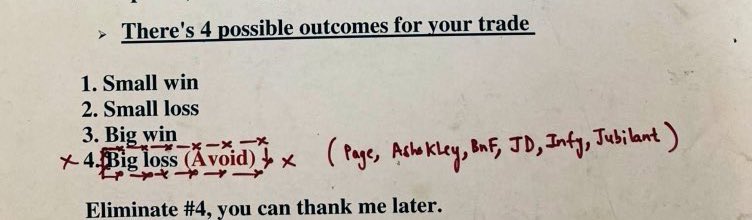

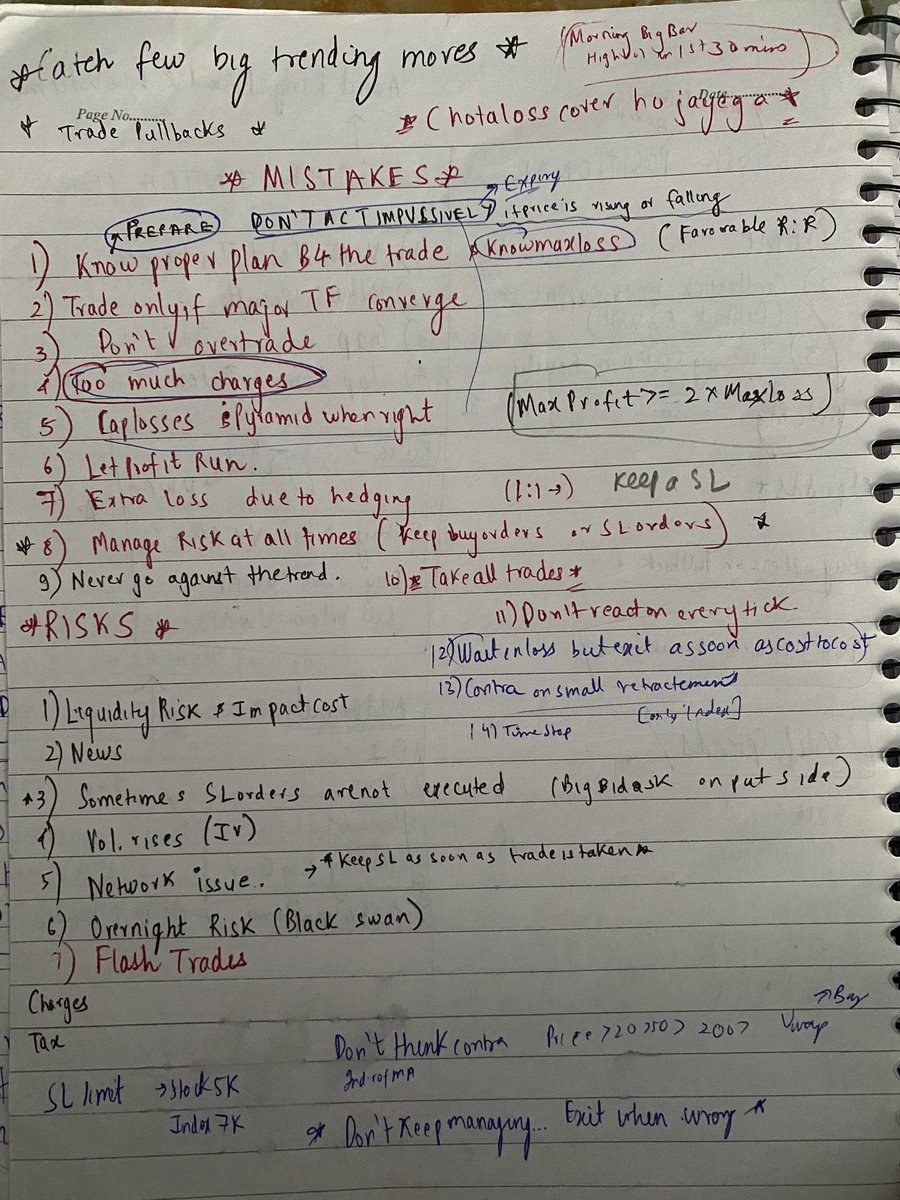

Trading Mistakes & Lessons Learnt 🧵

1) I always keep my mistakes & lessons learnt in front of my screen while trading.

Bcz we as traders tend to commit the same mistakes everytime.

So seeing your learnt lessons everyday ensures that you avoid them.

#trading #mistakes

1) I always keep my mistakes & lessons learnt in front of my screen while trading.

Bcz we as traders tend to commit the same mistakes everytime.

So seeing your learnt lessons everyday ensures that you avoid them.

#trading #mistakes

2) In 2017, I analysed all my trades and saw that I have majorly lost in stock futures and profits came only via index trading.

I accepted that I am not great at stock trading & been trading index only majorly since then & have never missed a day trading BankNifty

I accepted that I am not great at stock trading & been trading index only majorly since then & have never missed a day trading BankNifty

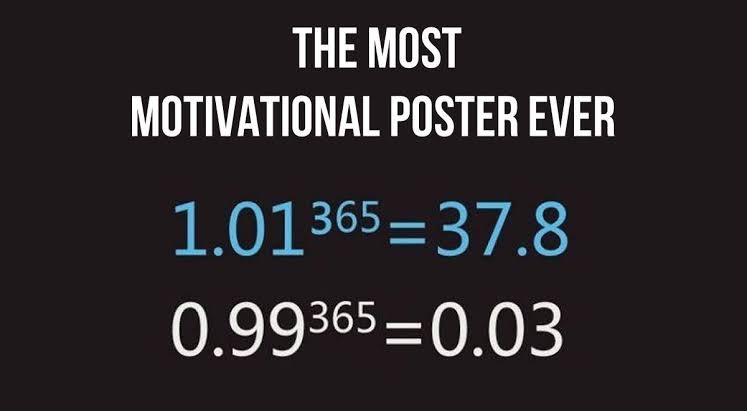

3) I decided to adjust all of my past losses to 1 % of capital to see the effect of capping the downside.

I would have had a gain of more than 230 % if I had capped losses at 1% of cap.

Lesson: Keep losses per trade less than 1% of capital no matter what !

I would have had a gain of more than 230 % if I had capped losses at 1% of cap.

Lesson: Keep losses per trade less than 1% of capital no matter what !

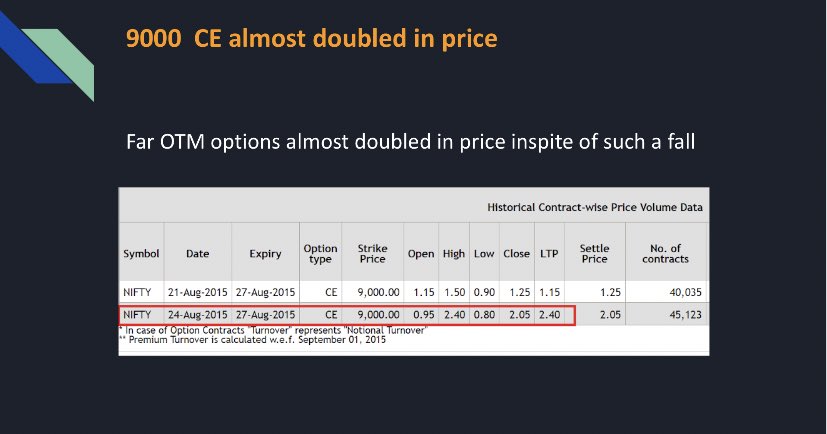

4) While trading index options, I lost sometimes due to IV rise,flash crash, and option freezes.

Lesson: Never take markets lightly & Always keep protective stops in the system (and not in your mind) to keep loss in control in case of blackswan.

Lesson: Never take markets lightly & Always keep protective stops in the system (and not in your mind) to keep loss in control in case of blackswan.

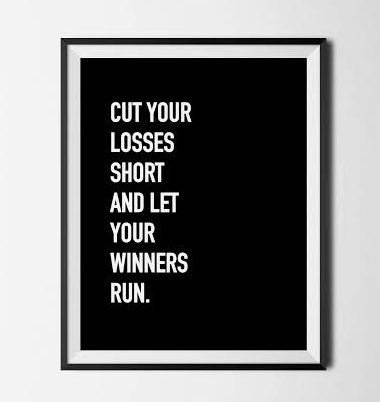

5) Being an option seller, I have a tendency to manage my position by rolling up/converting to calendar etc.

So many times I have wasted 1 or 2 weeks just to close a loss making trade at cost😢

Lesson: I do manage now but exit as soon sold options become ITM or 2 x in value.

So many times I have wasted 1 or 2 weeks just to close a loss making trade at cost😢

Lesson: I do manage now but exit as soon sold options become ITM or 2 x in value.

6) “Option sellers eat like a chicken but shit like an elephant”

So always always manage risk especially while selling options.

Eg. Corporate tax rate cut day, demontisation, surgical strike, 2020 fall etc were brutal moves & if not managed properly can take years of profits.

So always always manage risk especially while selling options.

Eg. Corporate tax rate cut day, demontisation, surgical strike, 2020 fall etc were brutal moves & if not managed properly can take years of profits.

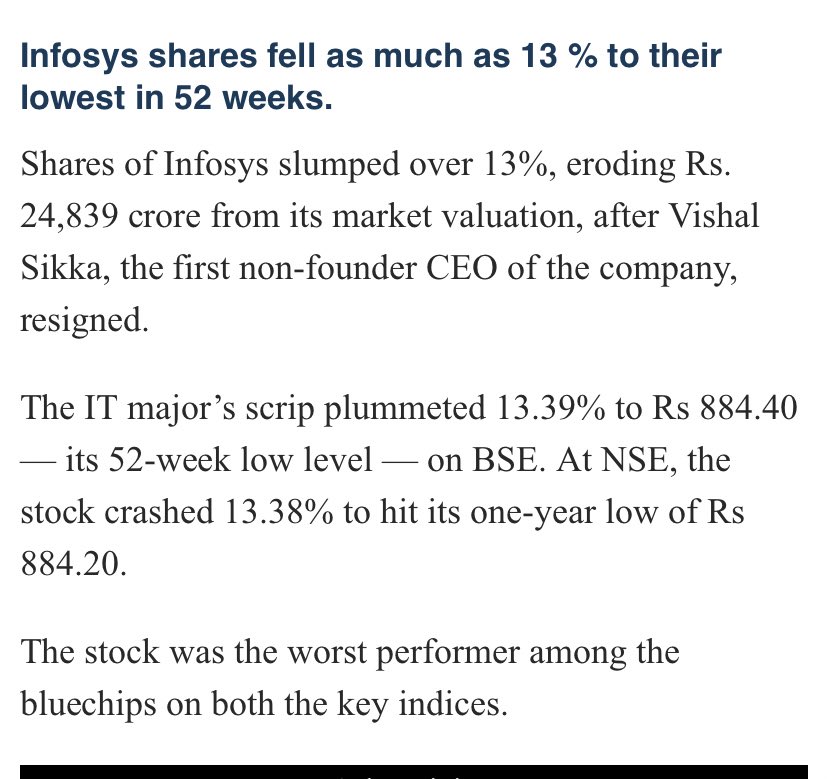

7) I used to carry naked far otm puts overnight position on largecap stocks thinking I was safe but on 18th Aug 2017 Infy was down 13% as CEO resigned.

Luckily I had only 1 lot but learnt a good lesson

Lesson : Always hedge your overnight position

Luckily I had only 1 lot but learnt a good lesson

Lesson : Always hedge your overnight position

8) From the lesson learnt from INFY trade I got saved later in my career

I had a position in Yesbank but it opened 10% gapdown next day but I got saved as position was completely hedged.

Lesson: Learn from your mistakes,note them in journal & never repeat it again!

I had a position in Yesbank but it opened 10% gapdown next day but I got saved as position was completely hedged.

Lesson: Learn from your mistakes,note them in journal & never repeat it again!

9) If possible also write about your biggest losses and how you felt that time so that you make sure you never go thru that emotional pain again by repeating earlier mistakes.

10) I committed the same mistakes for years.

Inspite of knowing that I shouldn’t commit them.

Bcz we as humans tend behave in a certain manner everytime.

So , it’s best to keep your lessons/mistakes hand written in front of you and read everyday before trading.

Inspite of knowing that I shouldn’t commit them.

Bcz we as humans tend behave in a certain manner everytime.

So , it’s best to keep your lessons/mistakes hand written in front of you and read everyday before trading.

11) We as traders get complacement when we are on a winning streak & my largest losses have come after my largest winning streaks

Lesson :

Never get complacement & always remember that market is supreme🙏

So stay humble always !

Lesson :

Never get complacement & always remember that market is supreme🙏

So stay humble always !

12) I have also written about my largest losses & the reason for the drawdown.

Was it my fault ?

Did Market conditions change?

How I felt during the drawdown ?

What could I have done better ?

Lesson :

All this gives you the confidence to sail your next drawdown smoothly.

Was it my fault ?

Did Market conditions change?

How I felt during the drawdown ?

What could I have done better ?

Lesson :

All this gives you the confidence to sail your next drawdown smoothly.

13) I think the key component in trading success is stock selection and limited focus.

-Select any 1 liquid instrument and analyse it’s historical behaviour in detail and build a rule based strategy around it.

-Stick to your strategy and never miss a trade in it.

-Select any 1 liquid instrument and analyse it’s historical behaviour in detail and build a rule based strategy around it.

-Stick to your strategy and never miss a trade in it.

14) Know all major levels, how the instrument moves generally & behaviour of that particular stock.

- Generate additional insights & incorporate the feedback & insights back in to your trading strategy.

- This sheer focus will give you the results you have been craving for.

End

- Generate additional insights & incorporate the feedback & insights back in to your trading strategy.

- This sheer focus will give you the results you have been craving for.

End

• • •

Missing some Tweet in this thread? You can try to

force a refresh