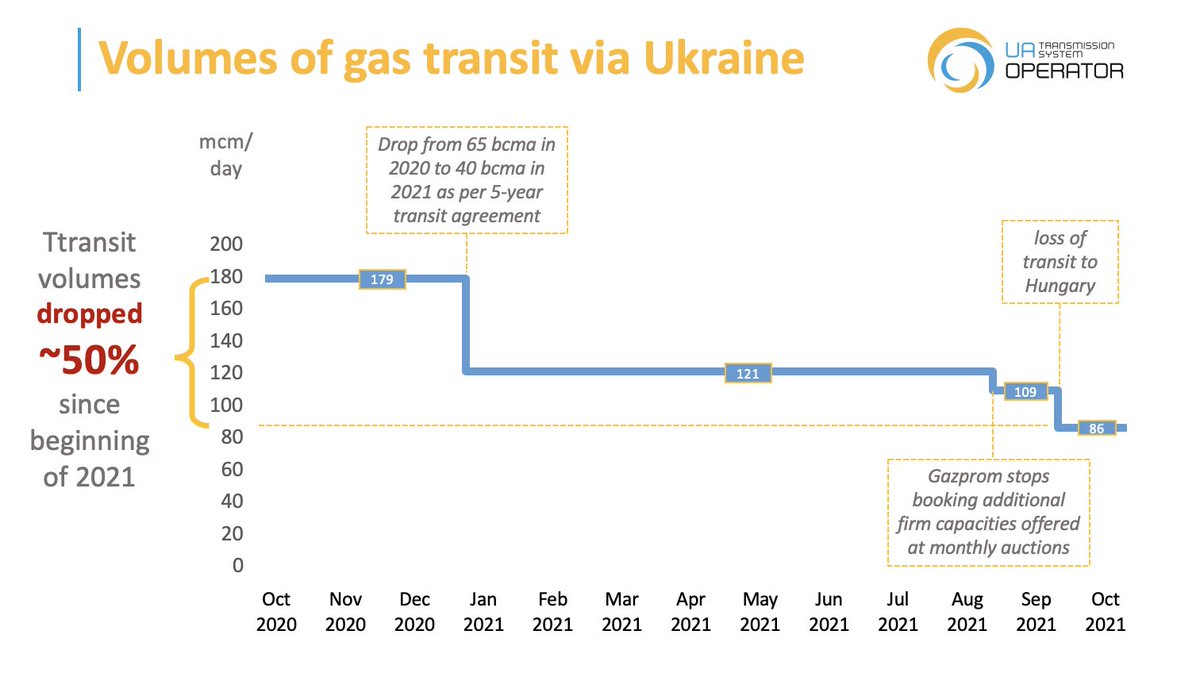

The 5-year contract which was signed in 2019 foresees the transit volumes of 40 bcm in 2021, which amounts to 109 mcm/day.

It is deeply alarming 🚨 and quite informative to note that Gazprom is now paying for capacity and not using it!

It is deeply alarming 🚨 and quite informative to note that Gazprom is now paying for capacity and not using it!

Since the beginning of the month, Gazprom is shipping 86 mcm/day which is ~25% less than what it's paying for. There is a great disconnect between the words and the actions when it comes to the role of the Russian Federation in the European gas crunch.

#EnergyCrisis #GasPrice

#EnergyCrisis #GasPrice

Ukraine stands ready to transport as much gas as Europe needs and our spare capacity, available at this very time, is nearly twice that of #NordStream2

#energyprices #energycrunch

#energyprices #energycrunch

“Despite the significant shortage of gas in the EU and maximum prices 📈, Gazprom does not even use the capacity that has already been paid for"

- Sergiy Makogon via @Reuters

#energycrisis #gasprice #gascrisis #nordstream2

reuters.com/article/russia…

- Sergiy Makogon via @Reuters

#energycrisis #gasprice #gascrisis #nordstream2

reuters.com/article/russia…

• • •

Missing some Tweet in this thread? You can try to

force a refresh