While $BTC is dipping #Metaverse and #PlayToEarn are pumping this week.

Get used to it 🚀🚀🚀

Games have had full-fledged gaming coin economies since before Satoshi dreamed up #Bitcoin.

Get used to it 🚀🚀🚀

Games have had full-fledged gaming coin economies since before Satoshi dreamed up #Bitcoin.

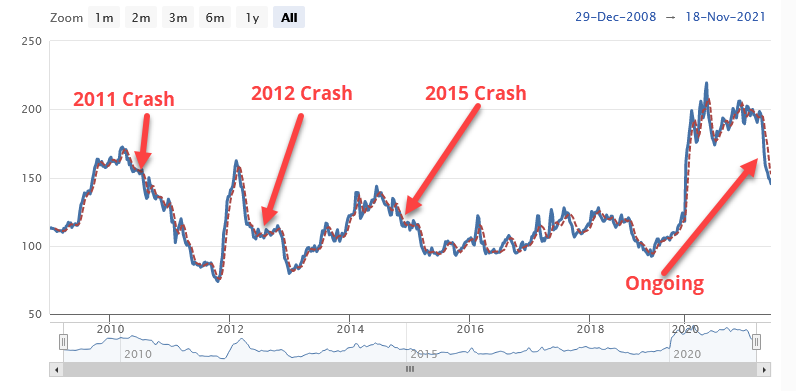

Look at Runescape, the economy is arguably more complex than that of any #GameFi economy to date. It's had several periods of inflation and deflation over Runescape's 20 year lifespan. Chart below tracks from 2008. Source:

runescape.wiki/w/RuneScape:Gr…

runescape.wiki/w/RuneScape:Gr…

Games like CSGO have an economy built around loot boxes and skins. Secondary marketplaces exist, third-party gambling sites, charting and price tracking. Even this market has peaks and troughs, 2021 saw a huge pump precipitated by a reduction in supply, followed by a dump.

I could give you endless examples of games with economies. Path of Exile has a booming black market earning some people hundreds of thousands per year. Which is nothing compared to WoWs black market, where the big players earn millions per year.

From MMOs to shooters many gaming economies are much older and more mature than Bitcoin, let alone new tokens like $AXS.

Game economies are perfectly comfortable operating independently. They don't care about BTC because the players don't care about BTC.

Game economies are perfectly comfortable operating independently. They don't care about BTC because the players don't care about BTC.

Don't get me wrong, though. If BTC crashes 30% today, I believe gaming cryptos would follow. We are not at a stage where they have fully decoupled. Many of the investors in gaming cryptos are not gamers, they are traders.

We might be at that stage soon though.

We might be at that stage soon though.

When you look at a game like Illuvium or Axie, they may crash alongside BTC but I can imagine them recovering a lot quicker. Honestly, I can imagine a BTC crash not having anywhere near the impact on these two games as it would on many other alts.

We are already seeing signs of this over the last few days with #metaverse games rising while BTC dumps.

In the next BTC bear markets, I believe gaming cryptos will be the go-to investment for degens like us. I believe they will decouple from BTC like no sector has before.

In the next BTC bear markets, I believe gaming cryptos will be the go-to investment for degens like us. I believe they will decouple from BTC like no sector has before.

This is just my opinion, not financial advice. Do your own research and figure out what is right for you. Feel free to discuss below but be nice.

• • •

Missing some Tweet in this thread? You can try to

force a refresh