Thinking out loud🧵on #Bitcoin DeFi

I'm a Bitcoiner first and foremost. It's the economics, scale of problem, and hunt for a better world that keeps me here.

Hold handful of alts in size ( $DCR, $ETH, $COMP, $STX) and have used a good whack of Ethereum DeFi and NFT markets

1/x

I'm a Bitcoiner first and foremost. It's the economics, scale of problem, and hunt for a better world that keeps me here.

Hold handful of alts in size ( $DCR, $ETH, $COMP, $STX) and have used a good whack of Ethereum DeFi and NFT markets

1/x

I've spent a good chunk of time studying many facets of the technology, from scaling, to economics, to incentives.

I think I've a fair + reasonable grasp

Despite being long $ETH, I dislike immensely the 'financial engineering' of monetary policy

Gas or money --> Choose one

2/x

I think I've a fair + reasonable grasp

Despite being long $ETH, I dislike immensely the 'financial engineering' of monetary policy

Gas or money --> Choose one

2/x

Base layer hard money needs PoW security and sound governance. Either rough consensus in $BTC, or formalised in $DCR.

PoS I simply can't see being decentralised consensus Long-T and thus = bad money. Too many examples of wealth concentrating wealth.

Finance layer, PoS is ok

3/x

PoS I simply can't see being decentralised consensus Long-T and thus = bad money. Too many examples of wealth concentrating wealth.

Finance layer, PoS is ok

3/x

Even after using many DeFi protocols, I really only ever find the following useful:

- On-chain settlement/SOV

- Lightning as payments

- Maker + Compound for borrow liquidity

- DEX to swap, but im ok with C.Exchanges

Those tools are analogous to what I use in meatspace too.

4/x

- On-chain settlement/SOV

- Lightning as payments

- Maker + Compound for borrow liquidity

- DEX to swap, but im ok with C.Exchanges

Those tools are analogous to what I use in meatspace too.

4/x

I've not seen a good example of why DeFi protocols require a token outside raising capital.

Need to pay bills.

Unfortunately, this is how VC's make ROI.

I align much stronger with:

Free market --> LN+RSK

Decred Treasury-->DCRDEX

Stacks --> Reg A+

Brink -->Funding $BTC Devs

5/x

Need to pay bills.

Unfortunately, this is how VC's make ROI.

I align much stronger with:

Free market --> LN+RSK

Decred Treasury-->DCRDEX

Stacks --> Reg A+

Brink -->Funding $BTC Devs

5/x

With all that said + having used Maker/Compound for years, do I feel compelled to keep using it? Even if ETH 2.0 scales fees down?

No.

All I need is the tooling to collateralise my $BTC/ $DCR + borrow against it

I believe these will actually get built for native #Bitcoin

6/x

No.

All I need is the tooling to collateralise my $BTC/ $DCR + borrow against it

I believe these will actually get built for native #Bitcoin

6/x

Whether via LN, RSK, Liquid, Stacks, or another, I do believe the cream of the DeFi crop can be replicated on #Bitcoin layers

The key for me is security, stability and resistance to capture. I don't need turing completeness, I need assurances.

Protect my🌽 at all costs.

7/x

The key for me is security, stability and resistance to capture. I don't need turing completeness, I need assurances.

Protect my🌽 at all costs.

7/x

The switching cost for me is not FROM ethereum/Solana net effects.

The switching cost is making me confident enough to deploy my $BTC. That is a huge hurdle and financially engineering the base layer is a no go.

I'm sure I'm not the only Bitcoiner who feels this way either.

8/x

The switching cost is making me confident enough to deploy my $BTC. That is a huge hurdle and financially engineering the base layer is a no go.

I'm sure I'm not the only Bitcoiner who feels this way either.

8/x

In short, I would rather continue to exercise low time preference and wait for the correct DeFi layer to emerge.

I never used to feel this way, but using Stacks has increased my confidence in DeFi layers built for #Bitcoin, and it will probably shock quite a few people.

9/x

I never used to feel this way, but using Stacks has increased my confidence in DeFi layers built for #Bitcoin, and it will probably shock quite a few people.

9/x

Mobilising dormant on-chain native $BTC is the killer app.

When you start seeing HODLer $BTC moving into a DeFi layer at scale, that is when you need to pay attention.

This is a game of🌽confidence, and $WBTC just ain't it.

There is a reason #Bitcoin remains top dog.

10/x

When you start seeing HODLer $BTC moving into a DeFi layer at scale, that is when you need to pay attention.

This is a game of🌽confidence, and $WBTC just ain't it.

There is a reason #Bitcoin remains top dog.

10/x

I'm always studying, but this leads me to believe the following are likely undervalued solutions:

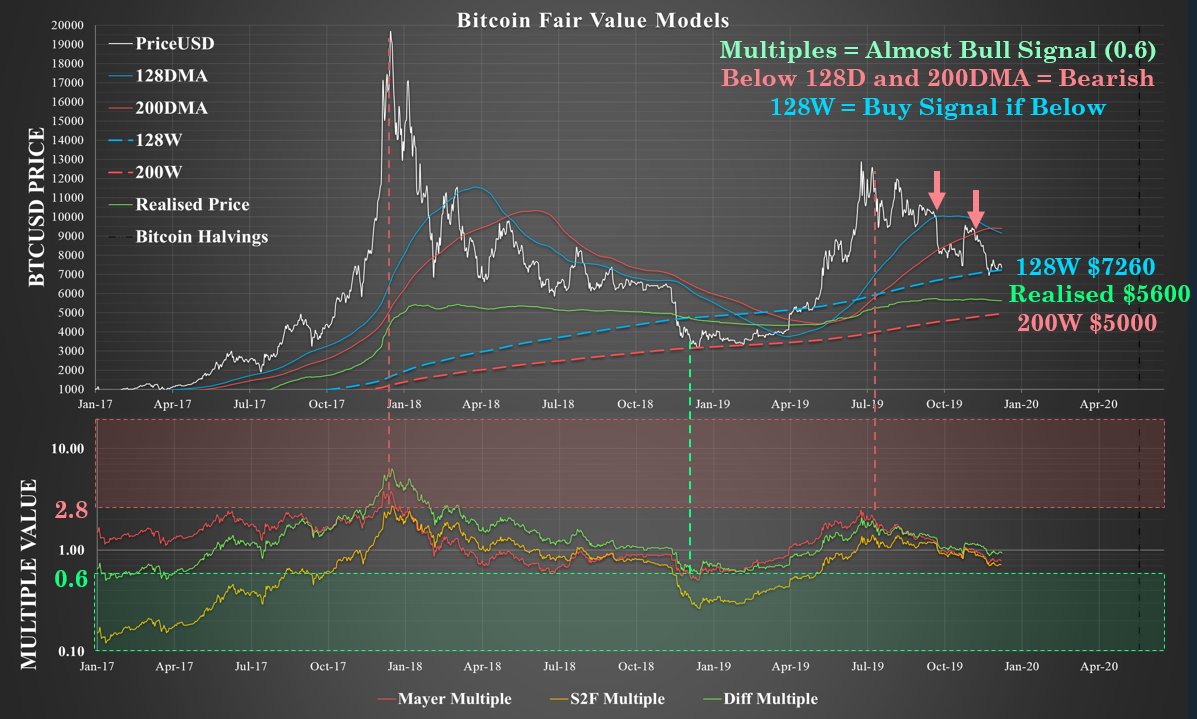

- $BTC is always undervalued

- LN is an awaking giant

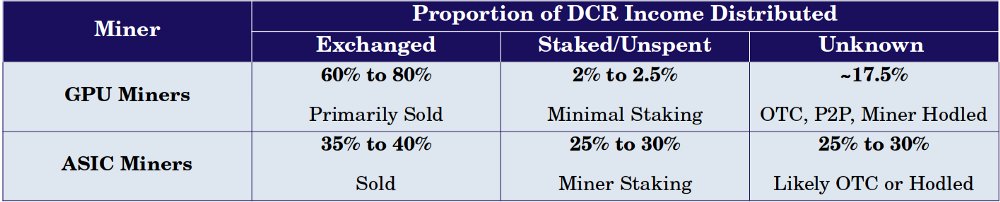

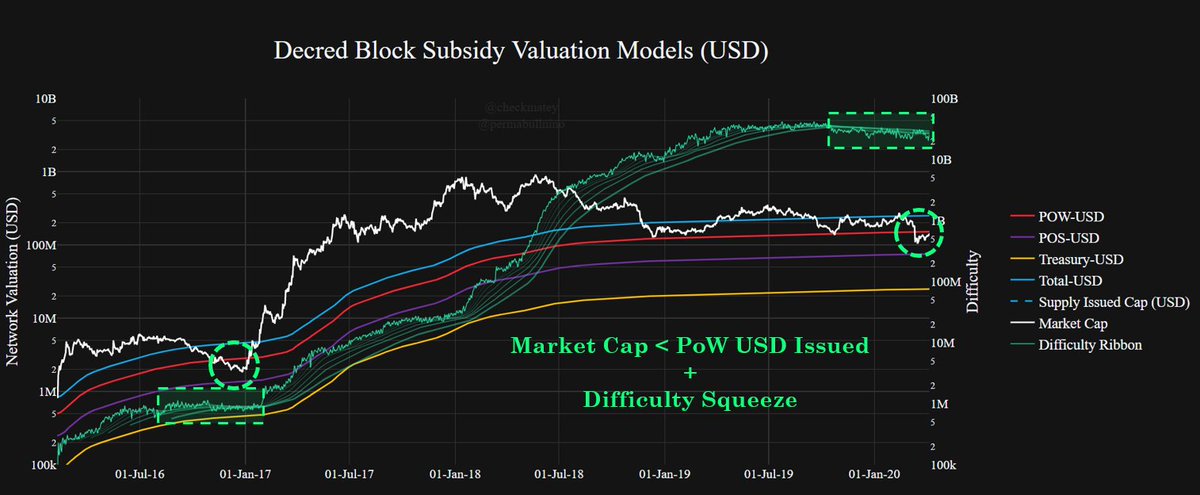

- $DCR + DCRDEX + StakeShuffle = critical infrastructure

- Stacks is very intriguing, feels robust, still early

- RSK TBD

~fin

- $BTC is always undervalued

- LN is an awaking giant

- $DCR + DCRDEX + StakeShuffle = critical infrastructure

- Stacks is very intriguing, feels robust, still early

- RSK TBD

~fin

P.S no real point to this thread, just getting ideas out.

Ever since EIP1559, my view that Ethereum has any long-term moat has declined dramatically. Always been sceptical, but that upgrade was extremely short-sighted+unsound imho

Thus I am researching #Bitcoin DeFi more deeply

Ever since EIP1559, my view that Ethereum has any long-term moat has declined dramatically. Always been sceptical, but that upgrade was extremely short-sighted+unsound imho

Thus I am researching #Bitcoin DeFi more deeply

• • •

Missing some Tweet in this thread? You can try to

force a refresh