A compilation of all my Important #Threads & #screeners !👇

Spread the word, if you find this helpful for investors!

@Vivek_Investor @Atulsingh_asan @abhymurarka @nid_rockz

👇👇👇

Spread the word, if you find this helpful for investors!

@Vivek_Investor @Atulsingh_asan @abhymurarka @nid_rockz

👇👇👇

1)

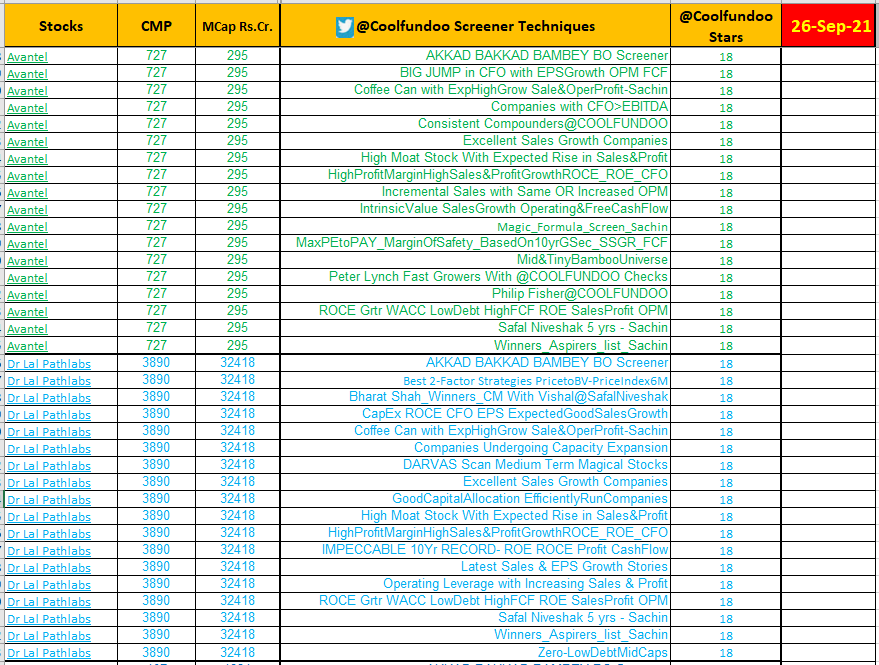

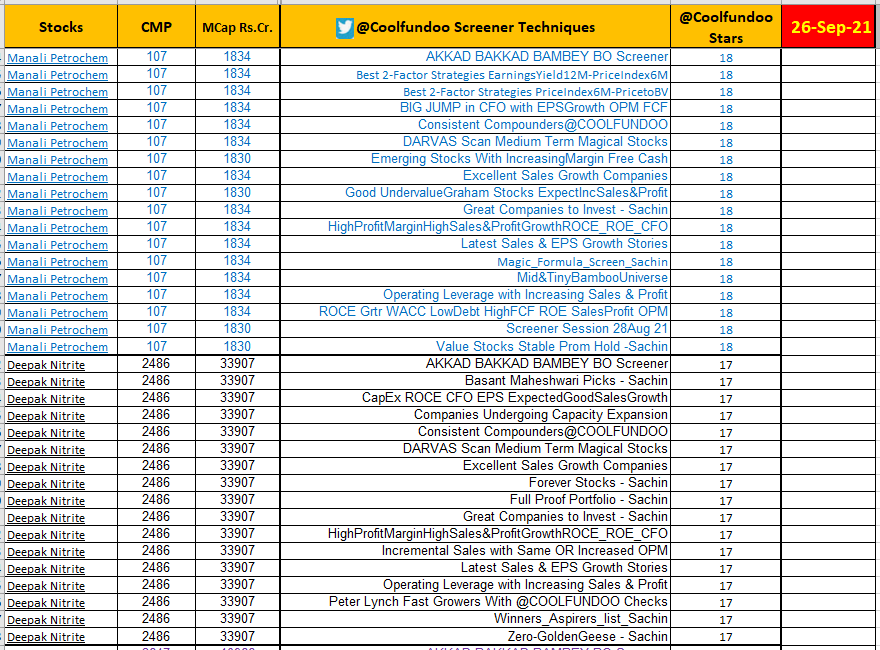

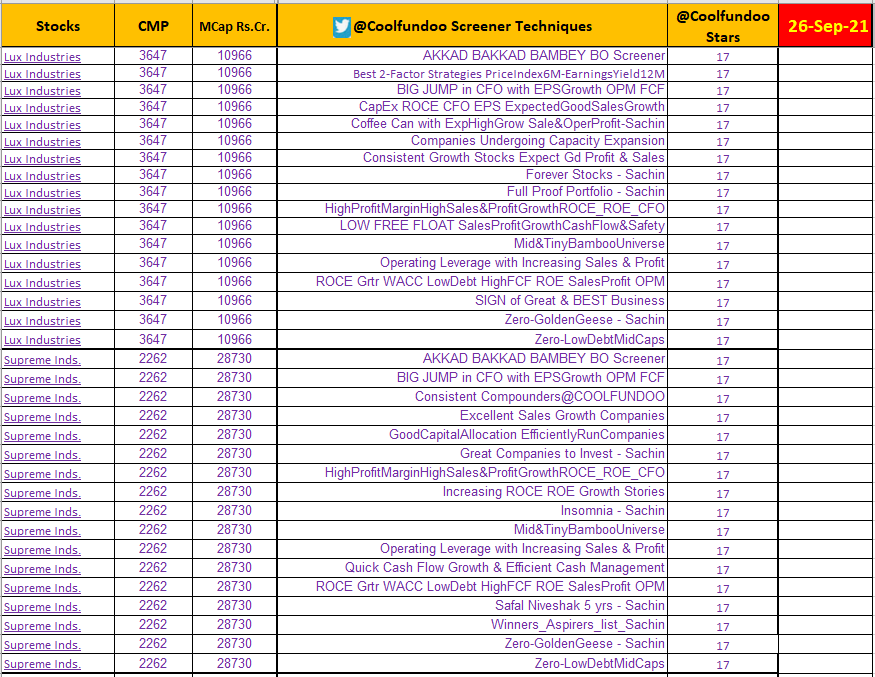

All my Top #Screeners with latest Updates !

🔗

docs.google.com/document/d/1a2…

Bookmark it, would be updating it regularly.

👍 &🔄

@Vivek_Investor

All my Top #Screeners with latest Updates !

🔗

docs.google.com/document/d/1a2…

Bookmark it, would be updating it regularly.

👍 &🔄

@Vivek_Investor

3)

🌟India & US Stocks Top Holdings

🌟Screening Technique Based Hypothetical Portfolio

🔗

docs.google.com/document/d/1lB…

🌟India & US Stocks Top Holdings

🌟Screening Technique Based Hypothetical Portfolio

🔗

docs.google.com/document/d/1lB…

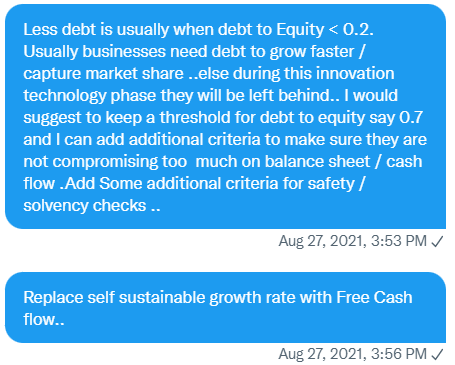

6)

Can a Leveraged Company be Investable?

Can a Leveraged Company be Investable?

https://twitter.com/Coolfundoo/status/1302101910841942016?s=20

7)

#Thread Negative Working Capital & Mulford’s Free Cash Profile (not Free Cash Flow)

#Thread Negative Working Capital & Mulford’s Free Cash Profile (not Free Cash Flow)

https://twitter.com/Coolfundoo/status/1326722411128090627?s=20

8)

Mood to explore interesting/random things to study or just update knowledgebase.

Search on Twitter🔎

@Coolfundoo Q&A

@Coolfundoo #AskCoolfundoo #Session

Mood to explore interesting/random things to study or just update knowledgebase.

Search on Twitter🔎

@Coolfundoo Q&A

@Coolfundoo #AskCoolfundoo #Session

9)

Looking for some Challenging #screening task ⁉️

Search on Twitter 🔎

@Coolfundoo screener challenge

Looking for some Challenging #screening task ⁉️

Search on Twitter 🔎

@Coolfundoo screener challenge

10)

Stressed ⁉️ Bored ⁉️ or just looking for some +ive vibes

Search on Twitter 🔎

@Coolfundoo #Stressbuster

@Coolfundoo #SweetMemories

@Vivek_Investor

Stressed ⁉️ Bored ⁉️ or just looking for some +ive vibes

Search on Twitter 🔎

@Coolfundoo #Stressbuster

@Coolfundoo #SweetMemories

@Vivek_Investor

11)

Happy Diwali Stock Picks 2019-20 & Performance Update

Happy Diwali Stock Picks 2019-20 & Performance Update

https://twitter.com/Coolfundoo/status/1321312482561003521?s=20

12)

Choti Diwali (2020-21) Performance Update !

Choti Diwali (2020-21) Performance Update !

https://twitter.com/Coolfundoo/status/1459702875953631232?s=20

13)

Happy Diwali 2020-21 Stocks Performance Update !!

Happy Diwali 2020-21 Stocks Performance Update !!

https://twitter.com/Coolfundoo/status/1459717715787227142?s=20

14)

Wisdom Series #1

NEW INVESTORS(<2 yrs) !

Wisdom Series #1

NEW INVESTORS(<2 yrs) !

https://twitter.com/Coolfundoo/status/1275224879323906048?s=20

15)

Wisdom Series #2

HOW LOW Debt/Equity could DECEIVE You ?

Wisdom Series #2

HOW LOW Debt/Equity could DECEIVE You ?

https://twitter.com/Coolfundoo/status/1294498610416168960?s=20

16)

Attempted to #Transform & automate @drvijaymalik Final Buying Checklist via @screener_in

🔗

Attempted to #Transform & automate @drvijaymalik Final Buying Checklist via @screener_in

🔗

https://twitter.com/Coolfundoo/status/1279699209340571648?s=20

18) Ideal Portfolio for long term

https://twitter.com/Coolfundoo/status/1332359395557187585?t=hxF7LC1KV1Uju8Eh27C93Q&s=19

19) My @screener_in story.

Got active on Twitter ~May20. Before that was living in my own world. Developed my own process for stock investment & followed it. Still do.

Here are the Challenges I faced & how I Resolved them 👇👇

Got active on Twitter ~May20. Before that was living in my own world. Developed my own process for stock investment & followed it. Still do.

Here are the Challenges I faced & how I Resolved them 👇👇

https://twitter.com/Coolfundoo/status/1367907511769169927?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh