#Pakistan Banking Sector M&A —

A Thread 🧵

Interesting things happening in 🇵🇰’s banking sector related to #GCC-based sponsors.

Samba Bank is leaving 🇵🇰 🔜 after parent entity’s merger with NCB in Saudi Arabia 🇸🇦, & MergeCo Saudi National Bank’s decision to divest some assets.

A Thread 🧵

Interesting things happening in 🇵🇰’s banking sector related to #GCC-based sponsors.

Samba Bank is leaving 🇵🇰 🔜 after parent entity’s merger with NCB in Saudi Arabia 🇸🇦, & MergeCo Saudi National Bank’s decision to divest some assets.

Silk Bank is on perpetual sale after its abysmal performance in #Pakistan 🇵🇰 despite benefitting from one of the highest equity injections till-date. It is to be sold 🔜 and IFC / Nomura / Bank Muscat / Gourmet Group along with others will take a massive hit on their investment.

In banking, the best combination is always *a strong sponsor with a strong management team*. If you can get that right, there’s no better business in #Pakistan.

However, if your institution does not benefit from either of the two, then the bank is highly likely to underperform.

However, if your institution does not benefit from either of the two, then the bank is highly likely to underperform.

Al Baraka Bank of #SaudiArabia may also eventually divest. From an ROE perspective, it doesn’t make sense for its sponsors & #Bahrain-based 🇧🇭 HoldCo to retain its banking license in Pakistan 🇵🇰 as ROCI is very low.

But from a geographical presence point of view, it’s fine.

But from a geographical presence point of view, it’s fine.

Faysal Bank’s (#FABL) sponsor Ithmaar Holdings of #Bahrain 🇧🇭 (ultimate beneficial owner being the former King Faysal’s family members in #SaudiArabia) is selling its other assets & only FABL - #Pakistan will be left in the portfolio as the sole viable & earning asset.

#FABL has a good valuation potential after full conversion to Islamic (in the process of converting), as it will most likely trade at a lesser P/B discount as compared to the price that the currently best-in-class Islamic bank of #Pakistan, Meezan Bank (#MEBL), trades at today.

Bank Alfalah, owned by Dhabi Group of #UAE 🇦🇪 along with #IFC, has probably the highest cost-to-income ratio (56%) in the Top 10 banks of #Pakistan, and a lower ROE amongst its immediate peer group.

This is despite having the highest ADR & current account base in the same group.

This is despite having the highest ADR & current account base in the same group.

It’s obvious to investors that #BAFL is less efficiently run given its lower ROE despite a 735+ local & foreign branch network.

This is probably why its share price continues to struggle (notwithstanding a recent bullish report & aggressive TP of Rs. 48 from Topline Securities).

This is probably why its share price continues to struggle (notwithstanding a recent bullish report & aggressive TP of Rs. 48 from Topline Securities).

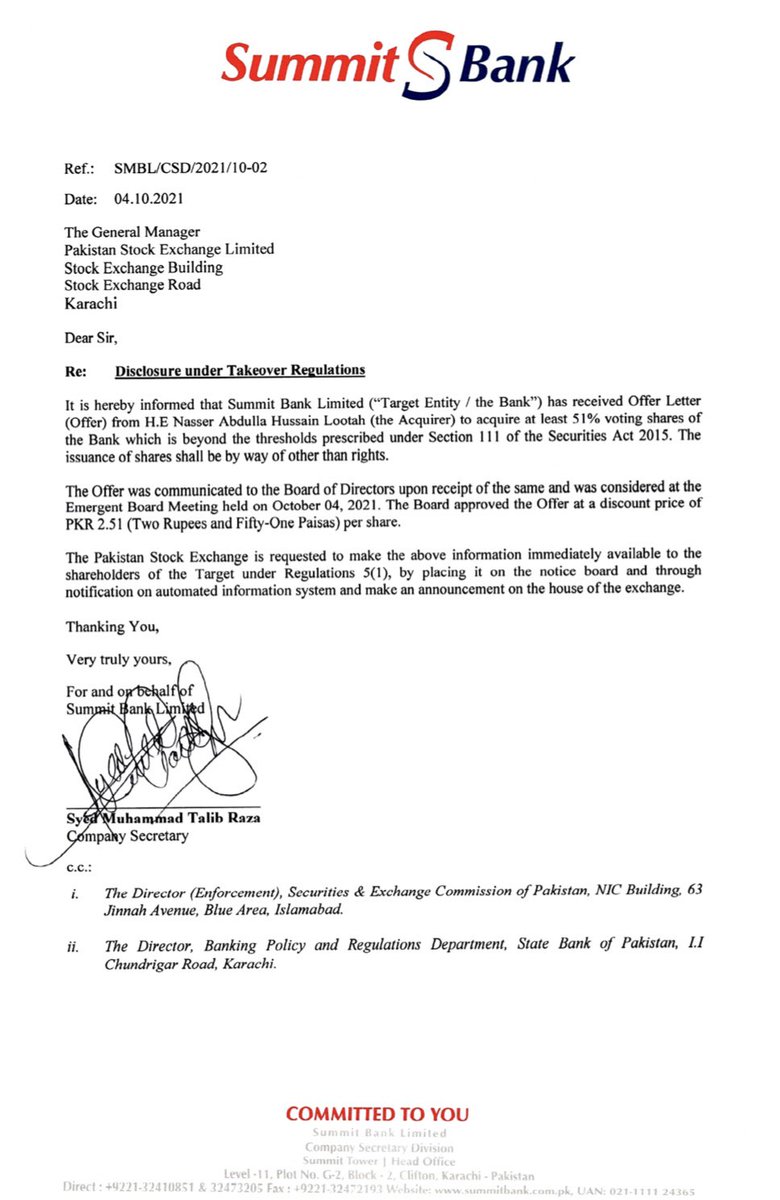

Summit Bank (#SMBL) is being revived by #UAE-based 🇦🇪 investors (Nasser Lootah Group) through a fresh equity injection against issuance of new shares (@ Rs. 2.51) other than right shares.

Management change has already taken place; it’s a potential turnaround case & one to watch.

Management change has already taken place; it’s a potential turnaround case & one to watch.

What’s commendable is the high ADR of #GCC-owned banks in #Pakistan 🇵🇰.

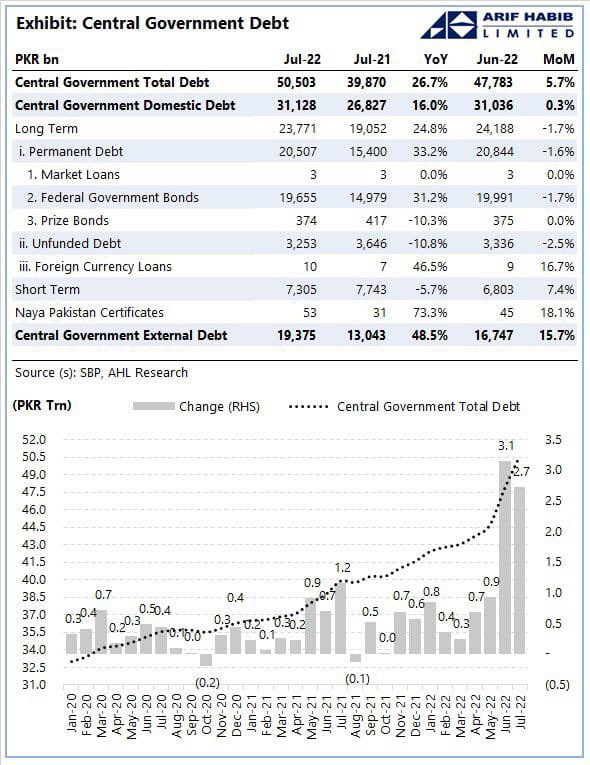

Unlike most Pakistani-owned banks (which have been lending on a risk-free basis to #GOP for years), GCC-owned banks have been undertaking aggressive, risk-based lending to the private sector.

— The End —

Unlike most Pakistani-owned banks (which have been lending on a risk-free basis to #GOP for years), GCC-owned banks have been undertaking aggressive, risk-based lending to the private sector.

— The End —

• • •

Missing some Tweet in this thread? You can try to

force a refresh