0/ It has been a hot minute since I let loose my thoughts on #Decred. Combination of taking a break from CT and life throwing lemons.

Enjoyed watching community and stakeholders engage and keep up the discussion

But an on-chain tweet-storm is long overdue!

Seeking Conviction👇

Enjoyed watching community and stakeholders engage and keep up the discussion

But an on-chain tweet-storm is long overdue!

Seeking Conviction👇

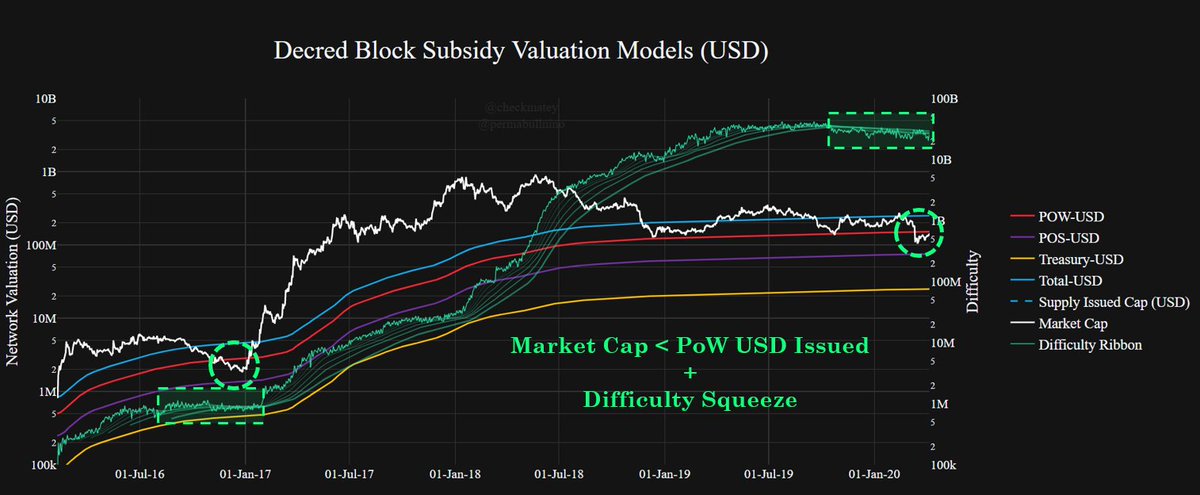

1/ Start with the big picture.

DCR/BTC price has been absolute carnage...

..but we have been here before.

You see Decred is primed to become an oscillator, outperforming BTC in bull markets and underperforming in bears.

The stakeholder block subsidy line is at fractal phase 0

DCR/BTC price has been absolute carnage...

..but we have been here before.

You see Decred is primed to become an oscillator, outperforming BTC in bull markets and underperforming in bears.

The stakeholder block subsidy line is at fractal phase 0

2/ When looking for stakeholder conviction, I use the 142-day metrics. These sample the entire ticket pool and looks as far back as late May.

The Strongest Hand metric.

This shows conviction as measured by DCR volume into tickets.

It oscillates between conviction + uncertainty

The Strongest Hand metric.

This shows conviction as measured by DCR volume into tickets.

It oscillates between conviction + uncertainty

3/ The Ticket Funding Rate

This shows the long term risk to reward as judged by DCR stakeholders.

On the 142-day period, a green signal means religious ticket buying

One ticket votes, one fresh ticket gets mined

I know I am one of these people

Mass DCR in a ticket = No Sales

This shows the long term risk to reward as judged by DCR stakeholders.

On the 142-day period, a green signal means religious ticket buying

One ticket votes, one fresh ticket gets mined

I know I am one of these people

Mass DCR in a ticket = No Sales

4/ This is further confirmed in Hodler Conversion Rate

This metric looks at relative balance of $DCR moving in regular vs ticket transactions

Over 12 months, we have consistently seen tickets dominate the transaction pool

Symptom of low attention + view of $DCR as undervalued

This metric looks at relative balance of $DCR moving in regular vs ticket transactions

Over 12 months, we have consistently seen tickets dominate the transaction pool

Symptom of low attention + view of $DCR as undervalued

5/ The 142-day sum of $DCR in tickets is an oscillator which presents the cumulative volume bound to the chain over the period.

These bands form psychological levels and the 50% level has proven to be a long term mean.

Thus we can see where stakeholders ramp up and buy/avoid 🎟️

These bands form psychological levels and the 50% level has proven to be a long term mean.

Thus we can see where stakeholders ramp up and buy/avoid 🎟️

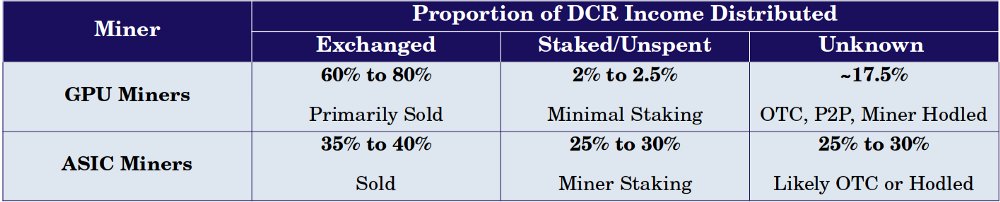

6/ Finally, we look to the miners.

In my last paper, I estimated that miners stake around 30% of their $DCR.

Despite coin price at local lows, miners are not easing off the pressure.

They are maintaining hashrate ~20% from ATH giving an equilibrium to bull read on Miner Pulse

In my last paper, I estimated that miners stake around 30% of their $DCR.

Despite coin price at local lows, miners are not easing off the pressure.

They are maintaining hashrate ~20% from ATH giving an equilibrium to bull read on Miner Pulse

7/ What I have always loved about on-chain analysis is the way it bakes human psychology into an immutable public ledger.

Each decision, hash, ticket and transaction is expensive and unforgeable.

The data tells me what I need to know.

I believe stakeholders are getting ready.

Each decision, hash, ticket and transaction is expensive and unforgeable.

The data tells me what I need to know.

I believe stakeholders are getting ready.

8/8

This is a coming of age story for #Decred

After years of building hyper-secure, world class, resilient and decentralised technology, v1.6 is getting released.

DCRDEX

CoinShuffle++

Lightning Network

Decentralised Treasury

Look around.

We need all of it.

#DCRisready.

This is a coming of age story for #Decred

After years of building hyper-secure, world class, resilient and decentralised technology, v1.6 is getting released.

DCRDEX

CoinShuffle++

Lightning Network

Decentralised Treasury

Look around.

We need all of it.

#DCRisready.

• • •

Missing some Tweet in this thread? You can try to

force a refresh