Lots and lots of tangy insights in @IEA's freshly pressed Global Hydrogen Review 🍊

It's a big piece of work but worth getting to the bottom. Congratulations! 👏

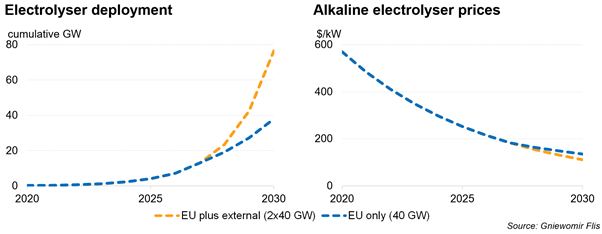

Below 5 of my favourite graphs 📊

iea.org/reports/global…

It's a big piece of work but worth getting to the bottom. Congratulations! 👏

Below 5 of my favourite graphs 📊

iea.org/reports/global…

1. Though hydrogen is crucial, renewables and electrification are still the most important drivers of emissions reductions.

2. 70% of flights could be electrified with fuel cells, but that would only account for 30% of fuel use.

Most fuel is burned on long range flights. Synthetic kerosene mitigates only about 50% of emissions. New engine types are a must.

Most fuel is burned on long range flights. Synthetic kerosene mitigates only about 50% of emissions. New engine types are a must.

3. Electric trucks, whether hydrogen or battery powered, will overtake diesel ICE's by 2030.

BEV has the upper hand into the 2040s for trips under 500km. These account for 80% of all trucking trips. Eventually fuel cell vehicles become cheaper. 2050 is only 30 years away.

BEV has the upper hand into the 2040s for trips under 500km. These account for 80% of all trucking trips. Eventually fuel cell vehicles become cheaper. 2050 is only 30 years away.

4. Though producing renewable hydrogen locally is expensive in a number of geographies today, by 2050 practically everyone bar Japan will be able to source it at below $2/kg.

Many, could produce at $1/kg, that's practically natural gas parity.

Many, could produce at $1/kg, that's practically natural gas parity.

5. And finally, where is venture captial flowing to? Non-electrolytic H2 production is attracting some investment. There's of course vehicles and refuelling. But the real star is project development. Europe very much leading this space.

• • •

Missing some Tweet in this thread? You can try to

force a refresh