We have been taking weekly #Nifty #Options trade every week.

In this learning thread would be about:

#Positional 𝙊𝙥𝙩𝙞𝙤𝙣 𝙒𝙧𝙞𝙩𝙞𝙣𝙜 #𝙎𝙩𝙧𝙖𝙩𝙚𝙜𝙮"

Like❤️ & Retweet🔁for wider reach and for more learning thread in the future.

1/12

In this learning thread would be about:

#Positional 𝙊𝙥𝙩𝙞𝙤𝙣 𝙒𝙧𝙞𝙩𝙞𝙣𝙜 #𝙎𝙩𝙧𝙖𝙩𝙚𝙜𝙮"

Like❤️ & Retweet🔁for wider reach and for more learning thread in the future.

1/12

Let's start with the strategy now. This strategy is similar to "𝗜𝗿𝗼𝗻 𝗖𝗼𝗻𝗱𝗼𝗿". This the simplest strategy that I follow and sharing with others too. Rules are also easy to follow.

We are trading this using technical charts and price action.

2/12

We are trading this using technical charts and price action.

2/12

Setup:

1. Open #Nifty chart on Thursday at 3pm.

2. Find out nearest support and resistance for Nifty on daily time frame.

3. Round off Resistance and Support.

4. Short Call options with strike equal to resistance

5. Short Put options with strike equal to support.

3/12

1. Open #Nifty chart on Thursday at 3pm.

2. Find out nearest support and resistance for Nifty on daily time frame.

3. Round off Resistance and Support.

4. Short Call options with strike equal to resistance

5. Short Put options with strike equal to support.

3/12

6. Always hedge your short option position. Don't keep it naked if you are not a full-time trader.

7. Buy 200 points away call options on upside and 200 points away put options on downside.

8. Reason to hedge is to mitigate unlimited risk on short position.

4/12

7. Buy 200 points away call options on upside and 200 points away put options on downside.

8. Reason to hedge is to mitigate unlimited risk on short position.

4/12

Important is Exit Part.

1. If any of the short options becomes ATM/ITM just before closing (3:25pm) then exit all the position.

2. If the above situation doesn't occur then hold your position till expiry and let the option expire OTM.

5/12

1. If any of the short options becomes ATM/ITM just before closing (3:25pm) then exit all the position.

2. If the above situation doesn't occur then hold your position till expiry and let the option expire OTM.

5/12

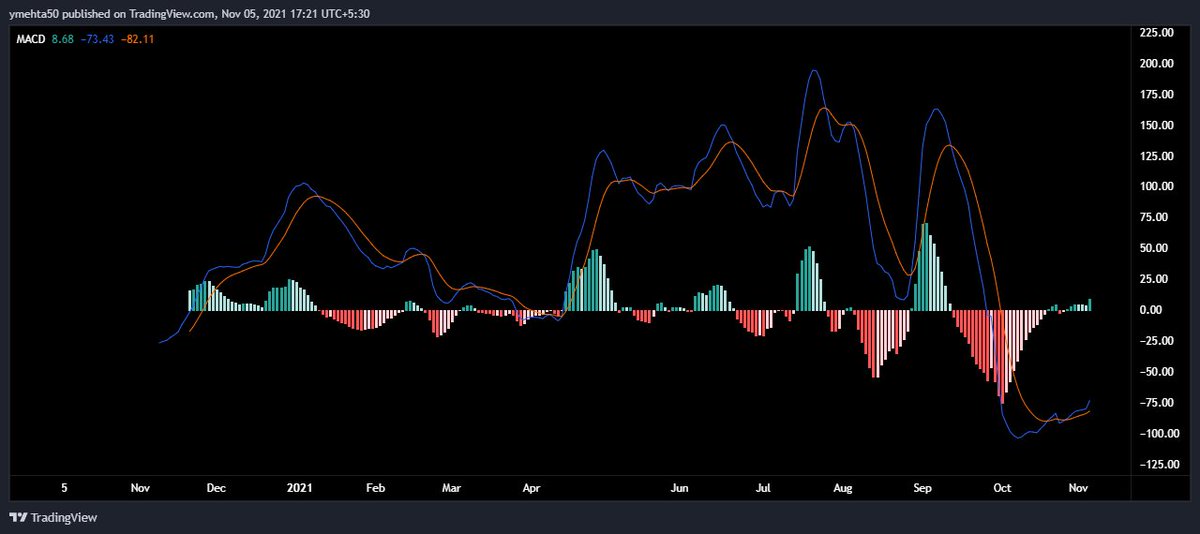

Let's see one example for Nifty. Starting with the technical analysis.

We identified 16000 as resistance and 15400 as support on the basis of chart.

Then we shorted 16000CE and 15400PE. To hedge our position, we bought 16200CE and 15200PE.

6/12

We identified 16000 as resistance and 15400 as support on the basis of chart.

Then we shorted 16000CE and 15400PE. To hedge our position, we bought 16200CE and 15200PE.

6/12

Live trade of the same was shared with everyone on our YouTube Channel👇

And we have booked profit of Rs 2300 per lot for 15th July 2021 Expiry.

7/12

And we have booked profit of Rs 2300 per lot for 15th July 2021 Expiry.

7/12

Sometimes, there would be the case where there is no immediate resistance or support or they are very far. Just maintain an equidistant difference between two legs (call and put) in that case.

8/12

8/12

So far we are following this strategy for six months and we have booked profit of Rs 23k on the margin of Rs 50k. This is 46% returns on the capital deployed.

One can track returns of all the expiry in the Google Sheet👇

tinyurl.com/s39yf2jf

9/12

One can track returns of all the expiry in the Google Sheet👇

tinyurl.com/s39yf2jf

9/12

We have been taking weekly #Nifty options trade every week. The analysis is shared regularly on our YouTube Channel starting from May 2021.

One can check all the videos

tinyurl.com/hnmctaz8

Do like and subscribe if you find this helpful.

10/12

One can check all the videos

tinyurl.com/hnmctaz8

Do like and subscribe if you find this helpful.

10/12

𝗜𝘀 𝘁𝗵𝗶𝘀 𝗮 𝗵𝗼𝗹𝘆 𝗴𝗿𝗮𝗶𝗹 𝘀𝘁𝗿𝗮𝘁𝗲𝗴𝘆?

Answer is 𝗡𝗼.

We have also booked losses in a few weeks but we maintained the consistency and followed all the rules to achieve the result.

For conviction; Backtest this strategy first and then trade.

11/12

Answer is 𝗡𝗼.

We have also booked losses in a few weeks but we maintained the consistency and followed all the rules to achieve the result.

For conviction; Backtest this strategy first and then trade.

11/12

One can ask their queries in the comments so that common doubts get clarified for everyone.

These are not a universal rules. One can tweak or create their own rules.

Only important thing is one must follow a fix rule instead of tweaking or changing setup frequently.

12/12

These are not a universal rules. One can tweak or create their own rules.

Only important thing is one must follow a fix rule instead of tweaking or changing setup frequently.

12/12

• • •

Missing some Tweet in this thread? You can try to

force a refresh