Thread: The #BuildBackBetter framework would extend for 1 year the Rescue Plan expansions of the #ChildTaxCredit & EITC for adults not raising children & do important work but for low wages

Plus: it makes the driver of the child poverty reduction–“full refundability”– permanent!

Plus: it makes the driver of the child poverty reduction–“full refundability”– permanent!

The framework extends for one year the Rescue Plan’s full #ChildTaxCredit expansion: $3,600 for young children and $3,000 for 6-17 year-olds.

It makes the key feature for cutting child #poverty -- “full refundability” – PERMANENT. This means that the full credit will permanently go to children in families with low or no income.

The expansion of the #ChildTaxCredit is working: 9 in 10 families with low incomes are spending their #ChildTaxCredit on food, housing, utilities, clothing, & education, & more families have enough to eat. @c_zippel explains: cbpp.org/blog/9-in-10-f…

The expansion will benefit roughly 9 in 10 children across the country. See Appendix Table 1 here for state-by-state #s: cbpp.org/research/feder…

It will also restore eligibility for the #ChildTaxCredit to children who aren’t eligible for a SSN because of their immigration status but may be claimed as tax dependents by using an ITIN, which would give children with ITINs access to the same credit as other children.

Let’s dig in more on why making full refundability permanent is so important.

Prior to the Rescue Plan expansion, 27 million children received less than the full #ChildTaxCredit or no credit at all because their parents earned too little.

Prior to the Rescue Plan expansion, 27 million children received less than the full #ChildTaxCredit or no credit at all because their parents earned too little.

The #BuildBackBetter bill ensures that all of these children will permanently receive the same amount as children in families with higher income.

Permanent full refundability of the #ChildTaxCredit is a step forward for racial equity. Before the Rescue Plan, roughly half of Black & Latino children did not receive the full credit or received no credit at all because their parents made too little. Now they will

Permanent full refundability of the #ChildTaxCredit is also a victory for families who live in rural areas –prior to the Rescue Plan, half of these children received less than the full amount or no credit at all because their parents earned too little.

The Rescue Plan’s full expansion of the #ChildTaxCredit – which #BuildBackBetter extends for one year – is expected to cut child #poverty by more than 40% compared to child poverty in the absence of the expansion.

Full refundability is the major driver of this reduction in child #poverty – it drives 87% of the reduction in child poverty flowing from the full extended Rescue Act expansion:

Congress still needs to make the entire #ChildTaxCredit expansion permanent, including the larger credit amount. But child poverty would still fall ~20% with permanent full refundability with a credit of $2,000, as compared to child poverty under the pre-Rescue Plan policy.

Here is our paper on why permanent full refundability is a potential game-changer for millions of children: cbpp.org/research/feder…

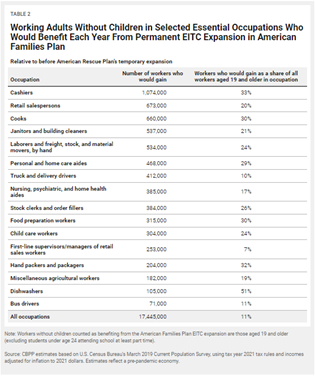

While the #ChildTaxCredit expansion understandably has garnered much excitement, note that the #BuildBackBetter framework also extends the expansion of the EITC, which boosts the incomes of +17 million adults not raising children & who work at important jobs but for little pay.

The #EITC expansion will reach 5.8 million adults who previously were actually being taxed into, or deeper into, #poverty in part because their payroll taxes and income taxes exceeded their paltry EITCs.

For one more year, the maximum #EITC will rise from roughly $540 under the pre-Rescue Plan EITC to roughly $1,500 with the income limit to qualify rising from about $16,000 to at least $21,000.

The #EITC expansion also extends the age range of workers without children eligible for the tax credit to include younger adults aged 19-24 (excluding students under 24 who are attending school at least part time), as well as people 65 and over.

While Congress will need to return to make these critical expansions in the full #ChildTaxCredit & #EITC permanent – they will be extended for next year and, of critical importance, the driver of the reduction in child #poverty, “full refundability,” will become permanent law.

• • •

Missing some Tweet in this thread? You can try to

force a refresh