#AvalancheRush

Here are my initial thoughts on @BenqiFinance $QI

-Super smooth launch so far (congrats to QI team!)

-UI is slick & a lovely experience

-#Defi on @avalancheavax $AVAX is silky smooth & fast, by far my favourite L1 to do stuff. Soooo much better than #Ethereum

1/8

Here are my initial thoughts on @BenqiFinance $QI

-Super smooth launch so far (congrats to QI team!)

-UI is slick & a lovely experience

-#Defi on @avalancheavax $AVAX is silky smooth & fast, by far my favourite L1 to do stuff. Soooo much better than #Ethereum

1/8

- @BenqiFinance $QI has launched on @kucoincom

Currently at $0.056, a 6x from IDO Price of $0.009

Circulating Mkt Cap is still a modest ~$18m

2/8

Currently at $0.056, a 6x from IDO Price of $0.009

Circulating Mkt Cap is still a modest ~$18m

2/8

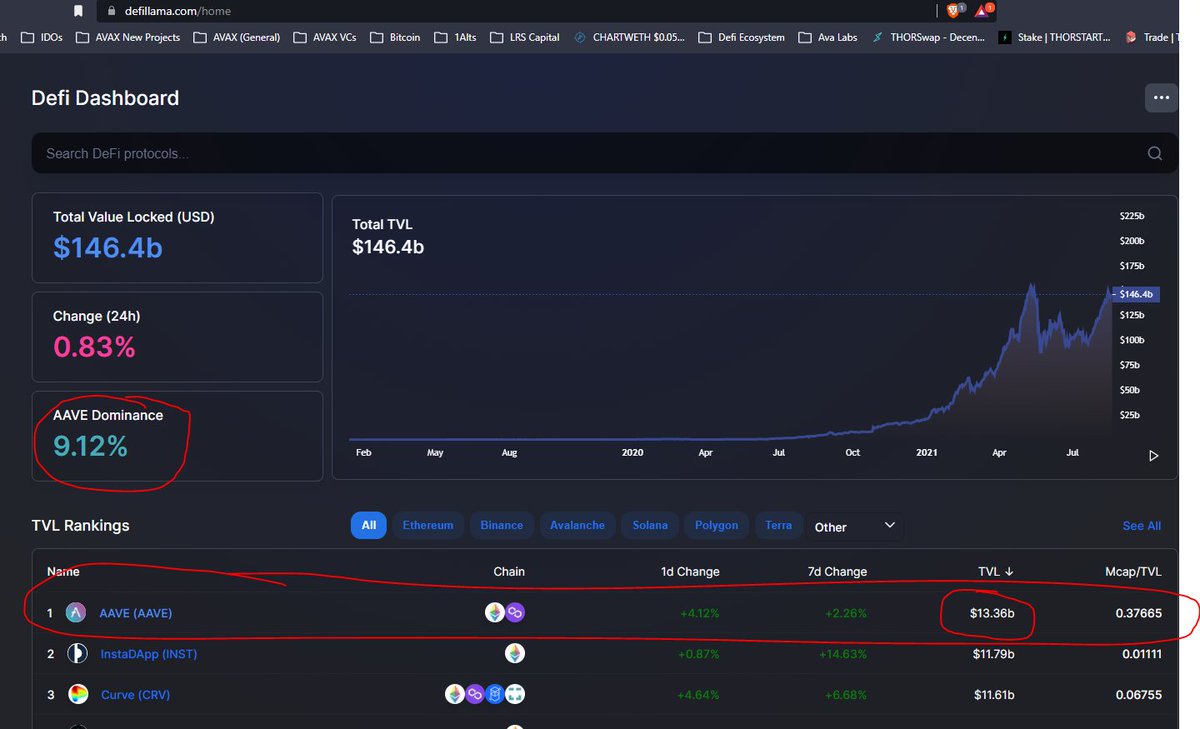

Meanwhile, @BenqiFinance $QI is already at $90m TVL

The market leader @AaveAave $AAVE, on the other hand has $13 BILLION

3/8

The market leader @AaveAave $AAVE, on the other hand has $13 BILLION

3/8

- UI is slick & a lovely experience

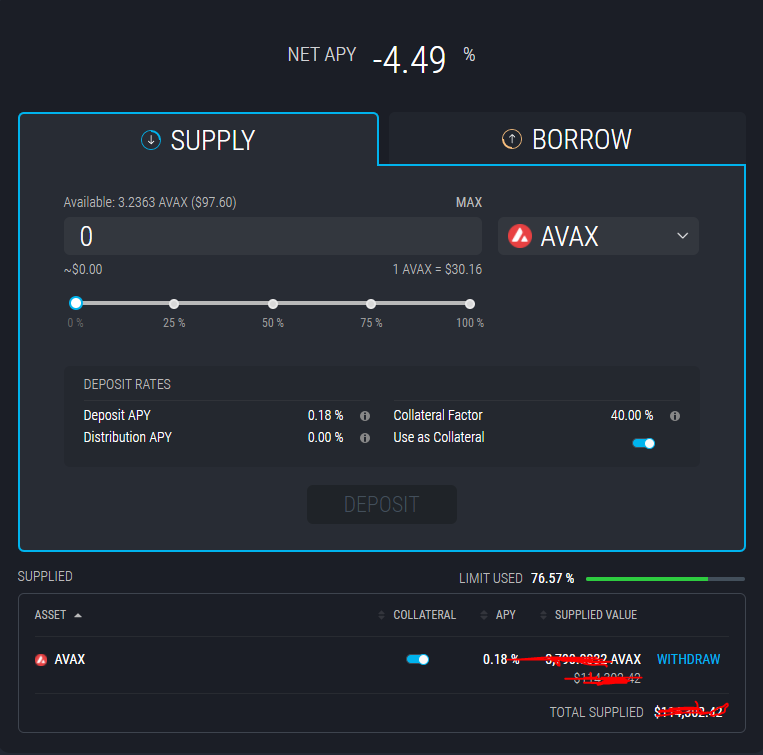

Super easy to lend & borrow! My only minor gripe is I prefer $AAVE's dashboard that shows both supply & borrow (but it is easy to switch between tabs)

I lent out my $AVAX at 30% LTV (40% is max) & borrowed USDTe-DAIe to stablecoin farm

4/8

Super easy to lend & borrow! My only minor gripe is I prefer $AAVE's dashboard that shows both supply & borrow (but it is easy to switch between tabs)

I lent out my $AVAX at 30% LTV (40% is max) & borrowed USDTe-DAIe to stablecoin farm

4/8

- The $QI experience really highlights the huge advantage on TPS & finality of @avalancheavax $AVAX. Forget about marketing, this is the best user experience, while also maintaining decentralisation

5/8

5/8

IMO the launch of $QI lending/borrowing (+$3m incentives) +$180m #defi ecosystem-wide incentivised liquidity mining program will bring an influx of new user to @avalancheavax

The superior UI of $AVAX has the *PROMISE* of making TVL explode

6/8

The superior UI of $AVAX has the *PROMISE* of making TVL explode

https://twitter.com/rogerclu/status/1428009505762258945

6/8

(Speaking of +$3m incentivised rewards on @BenqiFinance $QI, we're still waiting. Also still waiting on @pangolin $PNG trading)

7/8

7/8

Currently @avalancheavax $AVAX is currently at ~$400m TVL vs. a TOTAL TVL of ~$150b or 0.2% market share (that is also growing fast with greater #crypto #DeFi adoption)

The opportunity is HUGE

Ultra-bullish @Avalanche #DeFi

LFG #AvalancheRush

8/8

The opportunity is HUGE

Ultra-bullish @Avalanche #DeFi

LFG #AvalancheRush

8/8

• • •

Missing some Tweet in this thread? You can try to

force a refresh