🚨🚨Banks in Theory and Practice (9/27/21)👇👇

THEORY: Banks play a crucial role in a country's economy. They take money that is not currently being used and lend it to others. Through extending credit, they are allocating resources, but importantly they are also responsible for assessing the value of capital they have lent.

3. Example: a bank lends $100, and that money is used by the borrower to generate value, that ensures the bank is repaid $100 with interest. But that doesn't always happen. Its up to the bank to constantly reassess the value of that loan and the likelihood they will be repaid.

4. Taken in aggregate, banks are the bookkeepers for a country's credit expansion, ensuring that credit leads to productive growth and bearing first losses for bad debt. When done properly, this creates a market based structure of healthy credit expansion and economic growth

5. Key: Accounting is a *description* of reality. It does not dictate reality. #Evergrande never reported a loss but is insolvent. Similarly, whether a bad loan is properly recognized does change its ability to be repaid. Losses are *incurred* whether or not they are *recognized*

6. When banks conceal losses, it adds to systemic instability by misrepresenting losses to shareholders, counterparties, regulators and society in general. This compounds the problem by allowing asset values to remain overstated and capital to continue to be misallocated.

7. Banking failures occur when losses are *recognized* not when they are incurred. In the US, shoddy subprime loans fueled overinvestment in housing and inflated housing prices from 2003 - 2006, but banks failed years later, when they were forced to *recognize* those losses.

8. PRACTICE: The losses of unproductive investment in China has already been incurred. The country's collective resources has already been spent on rebar and cement for un-needed housing, whose market value depends on continued extension of debt to citizens to buy it.

9. This reality cannot be undone - the money was already spent. The fact that incurred losses to date have been concealed makes matters much worse by overstating the health of the financial sector and housing prices.

10. Consider the following article on bank responses to EGs missed payments:

AgBank (one of the big-four state banks) has made some loan-loss provisions for EG debt. Meanwhile Minsheng and CITIC have agreed to "rollover EG's near term maturities"

reuters.com/article/china-…

AgBank (one of the big-four state banks) has made some loan-loss provisions for EG debt. Meanwhile Minsheng and CITIC have agreed to "rollover EG's near term maturities"

reuters.com/article/china-…

11. The three banks likely have the same recovery prospects for their Evergrande loans. The difference is that AgBank is *recognizing* losses that others are pretending have not occurred, perhaps because the impact to the smaller banks is much more significant.

12. Now consider the overstated value of inventory on the balance sheet of all property developers. One man's inventory is another man's collateral. The ability to monetize this inventory is near zero, and the process of liquidation crushes the RE market and spreads contagion

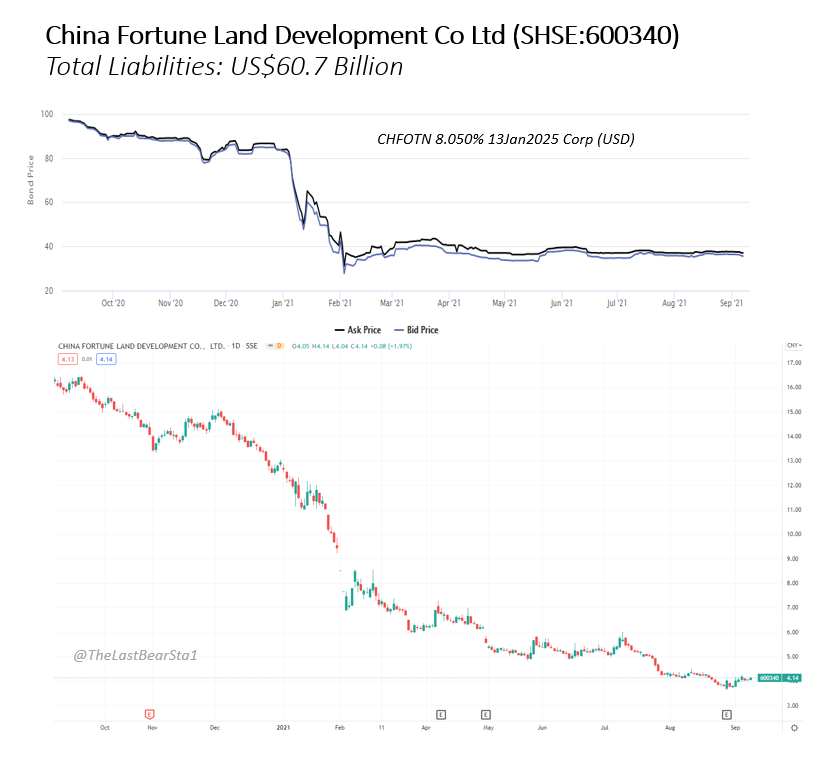

13. Indeed contagion has been spreading for months

(as detailed here weeks ago), and continues accelerating rapidly. Below are last 6 months indexed USD bond performance of 8 developers (includes accrued interest).

(as detailed here weeks ago), and continues accelerating rapidly. Below are last 6 months indexed USD bond performance of 8 developers (includes accrued interest).

https://twitter.com/TheLastBearSta1/status/1435720036073807884?s=20

14. Sunac, a major developer with >$150bn of reported liabilities (repeatedly highlighted in this master thread), is the latest to make headlines by warning of a "frozen" market and unprecedented cash flow concerns.

https://twitter.com/TheLastBearSta1/status/1435720082030800897

https://twitter.com/TheLastBearSta1/status/1438171734319013892

15. So while banks have been asked to stress test their direct EG exposure, the real stress test should encompass their entire direct and indirect property exposure which exceeds 40% for the highest risk banks, which also happen to have been papering over true losses for years.

16. The bleak reality is that absent an extraordinary and unlikely turnaround in the crashing property sector, the most exposed banks remaining true equity balances will be wiped out, forcing the recognition of losses that have been accruing for years.

18. Underscoring the magnitude of the issue and the link between banks and RE, consider that Chinese banks are the largest bank system by assets in the world at ~$50 trillion in 2020. Goldman estimates the total value of Chinese RE and inventory at just over $52tr as of 2019.

17. As for intervention, unless Beijing has a "second set" of books that recognize the true health of banks and the location and size of NPLs, they can't proactively intervene, and instead can only react to a crisis where it emerges. There's no indication this second set exists.

18. In fact, the recent move to ensure that pre-sale funds are segregated and held for completion of projects rather than creditors may be beneficial for social stability, but is a bad thing for creditors (banks).

ft.com/content/595c3f…

ft.com/content/595c3f…

18. My previous thread discusses the potential technical avenues for bank chaos and the limitations of state intervention, so I'll link to it, rather than repeat points:

https://twitter.com/TheLastBearSta1/status/1440726559883608065

19. Final note, this analysis has always clearly been in reference to CHINESE banks, not necessarily international banks. I would suggest to others who have speculated on international exposure to to draw a distinction between asset managers (Blackrock, PIMCO etc.) and banks.

20. In terms of international impact, I believe the highest risk of transmission will be through indirect channels, i.e. as a catalyst of a violent volatility unwind. Last weeks US market action was due to the unclenching and re-clenching of options gamma rather than EG news

21. Finally - *I am not an expert*, do your own diligence and consider this along with any other information and opinions available on the topic.

^typo. does *not* change its ability to be repaid.

• • •

Missing some Tweet in this thread? You can try to

force a refresh