My Strategy for Optimising Returns for Incoming #AvalancheRush

Epic 20-part thread incoming...

DISCLAIMER: DYOR, NOT INVESTMENT ADVICE, THIS MAY INVOLVE HIGH RISK

1/19

Epic 20-part thread incoming...

DISCLAIMER: DYOR, NOT INVESTMENT ADVICE, THIS MAY INVOLVE HIGH RISK

1/19

Hi All, it’s been quite a few months (May-21) since my last deep-dive into @avalancheavax $AVAX #defi investment strategies – frankly it’s become a FT job managing a larger portfolio & +EV was to focus on taking care of the $$$

Last Serious Post

2/19

Last Serious Post

https://twitter.com/rogerclu/status/1389183382370852867

2/19

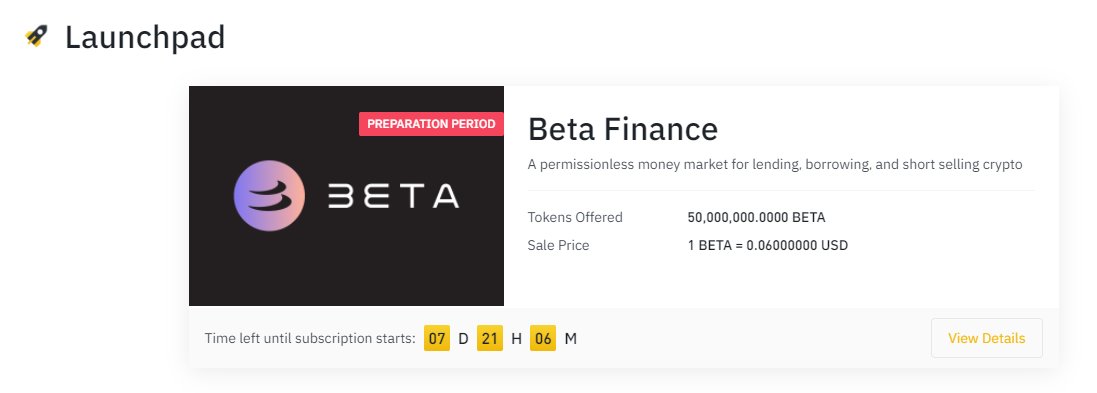

Now that #AvalancheRush is at our doorsteps - @kevinsekniqi has *promised* TODAY for @AaveAave $AAVE launch+rewards - I thought I'd gather my thoughts on how you might best position your @avalancheavax $AVAX native portfolio to take full advantage

3/19

https://twitter.com/kevinsekniqi/status/1443206379259445252

3/19

For starters, here’s my investment strawman/first principals for @avalancheavax $AVAX & #AvalancheRush:

4/19

4/19

How did I get to this investment thesis? IMO it's always good to maintain a high-level macro view that encompasses both tradfi (i.e. Everglade contagion risk?) & #crypto

Recently I’ve been thinking hard about @avalancheavax $AVAX in the context of L1 narratives

5/19

Recently I’ve been thinking hard about @avalancheavax $AVAX in the context of L1 narratives

5/19

These 2 recent @UpOnlyTV podcasts – which I rate as the best crypto content out there - have really helped me form my current view on this L1 narrative:

6/19

https://twitter.com/rogerclu/status/1442477737445236738

https://twitter.com/rogerclu/status/1434149654984368130

6/19

While we're on the topic of podcasts, here are my top weekly listens (in order of listen):

- Crypto: @UpOnlyTV, @ProfitMaxmalist, @WSBPodSummaries, @UCCPodcast, @BanklessHQ, @OnTheBrinkCIV, @APompliano

- TradFi: @MacroVoices, @RealVision

I spend hrs daily listening to these

7/19

- Crypto: @UpOnlyTV, @ProfitMaxmalist, @WSBPodSummaries, @UCCPodcast, @BanklessHQ, @OnTheBrinkCIV, @APompliano

- TradFi: @MacroVoices, @RealVision

I spend hrs daily listening to these

7/19

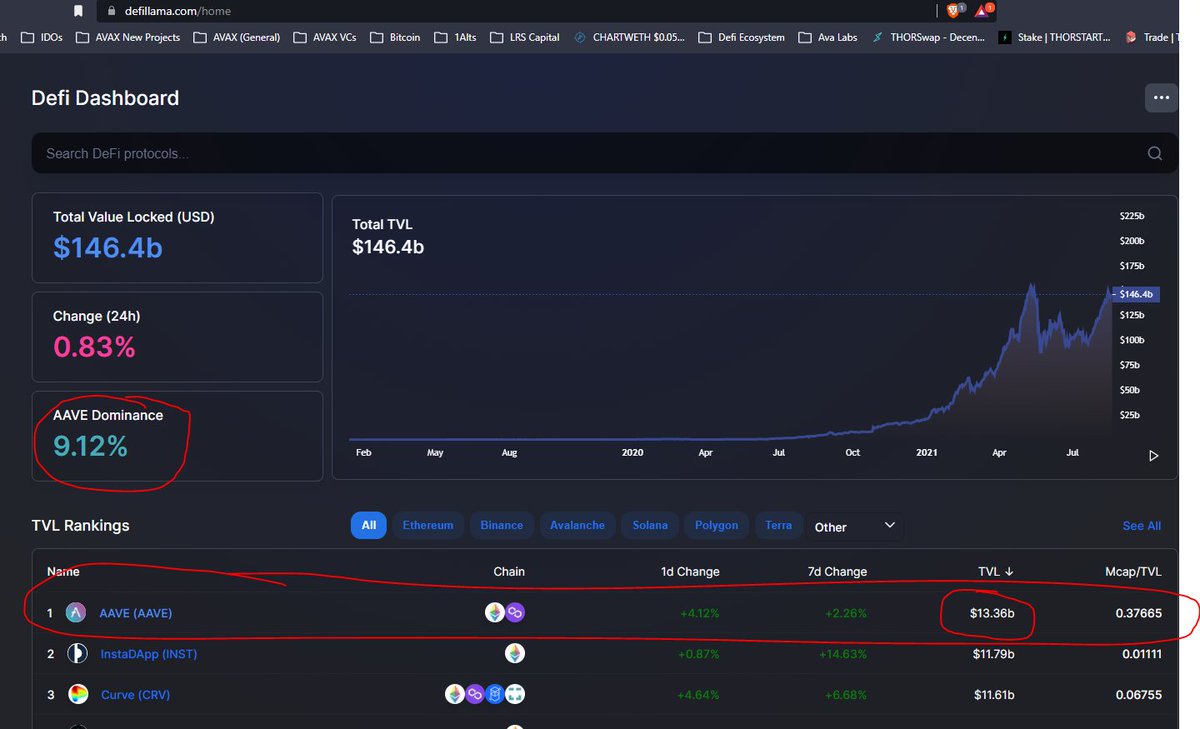

In addition to the macro view (& before we dive into tactical investment commentary), it’s worth doing a medium-level progress report on how @avalancheavax $AVAX #defi is doing on a relative basis

8/19

8/19

Not surprisingly, @AvalancheAvax $AVAX has outperformed since #AvalancheRush announcement & launch of @BenqiFinance lending & borrowing in Aug-18/19

9/19

9/19

Part of the reason for the big bet I’ve now placed on @avalancheavax $AVAX #defi is the precedent that was set by the @0xPolygon $MATIC incentives program which created ~$10b in circulating market cap gains

10/19

10/19

It’s exciting because #AvalancheRush has barely started

@Avalabs is following a similar playbook, & having consulted them for a time, I know they have thought about how to improve on that playbook to make it LT sustainable @luigidemeo @John1wu @jayks17

11/19

@Avalabs is following a similar playbook, & having consulted them for a time, I know they have thought about how to improve on that playbook to make it LT sustainable @luigidemeo @John1wu @jayks17

11/19

Now let’s go back to my @AvalancheAvax $AVAX First Principles & consider how that might guide construction of my AVAX native #defi portfolio:

12/19

12/19

In a nutshell, I want to go uber-long $AVAX & also native #defi projects leading into #AvalancheRush launch

Previously, I was happy holding AVAX & yield farming certain pairs – if for ex, $JOE outperformed in JOE-AVAX, I was gaining AVAX due to IL

13/19

Previously, I was happy holding AVAX & yield farming certain pairs – if for ex, $JOE outperformed in JOE-AVAX, I was gaining AVAX due to IL

https://twitter.com/rogerclu/status/1430755052323545090

13/19

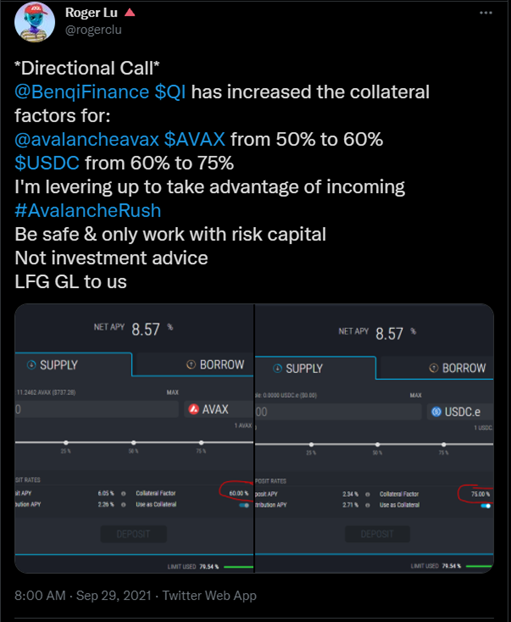

Now I want to:

- Go uber-long $AvalancheAVAX $AVAX via: leveraged trading positions on @binance &

- Up my lending positions to higher LTVs on @BenqiFinance (IMO 80% collateral factor is safely aggressive) to max AVAX beta

*DYOR, NOT INVESTMENT ADVICE, STAY SAFE*

14/19

- Go uber-long $AvalancheAVAX $AVAX via: leveraged trading positions on @binance &

- Up my lending positions to higher LTVs on @BenqiFinance (IMO 80% collateral factor is safely aggressive) to max AVAX beta

*DYOR, NOT INVESTMENT ADVICE, STAY SAFE*

14/19

I’ve also un-LPed some core $AVAX #defi tokens & now holding spot

In the Aug-21 post-Rush announcement, I didn’t maximise returns as these tokens outran AVAX & I lost value with IL. So I’m making a directional bet now that this will happen again

15/19

In the Aug-21 post-Rush announcement, I didn’t maximise returns as these tokens outran AVAX & I lost value with IL. So I’m making a directional bet now that this will happen again

https://twitter.com/rogerclu/status/1428962661249785860

15/19

In my next thread, I will go into detail my current @avalancheavax $AVAX native #defi portfolio positions & sizing, as well as key investment strategies

As a sneak peak, here are my current core positions:

16/19

As a sneak peak, here are my current core positions:

16/19

In addition, I’m far behind on updating my @AvalancheAvax $AVAX New (& Existing) Projects Google Sheets & will spend next few days updating

If you are interested in helping me update this sheet (& getting write access to the Sheets), please DM me!

17/19

If you are interested in helping me update this sheet (& getting write access to the Sheets), please DM me!

https://twitter.com/rogerclu/status/1428457026074578950

17/19

I’ll also plan to do a detailed thread on some of the very exciting #NFT projects on @avalancheavax $AVAX

1 of the projects I’m particularly excited about is @AvaxTreezNFT which is having their minting date *this Sunday, Oct-3*

18/19

1 of the projects I’m particularly excited about is @AvaxTreezNFT which is having their minting date *this Sunday, Oct-3*

https://twitter.com/AvaxTreezNFT/status/1443534919725105153?s=20

18/19

Full disclosure: I am working w/ the @AvaxTreezNFT team & have been allocated a few of these beautiful & super cool Treez

Exciting few weeks incoming (hopefully), GL to us & let's see how this @avalancheavax $AVAX bull thesis plays out!

19/19

Exciting few weeks incoming (hopefully), GL to us & let's see how this @avalancheavax $AVAX bull thesis plays out!

19/19

Oversight by me - I also have a large LT core position in @traderjoe_xyz $JOE. Readers thanks for highlighting this omission!

• • •

Missing some Tweet in this thread? You can try to

force a refresh