One take ive seen is "I get why other protocols would benefit from owning liquidity but I don't see why Olympus needs to exist"

I think the fact that others benefit is exactly why. it kind of goes along with this 👇🧵

I think the fact that others benefit is exactly why. it kind of goes along with this 👇🧵

https://twitter.com/statelayer/status/1447770298535878657?s=20

It seems like everyone is in favor of, at least, protocol owned liquidity. Given it is properly executed, this is a viable solution to the liquidity mining problem.

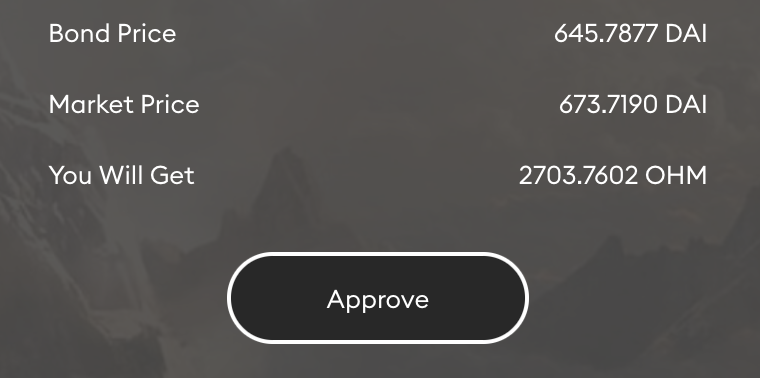

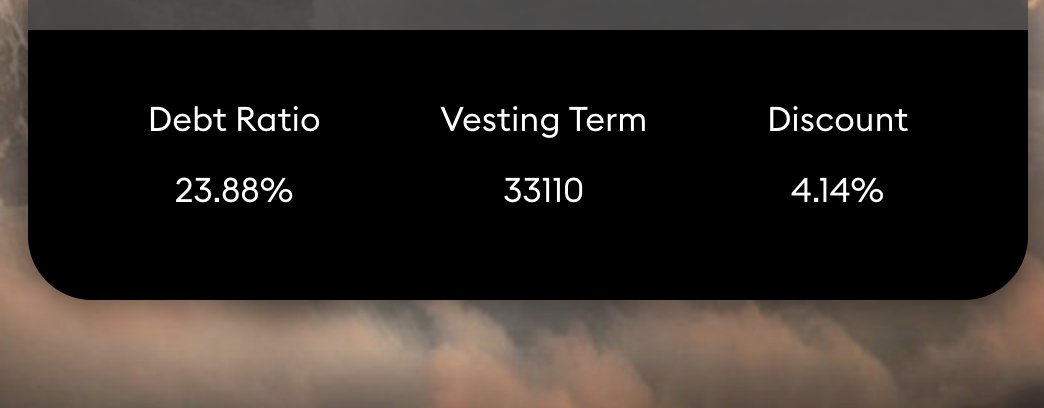

The problem is that buying liquidity is more expensive in the short term than renting liquidity.

This cost is in the form of new tokens, which dilute current holders to the benefit of future holders.

This cost is in the form of new tokens, which dilute current holders to the benefit of future holders.

This is a difficult thing to balance. If you have a $100m market cap and want to accumulate $10m liquidity, you need to spend 10% current circulating supply. This means almost 10% dilution for current holders.

This is why yields are crazy high on OHM. The protocol is aggressively accumulating assets, and compensates for it by increasing the balances of those staked. This minimizes dilution, creating an economically viable model despite the high short term costs.

This is a very specific tokenomic setup though. Not everyone can do this.

The good thing is you don't have to.

The good thing is you don't have to.

Here's something I can see happening frequently in the future. [warning: this is only a hypothesis]

Project X launches liquidity mining rewards for sOHM-X.

They utilize Olympus Pro to accumulate that liquidity, to whatever degree their tokenomics demand and can accomodate

Project X launches liquidity mining rewards for sOHM-X.

They utilize Olympus Pro to accumulate that liquidity, to whatever degree their tokenomics demand and can accomodate

If their need outweighs their ability, they then approach Olympus. Project X has already demonstrated alignment by incentivizing and accumulating an sOHM pool, and so they ask the DAO for assistance.

The DAO, favorable to the project, agrees to commit x OHM toward bonds, and ends up owning 20% of the pool. An insignificant amount relative to its total liquidity holdings, but quite significant for Project X

This is favorable to Project X because their cost of capital diminishes. This is favorable to Olympus because Project X brings new activity and capital into the econohmy (it's cost of capital is also likely lower since it produces more circular econohmic activity)

Olympus isn't really doing anything new here. It is and will be accumulating assets anyways. The only difference is the risk it takes on (which should always be systemically insignificant) and the positive externalities it creates.

All of this is currently theoretical because it hasn't been done yet, but this should create a virtuous cycle.

growth in econohmic activity -> diminished macroeconohmic risk -> heightened opportunity cost -> growth in econohmic activity

growth in econohmic activity -> diminished macroeconohmic risk -> heightened opportunity cost -> growth in econohmic activity

Remember, Olympus also owns the liquidity rails and takes fees on anything routed through them. This allows it to capture and retain financial energy better than comparable systems.

There's even a non-zero probability outcome that pairing with OHM becomes almost compulsory. The more liquidity we consume, the higher the cost of capital becomes outside of the econohmy and the cheaper it becomes inside the econohmy.

If that does prove to be the case, first movers will have a huge advantage. So what are you waiting for anon?

Utilize OHM as the currency its meant to be. Join the econohmy.

Utilize OHM as the currency its meant to be. Join the econohmy.

You don't need to be plugged in to the DAO or even the community (though we'd love to be frens); just make some good faith gestures, demonstrate legitimacy, tell the ohmies what you need, and see what they say

• • •

Missing some Tweet in this thread? You can try to

force a refresh