#RealMadrid 2020/21 accounts cover a season when they finished second in La Liga, reached the Champions League semi-finals and were eliminated in the last 32 of the Copa del Rey. Their finances were significantly impacted by COVID-19. Some thoughts in the following thread.

#RealMadrid profit before tax fell very slightly from €1.9m to €1.7m (€0.9m after tax), despite revenue dropping €62m (9%) from €715m to €653m, as this was offset by a similar sized decrease in operating expenses. Profit on player sales was up €5m to €106m.

#RealMadrid €62m revenue fall was due to COVID €116m (92%) reduction in membership fees & stadium to €10m, while other fell €18m to €5m. However, broadcasting increased €59m (40%) to €208m, competitions rose €11m (10%) to €116m and marketing was up €2m (1%) to €314m.

#RealMadrid compensated for lower revenue by cutting costs: wages fell €8m (2%) from €411m to €403m, split football €372m and basketball €31m, while other expenses were slashed by €61m (24%). Player amortisation trimmed €1m to €158m, but impairment credit was €9m lower.

#RealMadrid pre-tax €2m profit was an exceptional performance in the circumstances, as other Spanish clubs have posted large losses in 2020/21, e.g. Sevilla €39m, Real Betis €37m and Athletic €25m. All dwarfed by Barcelona’s massive €555m loss (€481m after tax).

COVID has had a huge impact with many leading European clubs reporting horrific losses in 2020/21, e.g. Inter €246m, Juventus €210m & Roma €185m, which makes #RealMadrid small profit very impressive. In fact, they are one of the few clubs not to incur losses in past 2 years.

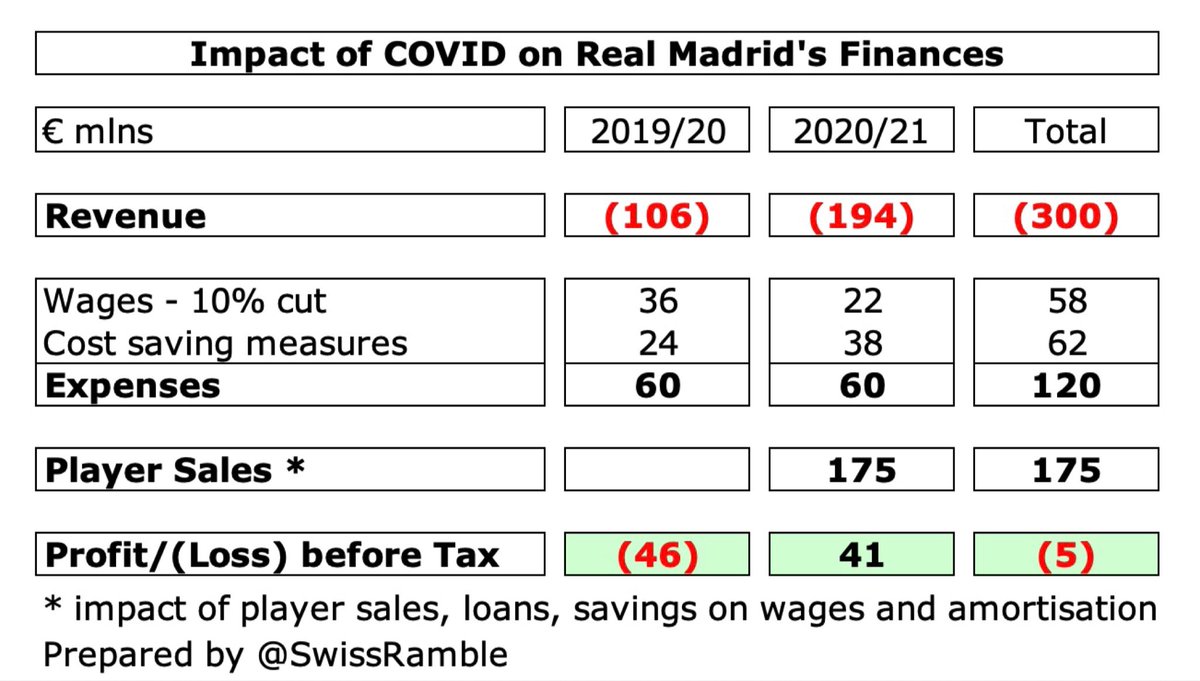

#RealMadrid said they lost €300m revenue in past 2 years due to COVID, excluding new revenue that could have been obtained, but balanced their books with cost reductions: salary cuts €58m, operational savings €62m and €175m player transfers (including wages & amortisation).

#RealMadrid benefited from profit on player sales rising from €101m to €106m, including Ashraf Hakimi to Inter, Sergio Reguilon to #THFC and Oscar Rodriguez to Sevilla. One of the reasons for Madrid’s much better financial performance than Barcelona, who only made €4m in 2021.

#RealMadrid are normally highly profitable, due to their ability to generate revenue. In the 8 years before 2020, they accumulated an impressive €350m profit, averaging €44m a season. Even after the pandemic struck, they still managed to deliver (small) profits.

#RealMadrid have become more reliant on player sales, making more than €300m from this activity in the last 3 years, one of the best in Europe. The 2021/22 budget includes another €108m, largely achieved via sales this summer, including Varane to #MUFC and Odegaard to #AFC.

#RealMadrid EBITDA (Earnings Before Interest, Tax, Depreciation & Amortisation), considered a proxy for cash profit, rose from €50m to €57m. Including player sales, this increased from €151m to €163m. Note: club’s €180m figure includes €17m release of impairment provision.

#RealMadrid operating loss, excluding player sales and interest, has been steadily declining, but stayed at €108m in 2021. In fairness, most football clubs post operating losses, so Madrid’s performance is the norm, actually significantly better than Barca’s shocking €509m.

#RealMadrid revenue has fallen by €104m (14%) from 2019 pre-COVID €757m peak to €653m in 2021, entirely due to €163m (94%) reduction in membership fees & stadium income from €173m to €10m. Incredibly, the other revenue streams have all increased in this period.

Barcelona’s revenue loss is much higher, so #RealMadrid have once again overtaken their Catalan rivals (€653m vs. €591m), which means a €146m swing in the last 2 years. Both clubs still much higher than other Spanish clubs, e.g. Atleti €345m, Valencia €172m & Sevilla €171m.

According to the Deloitte Money League, #RealMadrid had the second highest revenue in the world in 2019/20, with their €715m just behind Barcelona, but well ahead of Bayern Munich €634m & #MUFC €580m. Madrid’s revenue mix was: commercial 54%, broadcasting 31% & match day 15%.

#RealMadrid marketing revenue held up pretty well in 2020/21, rising 1% from €312m to €314m, the highest in Spain, ahead of Barcelona €270m, followed by Atleti €80m and Valencia €25m. In 2019/20 they had the highest commercial income in Europe (Deloitte definition).

It’s an “arms race” in shirt sponsorships and kit deals, but #RealMadrid’s are among the very highest with Emirates and Adidas paying €70m and €110m a year respectively. Emirates deal runs to 2022, while Adidas agreement has been extended to 2028 (merchandising is on top).

#RealMadrid broadcasting income rose €78m (35%) from €224m to €302m, mainly due to revenue deferred from 2019/20 for games played after the accounting close. Third highest TV revenue in the world in the prior year, only surpassed by Barcelona and #LFC (Deloitte definition).

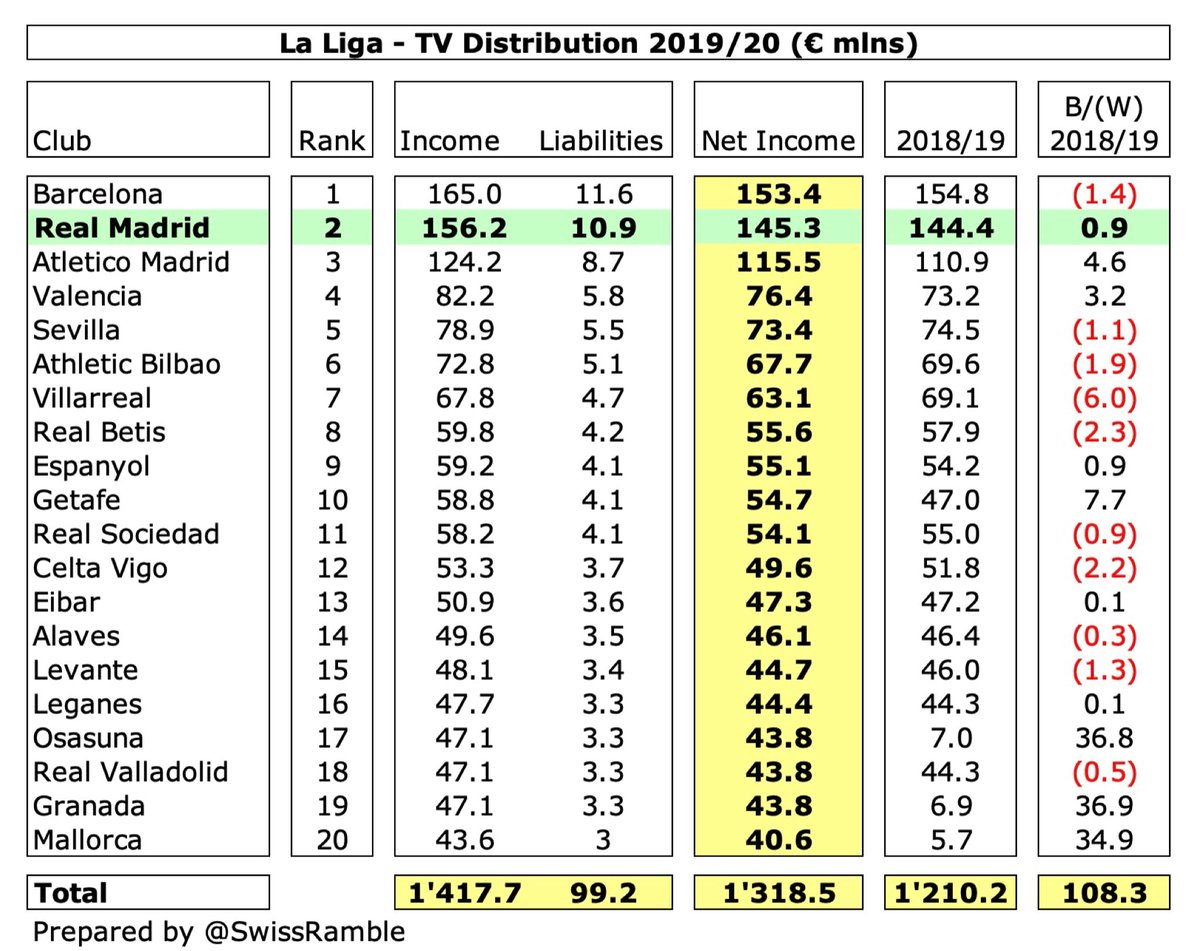

After years of individual deals in Spain, La Liga have introduced a collective deal, based on 50% equal share, 25% performance over last 5 years and 25% popularity (1/3 for average match day income, 2/3 for number of TV viewers). Gross income reduced by liabilities (7%).

Even after the changes, the big two still receive by far the highest TV income from La Liga’s TV deal. No figures yet for 2021, but in 2020 Barcelona and #RealMadrid got €153m and €145m, followed by Atletico Madrid €116m, then a big gap to Valencia €76m and Sevilla €73m.

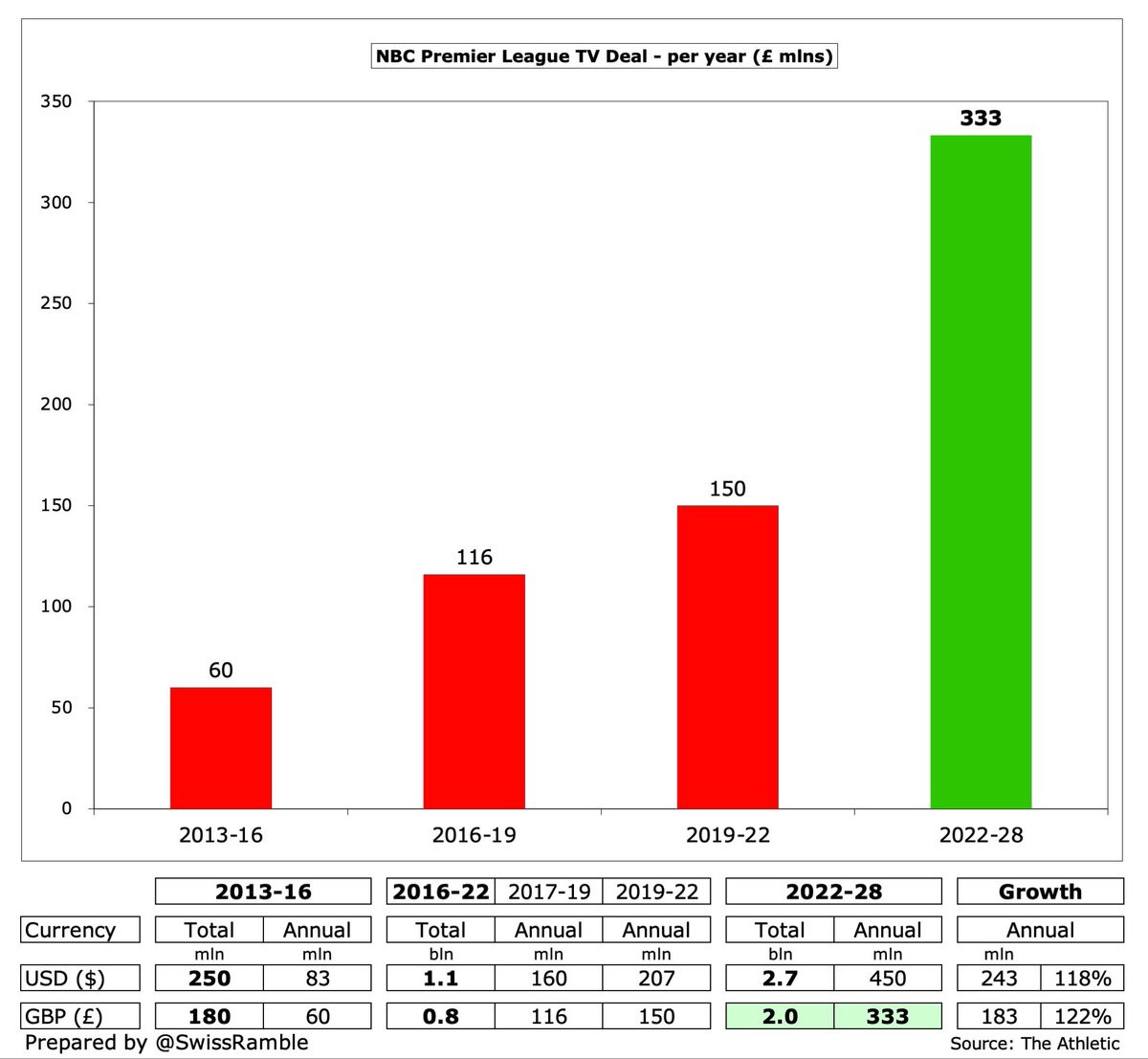

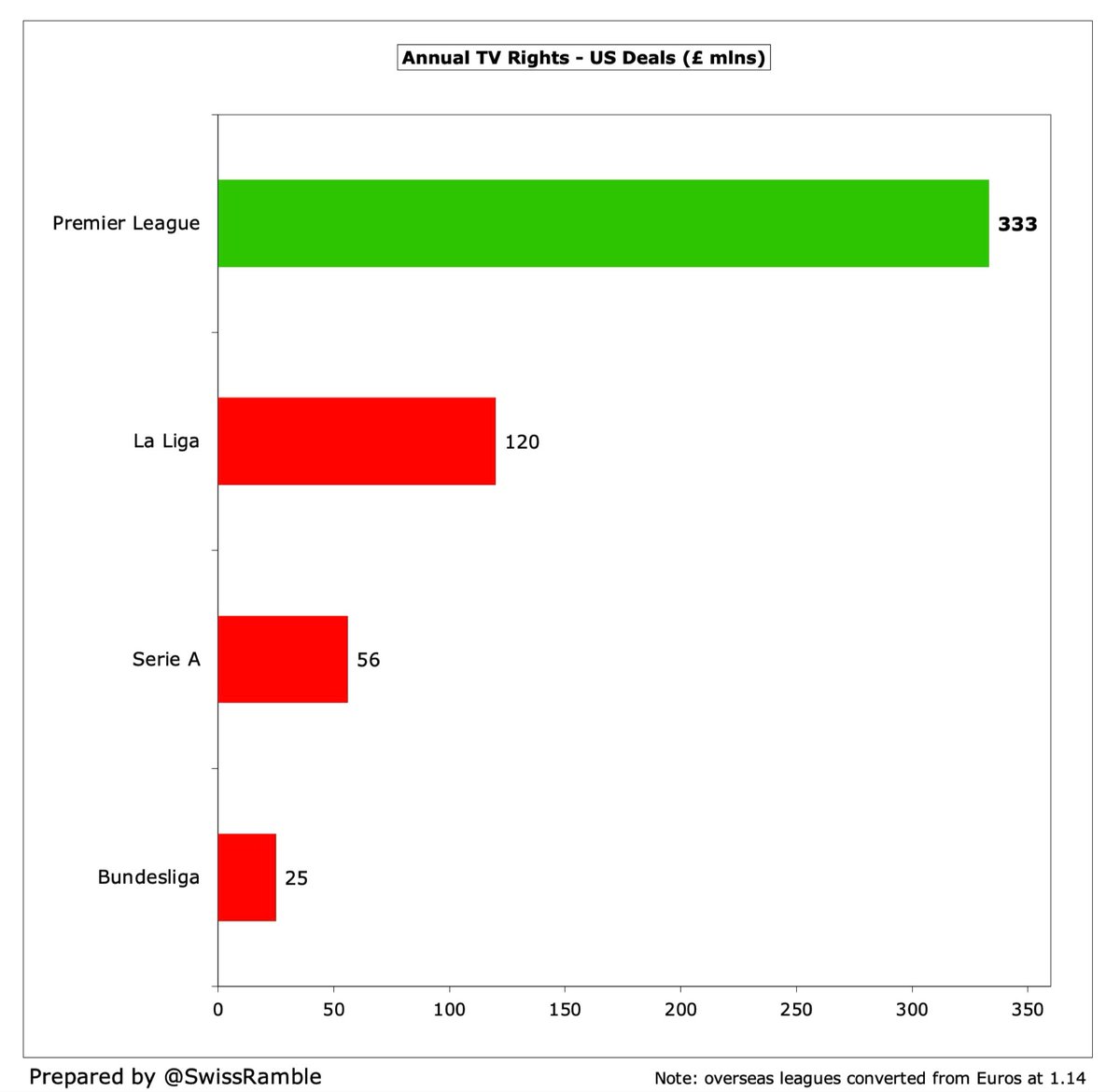

#RealMadrid benefited from La Liga international TV deal rising by 30% in 2019/20, giving total TV rights of €2.0 bln. Although still a long way behind Premier League €3.6 bln, it is comfortably ahead of the others: Bundesliga €1.4 bln, Serie A €1.3 bln and Ligue 1 €0.8 bln.

Based on my estimate, #RealMadrid earned €111m for reaching the Champions League semi-finals, €30m more than prior season €80m (only last 16). Much more than Barcelona €85m, Atletico Madrid €76m and Sevilla €68m. Figures are net of 3.4% COVID rebate.

Worth noting the influence on Champions League money of the UEFA coefficient payment (based on performances in Europe over 10 years), where #RealMadrid had the highest ranking, thanks to winning the competition 4 times in 5 years up to 2018, giving them €35m.

Thanks to their fantastic record in the Champions League, #RealMadrid have earned a hefty €446m from European competition in the last 5 years, which is €25m and €85m more than Barcelona and Atletico Madrid respectively. In Europe, this is only surpassed by Juventus.

#RealMadrid match day revenue fell €92m (85%) from €108m to €16m, as all home games were played behind closed doors. Down from €145m pre-COVID. In 2020 they had the second highest revenue in the world from this stream , only below Barcelona €126m.

#RealMadrid had the second highest crowds in Spain in 2019/20 with nearly 67,000, only behind Barcelona 72,000, so they will be delighted that the stadiums have been re-opened to fans this season. Spanish authorities have recently allowed the capacity to be increased to 100%

Work on the €575m redevelopment of #RealMadrid’s Santiago Bernabéu stadium continues with estimated completion date of 2023 (€279m investment to date). Funding is in place, charging 2.5% over 30 years. Annual loan repayments of €29.5m will start in July 2023.

#RealMadrid football wages fell €6m (2%) to €372m, due to 10% salary cut in response to COVID and players leaving (e.g. James) or going out on loan (e.g. Bale, Ceballos, Jovic and Odegaard). Down from €395m peak in 2018. Total wage bill, including basketball €31m, was €403m.

#RealMadrid €372m wage bill was still €60m lower than Barcelona’s €432m, though the difference has more than halved from €139m two years ago. There is then a big gap to the third placed club, Atletico Madrid €227m, followed by Sevilla €133m and Valencia €110m.

Despite the savings, #RealMadrid wage bill is still among the highest in Europe. In fact, in 2019/20 only Barcelona €443m, PSG €414m and #MCFC €401m paid more than them. Budgeted to further decrease in 2021/22 to €366m.

La Liga increased #RealMadrid salary cap to €739m, by far the highest in Spain, ahead of Sevilla €200m and Atletico Madrid €172m. Two years ago, Madrid’s €641m cap was lower than Barcelona’s €671m, but the Catalans have seen theirs severely reduced to €98m in 2021/22.

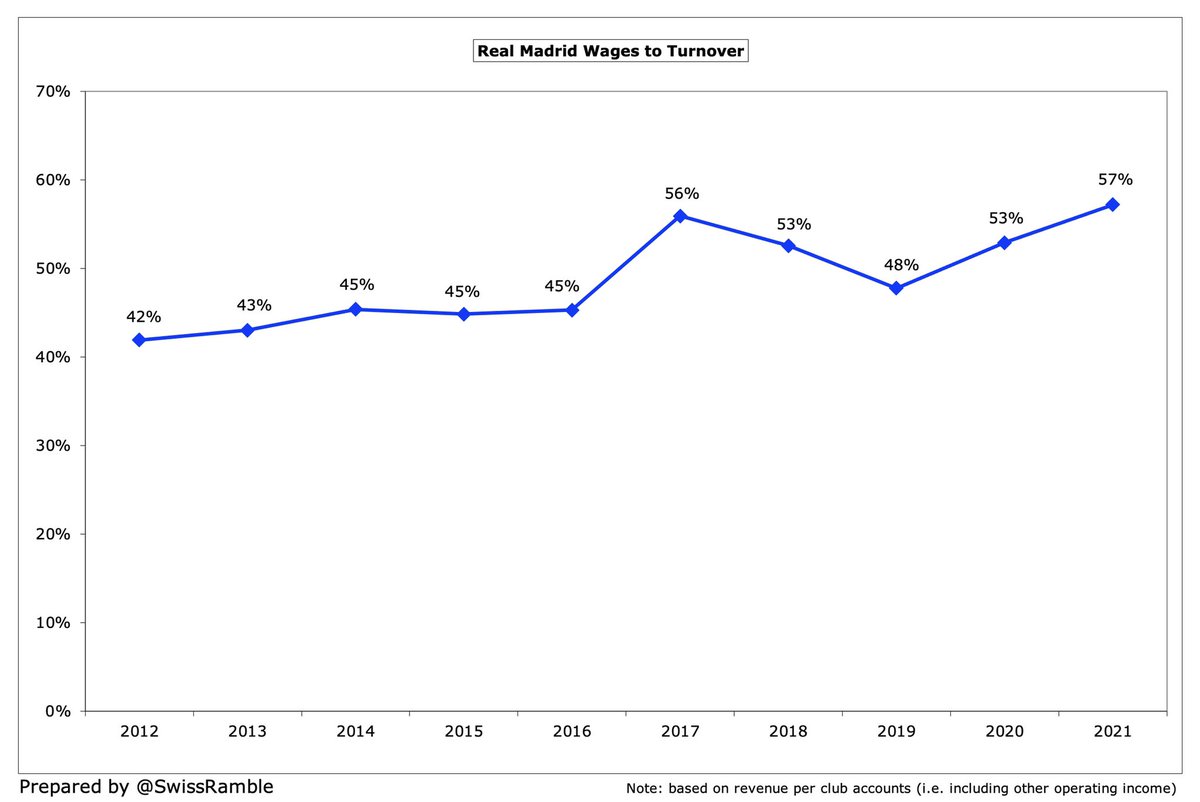

Following the revenue decrease, #RealMadrid wages to turnover ratio increased from 53% to 57%, still one of the lowest in Spain, much better than Barcelona 73%, while others are even worse in 2021, e.g. Bilbao 102%, Betis 93%. Prior year they had one of the best ratios in Europe.

#RealMadrid other expenses were cut by 24% (€61m) from €254m to €193m, as the club implemented a cost savings plan for the various activities and services contracted in response to the pandemic, as well as reduced operational costs, e.g. staging matches, travel, etc.

#RealMadrid player amortisation, the annual cost of writing-off transfer fees, was trimmed by €1m to €158m, though this expense has still increased by €75m (90%) since 2018. Highest in Spain, just ahead of Barcelona €155m, and one of the highest in Europe in 2020.

#RealMadrid are known as big spenders in the transfer market, and they did have the fifth highest gross spend in Europe in the 3 years up to 2019/20, with their €661m only beaten by Barcelona €960m, Juventus €801m, #CFC €758m and #MCFC €678m.

However, since then #RealMadrid have been extremely parsimonious, making no purchases at all in 2020 summer transfer window and spending only €31m in 2021 (on Eduardo Camavinga), leading to €151m net sales. Maybe they’re keeping their powder dry for a big purchase next summer?

Excluding the stadium, #RealMadrid net debt fell €195m from €241m to €46m per the club’s definition, which includes transfer debt. Gross financial debt was cut from €213m to €158m after €50m bank loan repaid. In addition, the club has €424m stadium debt (net €279m).

#RealMadrid cash balances decreased from €125m to €122m, excluding €144m that is ring-fenced for the stadium development. Worth noting that cash balances are always high in the annual accounts, just before the semi-annual wage payment in July.

#RealMadrid interest payments increased from €1m to €4m, but they are in a much better position than Barcelona, who paid a chunky €41m in 2021 (up from €26m in 2020). Will grow as Madrid’s stadium development debt ramps up.

#RealMadrid slashed transfer fees debt rose from €196m to €80m, while amounts owed by other clubs are up to €139m, giving net receivables of €59m. Significantly better position than Atletico Madrid and Barcelona, who owed €316m and €231m respectively.

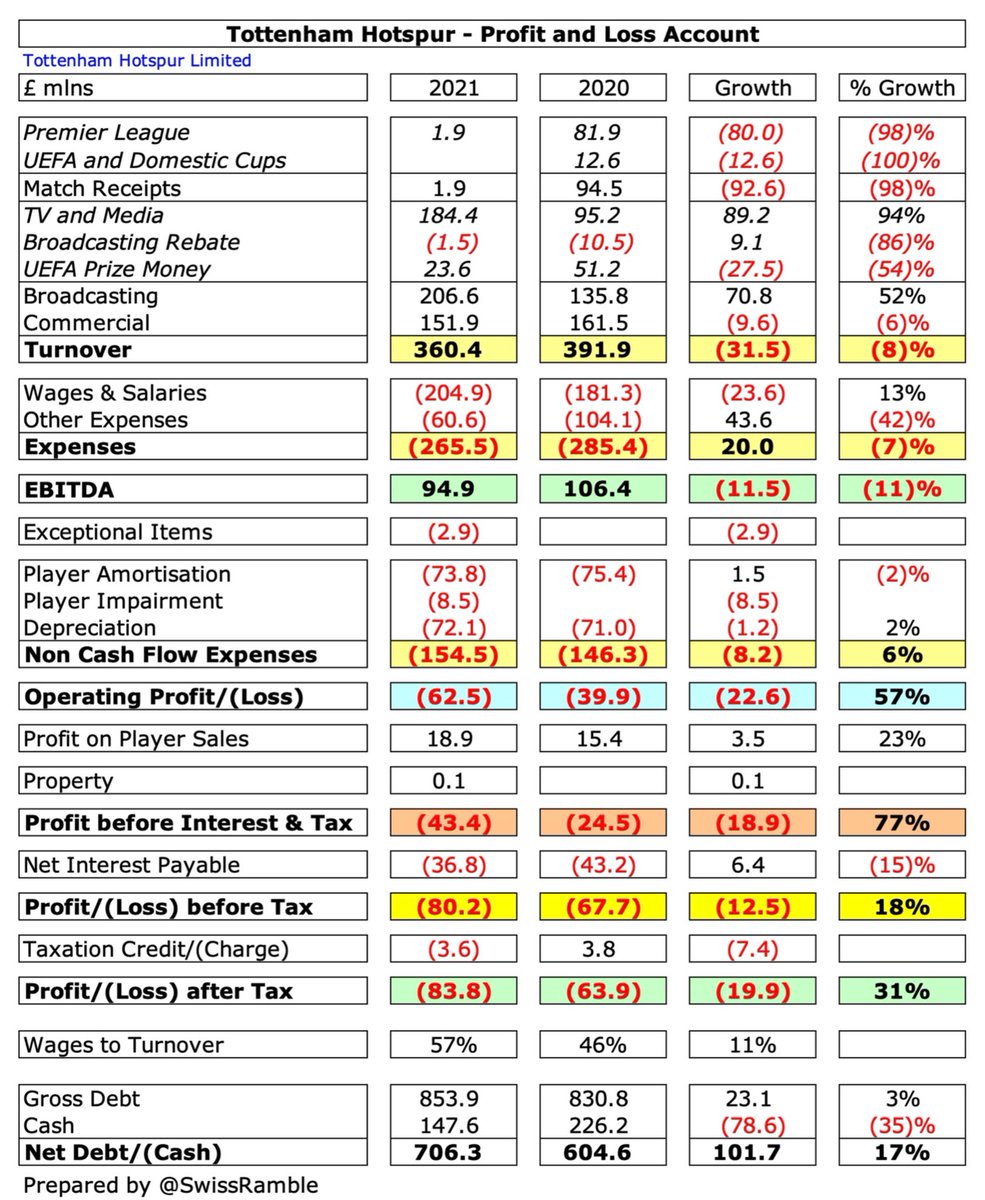

#RealMadrid total debt rose from €742m to €890m (including wages, tax authorities debt and trade creditors), mainly due to new stadium debt. However, this is still much less than #THFC and Barcelona (€1.3 bln and €1.2 bln respectively in 2020).

After adjusting for non-cash items, #RealMadrid generated €131m cash in 2020/21, but then spent €87m on players (purchases €161m, sales €74m), €147m on the stadium and €3m interest, offset by €10m tax credit. This was funded by €225m new loans.

As a result, cash balances increased by €131m from €135m to €266m, split €122m for operations and €144m for stadium development. Comfortably the highest in Spain, well ahead of Barcelona €60m, though it is a bit misleading, as much will be spent on the stadium.

Since 2012 #RealMadrid have used half of their available €1.5 bln cash on player purchases €740m, but have also invested €465m into stadium development and Real Madrid City. They also spent €100m on tax and €24m on interest, while increasing cash balance by €172m.

Although Florentino Perez argued that the club’s finances were awful when pushing for the European Super League, it is clear that they have outperformed rivals during COVID. As La Liga president Javier Tebas said, “#RealMadrid have managed the pandemic extremely well.”

The Bernabéu stadium development will represent a major challenge for #RealMadrid, but also an opportunity to generate more revenue. Recovery from the pandemic will not be immediate, but the club will look to once again invest in great players and expand internationally.

• • •

Missing some Tweet in this thread? You can try to

force a refresh