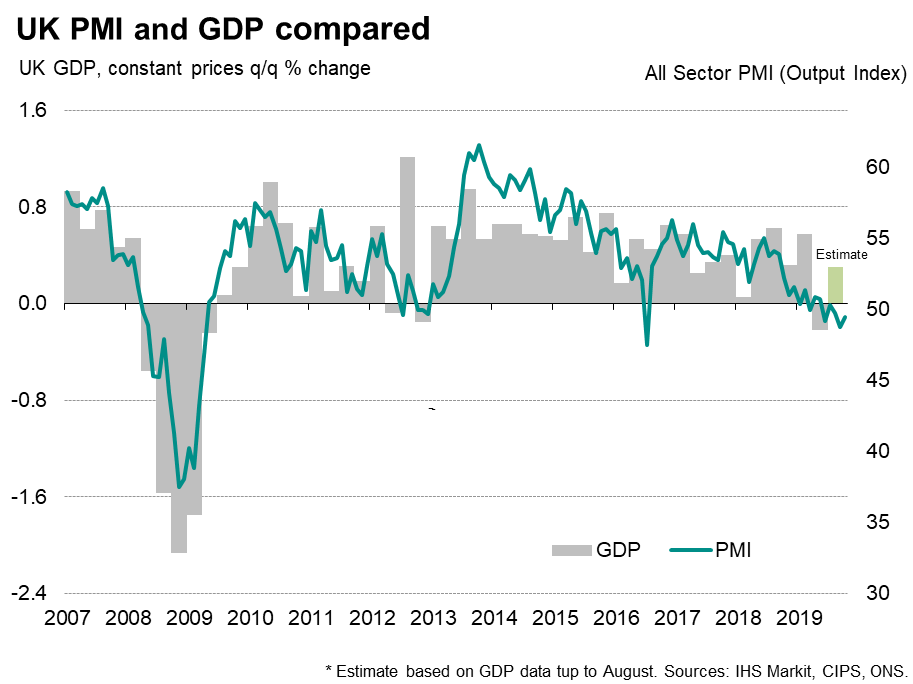

UK #PMI data showed #construction activity slowing sharply in August. Given the amount of stimulus and relatively early stage in the recovery, to be slowing so close to the long-term trend is disappointing 1/4

Part of the slowdown can be linked to weaker growth of new orders for construction work, but as the chart shows, activity has slowed much more sharply than demand for new work, so there are other factors at play 2/4

Part of the slowdown is clearly linked to ongoing near-record #shortages of raw materials, as measured by suppliers' delivery times, which have in turn led to unprecedented price hikes for building materials in recent months 3/4

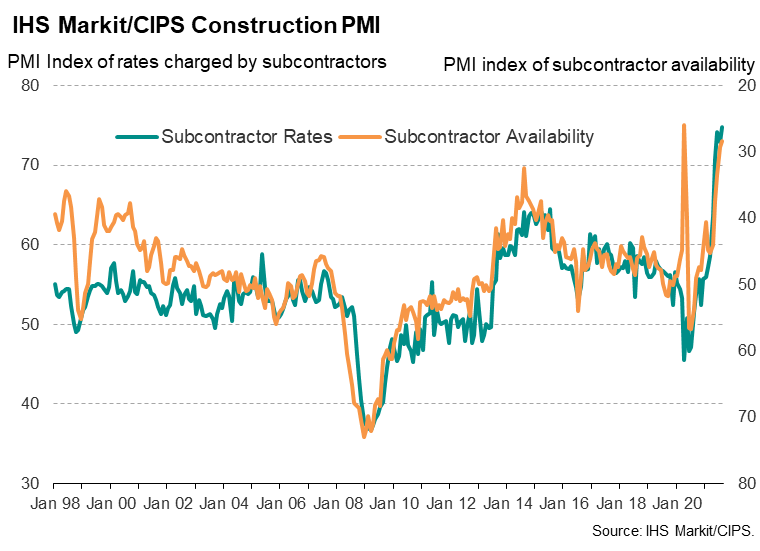

Adding to the materials shortages are problems finding subcontractors (think chippies, sparkies, groundwork specialists etc). The availability of subcontractors deteriorated at a record rate excluding last year's shutdown, leading to a record rise rates charged by subbies 4/4

• • •

Missing some Tweet in this thread? You can try to

force a refresh