Global #manufacturing output growth accelerated in December, coming back into line with growth of new orders, as supply constraints eased. Our #PMI wrap up in 10 charts bit.ly/3qRgGwc

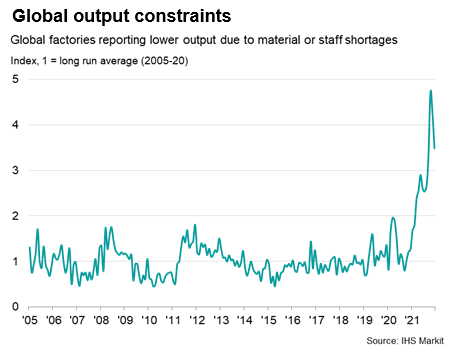

While the number of companies worldwide reporting that output was constrained by shortages continued to run at 3.5 times the long-run average in December, this is down from a record peak of 4.7 times the long-run average back in October.

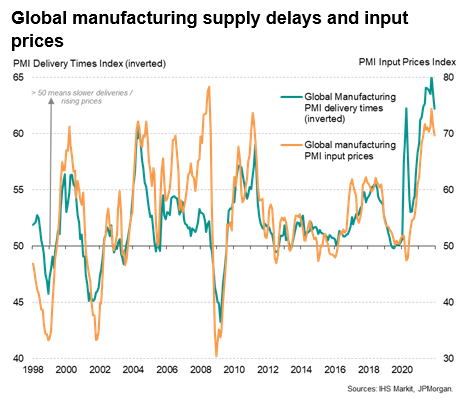

Although still running at a level far in excess of anything seen prior to the pandemic, the average lengthening of supplier delivery times globally eased for a second consecutive month in December to the smallest recorded since March.

An easing in the rate of increase of manufacturers’ input costs accompanied the cooling of supply chain pressures. Measured globally, input costs rose in December at the slowest pace since April, hinting that the rate of increase peaked back in October.

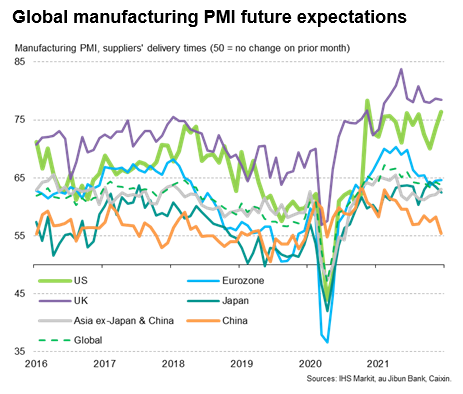

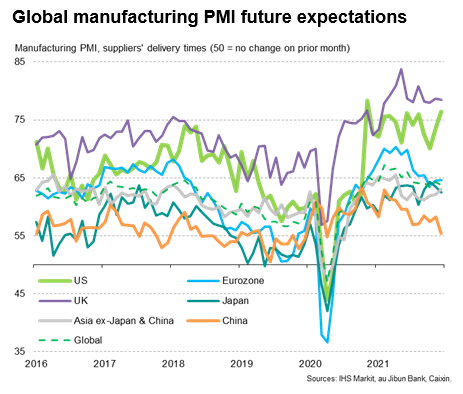

In a month in which Omicron led to a surge in global COVID-19 infections, the global PMI future expectations index showed encouraging resilience. The index dropped from 64.3 in November to 63.7 in December but remains above the long-run average of 62.4 .

Future expectations in fact even picked up in the US to the 2nd-highest in nearly 6 years, linked to the improving supply situation, and lifted higher both in the eurozone and Asia excl. Japan & China. The latter saw a notably marked downturn in expectations for the year ahead.

• • •

Missing some Tweet in this thread? You can try to

force a refresh