🚨🚨 Update: Our hourly whales ratio (1) maintains high, but lower than the days/weeks before. Also confirmed by our whales ratio 30D average. As you see, we had some hard dumps in whales ratio. That's usually a bullish signal. Happenend yesterday.

#BTC #ETH #XRP

#BTC #ETH #XRP

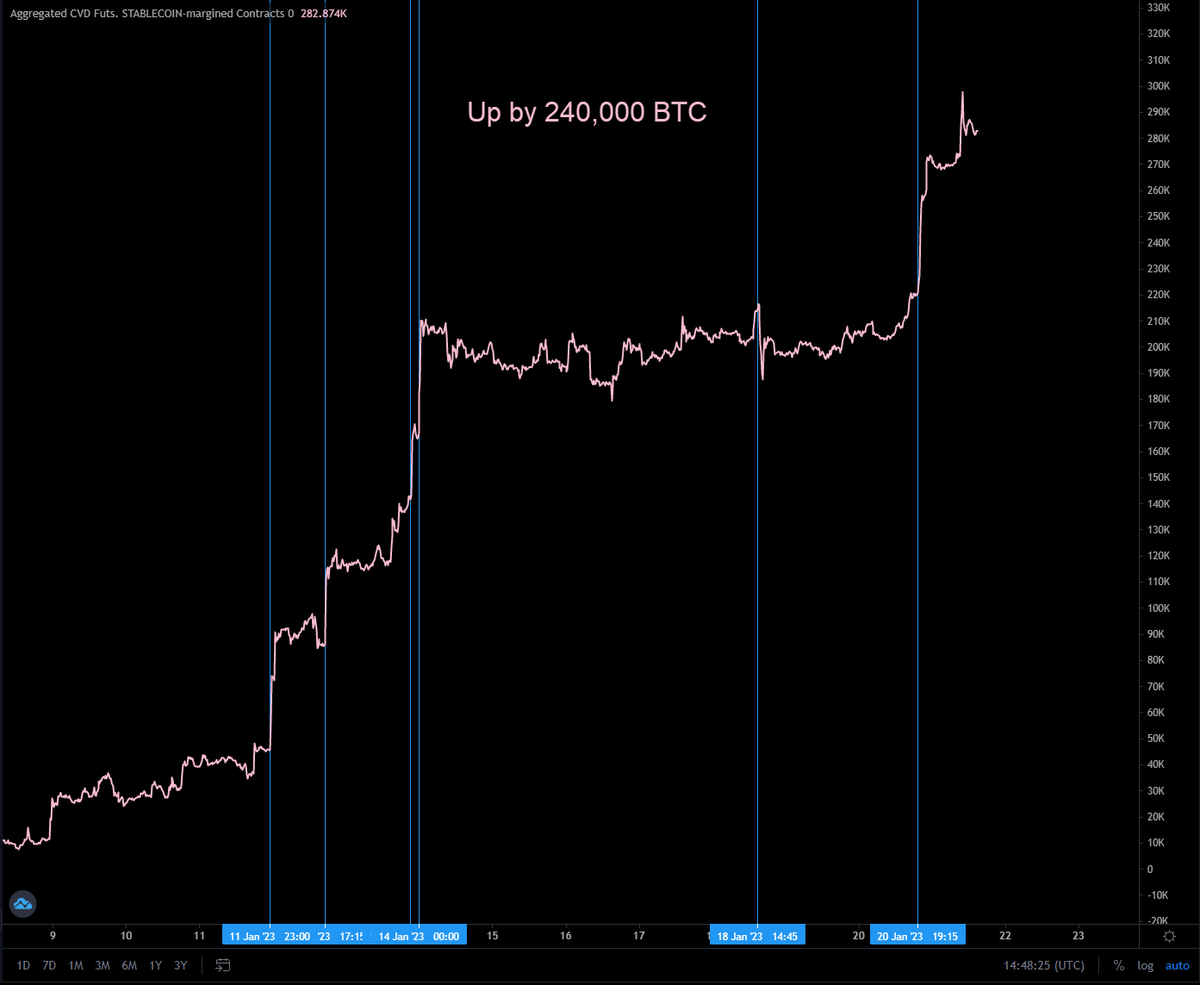

Since then I'm waiting for a pump or at least a lift up (2). Our netflow is indicating more outflows (bullish) than inflows (bearish), but since this morning more whales tokens arriving the exchanges. Anyway, the bullish signal is not strong yet, but the bearish signal not strong

enough either.

Our block view is showing also a dump (1) in whales ratio as announced yesterday. Also here our whales ratio 30D average (3) has declined. While our total netflow is showing big positive (2) moves since this morning, indicating bigger whales inflows to exchanges.

Our block view is showing also a dump (1) in whales ratio as announced yesterday. Also here our whales ratio 30D average (3) has declined. While our total netflow is showing big positive (2) moves since this morning, indicating bigger whales inflows to exchanges.

Futures showing a bearish sentiment confirmed with a declining funding (1) rate indicating more traders shorting. The leverage ratio keeps almost neutral (2) indicating no big high leverage positions involved in the new placed positions and no big liquidations (3).

Options also showing a bit more bearish sentiment since my last analysis yesterday. The 14Jan expiry has a total volume of almost $650m and has more calls than puts. That's bullish. We have still a max pain of 44k indicating we will reach this level at least friday.

The expiry 28Jan has declined in max pain from 50k to 48k indicating more bearish trades happenend since yesterday. Anyway, with a total volume of almost $1.9 billion its a good indicator. We have here much more calls ($1.3b) than puts ($600m). Interesting here, even if we have

a max pain of 48k yet, but the biggest strike is at 70k for this expiry with almost $170m in calls. I mean I'm flipping to bullish since yesterday, but 70k until 28Jan?! Is Nancy trading here? 😂

In 2.5 hours they will release the CPI. That could generate volatility. That would also explain the data, some bullish signals, but also dump preparations. So, expecting a big move at 2.30 pm (GMT+1). At the moment, I'm neutral. Still more bullish than bearish. But if the data

looks awful, we can dump heading 40k again. Otherwise 45k based on certain walls.

#FTX showing walls in 40k and 45.5k.

#Kraken showing walls close below our current level. No walls in upper ranges.

#Bitfinex showing walls at 46.6k (no big one) and lower ranges, the same like in

#FTX showing walls in 40k and 45.5k.

#Kraken showing walls close below our current level. No walls in upper ranges.

#Bitfinex showing walls at 46.6k (no big one) and lower ranges, the same like in

the last weeks at 39.2k (a small one) and at 38.5k a mid size one.

#Binance showing a tiny wall at 45k and a mid size wall at 40k.

And finally #Coinbase with a wall at 50k and a lower one at 40k

That's it. The first since weeks where I couldn't really create a solid trade

#Binance showing a tiny wall at 45k and a mid size wall at 40k.

And finally #Coinbase with a wall at 50k and a lower one at 40k

That's it. The first since weeks where I couldn't really create a solid trade

strategy based on the data. No trend is solid short-term. Bullish after this week. So, my trade strategy is keep my spots I bought yesterday, but thinking in stay away related to future trading atm. If we dump, that would be a nice opportunity to long the local bottom. To long

from here is risky imo. Low leverage is required to prevent a quick bad end 😜

Be careful and don't rush to risky trades. Max your risk management! Stay safe folks!

Be careful and don't rush to risky trades. Max your risk management! Stay safe folks!

Recent inflows. Another 5,500 #BTC to #Binance. I have checked the transaction. Is valid, from personal wallet to exchange it seems.

• • •

Missing some Tweet in this thread? You can try to

force a refresh