Today Flashbots is releasing v0.4 and introducing mega bundles to the Flashbots Network

Mega bundles will let us innovate faster, support more bundles and will lead to new searcher strategies and more miner revenue

A thread on mega bundles 🧵👇🏻

Mega bundles will let us innovate faster, support more bundles and will lead to new searcher strategies and more miner revenue

A thread on mega bundles 🧵👇🏻

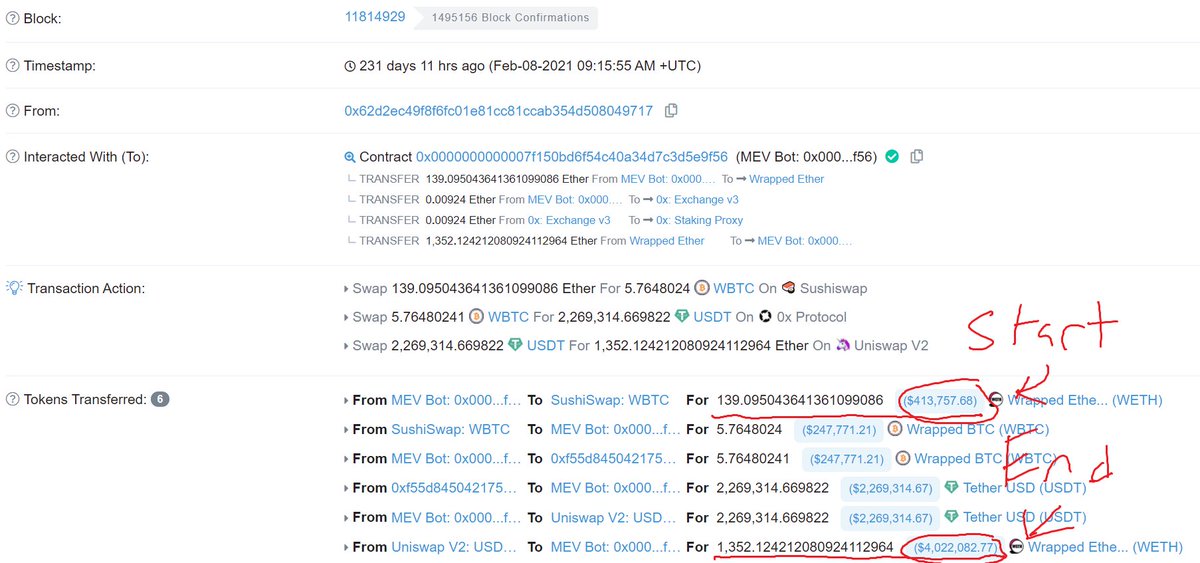

Flashbots is an open MEV marketplace. On 1 side of the market users submit "bundles" of txs. On the other miners run an auction & place the highest gas price bundles at the top of blocks.

This allows miners of any size to extract MEV, which is important for economic security.

This allows miners of any size to extract MEV, which is important for economic security.

In the early days of Flashbots only 1 bundle could be included in a block. That greatly limited our impact.

Our v0.2 release introduced multiple bundles per block through a merging process & gave miners control the number bundles they wanted to include

Our v0.2 release introduced multiple bundles per block through a merging process & gave miners control the number bundles they wanted to include

https://twitter.com/bertcmiller/status/1396961882121121799

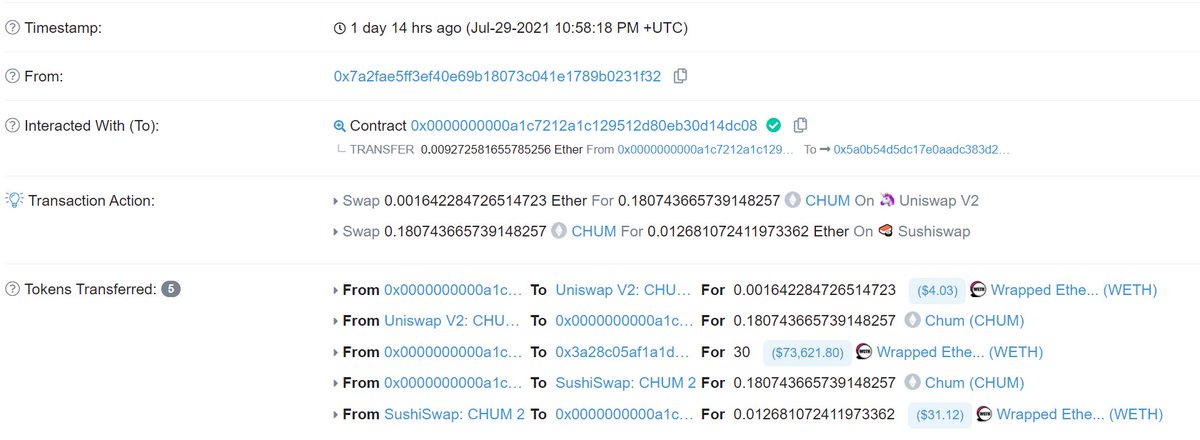

Merging bundles is very computationally intensive.

First, every bundle is simulated to figure out what its gas price is.

Then we place the highest gas price bundle at the top of a block.

First, every bundle is simulated to figure out what its gas price is.

Then we place the highest gas price bundle at the top of a block.

Next we try to merge the 2nd highest gas price bundle by simulating the top bundle and 2nd bundle together.

If the 2nd bundle reverts then it clashes with the first (e.g. targets the same opportunity) and is discarded.

If the 2nd bundle reverts then it clashes with the first (e.g. targets the same opportunity) and is discarded.

If the bundle does not revert then we repeat this process by attempting to merge the 3rd, 4th ... Nth bundle.

Most miners stop at 2 or 3 bundles because merging gets exponentially more difficult with more bundles.

Most miners stop at 2 or 3 bundles because merging gets exponentially more difficult with more bundles.

MEV-geth, our software for miners, manages this process by parallelizing it & choosing the most profitable combination / # of bundles.

But there are limitations to what can be done at the MEV-geth level, and beyond a threshold it doesn’t scale.

But there are limitations to what can be done at the MEV-geth level, and beyond a threshold it doesn’t scale.

A last note before turning to mega bundles.

To date bundles have been ranked according to gas price, not profitability. That meant that gas intensive MEV (e.g. liquidations) is at a disadvantage compared to less gas intensive MEV (e.g. arbs).

To date bundles have been ranked according to gas price, not profitability. That meant that gas intensive MEV (e.g. liquidations) is at a disadvantage compared to less gas intensive MEV (e.g. arbs).

However, the most profitable thing for miners isn't always to sort bundles by gas price. Some MEV can be left on the table.

But, sorting by gas price was the most feasible thing to do due to the limitations of merging at MEV-Geth. So we made that tradeoff.

But, sorting by gas price was the most feasible thing to do due to the limitations of merging at MEV-Geth. So we made that tradeoff.

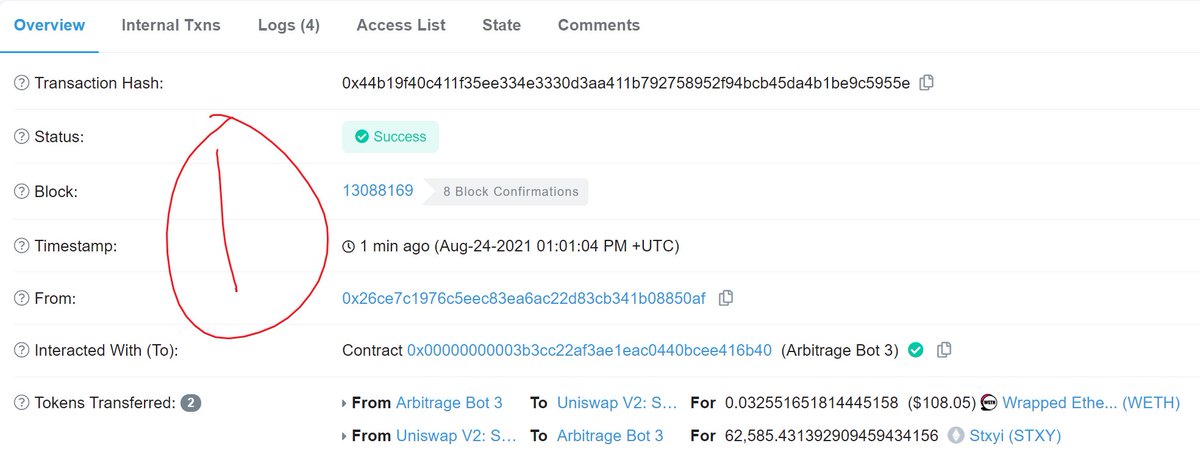

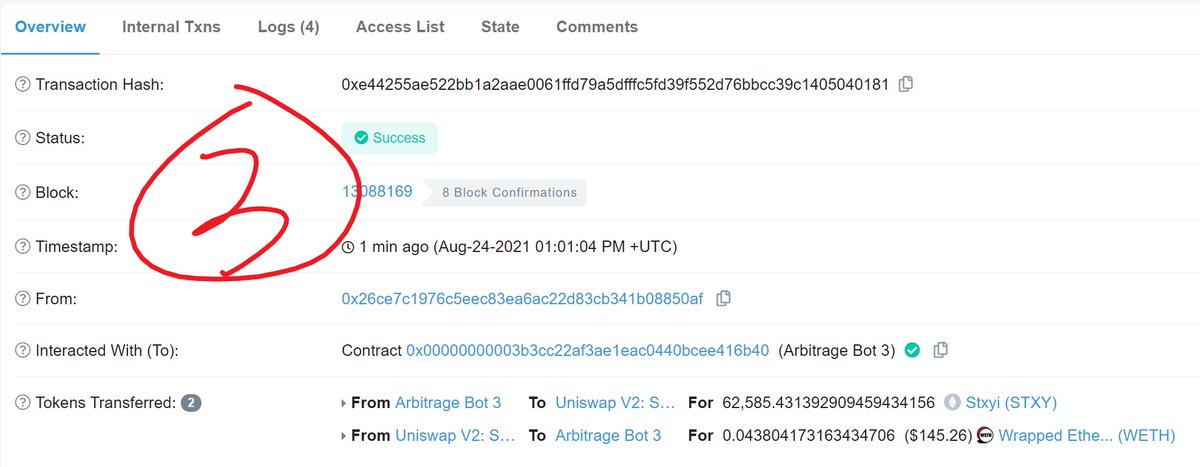

Today Flashbots is taking a big step forward by releasing mega bundles.

Mega bundles are bundles that are merged *before* being sent to miners.

Miners can, if they wish, move the problem of merging and ordering bundles upstream, including but not limited to the Flashbots Relay.

Mega bundles are bundles that are merged *before* being sent to miners.

Miners can, if they wish, move the problem of merging and ordering bundles upstream, including but not limited to the Flashbots Relay.

Moving the merging & ordering problem upstream enables specialization.

At Flashbots we have exciting plans for scaling bundle merging by orders of magnitude. We also have ideas for new ways of ranking bundles to support new strategies & improve revenue for searchers and miners.

At Flashbots we have exciting plans for scaling bundle merging by orders of magnitude. We also have ideas for new ways of ranking bundles to support new strategies & improve revenue for searchers and miners.

Mega bundles also enable faster product iteration. Previously shipping features meant coordinating updates to MEV-geth across miners accounting for ~85% of ETH hash rate. Not easy.

Now, in many cases, we can simply update our relay’s mega bundle code.

Now, in many cases, we can simply update our relay’s mega bundle code.

We’re building a whole team of superstars that will tackle just this problem.

If bundle merging, EVM optimization, or new transaction optimization features interests you please reach out :).

If bundle merging, EVM optimization, or new transaction optimization features interests you please reach out :).

Mega bundles are an important step towards full block proposals. As we laid out in On The Design of MEV Marketplaces, separating block builders and block proposers is integral to ensuring MEV is long term aligned with crypto.

https://twitter.com/bertcmiller/status/1423023166885142534

Join @hudsonjameson and I on a Twitter Spaces this Wednesday for a discussion on mega bundles!

https://twitter.com/hudsonjameson/status/1442547708925992966?s=20

Lastly I want to recognize the incredible Flashbots crew who makes all of this possible

@phildaian @tzhen @epheph @ObadiaAlex @thegostep @jparyani @fiiiu_ @IvanBogatyy @tkstanczak @taarushv @LukeYoungblood @hudsonjameson @metachris

@yoelopio @greg7mdp @DanielWorsley @lvanseters

@phildaian @tzhen @epheph @ObadiaAlex @thegostep @jparyani @fiiiu_ @IvanBogatyy @tkstanczak @taarushv @LukeYoungblood @hudsonjameson @metachris

@yoelopio @greg7mdp @DanielWorsley @lvanseters

• • •

Missing some Tweet in this thread? You can try to

force a refresh