The Adler Group – Bond Villains.

Viceroy’s report is now live:

viceroyresearch.org/2021/10/06/adl…

Adler Group is a stitched together and overly indebted dumpster fire, operated for the sole benefit of a secretive, kleptocratic cabal. $ADJ $ADL #thread 1/

Viceroy’s report is now live:

viceroyresearch.org/2021/10/06/adl…

Adler Group is a stitched together and overly indebted dumpster fire, operated for the sole benefit of a secretive, kleptocratic cabal. $ADJ $ADL #thread 1/

The Adler Group exists as a conduit for its shadow directors and associates to systematically enrich themselves to the detriment of bondholders, shareholders, and minority holders of various listed investments. $ADJ $ADL 2/

Properly accounted for: Adler has already triggered a default-event. Mismarked assets cannot support its crippling debt. Sales of Adler’s yielding portfolio will have a moot effect on Adler’s LTV - which we calculate to be in-excess of 85%. $ADJ $ADL 3/

Any such “strategic” divestment will a purely optical attempt to pay down debt, or, worse, as a last chance for undisclosed related parties to strip any remaining value in the structure. $ADL $ADJ 4/

Adler’s modus operandi is to acquire (or force mergers with) better capitalized companies &then to then saddle them with debt. Management then channels cash & assets to enrich friends & associates via undisclosed & blatantly uncommercial related party transactions. $ADJ $ADL 5/

Viceroy struggled to find any truly arm’s-length transactions Adler has undertaken in its corporate history. $ADL $ADJ 6/

A historically liberal bond market has allowed Adler to fraudulently raise billions of euros against horribly mismarked assets. Values are transferred to undisclosed related parties. $ADL $ADJ 7/

Our generous Base-Case scenario estimates Adler’s LTV exceeds 85%, in breach of its debt covenants, & will triggered a default-event. The assumption that recoveries from liquidating real estate assets will cover losses is sorely misplaced. $ADJ $ADL 8/

Viceroy’s analysis is based on publicly available information. We believe our adjustments only scratch the surface of the impropriety at Adler. $ADJ $ADL 9/

Adler’s kleptocratic cabal is headed by secretive financier Cevdet Caner, who was previously responsible for the second largest REIT collapse in German history: Level One. $ADJ $ADL 10/

Caner’s wife, brother-in-law and other associates from Caner’s failed Level One venture own or hold senior positions at various related party entities. These related-party entities act covertly and in concert with Adler in the commission of its schemes. $ADJ $ADL 11/

Adler systematically uses underhanded tactics to acquire better capitalized companies only to strip them of resources and assets in uncommercial transactions with related parties, or to leverage them to the hilt to enable more looting. $ADJ $ADL 12/

Any entity subjected to the “business practices” referred to above will inevitably be hollowed out. A loan-to-value (LTV) covenant breach constitutes a default-event under Adler’s bond terms, which in turn means its bonds become immediately due and payable. $ADJ $ADL 13/

Adler has insufficient liquidity to repay its bonds in a default scenario and no “good” assets to pledge or sell to raise money in an emergency. Regardless: Adler will have difficulty obtaining new financing when lenders realize they have been fooled. $ADJ $ADL 14/

Adler’s receivable balance exceeds €1b, most of which is due from related parties. In absence of generous terms, these receivables are overdue by up to 4 years. Auditors, Ebner Stolz, is under investigation surrounding “imaginary invoices” at Greensill. cc. @BondHack $ADJ 15/

Regulators have their sights set on Adler. Israel Securities Commission have intervened in transactions. Members of Germany’s Bundestag have written to the BaFin, raising questions surrounding Adler’s conduct and BaFin investigations. $ADJ $ADL 16/

THE INNER CIRCLE:

That Adler Real Estate operates under the influence of Caner is already a matter of public record. Caner, while controlling Adler, has already been involved in serious regulatory breaches by acting in concert with undisclosed related entities. $ADJ $ADL 17/

That Adler Real Estate operates under the influence of Caner is already a matter of public record. Caner, while controlling Adler, has already been involved in serious regulatory breaches by acting in concert with undisclosed related entities. $ADJ $ADL 17/

ADLER’S M.O.

Adler systematically engage in uncommercial transactions with undisclosed related parties. Viceroy have uncovered many of these and flagged many more for follow-up. It is likely that we have barely scratched the surface. $ADJ $ADL 18/

Adler systematically engage in uncommercial transactions with undisclosed related parties. Viceroy have uncovered many of these and flagged many more for follow-up. It is likely that we have barely scratched the surface. $ADJ $ADL 18/

- Gerresheim – “Marking Transaction”

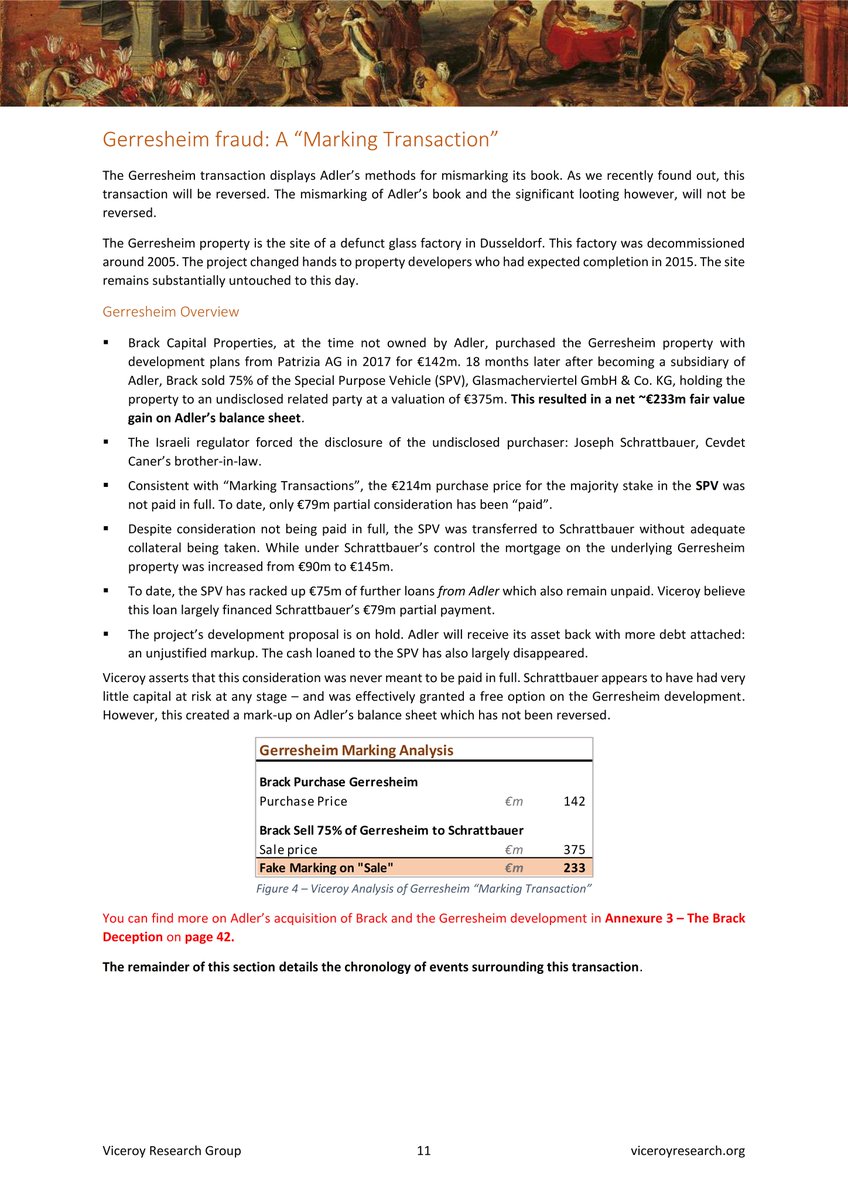

Brack purchased the Gerresheim property for €142m.

18 months later after becoming a subsidiary of Adler, Brack sold 75% of holding to Caner’s brother-in-law at a val of €375m, a ~€233m fair value gain on Adler’s balance sheet. $ADJ 19/

Brack purchased the Gerresheim property for €142m.

18 months later after becoming a subsidiary of Adler, Brack sold 75% of holding to Caner’s brother-in-law at a val of €375m, a ~€233m fair value gain on Adler’s balance sheet. $ADJ 19/

Consistent with “Marking Transactions”, the €214m purchase price for the majority stake in the SPV was not paid in full. To date, only €79m partial consideration has been “paid”. the SPV was transferred without adequate collateral being taken. $ADJ $ADL 20/

While under Schrattbauer’s control the mortgage on the underlying Gerresheim property was increased from €90m to €145m. To date, the SPV has racked up €75m of further loans from Adler which also remain unpaid. $ADJ 21/

The project’s development proposal is on hold. Adler will receive its asset back with more debt attached: an unjustified markup. The cash loaned to the SPV has also largely disappeared. This transaction was never intended to be consummated. $ADJ $ADL 22/

- ADO Properties – “Coup D’état”

Adler acquired a 33% shareholding in ADO Properties via a private transaction. Adler subsequently replaced much of ADO’s board despite not having a majority shareholding of ADO: several minority interests did not vote. $ADJ 23/

Adler acquired a 33% shareholding in ADO Properties via a private transaction. Adler subsequently replaced much of ADO’s board despite not having a majority shareholding of ADO: several minority interests did not vote. $ADJ 23/

Following the board reshuffle, ADO purchased Adler Real Estate at a substantial premium through a reverse merger transaction to severe shareholder backlash. $ADJ $ADL 24/

ADO announced it would acquire a majority stake in Consus, a thinly-capitalized property developer, from Caner-associated Aggregate Holdings: the credit rating of ADO debt dropped substantially on these transactions. $ADJ $ADL 25/

ADO Poison Pilled Consus into ADO’s structure to ensure ADO stayed under the control of Adler’s cabal: no one else wanted Consus. $ADJ $ADL 27/

The transaction cashed out several associates, bailed out Aggregate’s enormous Consus exposure, and allowed greater access to debt markets to facilitate more looting. $ADJ $ADL /28

- Consus – “Looting Transaction”

Consus acquired a 59% stake in CG Gruppe AG for €872m from Caner-associated Aggregate Holdings and CG Gruppe & Groner. Aggregate purchased the same stake in CG Gruppe 1 year prior for €49m, representing a ~17x profit. $ADJ $ADL 29/

Consus acquired a 59% stake in CG Gruppe AG for €872m from Caner-associated Aggregate Holdings and CG Gruppe & Groner. Aggregate purchased the same stake in CG Gruppe 1 year prior for €49m, representing a ~17x profit. $ADJ $ADL 29/

This created a false balance sheet and false equity from which all other Consus looting derives. Assets that were acquired for €49m became Consus. $ADJ $ADL 30/

Once it was clear that ADO was acquiring Consus: insiders began looting remaining value prior to the consolidation. Consus sold ~€300m in investments representing €4.3b & 33% of its GDV on opaque terms. Full consideration of these transactions has not been paid. $ADJ 31/

RESIDENTIAL (YIELDING) PORTFOLIO

$ADJ's yielding portfolio is valued extremely aggressively, derived from Adler’s delusional rent growth & residual value assumptions in its DCF model. Valuations are fatally sensitive to mild adjustments in their calculation assumptions. 32/

$ADJ's yielding portfolio is valued extremely aggressively, derived from Adler’s delusional rent growth & residual value assumptions in its DCF model. Valuations are fatally sensitive to mild adjustments in their calculation assumptions. 32/

Adler’s residential portfolio commands some of the lowest rent per m2 and much lower than baseline average rent against peers in all major cities. Adler’s rent growth assumptions are 3-5x that of its competitors, including those with similar portfolios. $ADJ 33/

Adler’s derived Capitalization Rate is comparable to the high-end properties in high-end districts in Berlin, across its entire portfolio. This is incompatible with its inferior portfolio. $ADJ 34/

Our base case analysis, which aims to reverse ridiculous assumptions and correct fatal logic flaws, suggests Adler’s residential investment portfolio is overvalued by €2,363m, or 36%. $ADJ 35/

A critical discovery is that as Adler’s third-party valuer, CBRE does not visit any of Adler’s properties. This was confirmed by Adler’s IR, who noted that CBRE conducts a “desk-top valuation” of the investment portfolio, and that “they can’t check 70,000 units”. $ADJ $ADL 36/

DEVELOPMENT PORTFOLIO

$ADJ uses a residual value method to value its development pipeline. This calculates the discounted residual value of the development after completion, minus the initial cost of the property, costs to develop the project, and costs to sell the project. 37/

$ADJ uses a residual value method to value its development pipeline. This calculates the discounted residual value of the development after completion, minus the initial cost of the property, costs to develop the project, and costs to sell the project. 37/

The residual value assumes that projects can be completed at estimated cost to completion. Adler has thin cash flows, is levered to the hilt, and cannot complete these projects. The residual value will not be reached as the projects will not be completed under Adler. $ADJ 38/

- VauVau Reversal

$ADJ consistently demonstrates an inability to complete projects, even those already pre-sold, and having to reverse cash receipts to purchasers. The VauVau developments are a series of high-rise “vertical village” developments Adler acquired through Consus. 39/

$ADJ consistently demonstrates an inability to complete projects, even those already pre-sold, and having to reverse cash receipts to purchasers. The VauVau developments are a series of high-rise “vertical village” developments Adler acquired through Consus. 39/

Consus announced that it had forward sold VauVau projects to the BVK pension fund (Germany’s largest public pension fund) for a “transaction value” of €670m. After years of development delays, this transaction was subsequently reversed in Q2 2021. $ADJ 40/

A change of heart is unfortunate, but understandable. However, Adler investor relations advised that deposits paid by BVK had been refunded, as well as compensation for interest expenses and incidental costs. This is against the very nature of a “deposit” $ADJ 41/

The only valid circumstance that we would understand a deposit being refunded is if the contract was cancellable under a break clause by the purchaser where the obligations of the developer were not being met. $ADJ 42/

In a default-event scenario, which Viceroy believe is likely, we believe Adler’s development and inventory pipeline will take a hit of at least a €1b. This is generous. $ADJ 43/

LTV ANALYSIS

Generally intertwined with its methodical siphoning of assets and funds is Adler’s necessity to saddle every asset with debt. This is limited by the Loan-to-Value (LTV) ratio. $ADJ 44/

Generally intertwined with its methodical siphoning of assets and funds is Adler’s necessity to saddle every asset with debt. This is limited by the Loan-to-Value (LTV) ratio. $ADJ 44/

The adjustments Viceroy have made are a result of our investigations; a more comprehensive third-party investigation would likely uncover substantially more uncommercial transactions and mismarking of assets. $ADJ 46/

RECEIVABLES

According to the FT, BaFin expressed concerns about Adler Real Estate’s auditor ,Ebner Stolz, claiming that “[the] watchdog will report Ebner Stolz to Germany’s audit watchdog Apas…” in relation to audit failures of Greensill’s receivables. $ADJ 47/

According to the FT, BaFin expressed concerns about Adler Real Estate’s auditor ,Ebner Stolz, claiming that “[the] watchdog will report Ebner Stolz to Germany’s audit watchdog Apas…” in relation to audit failures of Greensill’s receivables. $ADJ 47/

Adler’s receivables are in excess of €1b, and are substantially (over)due from undisclosed related parties. Adler have also filed a notice suggesting KPMG has been fired for 2021’s group audit, and raised a tender for a new auditor. $ADJ 48/

CONCLUSION

To the shareholders, debtholders, and minority interest holders: we advise immense caution. Do not fall under the illusion that Adler works for you: Adler works only in the interest of its insiders. You are being robbed. $ADJ $ADL end/

To the shareholders, debtholders, and minority interest holders: we advise immense caution. Do not fall under the illusion that Adler works for you: Adler works only in the interest of its insiders. You are being robbed. $ADJ $ADL end/

Viceroy's work was only possible due to immense effort from various journalists who indpendently covered parts of Adler's activities across the globe. It would have been nearly impossible to piece this together without their work.

#thankyou

#thankyou

• • •

Missing some Tweet in this thread? You can try to

force a refresh