Just touched down in Savannah, GA for the @NEI International #Uranium Fuel Seminar, the #nuclear industry’s first in person conference in almost two years. Should be an interesting few days… stay tuned for updates!

Pretty direct messaging from Kazatomprom $KAP to kick things off. Major focus on security of supply and the need for committed long term contracts to drive #uranium production decisions.

$CCJ follows with a similar theme - where are the pounds going to come from? Talking about long term market health, incentive structures, risk adjusting future supply assumptions and issues with prod cost comparisons. Know @FootnotesFirst is going to like the title…

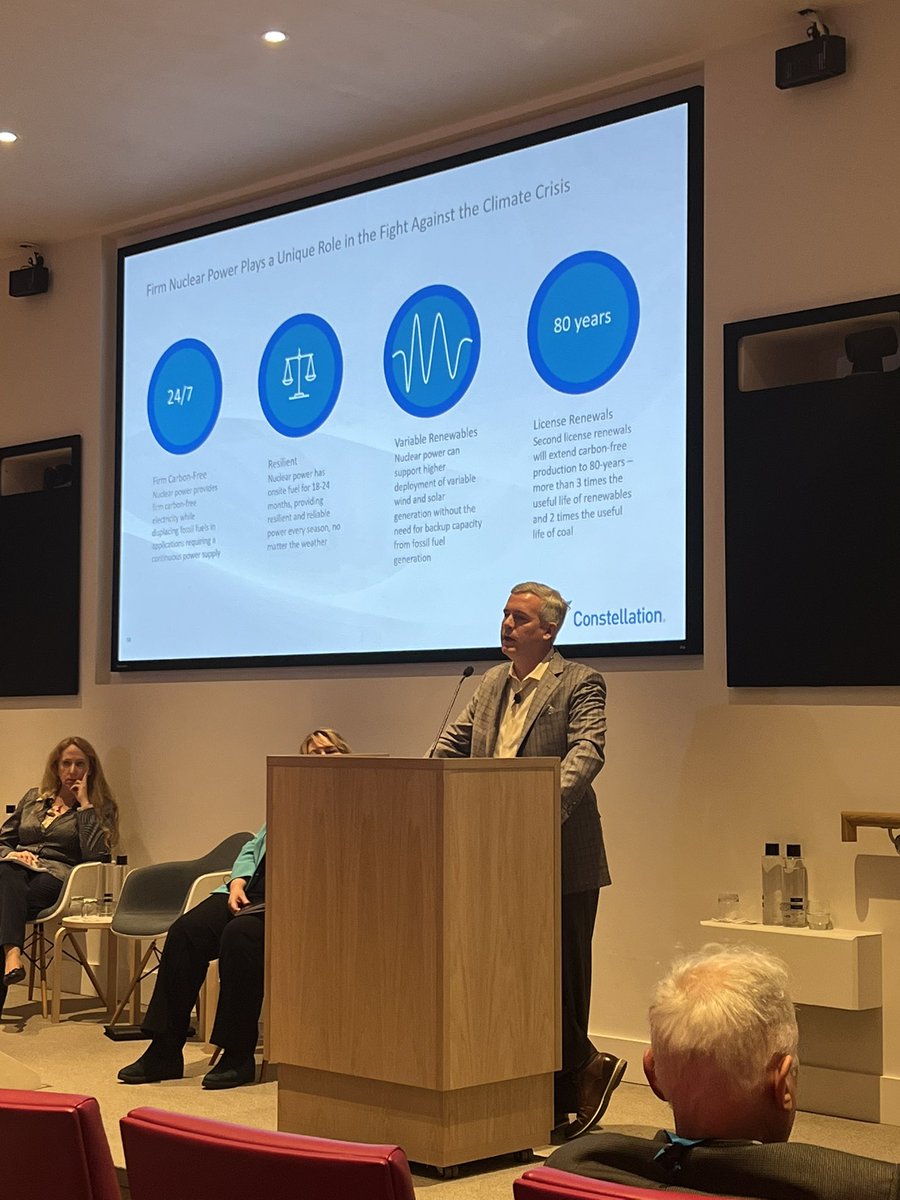

@Bruce_Power discussing #ESG from the utility perspective- their 2027 net zero target is one of the most aggressive in the industry. Why is this possible? #nuclear as the backbone of their clean energy portfolio. Clearly a major focus for their supply chain going forward as well.

Jonathan Hinze from @UxC_Nuclear opens today’s Market and Price Dynamics session emphasizing investor interest and reminding the room that we’ve actually been in a bull market for 5 years! Trading/liquidity in spot is changing how prices are reported, increasing mkt transparency.

@BillFreebairn of @SPGlobalPlatts up next talking about their approach to #uranium px reporting with an emphasis on transparency and process (including auditing & documentation of px reports). Their “heards” feature is cool - you should check it out!

Packed room for Per Jander from WMC / @Sprott explaining #SPUT to the industry. Discussed the fund’s funding mechanism, investor interest, and longer term goals. “Sprott’s only goal is to grow the vehicle. NYSE filing will happen before the end of Jan. We will not sell material.”

Fletcher Newton from Tenex asking the panel about social media’s impact on the market - Bill responding that we’ll see a growing link between social media / investor interest and the physical market and no one knows how this is going to develop.

That’s a wrap folks. Learned a lot as always and great to connect with the industry in person. Thank you @NEI and @NAshkeboussi for putting on a great event.

• • •

Missing some Tweet in this thread? You can try to

force a refresh