Oyo DRHP takeaways - Everything you need to know!

Do retweet and help this thread reach more investors :)

#IPOwithJST #oyo

Do retweet and help this thread reach more investors :)

#IPOwithJST #oyo

1/n -

About Oyo -

- First of all, Oyo is a foreign-owned and controlled company.

- OYO gets hotels and homeowners to list their properties on the platform. They market such properties on the OYO app and their ecosystem

- They help book hotels and vacation homes.

About Oyo -

- First of all, Oyo is a foreign-owned and controlled company.

- OYO gets hotels and homeowners to list their properties on the platform. They market such properties on the OYO app and their ecosystem

- They help book hotels and vacation homes.

2/n -

- OYO was co-founded by Ritesh Agarwal in May 2013. Since then, Oyo has raised 16,000 crores in VC money and Rs 5,000 crore in debt, totaling 21000 crores!

- Early investors, VCs such as Sequoia Capital and Lightspeed, have already cashed out, making cool returns.

- OYO was co-founded by Ritesh Agarwal in May 2013. Since then, Oyo has raised 16,000 crores in VC money and Rs 5,000 crore in debt, totaling 21000 crores!

- Early investors, VCs such as Sequoia Capital and Lightspeed, have already cashed out, making cool returns.

3/n -

- SoftBank Vision (Cayman) Ltd, with a 46.62% stake is the “investor promoter” for the purpose of the IPO.

- Ritesh Agarwal holds 8.21% in his name and 24.95% through RA Hospitality Holdings, an entity in the Cayman Islands.

- SoftBank Vision (Cayman) Ltd, with a 46.62% stake is the “investor promoter” for the purpose of the IPO.

- Ritesh Agarwal holds 8.21% in his name and 24.95% through RA Hospitality Holdings, an entity in the Cayman Islands.

4/n -

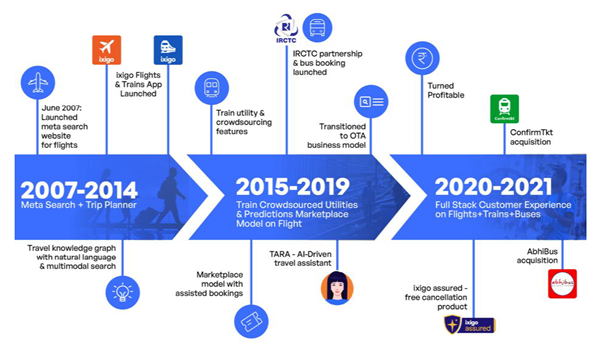

- What does Oyo Actually do? Don't let the Img 1 confuse you, in simple words, it is an aggregator that lets you book hotels and vacation homes.

- Google Trends for Aggregators

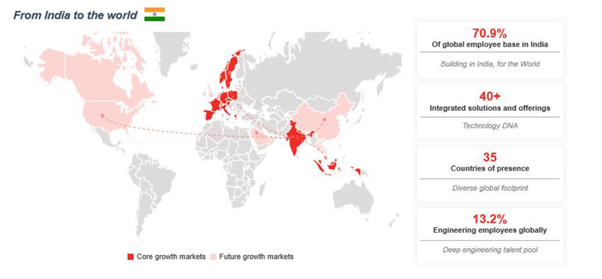

- As of FY21, Oyo had 157,344 storefronts across 35+ countries listed on their platform.

- What does Oyo Actually do? Don't let the Img 1 confuse you, in simple words, it is an aggregator that lets you book hotels and vacation homes.

- Google Trends for Aggregators

- As of FY21, Oyo had 157,344 storefronts across 35+ countries listed on their platform.

5/n -

- As of Sept 2021, they had the largest footprint in terms of hotel storefronts in India and SEA and the 2nd largest footprint in Europe. (Core Growth Markets.)

- 9.2 million OYO Wizard members as of FY21 (Loyalty program)

- As of Sept 2021, they had the largest footprint in terms of hotel storefronts in India and SEA and the 2nd largest footprint in Europe. (Core Growth Markets.)

- 9.2 million OYO Wizard members as of FY21 (Loyalty program)

6/n -

- Issue Details

Fresh issue of Rs 7000 Cr, OFS of 1430 Cr

Pre IPO of 1400 cr may be done

- Objects of the issue

2441 Cr debt payment

2900 Cr organic and inorganic opportunities funding

- Selling Shareholders

- Issue Details

Fresh issue of Rs 7000 Cr, OFS of 1430 Cr

Pre IPO of 1400 cr may be done

- Objects of the issue

2441 Cr debt payment

2900 Cr organic and inorganic opportunities funding

- Selling Shareholders

7/n -

Oyo Townhouse Restructuring - A 'Costly' solution

- In 2020, they went on a big restructuring exercise to shut down their self-operated Townhouse business.

- The company spent a lot of its time, money, and energy in building this.

Oyo Townhouse Restructuring - A 'Costly' solution

- In 2020, they went on a big restructuring exercise to shut down their self-operated Townhouse business.

- The company spent a lot of its time, money, and energy in building this.

8/n -

- model = hotels would be completely managed by their owners or franchisees of the Oyo brand.

- Back to restructuring, They removed 1000s of employees. 407 cr was spent on this covering termination costs of contracts, severance pay, inventory, + other asset write-downs

- model = hotels would be completely managed by their owners or franchisees of the Oyo brand.

- Back to restructuring, They removed 1000s of employees. 407 cr was spent on this covering termination costs of contracts, severance pay, inventory, + other asset write-downs

8/n -

Let's see how Oyo recognizes revenue -

It takes Gross booking revenue as Revenue in the hotel segment

Ideally, it should note commissions as revenue as -

GBV = Oyo commission + patron’s commission (hotel owner) + direct/indirect costs

Shocking!

Let's see how Oyo recognizes revenue -

It takes Gross booking revenue as Revenue in the hotel segment

Ideally, it should note commissions as revenue as -

GBV = Oyo commission + patron’s commission (hotel owner) + direct/indirect costs

Shocking!

9/n

Surprising that it notes commissions as revenue in the other 2 segments.

Also in segment breakup, it just gives India revenue and outside India revenue.

This doesn't tell much!

Note - Only 25% of revenue comes from India

Surprising that it notes commissions as revenue in the other 2 segments.

Also in segment breakup, it just gives India revenue and outside India revenue.

This doesn't tell much!

Note - Only 25% of revenue comes from India

10/n

Since May 2013, Oyo has raised Rs 21000 Cr (16000 cr of VC money and 5000 Cr in debt)

Losses (Rs Cr) -

FY19 - 2525

FY20 - 12800

FY21 - 3929

Has 95 subsidiaries (109 total, 95 operational) and 41 (52 total, 41 operational) joint ventures

Amusing!

Since May 2013, Oyo has raised Rs 21000 Cr (16000 cr of VC money and 5000 Cr in debt)

Losses (Rs Cr) -

FY19 - 2525

FY20 - 12800

FY21 - 3929

Has 95 subsidiaries (109 total, 95 operational) and 41 (52 total, 41 operational) joint ventures

Amusing!

11/n

Financials (Rs Cr)

Revenue -

FY19 - 6518

FY20 - 13413

FY21 - 4157

Losses -

FY19 - 2525

FY20 - 12800

FY21 - 3929

Losses reduced in FY21 as other expenses pulled back (like every other Tech IPO company did, Img 2)

No cash flows, nothing else worth talking about.

Financials (Rs Cr)

Revenue -

FY19 - 6518

FY20 - 13413

FY21 - 4157

Losses -

FY19 - 2525

FY20 - 12800

FY21 - 3929

Losses reduced in FY21 as other expenses pulled back (like every other Tech IPO company did, Img 2)

No cash flows, nothing else worth talking about.

12/n

- Also, there were exceptional items, which totaled Rs 1,644 Cr in FY20 and Rs 1001 Cr in Fy21.

- Rs 2644 Cr of exceptional items in just 2 years – to put that in perspective their revenue was 4157 cr in FY21, 50% of revenue as exceptional costs!

- Also, there were exceptional items, which totaled Rs 1,644 Cr in FY20 and Rs 1001 Cr in Fy21.

- Rs 2644 Cr of exceptional items in just 2 years – to put that in perspective their revenue was 4157 cr in FY21, 50% of revenue as exceptional costs!

13/n

Conclusion -

The DRHP was very ambiguous and I had to rely on outside sources to research!

What will happen with Oyo in the mid to long-term future is something that no one knows!

Valuations have no meaning here, so let's chuck that!

Thanks for reading!

Conclusion -

The DRHP was very ambiguous and I had to rely on outside sources to research!

What will happen with Oyo in the mid to long-term future is something that no one knows!

Valuations have no meaning here, so let's chuck that!

Thanks for reading!

Also , a fun fact on Oyo -

Stay tuned for more :)

https://twitter.com/aditya_kondawar/status/1444973095802982400

Stay tuned for more :)

• • •

Missing some Tweet in this thread? You can try to

force a refresh