Speeches are an important element of central bank communication. After two years at the @ecb’s Executive Board, I would like to present a selection of the most relevant of my (more than 30) speeches in a long thread🧵. 1/18

There are several categories of speeches: (1) on #MonetaryPolicy, explaining current policy considerations, (2) on #Narratives about monetary policy, and on the relationship of monetary policy & (3) #FiscalPolicy, (4) #FinancialStability, (5) #Inequality, (6) #ClimateChange. 2/18

#MonetaryPolicy: There are too many speeches to list them all, so let me select a few: on the ECB’s response to the pandemic (6 Apr 2020), mentioning (AFAIK) the concept of the euro area GDP-weighted yield curve for the first time: 3/18 ecb.europa.eu/press/key/date…

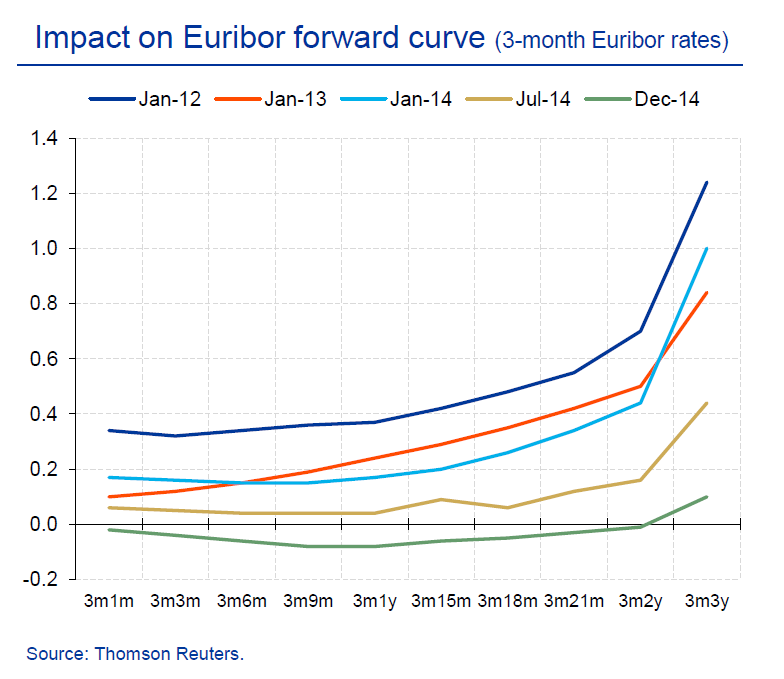

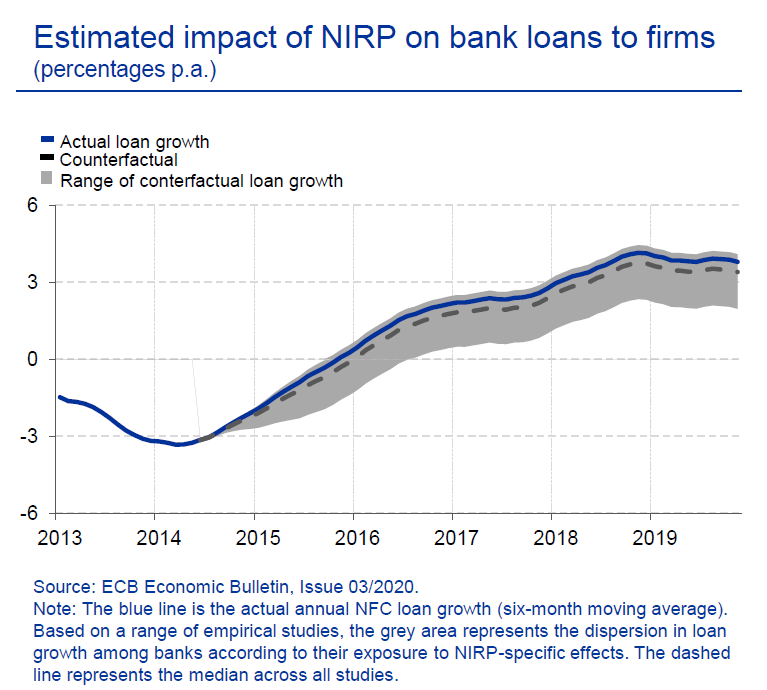

On the @ecb's experience with negative interest rates (26 Aug 2020): ecb.europa.eu/press/key/date…; and on the proportionality of PEPP (27 Jun 2020): ecb.europa.eu/press/key/date… 4/18

On potentially diminishing returns of monetary policy and its side effects, two recurrent themes in my speeches (24 Nov 2020): ecb.europa.eu/press/key/date…; and on “preserving favourable financing conditions” under the PEPP (25 Mar 2021): ecb.europa.eu/press/key/date… 5/18

On the euro area hopefully escaping the low inflation – low growth environment (3 Jul 2021): ecb.europa.eu/press/key/date…; and on our new monetary policy strategy (14 Jul 2021): ecb.europa.eu/press/key/date… 6/18

On the changing role of asset purchases (20 Sep 2021): ecb.europa.eu/press/key/date…; and on the return of inflation and the appropriate monetary policy response in times of high uncertainty “Reflation, not stagflation” (17 Nov 2021): ecb.europa.eu/press/key/date… 7/18

#Narratives: My narratives speeches are directed at a broader public and try to dispel misleading narratives on monetary policy in order to encourage a factual discourse. The first is my Karlsruhe speech (11 Feb 2020): ecb.europa.eu/press/key/date… 8/18

... and the second my Baden-Baden speech on inflation (13 Sep 2021), which remains broadly valid in spite of strong inflation surprises since then: ecb.europa.eu/press/key/date… 9/18

#FiscalPolicy: One speech is on some misconceptions on fiscal dominance (11 Sep 2020): ecb.europa.eu/press/key/date…; another one on the need for “Unconventional fiscal and monetary policy at the zero lower bound” (26 Feb 2021): ecb.europa.eu/press/key/date… 10/18

#FinancialStability: One speech discusses the risks from the non-bank sector that became apparent in the COVID-19 crisis (19 Nov 2020): ecb.europa.eu/press/key/date…; another one is on the impact of non-banks on monetary policy transmission (24 Aug 2021): ecb.europa.eu/press/key/date… 11/18

One speech deals with a new sovereign-bank-corporate nexus, which so far has turned out virtuous rather than vicious (28 Jan 2021): ecb.europa.eu/press/key/date…; and one with the relationship of monetary policy and financial stability (8 Dec 2021): ecb.europa.eu/press/key/date… 12/18

#Inequality: One speech deals with the effects of the pandemic on inequality “Unequal scars” (18 Sep 2020): ecb.europa.eu/press/key/date…; another one discusses the relationship of monetary policy and inequality (9 Nov 2021): ecb.europa.eu/press/key/date… 13/18

My speech on why “Women are central, not just in central banks” essentially also deals with an aspect of inequality that is very dear to my heart, and what the ECB is doing about it (28 Sep 2020): ecb.europa.eu/press/key/date… 14/18

#ClimateChange: Several speeches are devoted to the role of monetary policy in fighting climate change. My first speech on this topic discusses why monetary policy may have a role to play “Never waste a crisis” (17 Jul 2020): ecb.europa.eu/press/key/date… 15/18

Several speeches question the market neutrality principle: “When markets fail” (28 Sep 2020): ecb.europa.eu/press/key/date…; and “From market neutrality to market efficiency” (14 Jun 2021): ecb.europa.eu/press/key/date… 16/18

A further speech discusses the constraints of a “green” monetary policy in order to avoid that we move “from green neglect to green dominance” (3 March 2021): ecb.europa.eu/press/key/date…; another speech on climate change is coming up on January 8 (American Finance Association). 17/18

Almost all my speeches are accompanied by slides, which can be found on the @ecb's website (at the very end of each speech or on the speeches website as Annex). Thanks to the team @ecb for their extraordinary support! And stay tuned in #2022! 18/18

• • •

Missing some Tweet in this thread? You can try to

force a refresh