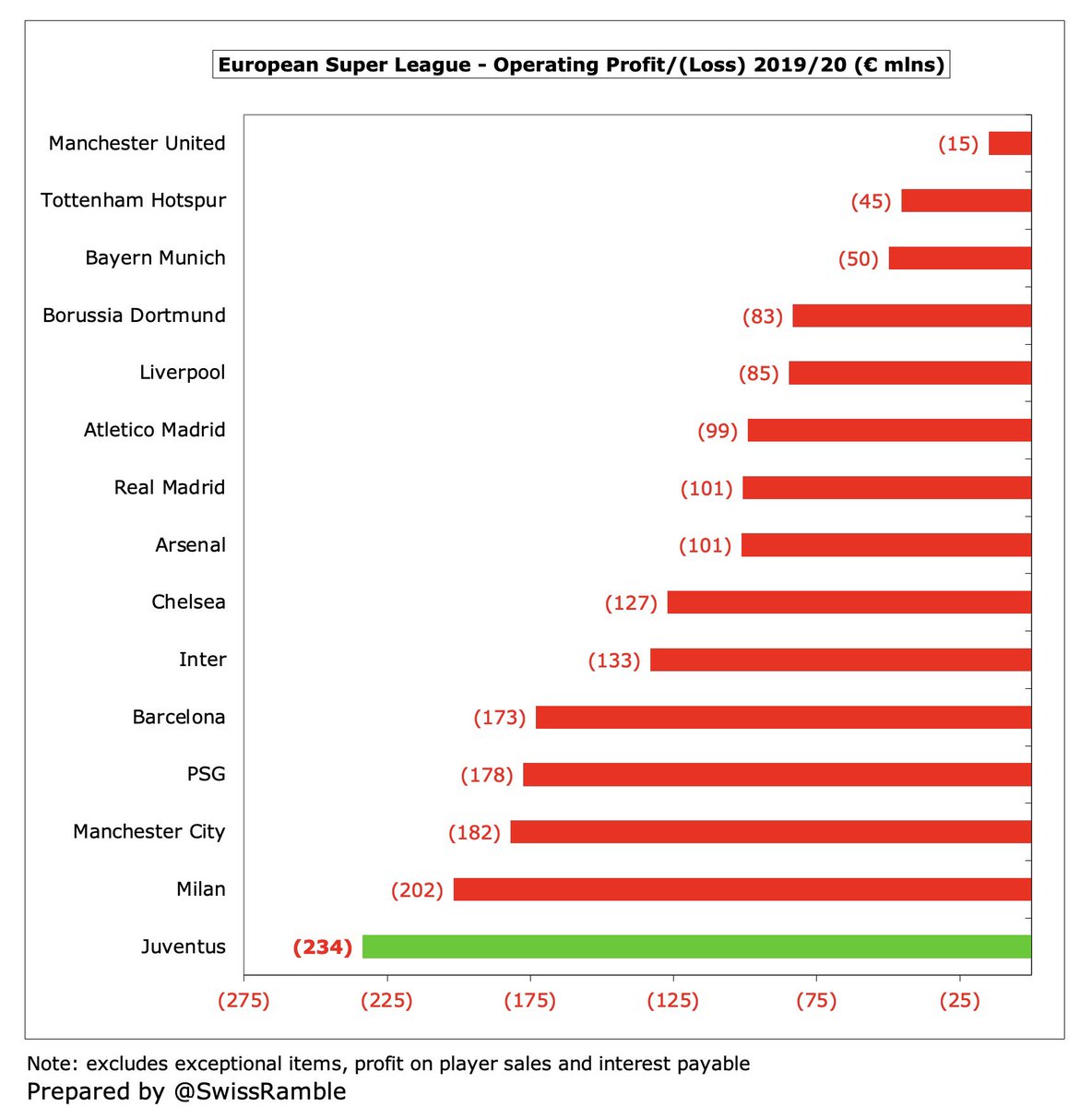

#Juventus operating loss improved slightly from €234m to €228m, but this is still the worst in Italy (pending other clubs 2020/21 accounts). Even before COVID this had been on a steady downward trend from €1m in 2015 and was the highest of the major European clubs in 2020.

Excluding player sales, #Juventus revenue has fallen by €44m (9%) in the past two years from the €494m peak to €450m, though still club’s second highest. The reduction has been driven by match day, down to €8m as games played behind closed doors, so just 2% of total revenue.

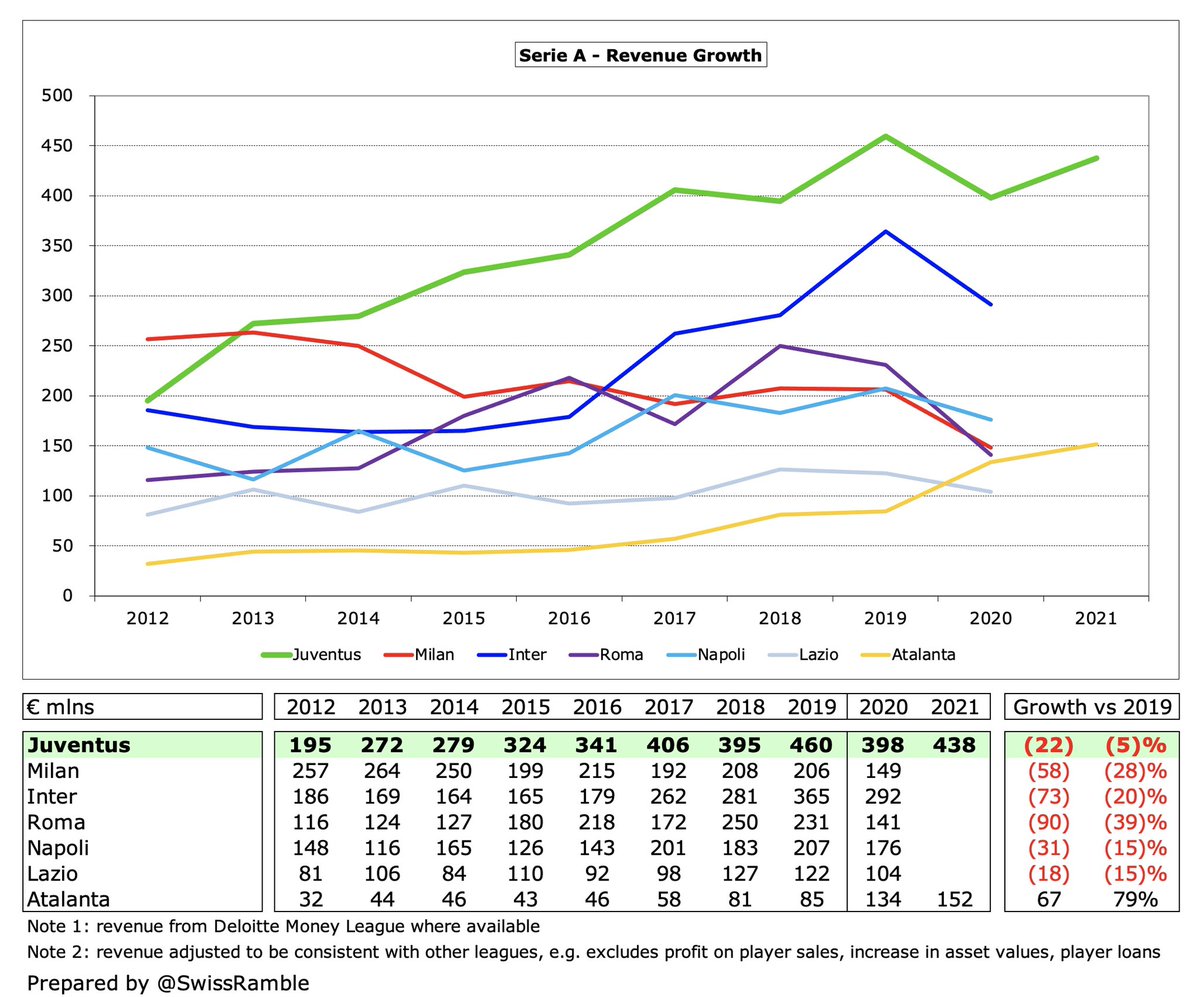

Despite reflecting a full season of COVID, #Juventus €450m revenue is still highest in Italy, well ahead of Inter €302m, Napoli €179m, Milan €172m, Roma €149m & Lazio €106m (2019/20). Atalanta up to €152m in 2020/21, thanks to CL. All other Serie A clubs below €100m.

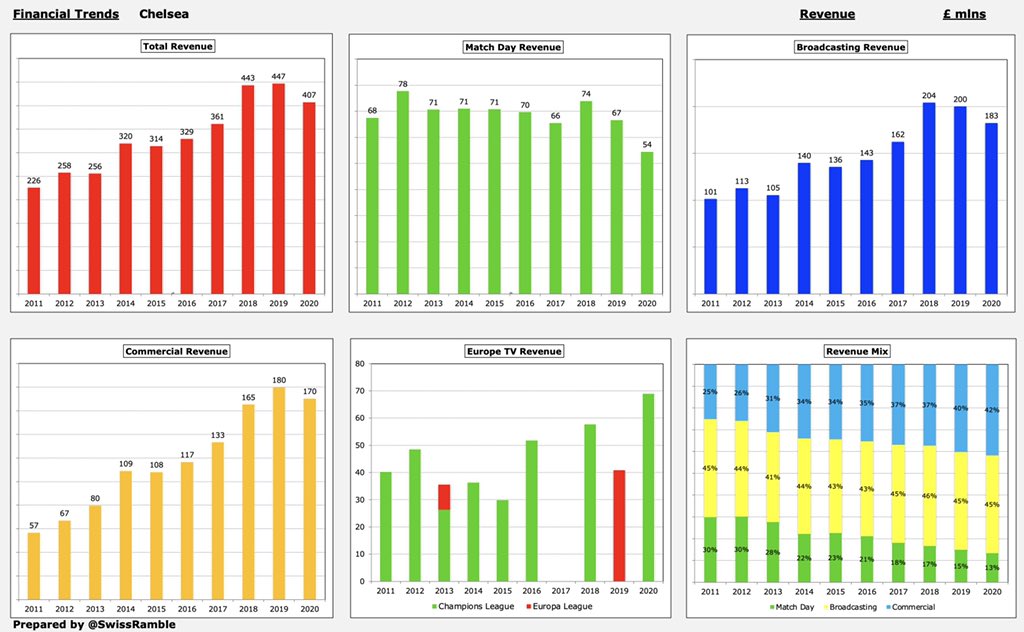

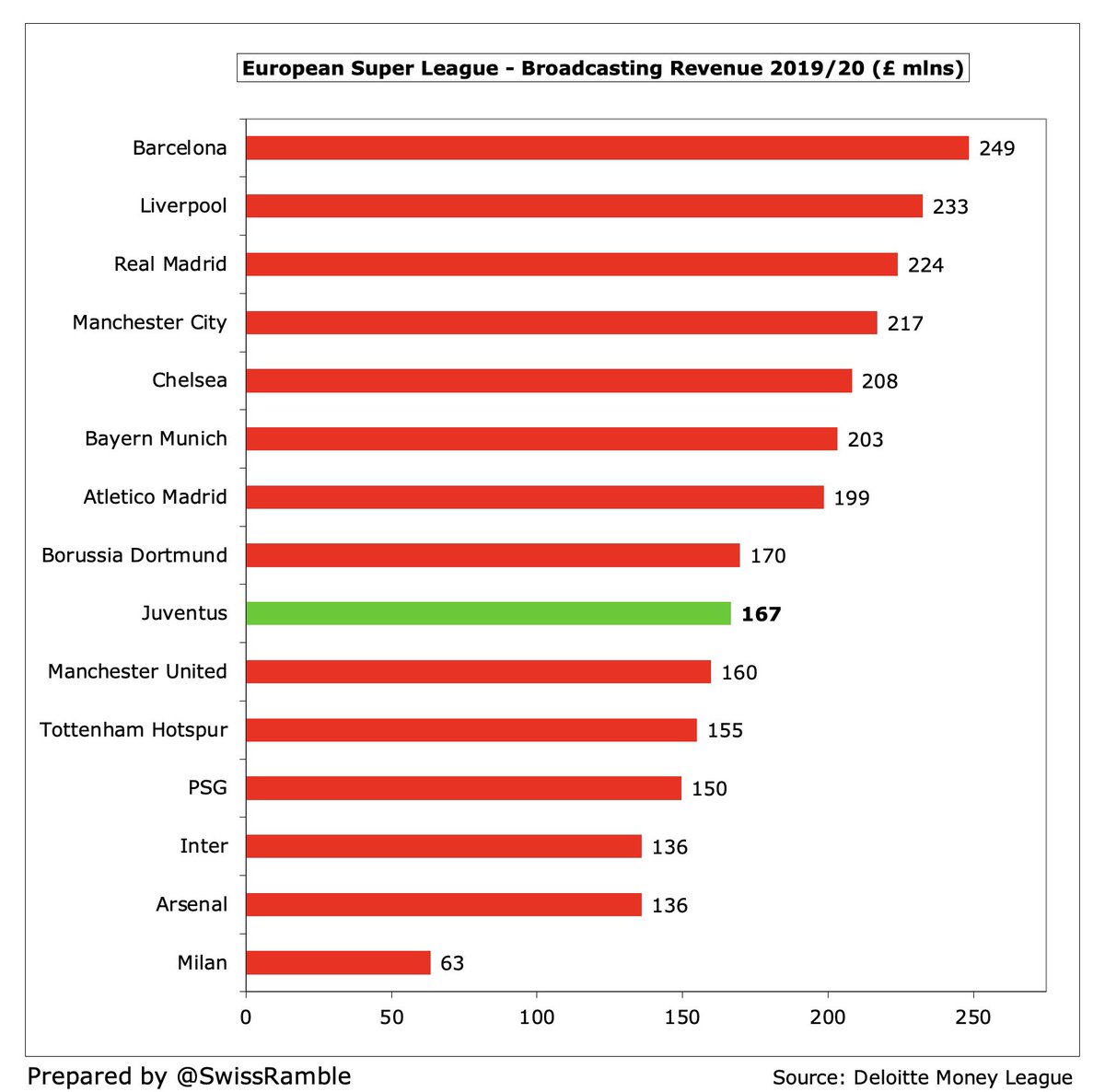

#Juventus remained in 10th place in the Deloitte Money League, based on 2019/20 revenue, having overtaken Arsenal the previous season. However, their €255m revenue growth since 2010 is the lowest in the top 10, miles below the likes of PSG, #MCFC, Barcelona, #LFC and #THFC.

#Juventus broadcasting revenue shot up €69m (41%) from €166m to €235m, a club record for this revenue stream, benefiting from income deferred from 2019/20 for games played after end-June accounting close. Highest in Italy by far, but below average in Europe (in a normal year).

Per my model #Juventus received €81m TV money from Serie A in 2020/21: 50% equal share; 30% performance (15% last season, 10% last 5 years, 5% historical); 20% media profile (8% TV audience, 12% fans). Also some income deferred from 2019/20 for games played in July and August.

It is imperative that #Juventus do well in the Champions League to boost their broadcasting income, as the TV rights in Serie A are relatively low. Indeed, there were big increases in England (€3.6 bln) and Spain (€2.0 bln) in 2019/20, while Italy was unchanged (€1.3 bln).

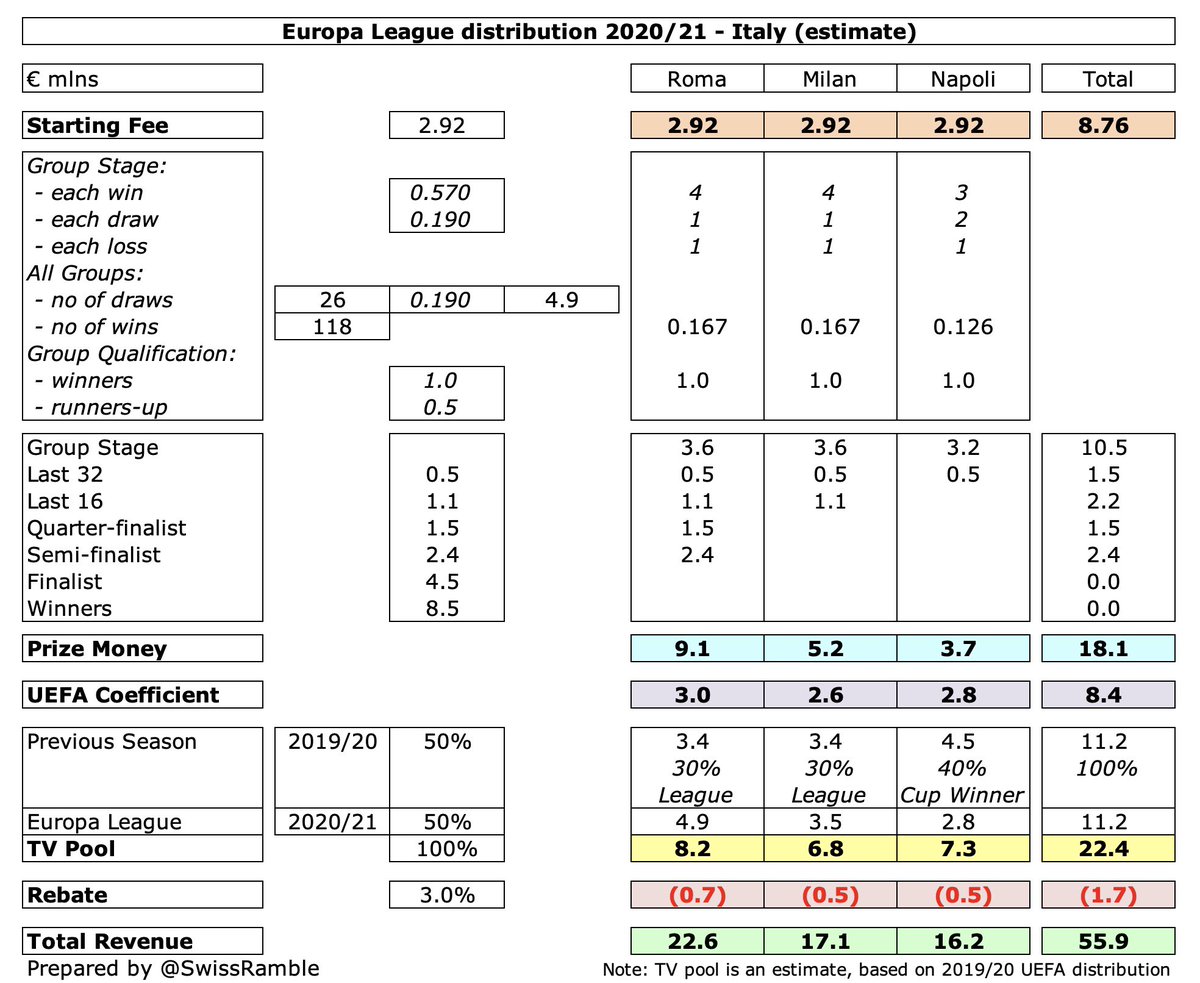

Based on my estimate, #Juventus earned €83m from the Champions League after going out in the last 16, around the same as prior season’s €84m. Well ahead of other Italian clubs: Lazio €54m, Atalanta €51m, Inter €50m, Roma €23m, Milan €17m & Napoli €16m. Net of COVID rebate

Worth noting the influence on Champions League money of the UEFA coefficient payment (based on performances over 10 years), where #Juventus had the 6th highest ranking, guaranteeing them €30m, compared to much lower amounts at Inter €18m, Lazio €12m & Atalanta €6m.

The Champions League is extremely important for #Juventus, who have earned an impressive €454m from Europe in last 5 seasons, which is significantly higher than other Italian clubs (Napoli €243m, Roma €209m and Inter €171m). However, Juve peaked in 2017 with €110m.

#Juventus match day income fell €41m (84%) from €49m to just €8m, as all home games were played behind closed doors (except one with 1,000 fans). This revenue was as high as €71m pre-COVID, though is one of the lowest of major European clubs (as seen in 2020 Money League).

#Juventus will be happy to see that all Italian stadiums have re-opened with 25% capacity this month, though will be looking for a full return of fans as soon as practically possible. Average attendance in 2019/20 only 5th highest in Serie A, but tickets relatively expensive.

#Juventus commercial income rose €9m (5%) to €194m, as new sponsorship deals, up €16m (13%) to €146m, offset €6m reductions in sale of products. This resilience holds Juve in good stead, as other Italian clubs have suffered, e.g. Inter’s Chinese sponsors have reduced.

As a result, #Juventus €194m commercial income is by some distance the highest in Italy, well ahead of Inter €115m, then big gap to Milan €77m, Napoli €42m, Sassuolo €39m & Roma €35m. However, Juve miles below other top European clubs like Real Madrid €383m & Bayern €361m

Commercial growth linked to Ronaldo, so interesting to see development after his sale. #Juventus shirt sponsor Jeep extended to 2024, up from €42m to €45m (€17m in 2019). Adidas kit deal up from €23m to €51m in 2020. Allianz stadium/training kit €10m. Cygames back-of-shirt.

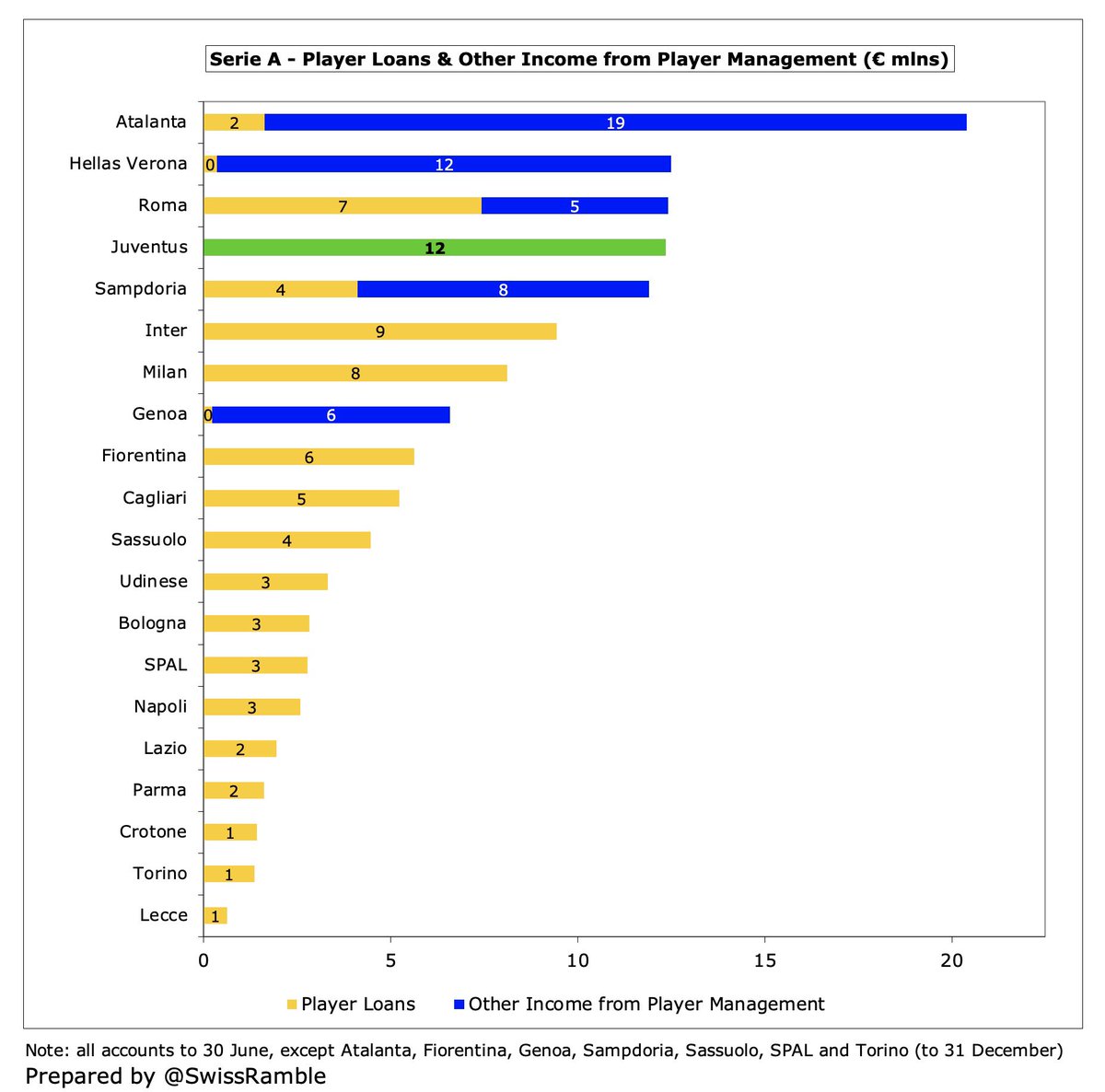

#Juventus player loans income increased from €5m to €12m, mainly Rugani, Mandragora, De Sciglio, Romero and Costa. One of the highest in Italy, though others benefited from other income from player management (mainly performance bonuses).

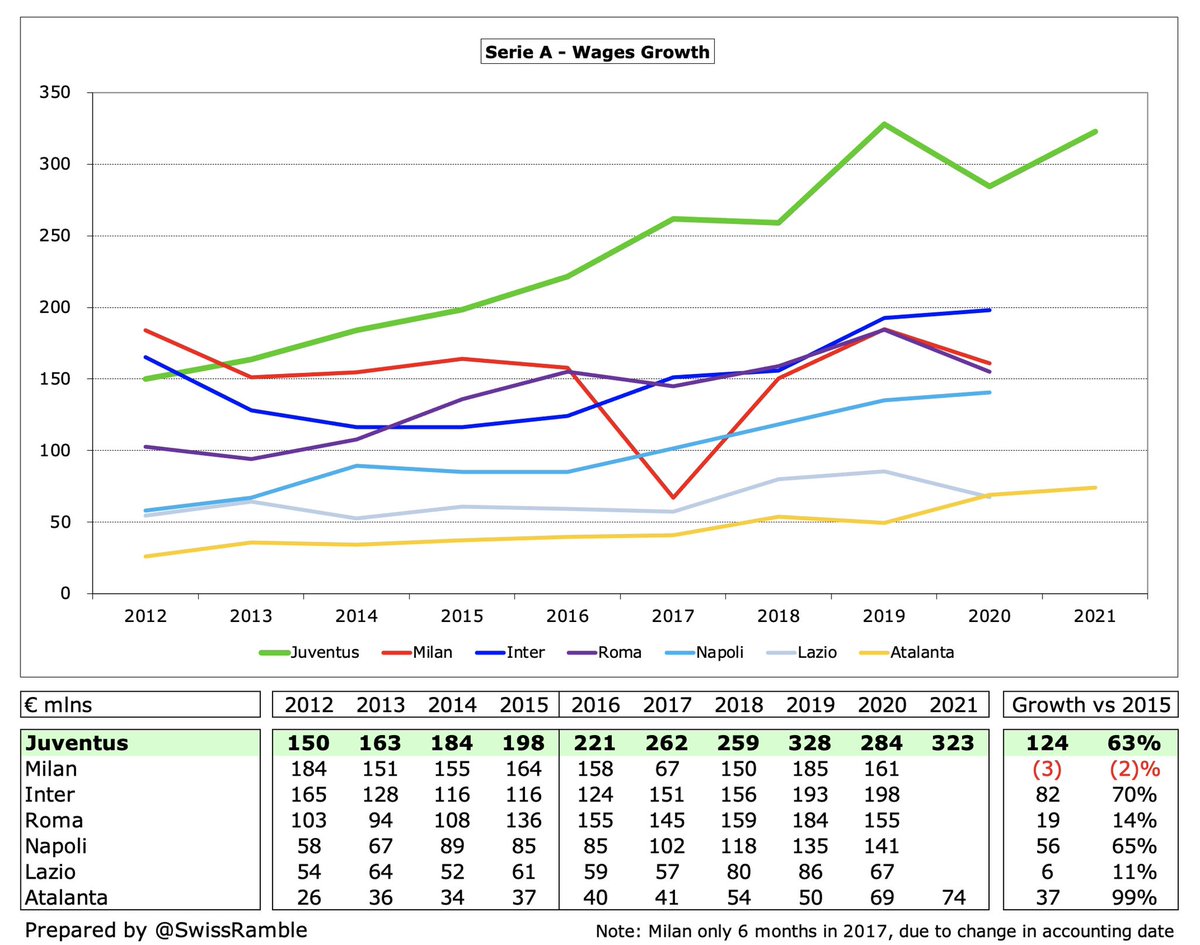

#Juventus wage bill rose €39m (14%) from €284m to €323m, partly due to players giving up some salary in 2020 because of COVID. Almost back to €328m club high in 2019. Wages have grown more than any other Italian club (€124m since 2015), but will fall after CR7’s departure.

#Juventus wage bill of €323m is significantly higher than the rest of Serie A with closest clubs being over €100m lower: Inter €198m, Milan €161m, Roma €155m & Napoli €141m. However, a fair bit less than European peers, e.g. Barcelona €443m, PSG €414m and #MCFC €401m.

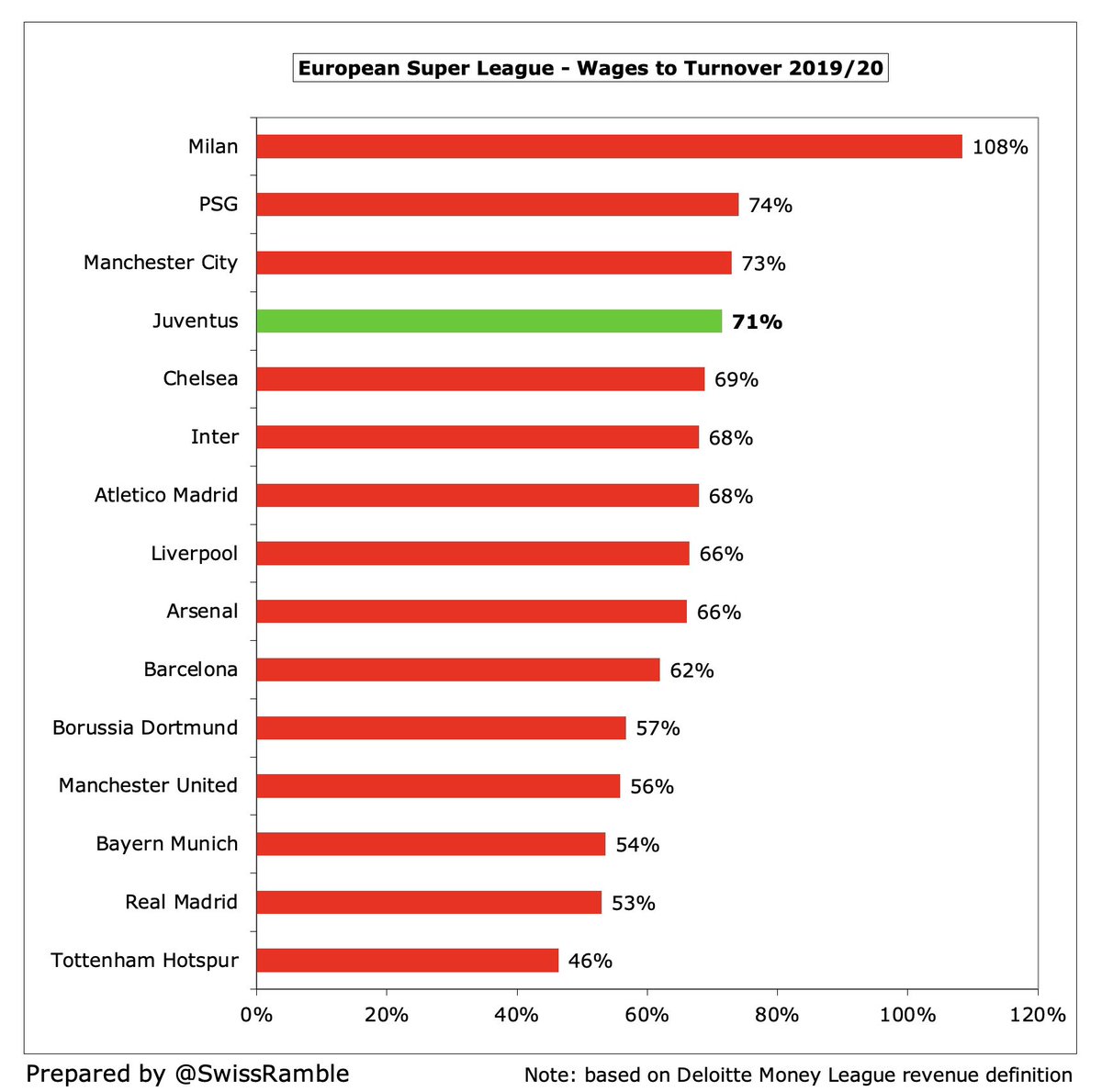

#Juventus wages to turnover ratio increased from 70% to 72%, the club’s highest since 2012 and just above UEFA’s recommended upper limit. This is mid-table in Italy, but one of the highest (worst) of the leading European clubs, around the same as PSG and #MCFC.

#Juventus player amortisation, the annual cost of writing-off transfer fees, rose €30m (19%) from €167m to €197m, reflecting investment in the playing squad. Up from only €54m in 2015. Prior year also included €27m player write-downs (mainly Higuain and Matuidi).

As a result, #Juventus player amortisation of €197m is by far the highest in Italy, much more than Inter €120m, Napoli €118m, Milan €95m and Roma €94m. To place this into context, their €167m in 2019/20 was more than all other European clubs except Barcelona (€174m).

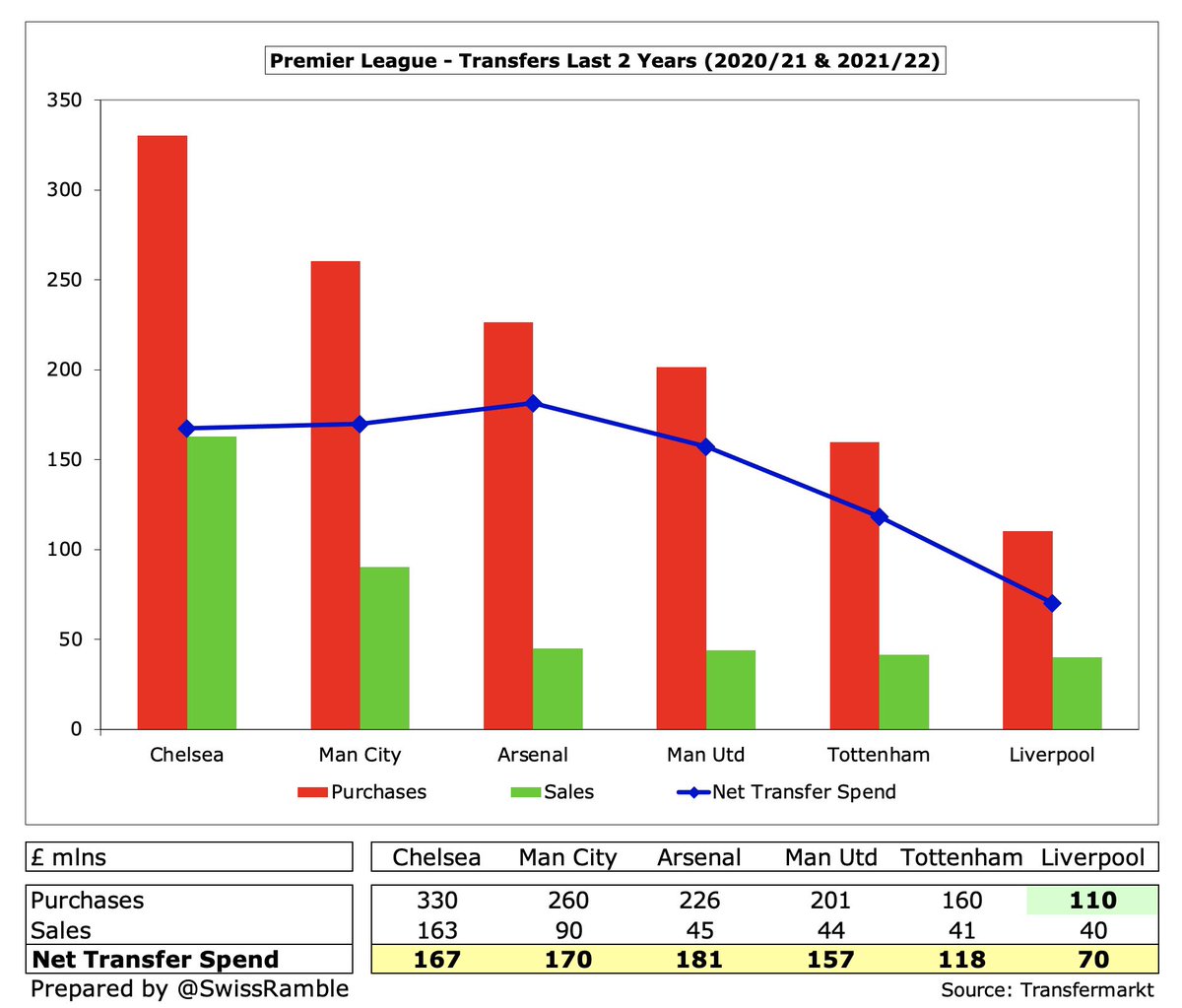

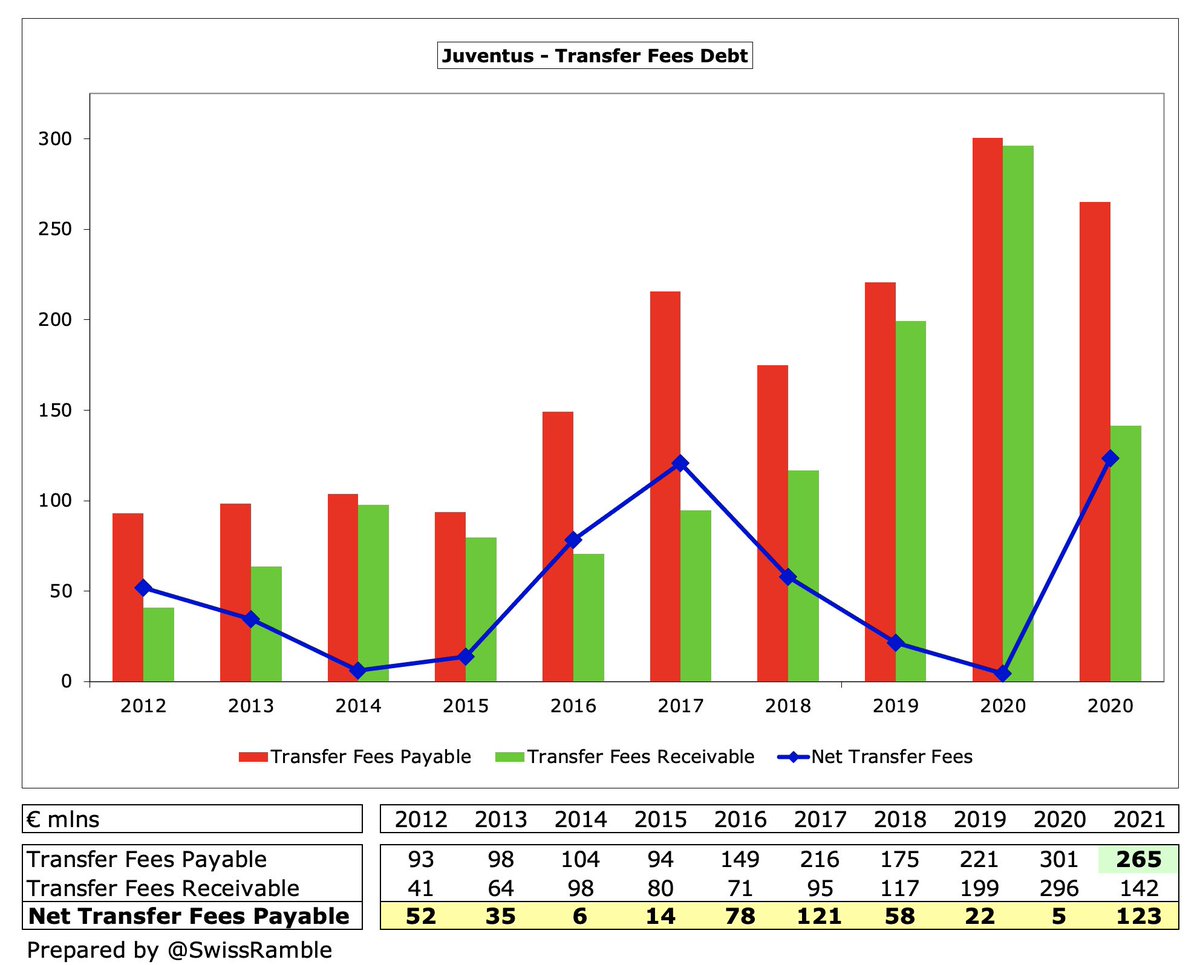

#Juventus gross transfer spend in 2021 was €122m, down significantly on the previous two years (€293m in 2019 and €349m in 2020) and the smallest since 2015. However, net spend of €90m was only a bit lower, as player sales were just €32m.

Based on Transfermarkt, #Juventus have the highest gross transfer spend in Serie A in last 4 years of €656m, over €200m more than Roma €443m, Inter €434m, Milan €411m and Napoli €358m. However, on a net spend basis, Juve €200m are second to Milan €212m.

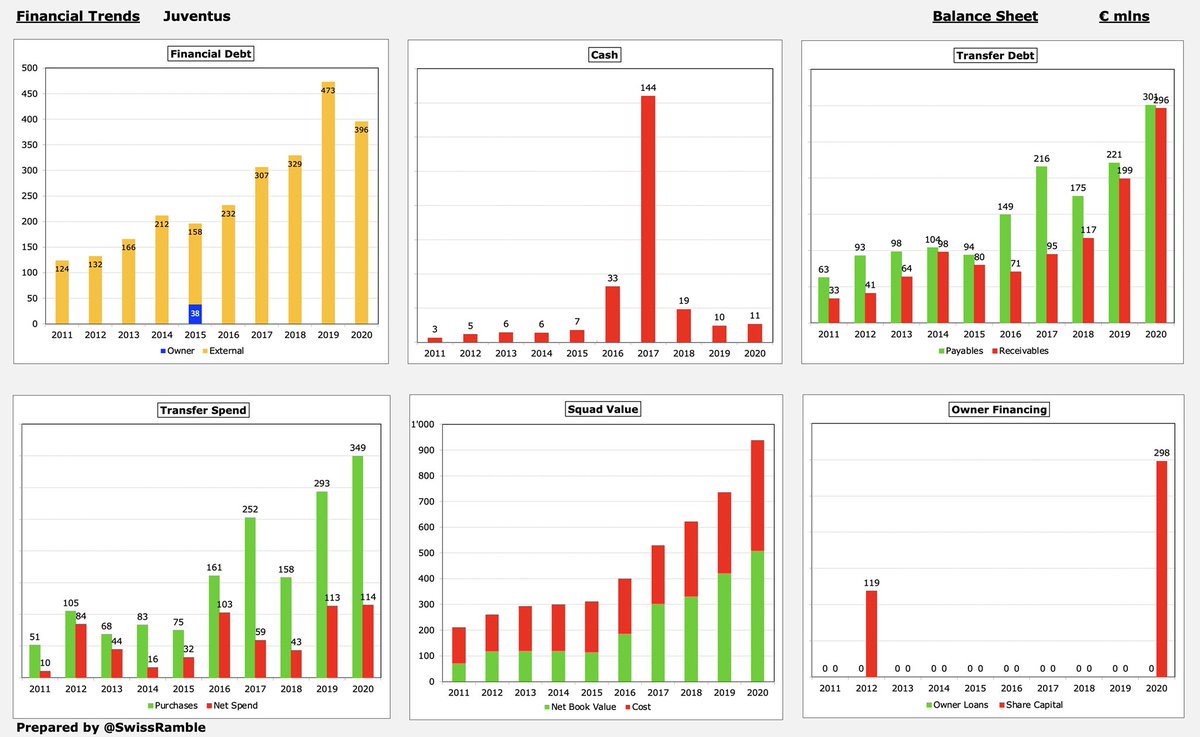

#Juventus gross financial debt increased slightly from €396m to €400m, including €176m bonds, €97m owed to factoring companies, €86m bank loans, €18m owed to Istituto per il Credito Sportivo €24m and €24m other debt. This has tripled since the €132m debt in 2012.

#Juventus €400m gross debt is second highest in Italy, only surpassed by Inter €411m. Much of the debt was for the stadium development, but has increasingly been used to finance investment in the squad. Still far below clubs like #THFC €947m, #MUFC €599m and Barcelona €480m.

#Juventus net interest payable fell €4m (27%) from €15m to €11m, the third highest in Italy, but a fair way below Roma €32m and Inter €26m.

#Juventus reduced transfer debt from €301m to €265m, but this was still their 2nd highest ever and the most in Italy, way ahead of Inter €207m and Roma €191m. Also 3rd highest in Europe last year, only behind Barcelona & Atleti. On a net basis, big leap from €5m to €123m.

#Juventus €858m total debt was also one of the highest in Europe in 2019/20, though a lot less than #THFC €1.3 bln and Barcelona €1.2 bln. Note: total debt includes bank debt, transfer debt, tax liabilities, trade creditors and staff debt.

After adding back €229m non-cash items and €12m working capital movements, #Juventus had €13m operating cash flow in 2020/21, boosted by €26m from player trading, before interest payments €10m, loan repayments €7m, capex €6m and tax €3m. Net cash inflow €12m.

In the last three years #Juventus have had £336m available cash, but that was largely due to a major €298m capital injection in 2020. This money was primarily used to make €224m net player purchases and cover €46m operating losses.

#Juventus will strengthen its balance sheet with another €400m capital increase (majority shareholder EXOR has already paid €75m on account in August). This means that the club will have received €918m of owner funding since 2007, including nearly €700m in last 3 years alone.

The #Juventus business model clearly faces financial challenges, made worse by the pandemic, which is why they did not make a major signing to replace Ronaldo. It also helps explain why the club remains interested in the European Super League project.

That said, #Juventus are still very much the biggest club in Italy, certainly in financial terms. Although the 2021/22 season will deliver another large loss, the club expects the economic performance to “improve significantly starting from 2020/23 financial year.”

• • •

Missing some Tweet in this thread? You can try to

force a refresh