𝗖𝗧𝗠 #𝗕𝗧𝗖 𝗢𝗻-𝗖𝗵𝗮𝗶𝗻 𝗠𝗲𝘁𝗿𝗶𝗰 𝗗𝗮𝘀𝗵𝗯𝗼𝗮𝗿𝗱: 𝗪𝗸𝘀 𝟰𝟭 & 𝟰𝟮 '𝟮𝟭

𝗣𝗲𝗮𝗸 𝗜𝗻𝗱𝗶𝗰𝗮𝘁𝗼𝗿𝘀

TLDR: BTC broke its ATH so it isn't in its bear phase as shown repeatedly here.

5 indicators show that BTC is on #CTM Wave 2 & on its way to its cycle peak.

𝗣𝗲𝗮𝗸 𝗜𝗻𝗱𝗶𝗰𝗮𝘁𝗼𝗿𝘀

TLDR: BTC broke its ATH so it isn't in its bear phase as shown repeatedly here.

5 indicators show that BTC is on #CTM Wave 2 & on its way to its cycle peak.

𝟭 𝗕𝘂𝗹𝗹 𝗣𝗵𝗮𝘀𝗲 𝗧𝗼𝗽 & 𝗕𝗲𝗮𝗿 𝗣𝗵𝗮𝘀𝗲 𝗕𝗼𝘁𝘁𝗼𝗺

𝟭𝗮. 𝗧𝗼𝗽 𝗖𝗮𝗽 𝗠𝗼𝗱𝗲𝗹

This model is based on Willy Woo's Top Cap Model for tracking the peak & the bottom tracker is based on #BTC's moving average price.

BTC hasn't peaked yet.

𝟭𝗮. 𝗧𝗼𝗽 𝗖𝗮𝗽 𝗠𝗼𝗱𝗲𝗹

This model is based on Willy Woo's Top Cap Model for tracking the peak & the bottom tracker is based on #BTC's moving average price.

BTC hasn't peaked yet.

𝟭𝗯. 𝗙𝗶𝗯 𝗠𝘂𝗹𝘁𝗶𝗽𝗹𝗶𝗲𝗿𝘀

This model is based on Fib retracement & extension numbers as multiples of the 350D SMA of #BTC's price.

BTC hasn't peaked yet.

This model is based on Fib retracement & extension numbers as multiples of the 350D SMA of #BTC's price.

BTC hasn't peaked yet.

𝟮. 𝟲𝟬-𝗗𝗮𝘆 𝗩𝗼𝗹𝗮𝘁𝗶𝗹𝗶𝘁𝘆: 𝗖𝗼𝘂𝗻𝘁𝗱𝗼𝘄𝗻 𝘀𝘁𝗮𝗿𝘁𝗲𝗱? 𝗡𝗼

When 60D VVOL crosses V2 again, #BTC is expected to peak within 60 days. It is closing in on V1!👀

* Please read 2(i)(a) of pinned tweet about using the 60D VVOL metric for determining BTC cycle tops.

When 60D VVOL crosses V2 again, #BTC is expected to peak within 60 days. It is closing in on V1!👀

* Please read 2(i)(a) of pinned tweet about using the 60D VVOL metric for determining BTC cycle tops.

𝟯. 𝗨𝗦 𝗜𝗻𝘀𝘁𝗶𝘁𝘂𝘁𝗶𝗼𝗻𝗮𝗹 #𝗕𝗧𝗖 𝗣𝘂𝗿𝗰𝗵𝗮𝘀𝗲 𝗣𝗮𝘁𝘁𝗲𝗿𝗻 (>𝟬.𝟬𝟬𝟱𝟯)

𝗡𝗼

* Please read 2(ii)(e) of pinned tweet for details about this metric to determine BTC topping pattern & whether cycle peak is imminent.

𝗡𝗼

* Please read 2(ii)(e) of pinned tweet for details about this metric to determine BTC topping pattern & whether cycle peak is imminent.

𝟰𝗮. 𝗠𝗩𝗥𝗩-𝗭 𝗦𝗰𝗼𝗿𝗲 (>𝟳.𝟱): 𝗡𝗼

10/16: 2.6*

10/23: 2.4*

*This is similar to that when #BTC was on #CTM Wave 2 of the 2013 bull phase.

This metric went up to 3 on 10/20/21 coinciding when BTC broke its ATH. There is no question that BTC isn't in a bear phase.

10/16: 2.6*

10/23: 2.4*

*This is similar to that when #BTC was on #CTM Wave 2 of the 2013 bull phase.

This metric went up to 3 on 10/20/21 coinciding when BTC broke its ATH. There is no question that BTC isn't in a bear phase.

𝟰𝗯. 𝗠𝗩𝗥𝗩-𝗭 𝗦𝗰𝗼𝗿𝗲 (𝟯𝟬-𝗗𝗮𝘆 𝗠𝗔) (𝗪𝗮𝘃𝗲 𝟱): 𝗬𝗲𝘀

This corresponds to that when #BTC is on #CTM Wave 2.

* BTC is on its way to its cycle peak.

This corresponds to that when #BTC is on #CTM Wave 2.

* BTC is on its way to its cycle peak.

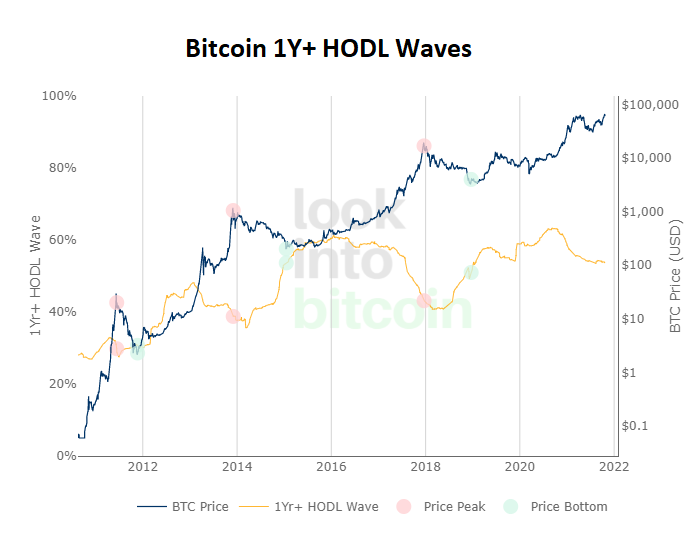

𝟲𝗮. 𝗥𝗲𝘀𝗲𝗿𝘃𝗲 𝗥𝗶𝘀𝗸 (>𝟬.𝟬𝟮): 𝗡𝗼

10/16 & 10/23: 0.005*

The chart pattern is similar to that when #BTC was on #CTM Wave 2 of the 2013 bull phase.

10/16 & 10/23: 0.005*

The chart pattern is similar to that when #BTC was on #CTM Wave 2 of the 2013 bull phase.

𝟲𝗯. 𝗥𝗲𝘀𝗲𝗿𝘃𝗲 𝗥𝗶𝘀𝗸 (𝟯𝟬-𝗗𝗮𝘆 𝗠𝗔) (𝗪𝗮𝘃𝗲 𝟱): 𝗬𝗲𝘀

This corresponds to that when #BTC is on #CTM Wave 2.

* BTC is on its way to its cycle peak.

This corresponds to that when #BTC is on #CTM Wave 2.

* BTC is on its way to its cycle peak.

𝟳. 𝗥𝗲𝗮𝗹𝗶𝘇𝗲𝗱 𝗛𝗢𝗗𝗟 𝗥𝗮𝘁𝗶𝗼 (𝗥𝗛𝗥) (>𝟰𝟬𝗞): 𝗡𝗼

10/16: 11185*

10/23: 13605*

* RHR is similar to that when #BTC was on #CTM Wave 2 of the 2013 & 2017 bull phases.

The chart pattern is similar to that in 2013.

10/16: 11185*

10/23: 13605*

* RHR is similar to that when #BTC was on #CTM Wave 2 of the 2013 & 2017 bull phases.

The chart pattern is similar to that in 2013.

𝟴. 𝗥𝗲𝗮𝗹𝗶𝘇𝗲𝗱 𝗖𝗮𝗽 𝗛𝗢𝗗𝗟 𝗪𝗮𝘃𝗲𝘀 (𝟯𝗿𝗱 𝗪𝗮𝘃𝗲):

𝗪𝗮𝘃𝗲 𝟭

* It looks like RC HODL Waves has entered Wave 2 of the 3-Wave pattern & this will be accompanied by the next leg up in #BTC's bull phase.

𝗪𝗮𝘃𝗲 𝟭

* It looks like RC HODL Waves has entered Wave 2 of the 3-Wave pattern & this will be accompanied by the next leg up in #BTC's bull phase.

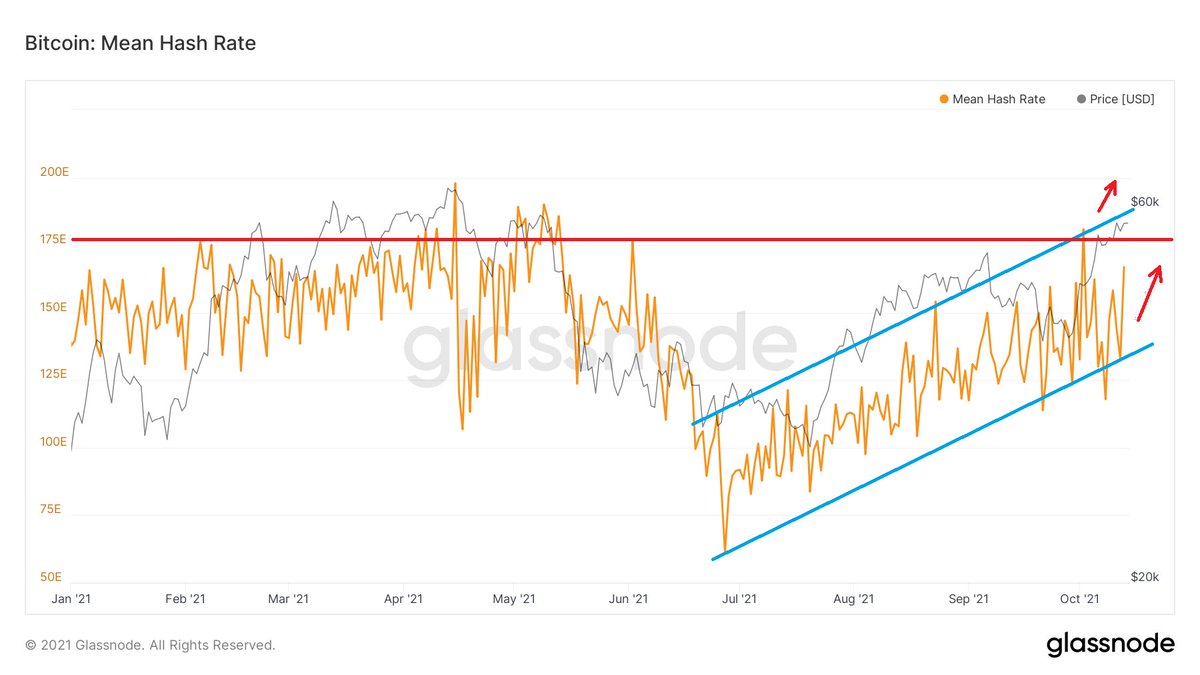

𝟵𝗯. 𝗣𝘂𝗲𝗹𝗹 𝗠𝘂𝗹𝘁𝗶𝗽𝗹𝗲 (𝟯𝟬-𝗗𝗮𝘆 𝗠𝗔) (𝗪𝗮𝘃𝗲 𝟱): 𝗬𝗲𝘀

This corresponds to that when #BTC is on #CTM Wave 2.

* BTC is on its way to its cycle peak.

This corresponds to that when #BTC is on #CTM Wave 2.

* BTC is on its way to its cycle peak.

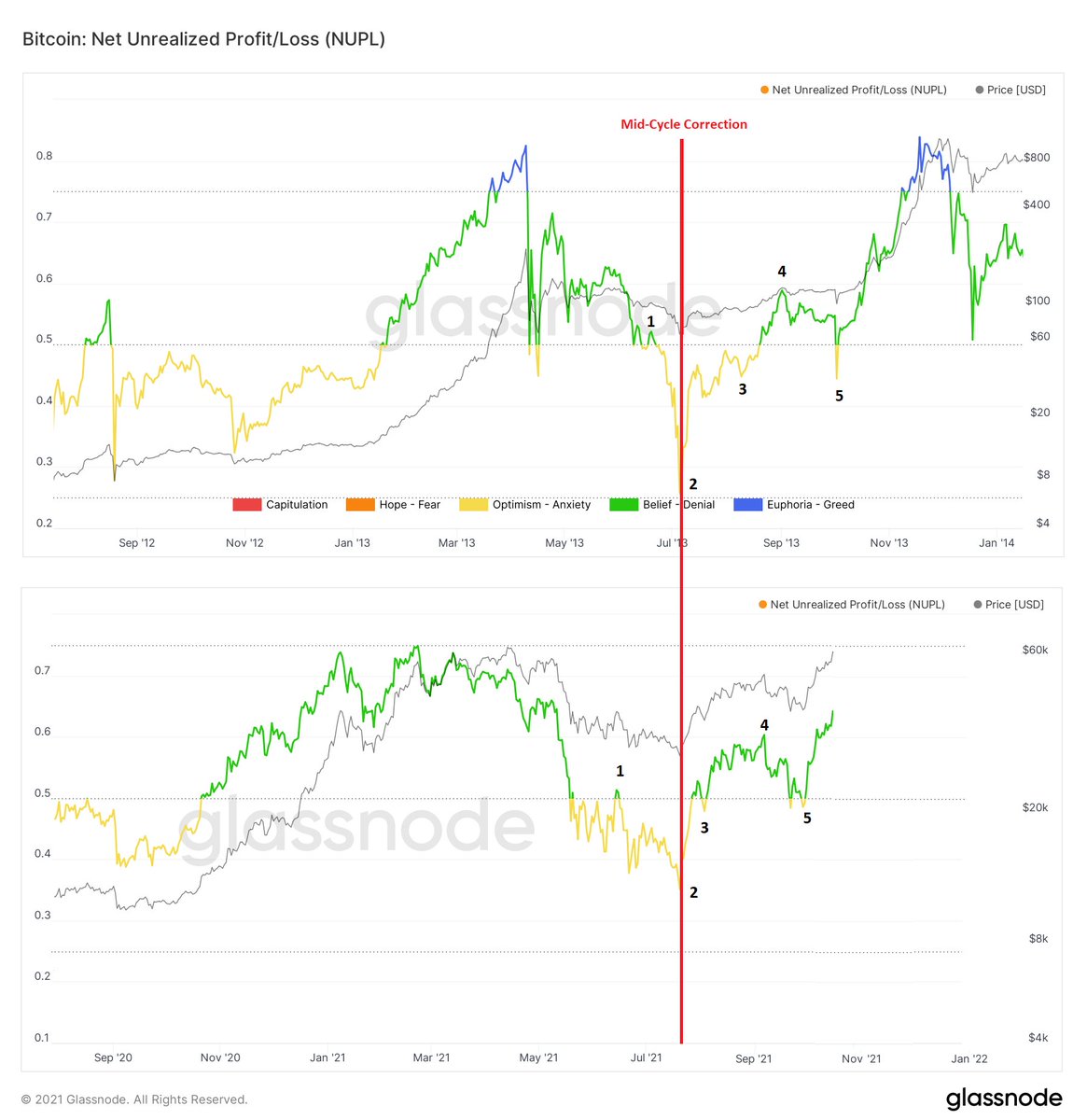

𝟭𝟬. 𝗡𝗨𝗣𝗟 (𝗕𝗹𝘂𝗲): 𝗡𝗼 𝗘𝘂𝗽𝗵𝗼𝗿𝗶𝗮

10/16: 0.64 (Green)*

10/23: 0.63 (Green)*

* This is similar to that when #BTC was on #CTM Wave 2 of the 2013 & 2017 bull phases.

The chart pattern is similar to that in 2013.

10/16: 0.64 (Green)*

10/23: 0.63 (Green)*

* This is similar to that when #BTC was on #CTM Wave 2 of the 2013 & 2017 bull phases.

The chart pattern is similar to that in 2013.

• • •

Missing some Tweet in this thread? You can try to

force a refresh