The #CBAM proposal was released almost 3 months ago. Various aspects of the proposal have been already discussed: impact on economy, int'l trade patterns, compatibility w/ WTO & Paris Agreement.

I’d like to highlight here a number of less discussed issues. (thread)

I’d like to highlight here a number of less discussed issues. (thread)

At the outset, let me point out that two main issues that in my view will determine the future of #CBAM in the Council and the Parliament have been somewhat discussed in the media, but in an insufficient and highly distorted way: free ETS allowances and export competitiveness. /1

Free allowances are an emotional issue. I won't focus on them here: I will address them separately in a few days. But I would like to emphasize that these two issues are insufficiently analyzed and the public discussion on them is distorted, so expect major surprises. /2

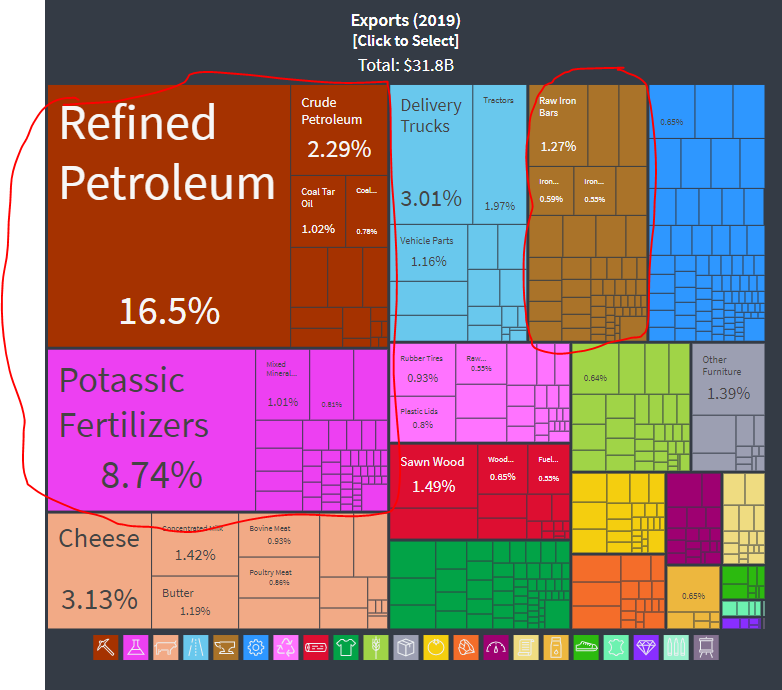

The main point is that if free allowances are taken away, CBAM will result in a decrease in exports in CBAM sectors. The Impact Assessment leaves no doubts about this. 👇

(Chart is for export performance of CBAM sectors; option 4 is the CBAM option ultimately taken by EC). /3

(Chart is for export performance of CBAM sectors; option 4 is the CBAM option ultimately taken by EC). /3

As (1) all CBAM sectors made their support for #CBAM conditional on EU Commission finding a way to protect exports & (2) EC has given up on this (admitting there is no WTO compatible way), failure to address export competitiveness results in a massive political problem for EC. /4

The most talked about option (export rebates) has been rejected by the EC at the outset as WTO incompatible & contrary to climate objectives and EC has not even analyzed it at length. /5

All of this makes perfect sense from WTO/climate objectives, but does not account for political realities in Brussels and Member States.

Unless EC finds a way to protect EU exports for CBAM sectors, CBAM will run into massive problems in the Council and the Parliament. /6

Unless EC finds a way to protect EU exports for CBAM sectors, CBAM will run into massive problems in the Council and the Parliament. /6

Especially once it becomes clear which countries/sectors will lose exports. Conveniently, contrary to other elements of CBAM, EC has not provided a country-specific or sector-specific export loss analysis. /7

I will focus on this in a separate thread. /8

Main elements which I want to discuss here:

- transitional period;

- #CBAM based on trust:

- centralized vs. decentralized CBAM system;

- default values; and

- registration of 3rd country installations.

This will be a bit nerdy & detailed, so apologies to the general audience./9

- transitional period;

- #CBAM based on trust:

- centralized vs. decentralized CBAM system;

- default values; and

- registration of 3rd country installations.

This will be a bit nerdy & detailed, so apologies to the general audience./9

Transitional period. Under the current CBAM set up, the Regulation is envisioned to enter into force on 1 January 2023 and have a "transitional period" from Jan. 2023 to Dec. 2025 (3 years). /10

CBAM's entrance into force by Jan 2023 - in my conversations in Council and EP - is v difficult. It leaves one year for EP & Council o finish their work (EP: Committees & Plenary), then trialogues, translations, publication. Extremely difficult with the entire FF55 package. /11

The EC proposed that for three years (2023-2025), importers do not actually pay #CBAM. EC proposes that they just report their emissions, without the actual duty to pay, which will only come in in 2026. /12

This makes perfect sense from EC perspective. It will temper the risk of international opposition (as exports won't really face a barrier) and allow space (4 years from today) for international diplomacy to achieve matching commitments from main trading partners. /13

We have already seen that #CBAM is accelerating discussions on carbon pricing in US, Russia and other countries. China is also rolling out its own ETS-like system. /14

As European Commission may have the delegated authority to exempt countries from #CBAm altogether, if they have an ETS equivalent, and carbon paid for in 3rd countries is deducted from the importer's CBAM bill, it is possible that by 2026, #CBAM won't be such a big problem. /15

However, the problem is what happens to EU producers within these ETS sectors covered by CBAM in the meanwhile. /16

The carbon price today is already north of 60 EUR. When CBAM kicks in in 2023, it may be around 80 EUR (?). By 2026, when importers start paying CBAM, EU ETS is well north of 100. /17

As we have seen, EU ETS prices are already factoring in #FF55 package goals, i.e., 55% emissions reductions by 2030 & climate neutrality by 2050. Domestic carbon price is already factoring in the new regime, but it will touch imports only with a massive delay: 4 years. /18

So the 3 year transitional period (2023-2025) may make sense from climate diplomacy point of view, it will not however make sense from domestic investment & industrial policy perspective. /19

Also, if the purpose of the transitional period is to test the system before domestic producers start losing free allowances in 2026, the system hasn't really been tested until importers are already paying for their emissions. /20

All this to say that the transitional period will most likely have to be shortened or abolished altogether. /21

Second issue: a detailed reading of the #CBAM proposal leads to the conclusion that the system that was created is based entirely on trust. /22

To make sure the readers understand the issue, it is necessary to explain briefly how the CBAM system will work in practice. /23

1⃣ Importers of CBAM-covered products need to register/get authorized and obtain a special CBAM account with the authorities.

2⃣ As they import throughout the year, they need to ensure that each quarter, they have CBAM certificates covering at least 80% of their emissions. /24

2⃣ As they import throughout the year, they need to ensure that each quarter, they have CBAM certificates covering at least 80% of their emissions. /24

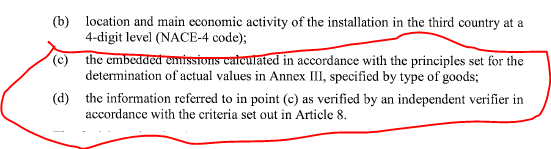

3⃣ At the end of May the following year, they file an annual CBAM declaration, in which they spell out (1) what products they have imported, (2) what were the emissions from these imports and (3) how many CBAM certificates they must surrender. /25

4⃣ Separately, this CBAM declaration must be verified by an independent, govt authorized verifier, according to principles set out by the Commission. /26

And that is it folks, as far as the main elements of the system are concerned. Now, the question is: how do the authorities know that the CBAM declaration is accurate? That is has been verified by the verifier, as required? That the verifier is doing his job properly? /28

The answer is: the authorities don't. The system as proposed is based entirely on trust. Therefore, it needs to be tightened to make sure that CBAM declarations are accurate, that authorities have constant oversight of CBAM declarations being correctly verified by verifiers. /29

This is it key: in int'l trade, minor advantage over competitors is extremely important. CBAM will provide such advantages. Exporters with low CBAM will win sales over exporters with high CBAM. Veracity of CBAM declarations will be extremely important./30

Therefore, ensuring that all CBAM declarations have been verified, as required, and ensuring their veracity is key to making CBAM work on the market and politically (vs. EU producers). Thus these provisions must be fixed. /31

Third topic: centralized vs. decentralized #CBAM system. The issue we are discussing here is the level at which #CBAM is implemented, monitored, verified: central EU-level (with a new EU agency: CBAM Authority) or EU Member State levels (each MS has its own authority). /32

In an earlier draft of the #CBAM proposal, EC went for a centralized system w. a new EU-level CBAM Authority that authorized importers, sold & cancelled CBAM certificates, received/verified CBAM declarations & generally was in charge of ensuring proper operation of the system./33

However, in the final proposal that has been submitted, the Commission did a 180° turn and went for a decentralized, EU Member State-based system instead, with 27 separate national "competent authorities". /34

Side-stepping all the political issues around "creeping centralization" vs. Member States rights, central issue here is who is in a better position to properly execute a watertight and efficient CBAM system that will ensure that the carbon price is properly paid on imports./35

The main concern is that CBAM will ultimately exclude uncompetitive exporters from EU market, effectively leaving a smaller amount of more competitive, greener exporters. These large entities will be exporting to multiple Member States, with numerous importers. /36

The question is who is better positioned to ensure correct amounts of emissions are reported in CBAM declarations. /37

With a decentralized system, there is a real potential that different importers importing into different EU Member States from the same foreign exporter the same products will file to different Member State authorities CBAM declarations with contradicting emissions. /38

Since importers have no real way to assess emissions in a foreign facility, they will have to rely on the data from the exporter. The exporter may or may not provide the data. As the data determines level of CBAM, it also determines which importer has better market access. /39

This alone may lead to competition law violations, as exporters may indirectly decide which importers win, and geographically divide up the market. /40

Another risk is that importers, with limited access to data, may be reporting different emissions for the same products and since their declarations are verified not by govt, by but independent verifiers, the level of scrutiny in different Member States will be different. /41

In effect, with a decentralized system, the risk is that imports into Germany, for example, will face tougher scrutiny than imports into, say, Cyprus, and CBAM levels will differ, even though the product and exporter is exactly the same. /42

Another problem is that - lets be honest - Member States' ability to properly assess the correctness of emissions calculations for all CBAM products manufactured in foreign locations will be limited. /43

It seems it makes more sense for one authority to do these calculations for the entire EU, as that authority will have better access to EU-wide data and will be able to cross-check the calculations filed in different locations for the same type of imports. /44

Given the amount of import transactions at the EU level 👇, it will also have a quicker learning curve of what level of emissions are possible, what the main variants/factors influencing emissions are, etc. /45

All in all, it seems that probably a central, EU-level authority may be in a better position to assess multiple CBAM declarations, filed from importers in different Member States, to ensure their consistency. /46

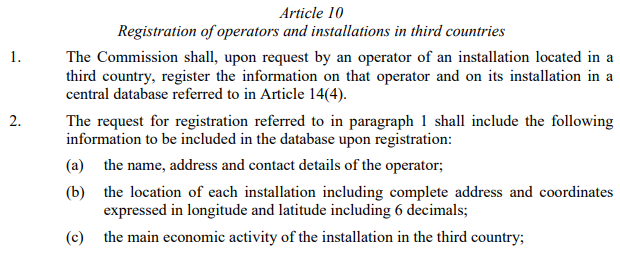

Fourth final point: registration of 3rd country installations. This is a bit complicated, bz it appears that the original idea once envisioned by EC for this concept has been diluted and now its unclear what the purpose of this mechanism is.

So we need to dissect it a bit. /47

So we need to dissect it a bit. /47

In general, the issue is that under CBAM, imports of certain products manufactured by foreign exporters will be subject to additional climate payment (CBAM) upon importation into the EU. This raises of lot of uncertainty for multiple parties. /48

First, importers importing CBAM products will have to submit CBAM declarations and pay for imported emissions w/ CBAM certificates. The amount of CBAM due depends on emissions of the exporter; it has nothing to do with the importer. /49

But the importer cant be sure what the exporter's emissions really are. He must rely on information obtained from the exporter. He cant be sure if the exporter will provide him reliable true information that will withstand the scrutiny of the verifier and of EU authorities. /50

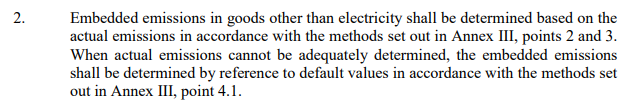

So importers of CBAM products run a massive risk of getting stuck with an unexpected CBAM bill, that has got nothing do with their negligence. They risk being duped by exporters/traders and are burdenened with the risk of different interpretation of the law by the authorities./51

EU producers also face the risk of being in CBAM, if they lose free allowances in exchange. Their competitive situation on the EU market may improve (as some imports become more expensive), but losing free allowances is a massive cost measured in millions EUR per year. /52

This trade-off may make sense, or it may not, depending on how well CBAM is implemented and how well the carbon emissions of exporters are reported, verified and paid for. /53

All of this points to a situation where it would benefit everyone - importers and EU producers alike - if the CBAM imposed on imports could somehow be made official, if not even public. /54

If a given exporter had an official rate assigned to him, this would benefit the importers (as they would no longer face the risk of unknown or unstable CBAM rate) and EU producers (as they wouldn't risk that imports into some jurisdictions have an unreasonably low CBAM). /55

For those that understand trade law, in particular trade defense (anti-dumping, anti-subsidy/countervailing duties), Im referring to a situation where an exporter has his own individual public AD/CVD rate. Everyone knows more or less how much more expensive his imports are. /56

It seems that in earlier drafts of the #CBAM regulation, the EC envisioned something analogous to this system. It provided for a procedure where exporters can be registered and their emissions officially confirmed and entered into the central database. /57

Once the exporter was registered in the central database, it could let any importer know what its official CBAM rate was and this would be the rate that the importer could rely on without any risk of future changes. /58

This provision, although not perfect, made actually a lot of sense. However, it was completely dismantled in the proposal that ultimately got filed. /59

While #CBAM proposal still provides for registration of 3rd country installations in an official database, registration doesnt include anymore the facility's emissions. It begs the question of why such a database exists & what its purpose is, if emissions are not included. /60

Therefore, the provisions on registration of 3rd country installations should be revised in three directions. /61

1⃣ The legislators should bring back the provisions requiring the 3rd country installations' emissions to be registered in the database. That should be the primary function of such registration. /62

2⃣ In contrast to current and previous #CBAM drafts, the CBAM/emissions rate of the registered 3rd country installation should be made public. This would even the playing field for all importers/traders, it would allow EU producers to verify the veracity of the data, and ... /63

... it would contribute to the public's understanding and knowledge of emission intensity of production processes and emission rates. There is no reason to keep these rates private/secret. /64

3⃣ The proposed system (as well as previous drafts) envisions registration of the 3rd country installation only when the exporter requests this. Actually, it would make perfect sense to make such registration mandatory for major/largest exporters to the EU. /65

This would ensure that CBAM charged on such imports is properly verified, that there is no discrepancy on rates and this would give EU authorities full insight into emissions of competing technologies/installations around the world. /66

This could be mandatory for largest exporters (above a certain threshold of exports) or should be done within a certain timeframe after the first export to the EU, or should be encouraged through data verification methodologies (actual vs. default). /67

Either way, it would be beneficial for everyone if most exports into the EU would be done under a public registration system where CBAM/emissions rates of top exporters are officially verified and publicly available to all interested. /68

Fifth point, default emission values. This deals with how CBAM is actually calculated at the border. /69

In general, if purpose of CBAM is to impose a carbon cost on imports, the authorities need to know the level of emissions that the imported product is responsible for. /70

The importer doesn't know the actual level of emissions. He must rely on information provided by the producer. Same for verifier and CBAM authorities. So the exercise boils down to the reliability of data in possession of a 3rd party. /71

This data is not always available or it may be not reliable. For this reason, the proposal envisions two potential sources of such data: the actual data of the foreign producer, or "default data" that should be used if actual emissions "cannot be adequately determined." /72

The details of how "default values" would be determined or established are set out in Annex III, which - to be honest - is horribly unclear and poorly drafted. /73

I'll skip the details, but briefly:

1⃣ actual values and literature may be used.

2⃣ to be based on "best available data"

3⃣ to be revised periodically via implementing acts, based on most up-to-date & reliable information, incl. provided by 3rd countries. ... /74

1⃣ actual values and literature may be used.

2⃣ to be based on "best available data"

3⃣ to be revised periodically via implementing acts, based on most up-to-date & reliable information, incl. provided by 3rd countries. ... /74

4⃣ to be set at the average emission intensity of each

exporting country and for each of the goods, increased by a mark-up to be determined in the implementing acts;

5⃣ when reliable data cannot be found, resort to average emissions of 10% worst performing

EU installations./75

exporting country and for each of the goods, increased by a mark-up to be determined in the implementing acts;

5⃣ when reliable data cannot be found, resort to average emissions of 10% worst performing

EU installations./75

Given that the #CBAM proposal is poorly drafted on this point of default values and Annex III is particularly unclear, the Council and the Parliament have a lot of work to do in clearing up these provisions, but the main issues are: /76

1⃣ The Reg needs to spell out very clearly at what point "actual emissions" data cannot be "adequately determined" so default values kick in. It is admittedly hard to set a rule for all future cases, but more clarify is needed than just "adequateness" of data./77

2⃣ The Reg needs to clearly set out who establishes the default values. You will be surprised, but currently the #CBAM reg and Annex III aren't clear on this. There are vague and indirect references to "implementing regulations", but we need a clear provision confirming this./78

3⃣ It does not seem workable that verifiers would establish these values, as they are not ideally positioned to make such important judgment calls with implications for entire sectors in entire countries. So it must be the Commission. /79

4⃣ A special procedure, with public consultations and participation, possibility to make submissions should be given, so that foreign exporters & governments and EU interested parties and stakeholders can participate and submit data. /80

5⃣ This may sound protectionist, but the default values should be sufficiently punitive to incentivize foreign exporters to get an official rate correctly reflecting their emissions. Even 10% worst EU performers - as currently set - may be an upgrade for some sectors. /81

Anyway, so these are my five main "insider points" about CBAM. There are many more points to discuss in future tweets. I doubt anyone made it this far 😴, but if you did, feel free to "like" or drop a short comment. I'm curious how many CBAM nerds are lurking out there. 🤓82/82

• • •

Missing some Tweet in this thread? You can try to

force a refresh