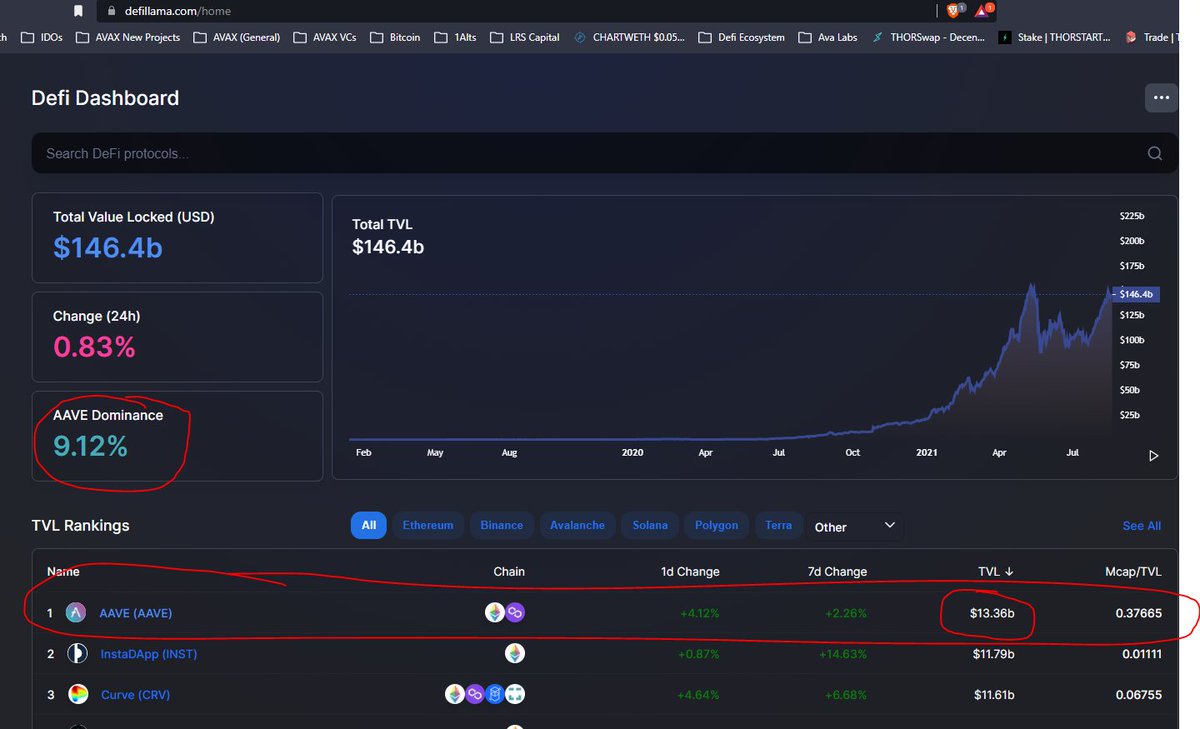

#alphaleak (outside of $AVAX) #BNB #launchpadstrategy

Yesterday, I saw a big spike-up on $BNB among an ocean of crypto weakness

1/8

Yesterday, I saw a big spike-up on $BNB among an ocean of crypto weakness

1/8

It could've meant a variety of things, perhaps regulatory clearance in a key market (@binance has been getting shut down), but I was hopeful that it could possibly mean... #BNB #launchpad season. And yes my prayers were answered!

2/8

2/8

So what's the #BNB #launchpad strategy? It's a tried & true strategy I've deployed successfully to get *outsized* gains. When @binance does a launchpad, it typically means very large gains for $BNB w/ a very nice #IDO dividend at the end

3/8

3/8

#bnbstrategy

Here's the playbook I use. Sometimes the rules vary between launchpads (so always read the rules!), but it normally involves a measurement period with #IDO allocations based on avg #BNB balance

4/8

Here's the playbook I use. Sometimes the rules vary between launchpads (so always read the rules!), but it normally involves a measurement period with #IDO allocations based on avg #BNB balance

https://twitter.com/rogerclu/status/1384746948557774848

4/8

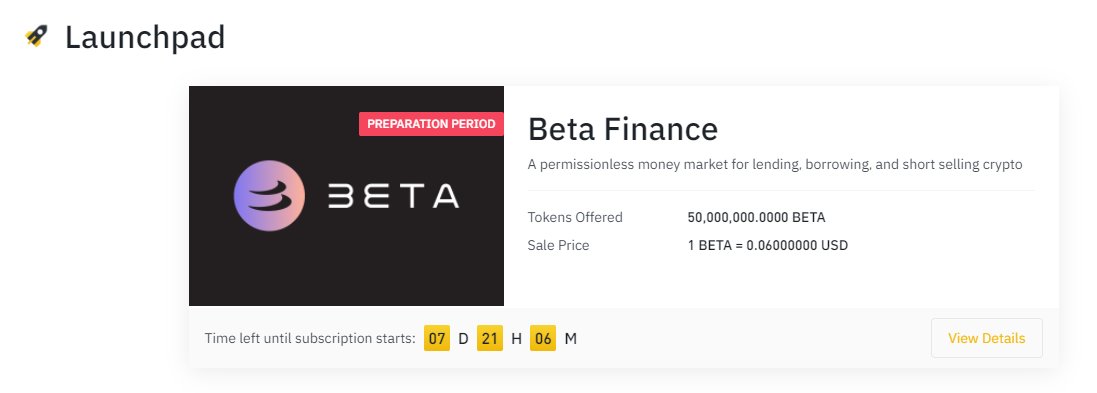

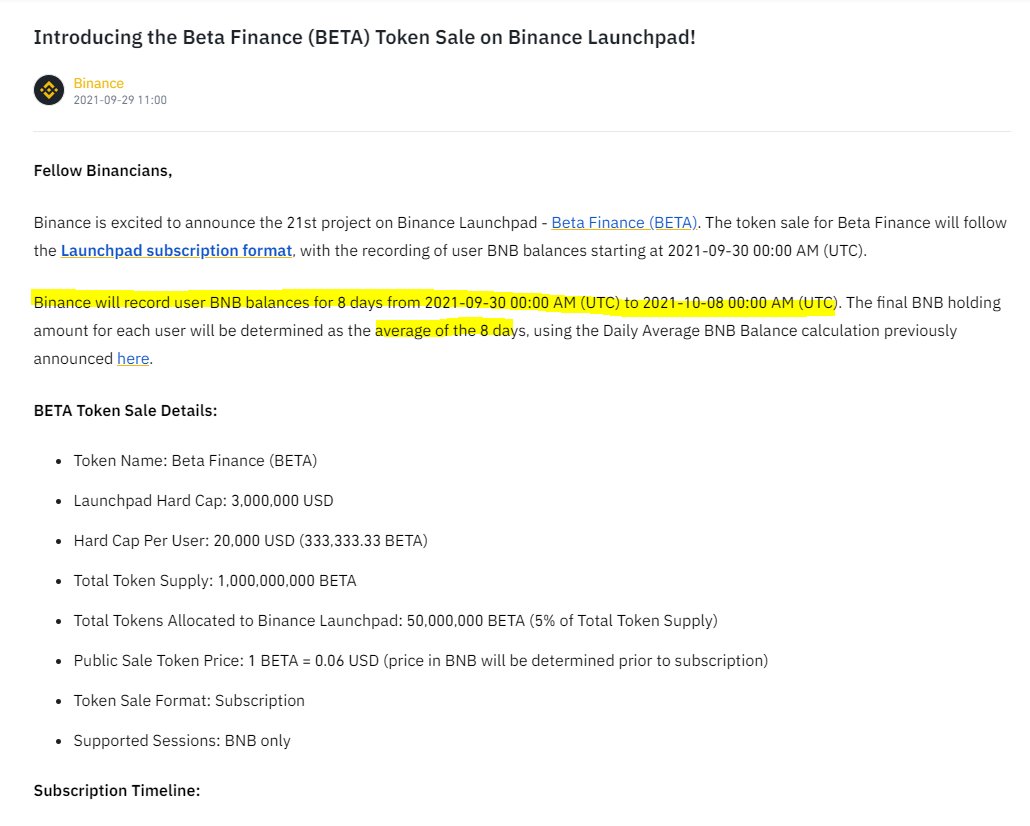

The current #launchpad involves @beta_finance $BETA, a permissionless money market for lending, borrowing & shorting crypto

Measurement period is Sep-30 0:00 UTC to Oct-8 0.00 UTC using avg. #BNB balance of 8 days

5/8

Measurement period is Sep-30 0:00 UTC to Oct-8 0.00 UTC using avg. #BNB balance of 8 days

https://twitter.com/binance/status/1443153927286018054

5/8

Here's past few #BNB #launchpad IDO performances (ATM Price-to-IDO price) which has been pretty awesome:

- @coin98_wallet $C98 = 88x

- @Tokocrypto $TKO = 49x

- @iSafePal $SFP = 40x

6/8

- @coin98_wallet $C98 = 88x

- @Tokocrypto $TKO = 49x

- @iSafePal $SFP = 40x

6/8

Holding #BNB is NOT w/out its risks. In the past it's been a core holding as a utility token with 25% discount on trades, VIP status & access to #launchpads, a big winner. BNB has been on my "no play" list due to reg. issues globally but can't pass up this "event-driven" play

7/8

7/8

Also check out my write-ups on other recent

@binance launchpad events including:

- $C98:

- $TKO:

- $SFP:

8/8

@binance launchpad events including:

- $C98:

https://twitter.com/rogerclu/status/1415630912340045824

- $TKO:

https://twitter.com/rogerclu/status/1377263493196488709

- $SFP:

https://twitter.com/rogerclu/status/1358784038937444353

8/8

• • •

Missing some Tweet in this thread? You can try to

force a refresh