The IHS Markit/CIPS flash UK #PMI rose from 54.9 in Sep to 56.8 in Oct, indicating the fastest expansion of the economy since July.

That's above the pre-pandemic survey average of 54.0 and indicative of roughly 0.7% q/q #GDP growth.

bit.ly/3m3apw0

That's above the pre-pandemic survey average of 54.0 and indicative of roughly 0.7% q/q #GDP growth.

bit.ly/3m3apw0

UK growth is looking increasingly lop-sided, however, with the upturn led by the services sector, and consumer-facing and hospitality firms in particular driving the expansion for a third month running. In contrast, manufacturing saw production growth slide to near-stagnation.

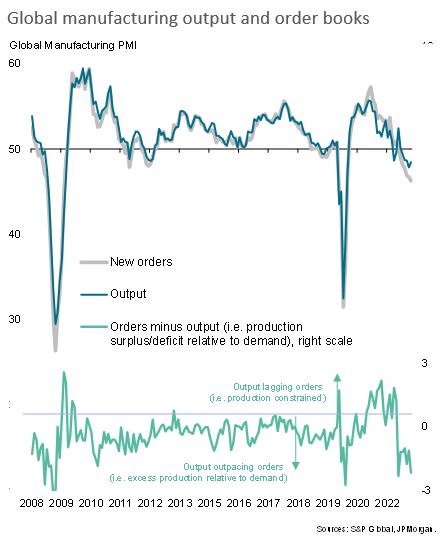

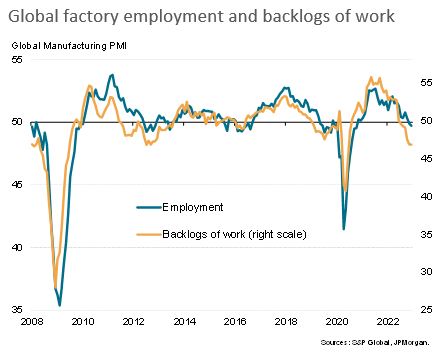

While the service sector continued to benefit from the opening up of the economy, factories have been besieged by a further worsening of supply chain delays and ongoing staffing issues, as well as falling exports and what appears to have been diversion of spend toward services.

Drilling down into the reasons provided by those manufacturers who reported a fall in production during October, some 43% reported that output had been hit by shortages of components or supply chain delays.

These shortages were highlighted by the UK survey’s suppliers’ delivery times index falling further in October, indicating the greatest lengthening of supply lines since the initial global factory closures seen at the start of the pandemic.

A further 15% of respondents reported that output had fallen due to staff shortages – linked either to illness, COVID-19 confinement or staff leaving.

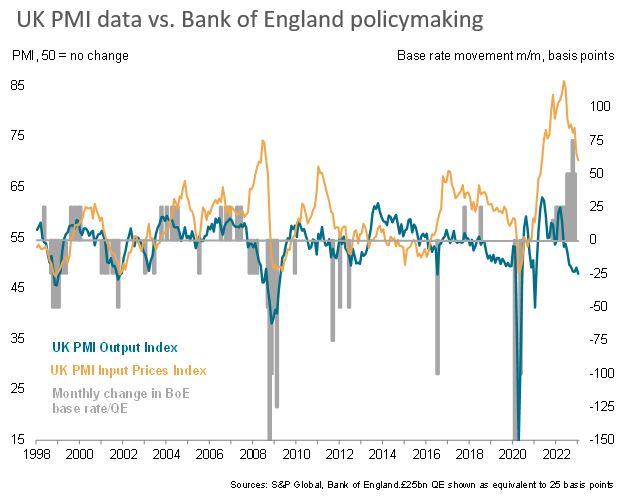

Costs consequently rose further in October. The latest increase in costs was the largest since comparable data were first available in January 1998. Survey respondents often cited rising fuel, transport and energy bills, alongside steep price increases for items in short supply.

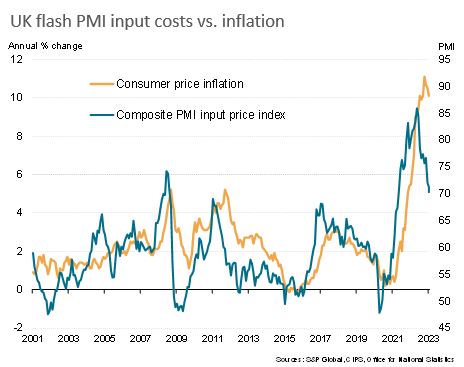

These higher costs will inevitably feed through into higher consumer prices. Have moderated to 3.1% in September, consumer price inflation looks set to rise markedly as we head towards the end of the year, given that the PMI price gauges tend to lead the official inflation data.

The record readings of the PMI survey’s price gauges will inevitably pour further fuel on inflation worries at the #BOE and add to the case for higher interest rates.

However, the economic growth signals from the PMI remain less convincing from a policy standpoint. The service sector is in something of a sweet spot as the UK has opened up its economy. Some of the growth momentum will therefore fade as this rebound passes.

Moreover, rising COVID-19 case numbers pose a downside risk to growth in the coming months, potentially deterring some services-oriented activity among consumers in particular and potentially leading to the renewed enforcement of health restrictions as winter draws in.

The recovery meanwhile faces headwinds from numerous other angles. It’s becoming increasingly evident that businesses will have to contend with disrupted supply chains and higher logistics costs for some time to come, as well as acute labour shortages and rising wage pressures.

UK households are meanwhile facing rising prices, including elevated energy and fuel costs, as well as impending tax increases and the end of several COVID-19 support measures.

It’s therefore clear that the resilience of the economy will be tested severely in the coming months, which suggests a strong risk that any imminent tightening of policy could quickly need to be reversed.

• • •

Missing some Tweet in this thread? You can try to

force a refresh