China Credit Update - Mini Thread (10/6/21) 👇👇

2. #Evergrande made headlines in the US two weeks ago when markets dropped 2%. But the slide was more likely due to gamma "unclenching" after a massive 9/17 options expiration. Since Evergrande has now been deemed "contained", attention has moved elsewhere.

3. The story was never #Evergrande. The story is a decade of unsustainable, unproductive debt fueled growth that is key to Chinese economic growth, holds the countries wealth, and is at risk of imploding as Beijing breaks the implicit debt backstop.

https://twitter.com/TheLastBearSta1/status/1399748954082971659

4. But #Evergrande is important because forced the Chinese homebuyers and banks, as well as international debt holders to recognize the central backstop is indeed dead. It has sparked contagion both in the property market and the financing market.

https://twitter.com/TheLastBearSta1/status/1435720036073807884

5. #EG shows asset sales, referenced by commentators and ratings agencies, are not a viable option. A debt spiral does not end with unencumbered valuable assets. All value has been extracted, pledged, or sold. #EG collapses when there is nothing to sell and no more debt available

6. Contagion is now a reality as recent data shows. The property market is frozen. Land sales have plummeted putting stress on local govts, new home sales (developer revenue) have crashed, and no one will provide financing to developers to service debt.

https://twitter.com/TheLastBearSta1/status/1443690350246350849?s=20

7. Contagion is an accelerating, self-reinforcing process. USD bonds of #Sunac and #Greenland - with combined liabilities greater than Evergrande - have plummeted in recent days, far faster than Evergrande's bonds over the summer.

8. As revenue and financing dries up to all developers, even "higher quality" developers will come under increasing stress. A trade idea is highlighted below that so far has proved wise.

https://twitter.com/TheLastBearSta1/status/1438171695685283847

9. Its now near impossible to restore the faith of the home buyers or lenders as they seek to minimize exposure. IMO, this ends with the forced recognition of accumulated losses by banks that will result in a tumult in the Chinese credit markets.

https://twitter.com/TheLastBearSta1/status/1440726559883608065

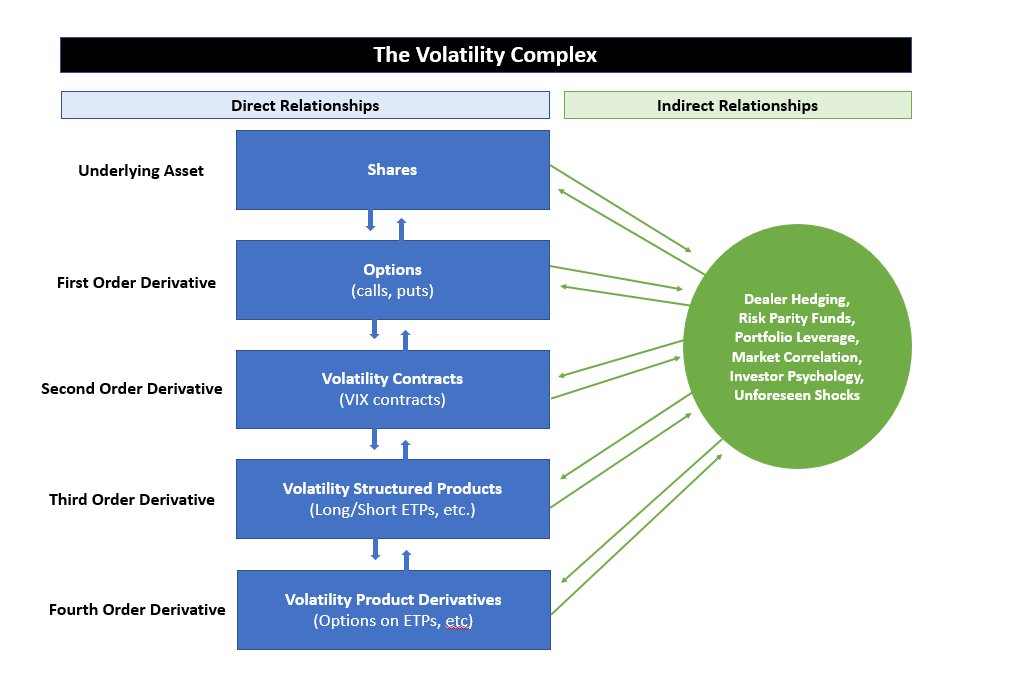

10. While this is most directly a domestic Chinese issue, it has global implications. Transmission to US markets, IMO, will not happen through direct exposure, but merely as a potential catalyst for massive volatility unwind already underway.

https://twitter.com/TheLastBearSta1/status/1443984040600776704?s=20

11. As always - this is one *non-expert* opinion. Please feel free add your thoughts to the conversation.

• • •

Missing some Tweet in this thread? You can try to

force a refresh