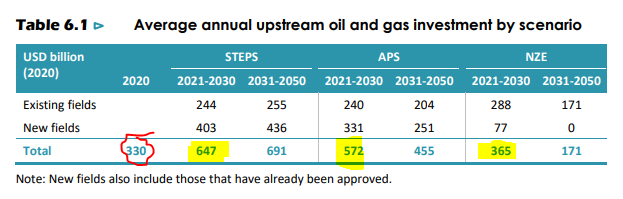

My favorite commodity index has hit an **all-time high**. This is the CRB / BLS US spot raw industrials index, a measure of some really old fashioned commodities. If you are on @TheTerminal, the ticker is CRB RIND Index [GO]. If you want to know more, see the nerd thread 🤓🧵 1/6

The CRB / BLS US spot raw industrials index excludes energy and foodstuff, and focuses on, well, yes, industrial stuff. Its current 13 components are: burlap, print cloth, tin, copper scrap, rosin, wool, cotton, rubber, zinc, hides, steel scrap, lead scrap, and tallow 2/6

It is the oldest of all indices measuring commodities prices. It tracks its origins to Jan 1934, when the U.S. Department of the Treasury asked the Bureau of Labor Statistics (BLS) to prepare a commodity price index. The data was released publicly first in 1940 3/6

Since then, the index has seen several iterations (and it's no longer published by the US gov), including large re-calculations in 1952 and again in 1962. The current version goes back to May 1981. You can read the methodology and components here: barchart.com/cmdty/media/pd… 4/6

The index retains a 'je ne sais quoi' from the old commodity days. If not, look at the specifications of one of its components. Hides: "Cow, light native, packer 30/53 lbs., fleshed, packer to tanner, dealer, or exporter per lb., f.o.b. shipping point". Great, isn't it? 5/6

Finally, because most of the index components do not trade on a futures exchange, you can arguably use it as a financial speculation-free measure of commodity markets. After all, how many hedge funds do you know trading burlap, hides and tallow? 6/6

• • •

Missing some Tweet in this thread? You can try to

force a refresh