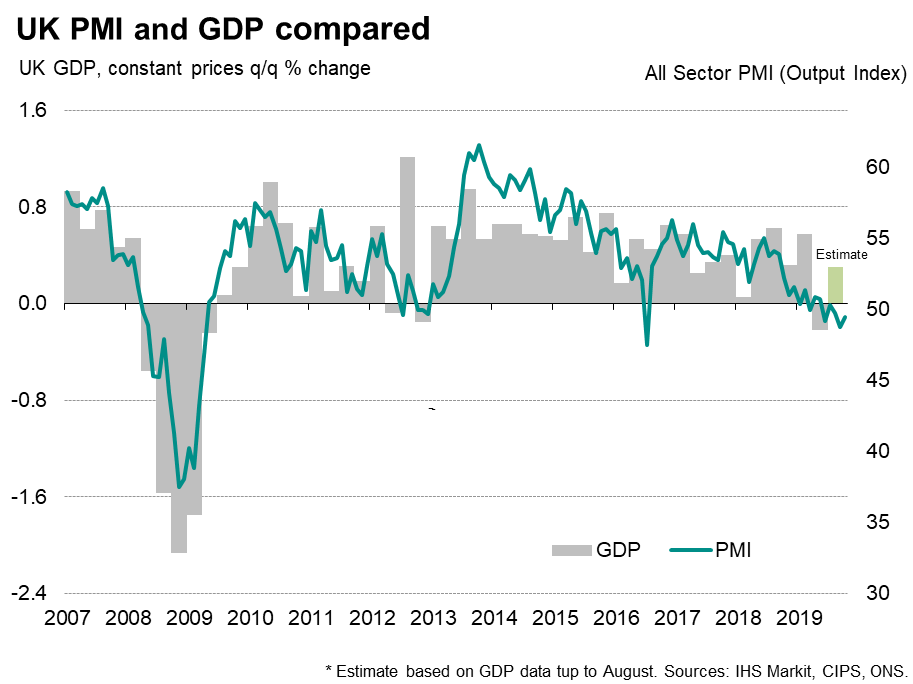

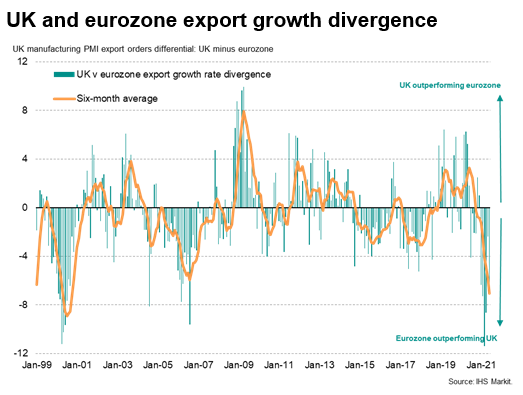

#Manufacturing #PMI survey data reveal how the UK’s exporters have underperformed their peers in the eurozone to the greatest extent for over two decades so far this year, i.e. since the end of the #Brexit transition period.

bit.ly/3yfQGNc

bit.ly/3yfQGNc

UK suppliers of components in particular have seen only a marginal increase in export sales in the past six months, while similar firms in the eurozone, in contrast, has seen record export growth of component export sales.

This is itself an underperformance by UK suppliers of a degree never previously seen in at least 20 years of survey history

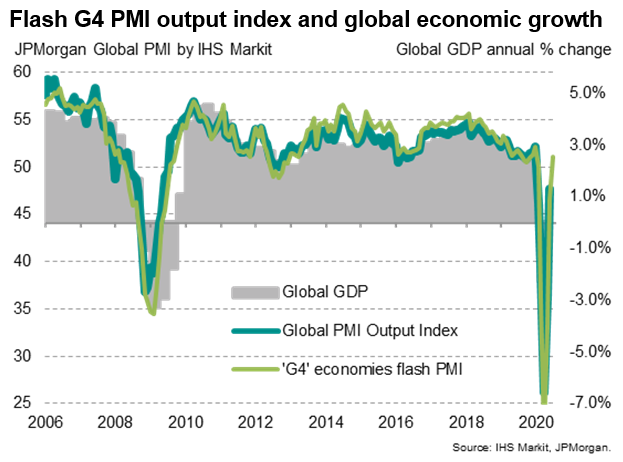

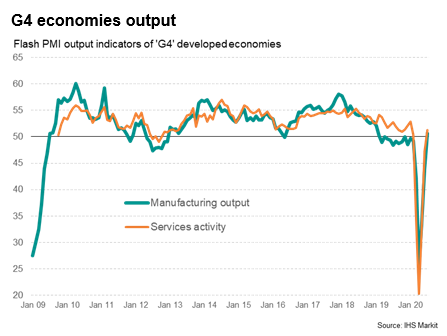

Note that the last six months have been a period when the global manufacturing economy has been growing at its fastest rate for a decade, and likewise sucking up components at the sharpest rate for a decade,

While larger UK firms have enjoyed rising overseas sales on the back of the fastest global manufacturing expansion for a decade, small UK firms have seen an overall DROP in export sales so far this year

The resulting gap between the performance of large and small firms is by far the widest on record since comparable data were first available over 25 years ago.

i.e. small UK firms, and especially suppliers to other companies, have been hit very hard by #Brexit so far this year

i.e. small UK firms, and especially suppliers to other companies, have been hit very hard by #Brexit so far this year

• • •

Missing some Tweet in this thread? You can try to

force a refresh