As usual this week's summary had basic road map for

Cryptos

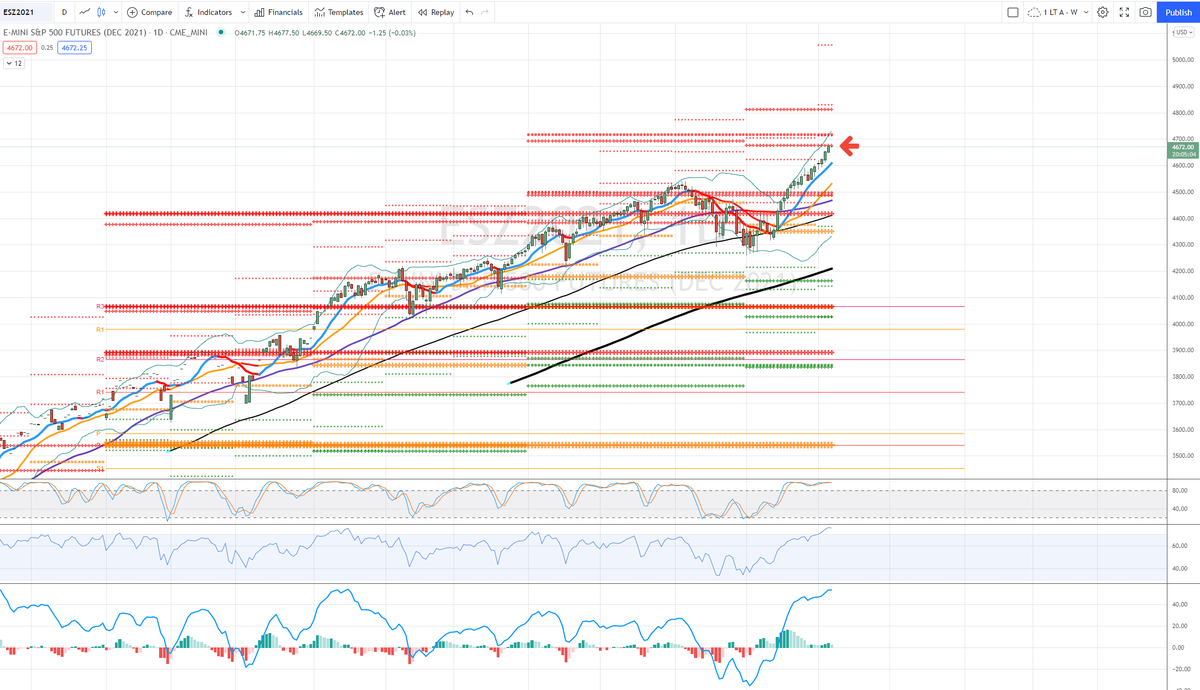

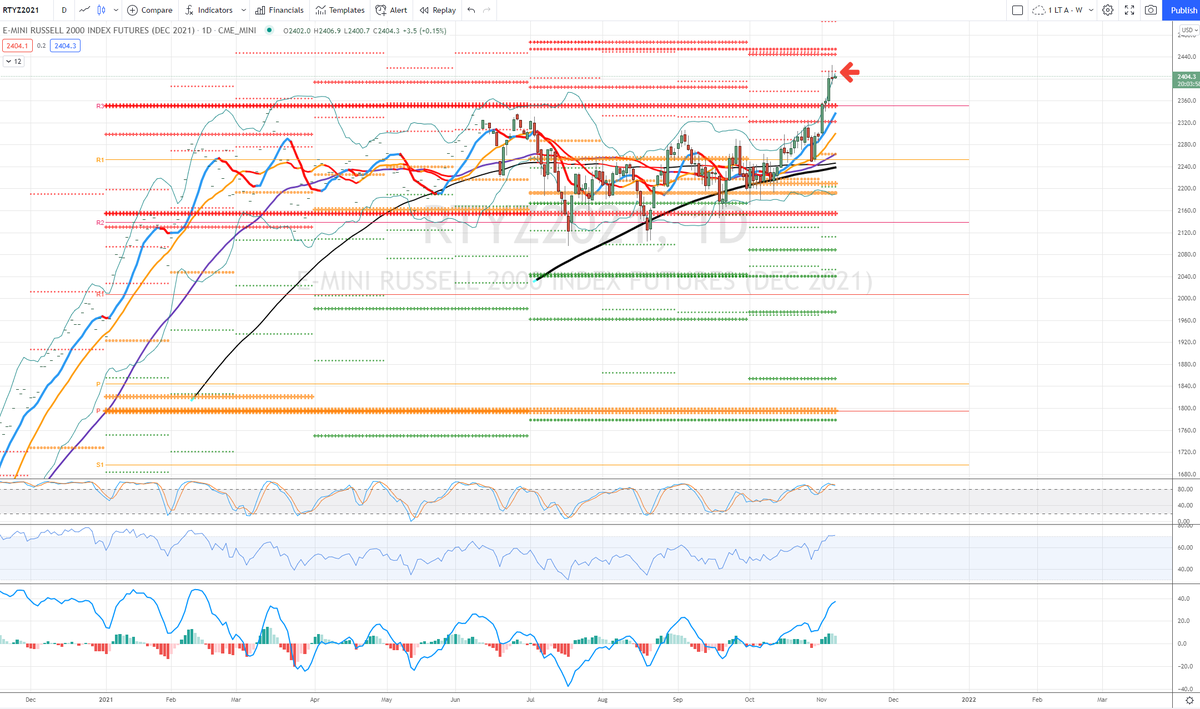

Indexes

Also mentioned commodities this time, don't always

And safe havens VIX TLT DXY GLD I combine but don't expect them all to move together

Cryptos

Indexes

Also mentioned commodities this time, don't always

And safe havens VIX TLT DXY GLD I combine but don't expect them all to move together

https://twitter.com/MarsiliosMM/status/1454882037257551875

And higher in that thread, was a few tweets about the FOMC, summed to

"means more push up on indexes and & prefer cryptos back to highs

Yes, even if taper announced - an expectation thing, because 120B per month adjusted to 105B or whatever... is still going UP"

"means more push up on indexes and & prefer cryptos back to highs

Yes, even if taper announced - an expectation thing, because 120B per month adjusted to 105B or whatever... is still going UP"

Literally everything

What I wrote for all of this has happened

What I wrote for all of this has happened

Safe-havens are helping confirm that risk-trades under pressure now with -

VIX 11/3-4 low, 11/3 probably the close low

TLT 11/3 pullback low

DXY 11/2-3 with close test 11/4 today up pretty strong, pressuring cryptos

GLD 11/3 low up today despite DXY which is some tell

VIX 11/3-4 low, 11/3 probably the close low

TLT 11/3 pullback low

DXY 11/2-3 with close test 11/4 today up pretty strong, pressuring cryptos

GLD 11/3 low up today despite DXY which is some tell

Marko Kolanovic (head quant JPM) cannot do this in his dreams with 100 quants and I'm doing it for many if not most weeks!!

• • •

Missing some Tweet in this thread? You can try to

force a refresh