🚨The Volatility Squeeze: TLDR Twitter Thread👇👇

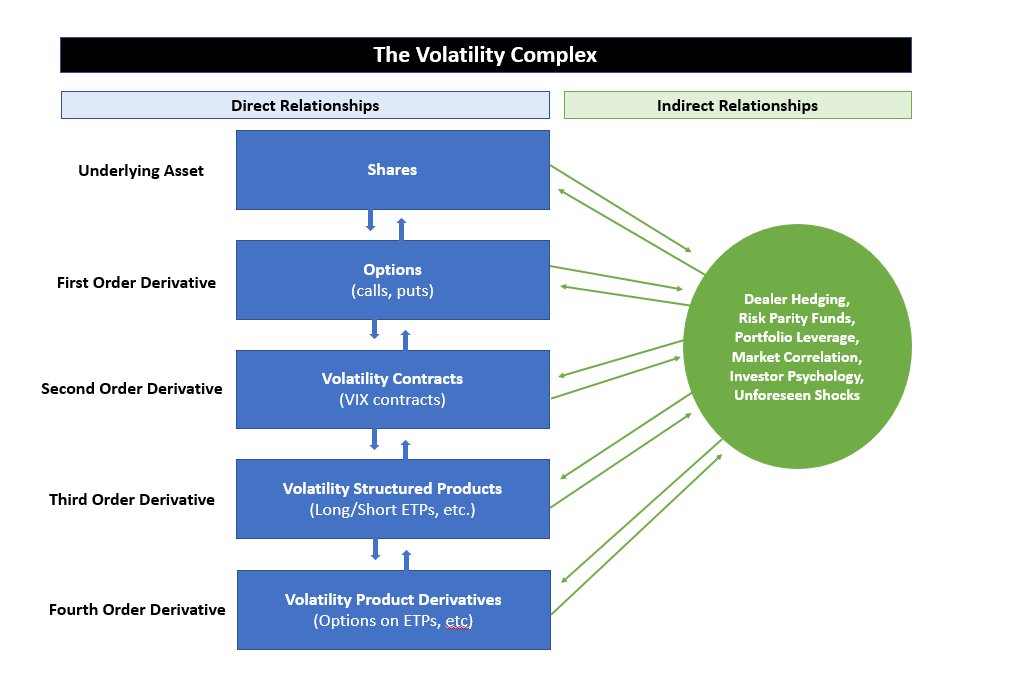

2. Volatility is a financial product, complete with ever-growing chain of derivatives and structured products. Each stage magnifies leverage and exposure. There are also indirect connections that amplify these movements (dealer hedging, risk parity funds, etc.)

3. Volatility is subject to short squeezes given its unlimited downside. Structured products and derivatives can amplify these moves. The first volatility squeeze occurred on "Volamageddon". Short Vol products were wiped in a day.

4. After declining for 16 months after the "COVID crash", Volatility has been rising since in early July, and realized volatility has increased.

5. VOLATILITY IS NEGATIVELY CORRELATED WITH PRICE. When volatility spikes - equity prices decline. Therefore, owning equities is effectively taking short-volatility exposure. Below is $UVXY - a levered long-volatility ETF compared to the S&P500 (in blue - inverted scale)

6. When volatility is squeezed, markets rapidly decline. This is the likely cause of every selloff since 2018, including the "COVID" crash. Below, you see that increasing volumes in a levered long-volatility product $UVXY preceded the three major drawdowns since 2018:

8. Looking at volume over a long period is somewhat misleading since the price of the product has gone down so the same dollars traded result in higher volumes - but this highlights a key point. As the price of volatility declines, the same dollars can buy more long-vol exposure.

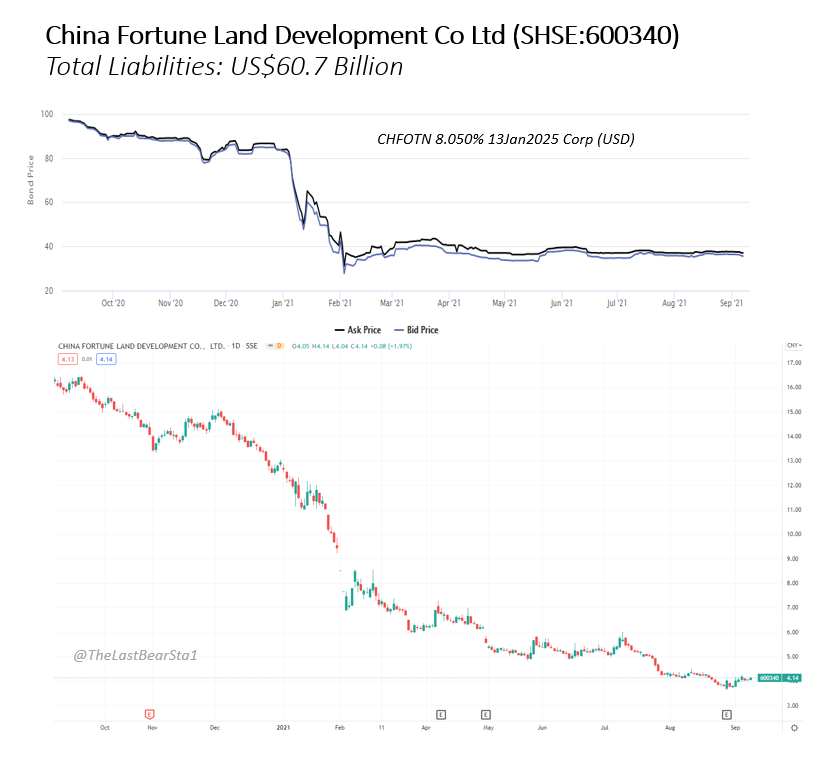

9. Unless Volatility is crushed below its July lows, a serious Volatility Squeeze is likely in the near term. This would result in a significant and rapid drawdown in the market. The drawdown may be attributed to macro events of which there are plenty to choose from.

10. As in investor - you must recognize that equities are at high risk given their correlation with Volatility. *not investment advice* but to prepare yourself for this squeeze, either be on the sidelines or the right side of the squeeze.

11. Full text below. If you find the content useful,, please subscribe!

thelastbearstanding.substack.com/p/the-volatili…

thelastbearstanding.substack.com/p/the-volatili…

To understand the important role options positioning and hedging plays in this feedback look, read the thread below:

https://twitter.com/TheLastBearSta1/status/1424833306781159433?s=20

Maybe Gary's a subscriber...

https://twitter.com/EricBalchunas/status/1445148813539356677?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh