#RangersFC 2020/21 accounts cover a year of “unprecedented challenges” due to COVID, though they won the league for the first time in a decade, staying unbeaten in the process, and reached the quarter-finals of both domestic cup competitions and the last 16 of the Europa League.

#RangersFC pre-tax loss widened from £17.8m to £24.7m (£24.2m after tax), as revenue fell £11.3m (19%) from £59.0m to £47.7m, partly offset by increases in other income, up £1.4m to £3.4m, and profit on player sales, up £1.0m to £1.7m, while expenses were down £2.3m (3%).

#RangersFC revenue decrease was driven by match day, which dropped £17.5m (49%) from £35.7m to £18.2m, though there was growth in broadcasting, which rose £5.3m (39%) from £13.5m to £18.9m, and commercial, up £0.9m (9%) from £9.8m to £10.7m.

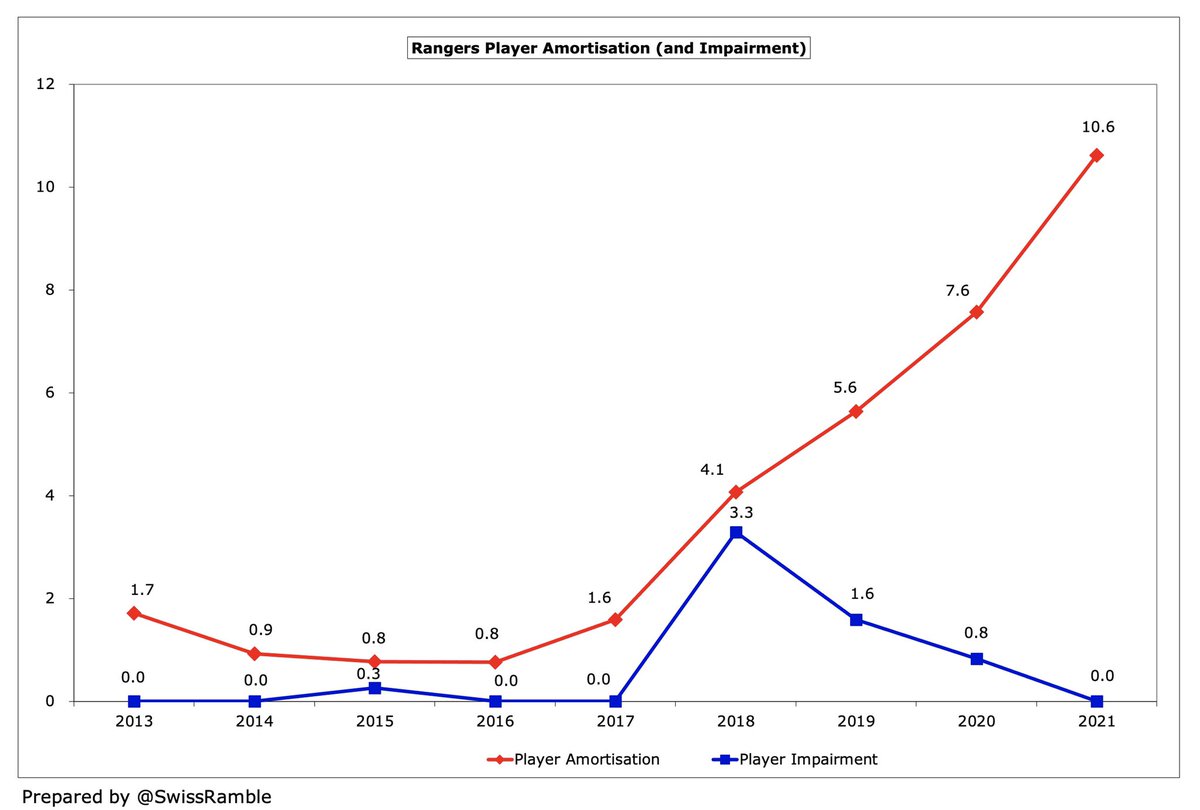

Despite the revenue fall, #RangersFC wage bill increased £4.3m (10%) to £47.7m, while player amortisation also rose £3.0m (40%) to £10.6m. However, other expenses were cut £8.8m (38%) to £14.6m and there was no repeat of previous season’s £0.8m player impairment.

Most Scottish clubs normally aim for break-even, but COVID has meant larger losses than usual. That said, #RangersFC £24.2m post-tax loss is by far the highest in the Premiership, almost twice as much as their great rivals Celtic’s £12.6m, due to their “recovery investment”.

Clearly, the pandemic has had a major effect on financials at all clubs with revenue hugely impacted by playing games behind closed doors. #RangersFC estimate the revenue loss as £20m, while the net impact was £10m, which means their loss would have been “only” £14.7m.

COVID has had a significant adverse impact on football in 2020/21 with many leading clubs in Europe posting huge losses, e.g. Barcelona £422m, Inter £215m, Juventus £184m and Roma £163m, which places #RangersFC £24m loss more into perspective.

#RangersFC results only benefited from £1.7m profit from player sales. Although this was actually more than double prior year’s £0.7m, it was still significantly lower than Celtic £9.4m. The club has evidently made a decision to keep hold of its talent (or saleable assets).

#RangersFC strategy of investing in the squad has had “clear effects on our financial statements”. In fact, they have lost money 8 years in a row, adding up to a hefty £95m in that period. Obviously, the deficits in 2020 and 2021 were exacerbated by the pandemic.

The last time that #RangersFC posted profit was way back in 2013 (and that was only £1.3m), but this was only due to a £20.5m release of negative goodwill. On the other hand, the 2020 loss included a £3.1m provision for the legal dispute with Sports Direct.

#RangersFC have made only £8m from player sales in the last 9 years, which is in stark contrast to Celtic’s £112m in this period. If Rangers were to adopt a similar selling strategy, this would make a big difference to their financials, though obviously weaken the squad.

#RangersFC operating loss (i.e. excluding player sales) has been on a steadily declining trend and further worsened from £15.9m to £23.5m in 2021. This was the highest in Scotland, just above Celtic’s £20.7m, then a large gap to Aberdeen £5.2m. Hearts boosted by £6.4m donations.

#RangersFC EBITDA (Earnings Before Interest, Tax, Depreciation & Amortisation), considered a proxy for cash operating profit, almost doubled from negative £5.7m to £11.2m, though the Board is targeting profitability at this level in 2022.

Despite the fall in 2021, #RangersFC £48m revenue was still two-thirds more than the £29m they generated in their first year back in the Premiership in 2017. If the club were to repeat their pre-COVID match day income in 2022, their revenue would rise to £65m.

#RangersFC have significantly narrowed the revenue gap to Celtic, reducing this from a massive £69m in 2018 to just £13m in 2021 (albeit slightly higher than the £11m in 2020).

Of course, the big two Glasgow clubs generate significantly more revenue than the rest of the Scottish Premiership. Even after the impact of COVID, #RangersFC £48m is still more than four times as much as Aberdeen £11m, followed by Hibernian £9m (2019/20) and Hearts £8m.

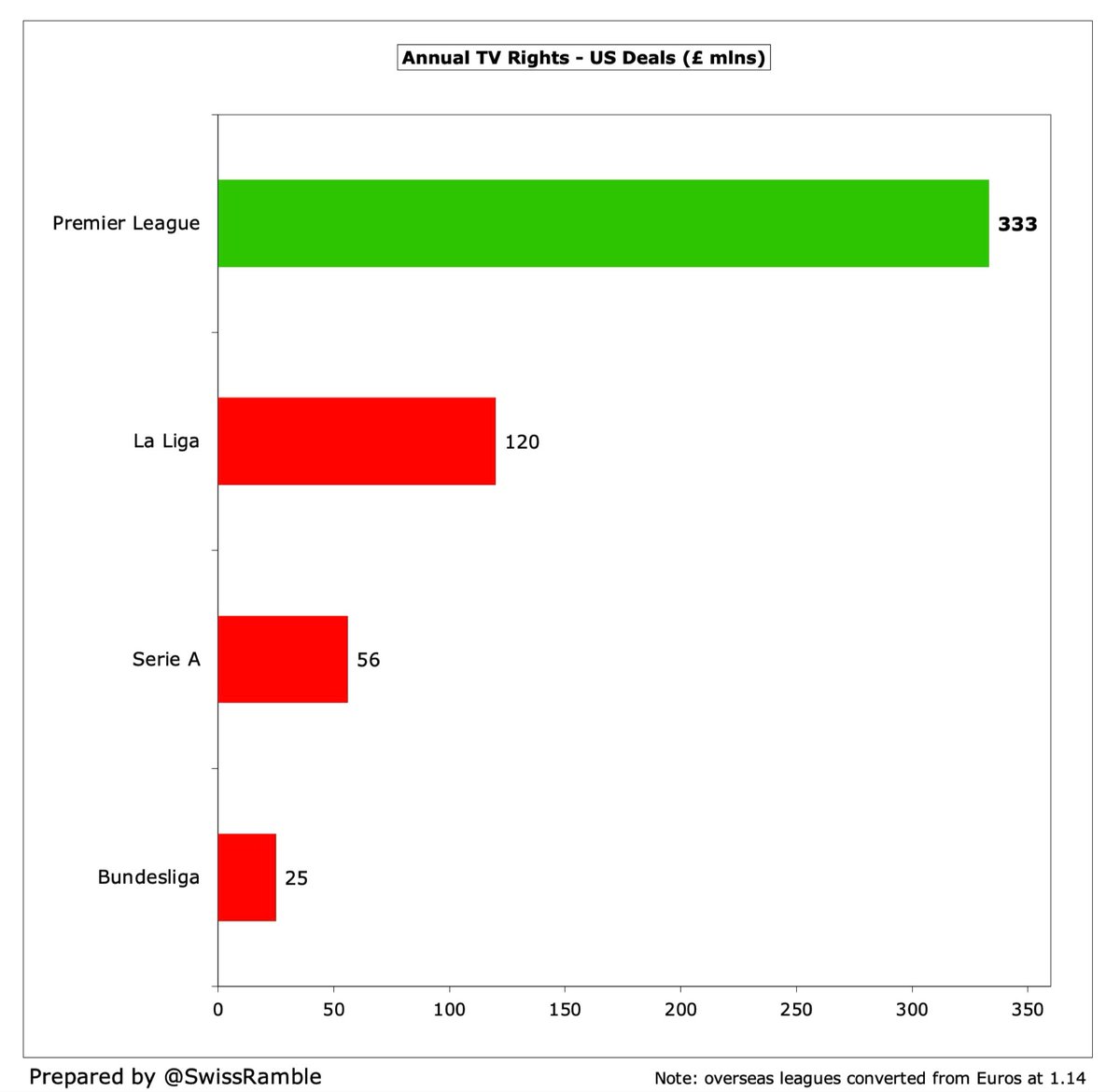

However, like others outside the Big Five leagues, #RangersFC are still faced by a major revenue challenge, e.g. their £59m revenue in 2019/20 was less than half the £130m required to be in the Top 30 European clubs, as shown by the Deloitte Money League global ranking.

This might seem like a spurious comparison, but the fact is that in 2006 #RangersFC were as high as 18th in the Money League. Since then, their revenue has actually fallen by £2m, while the club in 20th place has increased by £94m and the top club by £425m (more pre-COVID).

This is at the heart of #RangersFC issue, i.e. they are the proverbial big fish in a small pond. In 2019/20 the Scottish Premiership generated £221m revenue, miles behind England £5.1 bln and Germany £3.2 bln, but also below the likes of Austria £266m and Switzerland £229m.

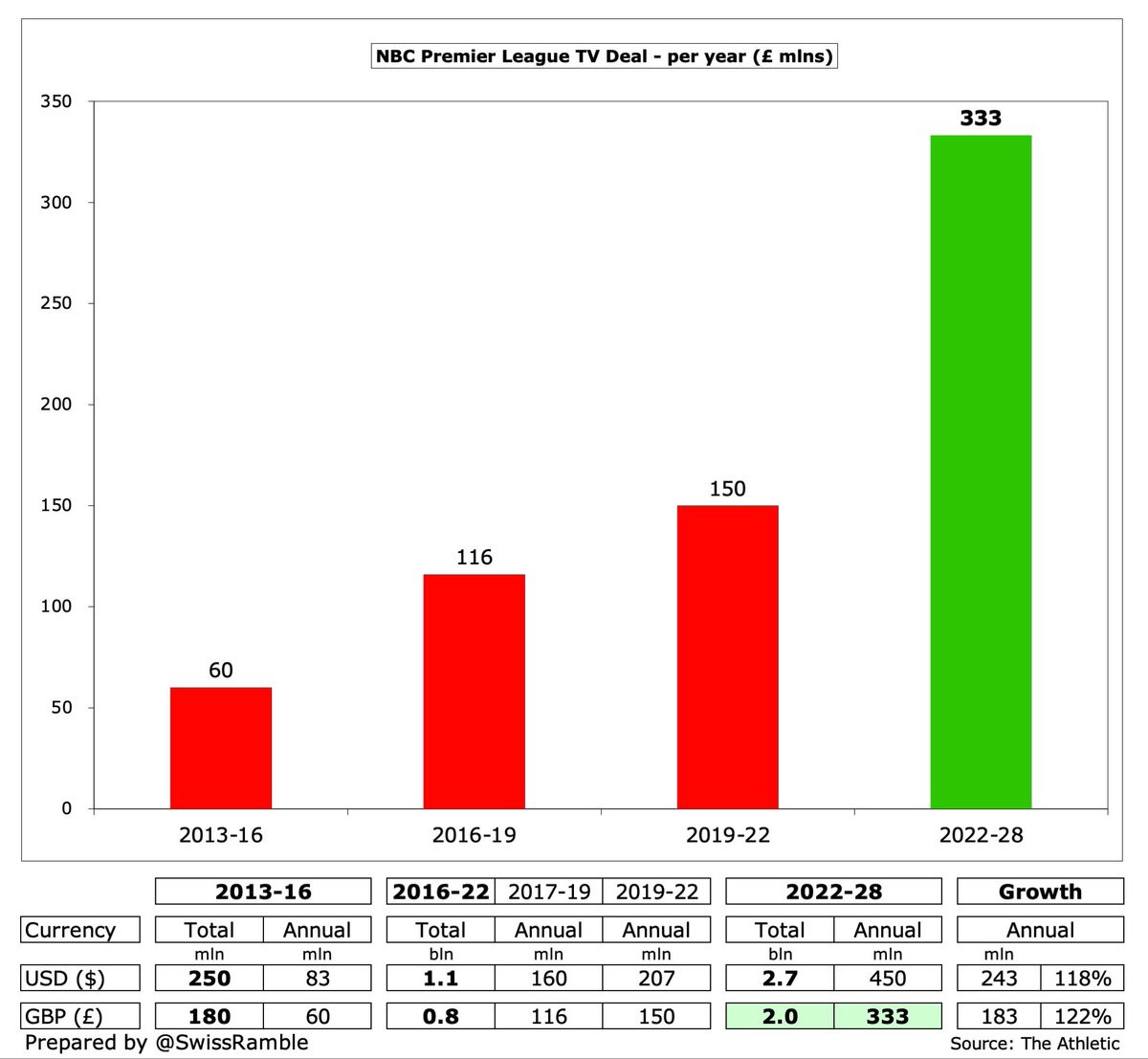

#RangersFC broadcasting revenue increased £5.3m (39%) from £13.5m to £18.9m with domestic up £3.0m to £7.7m, due to winning the league and fewer games in 2020, and Europa League up £2.3m to £11.2m, mainly due to better results in the group stage. Highest TV money in Scotland.

The SPFL has not yet published details of TV distributions for 2020/21, but #RangersFC only received £2.4m for finishing runners-up the previous season, which pales into insignificance compared to many European leagues, e.g. last place in Premier League is worth around £100m.

New 5-year Scottish TV deal with Sky Sports from 2020/21 is worth £30m (€34m) a year, up from £25m, but this is still not great. As #RangersFC chairman Douglas Park said, “we believe that Scottish football is a strong product, but it is undervalued and as a result undersold.”

Based on my estimate, #RangersFC earned €12.2m from the Europa League in 2021, which was more than 2020’s €10.4m, even though reached the last 16 in both seasons, due to better performance in the group (more wins, bonus for winning group) plus improved UEFA coefficient.

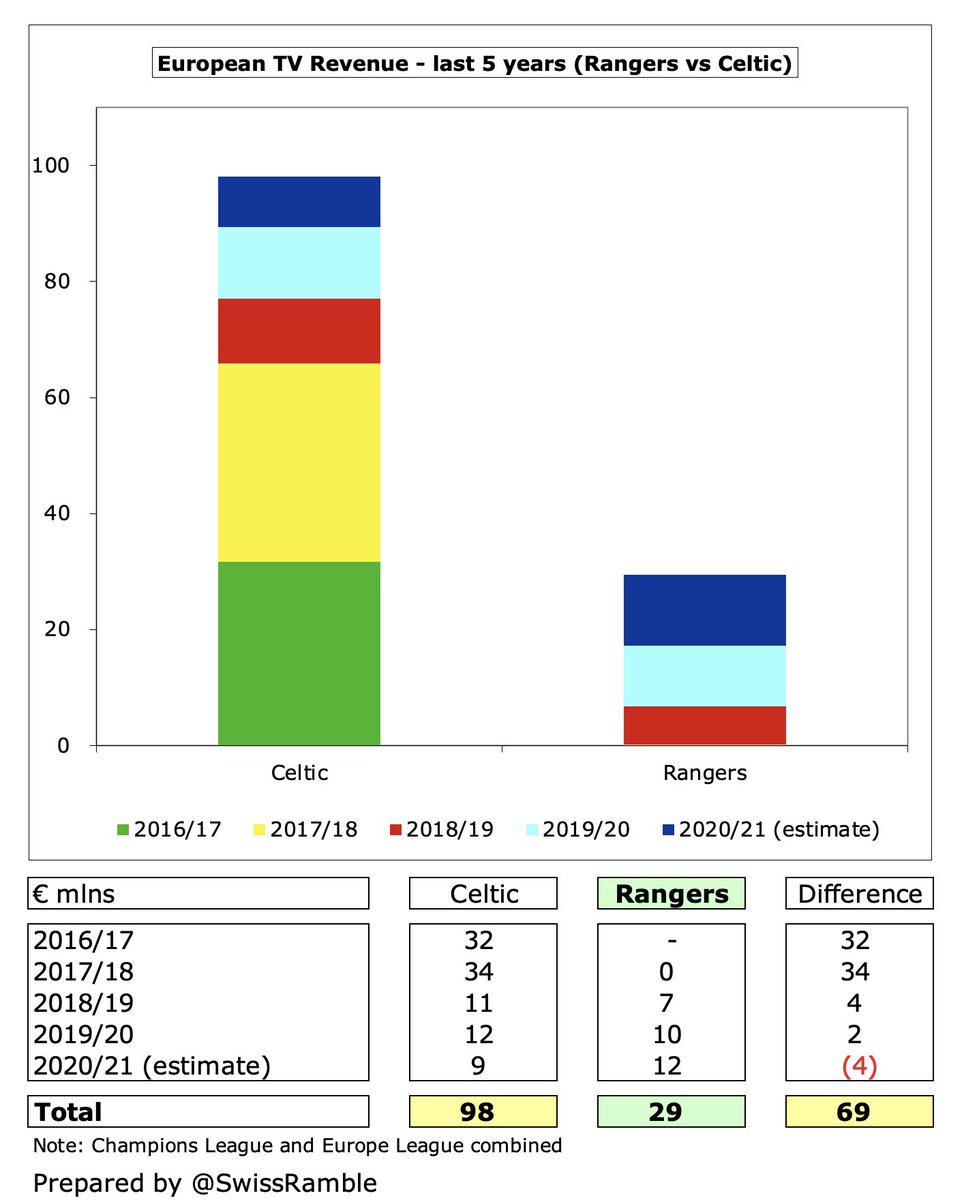

As Park said, “European football is so important” for #RangersFC with €29m in the last 3 years driving revenue improvement. This has been a real differentiator for Celtic, who received €98m in last 5 years, including over €30m from the Champions League in both 2017 and 2018.

It is therefore significant that recent good performances in Europe by #RangersFC and Celtic have improved Scotland’s UEFA coefficient, so that the 2021/22 Scottish champions will have a decent chance of direct entry into the Champions League group stage.

#RangersFC match day income fell £17.5m (49%) from £35.7m to £18.2m, as all games played behind closed doors, though fans’ generosity limited the damage. Second highest in the Premiership, below Celtic’s £20.8m, though significantly higher than Aberdeen £2.0m and Hearts £1.8m.

#RangersFC average attendance in 2019/20 was 49,238, nearly 9,000 less than Celtic 57,857. Managed to sell out their season tickets at 44,957, despite uncertainty around possibility to attend matches, so they will be delighted with fans’ return to the stadium in 2021/22.

Match day revenue is particularly important for Scottish clubs, given the low TV deal. According to Deloitte, this accounted for an incredible 48% of total revenue in Scotland in 2018/19 (pre-pandemic) with the next highest being significantly lower, i.e. Belgium 26%.

#RangersFC commercial revenue rose £0.9m (9%) from £9.8m to £10.7m, mainly due to sponsorship deals. Although this is a club record, it is still less than half of Celtic’s £28.7m, so there is room for improvement (though Rangers report their merchandising sales net of costs).

So it is good news that #RangersFC signed a 5-year kit deal with Castore, reportedly worth £4m a season from 2020/21, up from Hummel’s £3m. Shirt sponsor 32Red has extended its deal in a multi-year agreement, while the club’s first ever sleeve sponsor is Tomket Tires.

In addition to reported revenue, #RangersFC accounts include £3.4m other operating income, up from prior year’s £2.0m, due to £2.1m revenue grants and £1.3m insurance claims, i.e. compensation for matches being played behind closed doors.

#RangersFC wage bill grew by £4.3m (10%) from £43.3m to £47.7m, mainly due to a £3.8m rise in first-team salaries from £29.7m to £33.5m, following investment in the squad “in the quest for more silverware”. This means that wages have more than tripled since promotion in 2016.

Similar to revenue, #RangersFC £48m have closed the wages gap to #CelticFC £52m from £35m in 2018 to just £4m. However, there remains an abyss between the top two and the other Scottish clubs, e.g. the next highest are Aberdeen £9.4m and Hearts £7.5m.

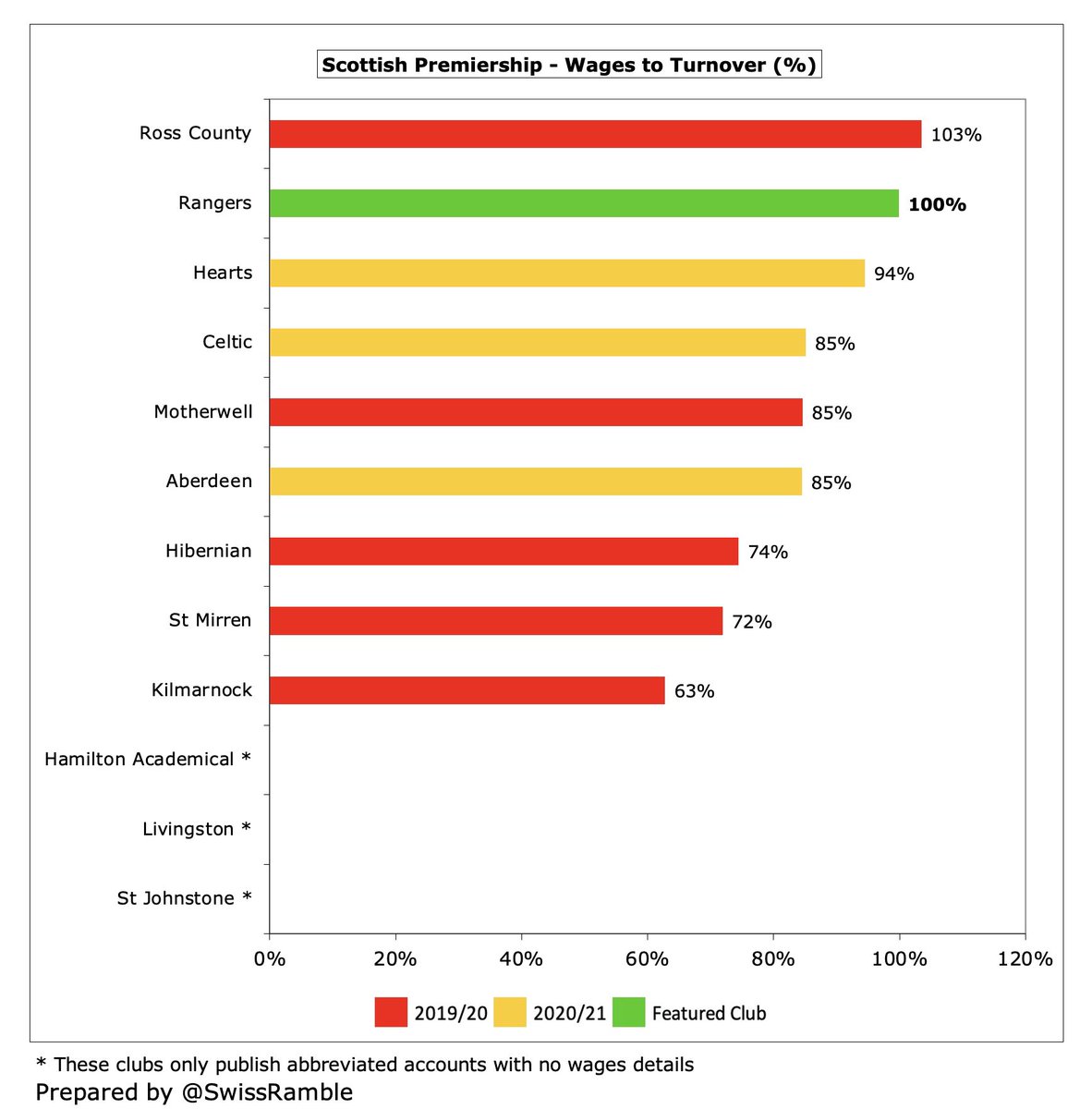

#RangersFC wages to turnover ratio worsened from 73% to 100% (first team up from 50% to 70%), which is one of the worst in Scotland, higher than Hearts 94%, Celtic 85% and Aberdeen 85%. Should improve in 2021/22 as match day income returns to normal levels.

As a result of squad investment, #RangersFC player amortisation, the annual cost of writing-off transfer fees, increased by £3.0m (40%) from £7.6m to £10.6m, up from only £0.8m in 2016. Still not as much as Celtic’s £11.8m, though every other Scottish club is below £1m.

#RangersFC spent £16.8m on player purchases in 2020/21, up from prior year £11.0m, including Kemar Roofe, Cedric Itten and (presumably) Ianis Hagi. Highest in Scotland, ahead of Celtic £13.5m, though both Glasgow clubs spend much more than the rest of the Premiership combined.

#RangersFC have invested £58m in their squad since 2017, averaging £12m a year, compared to only £4m in the preceding 4 years. Club noted that “building a team to challenge requires investment before success.” However, they only spent £2.7m last summer, mainly on Juninho Bacuna.

#RangersFC gross debt decreased from £19.3m to £13.9m, comprising investor loans £10.3m, other commercial loans £1.9m and finance leases £1.7m. Would have been much higher without investors converting £60m of debt into equity in the last 3 seasons, including £26m in 2021 alone.

#RangersFC £13.9m gross debt is by far the highest in Scotland, well ahead of Hearts £5.8m, Aberdeen £5.4m and Celtic £4.1m. However, vast majority of this debt is “soft” with almost all provided by directors and investors. Unlike Celtic, took £3.2m COVID loan from government.

Indeed, since these accounts were published #RangersFC investors have provided a further £8.5m of loans, though the club repaid former chairman Dave King’s £5m loan (plus £832k interest). Replaced this short-term, high interest loan with a long-term, lower interest bank loan.

#RangersFC have also “funded” their investment in new players by increasing transfer debt, i.e. paying transfer fees in instalments, from just £0.3m in 2016 to £13.4m in 2021 (though down from £14.3m in 2020). Only owed £0.3m by other clubs for player sales.

After adding back non-cash items and working capital movements, #RangersFC had £7m negative operating cash flow, but then spent £18m on players (purchases £20m, sales £2m), £2m on infrastructure and £1m interest. Largely funded by £21m investor loans, though net £8m cash outflow.

As a result, #RangersFC cash balance fell from £11.1m to £3.3m, significantly lower than Celtic’s £19.5m (before their rivals’ high expenditure in the summer transfer window) and also Aberdeen’s £4.1m.

Since 2013 #RangersFC available cash of £105m is almost all from investor funding: (a) £70m loans (b) £34m share capital. Most of this has been used for player purchases £40m, covering operating losses £36m, £15m capital expenditure and £7m purchase of trade & assets.

#RangersFC board stated that the club will need additional debt or equity funding of £7.5m in 2021/22, but just £0.4m in 2022/23. Including £4.5m from the fans share issue in August 2021, the total received from investors since 2013 is a staggering £119m.

Comparing #RangersFC with Celtic since 2013, we can see that net cash inflow is similar (£3m vs. £11m), but there is a big difference in approach. Celtic have made much more from operations and player sales, which Rangers have matched via £70m loans and £34m share capital.

#RangersFC board acknowledged a “material uncertainty which may cast significant doubt over the club’s ability to continue as a going concern”. However, the directors have confirmed that they will provide financial support as required, which they have done to date.

#RangersFC have clearly made a lot of progress on the pitch, albeit supported by significant investment from directors. Chairman Douglas Park noted this was necessary, due to “the condition in which our club was left” when the current board took control in late 2015.

In order for #RangersFC to move towards a sustainable model, they will have to continue to perform well, not just domestically, but also by qualifying for the Champions League group stage. Otherwise, the club will have to start selling some of its talented players.

• • •

Missing some Tweet in this thread? You can try to

force a refresh