#DeepakNitrite

#Thread 🧵

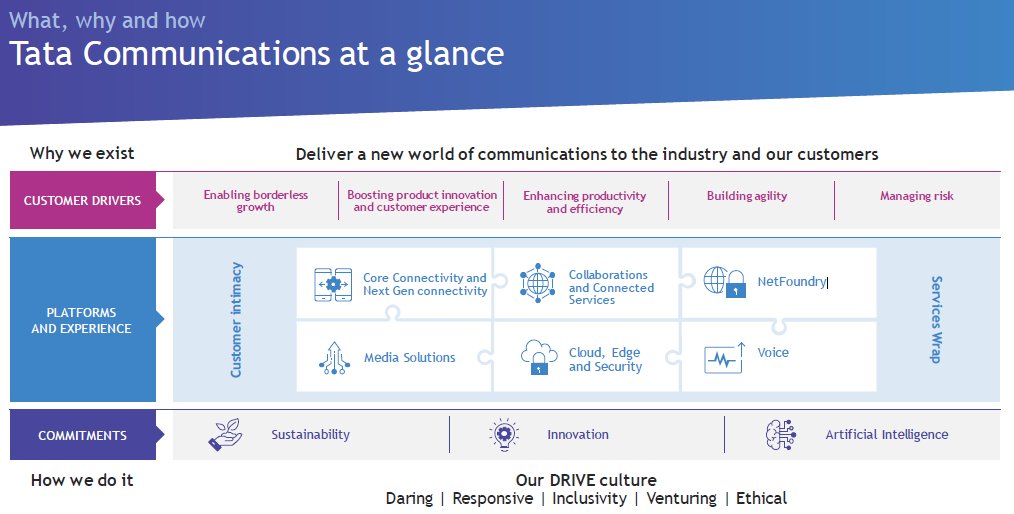

VISION: To become the FASTEST GROWING Indian chemical intermediates company.

Three Approach:

1⃣ RIGHT to WIN

2⃣ INTEGERATION

3⃣ IMPORT Substitution

#deepakntr

1/

#Thread 🧵

VISION: To become the FASTEST GROWING Indian chemical intermediates company.

Three Approach:

1⃣ RIGHT to WIN

2⃣ INTEGERATION

3⃣ IMPORT Substitution

#deepakntr

1/

#deepakntr

2/

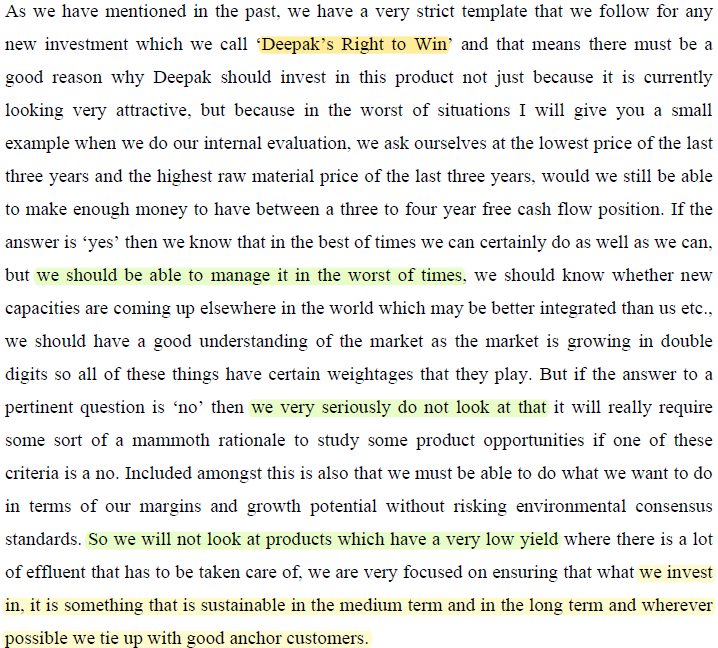

1⃣ Right to WIN

"We are very focused on ensuring that what we invest in, it is something that is sustainable in the medium/long term & wherever possible we tie up with good anchor customers so that but we should be able to manage the biz. in the worst of times,."

2/

1⃣ Right to WIN

"We are very focused on ensuring that what we invest in, it is something that is sustainable in the medium/long term & wherever possible we tie up with good anchor customers so that but we should be able to manage the biz. in the worst of times,."

#deepakntr

3/

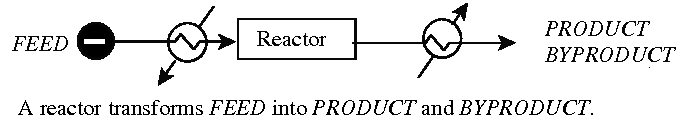

2⃣ INTEGERATION - Like a tree with strong roots, Deepak has and is growing taller with fresh branches and new off-shoots to fulfill its growth aspirations.

So, integration in backward, forward, horizontal & vertical.

P1: Simple process

P2: Integrated process

3/

2⃣ INTEGERATION - Like a tree with strong roots, Deepak has and is growing taller with fresh branches and new off-shoots to fulfill its growth aspirations.

So, integration in backward, forward, horizontal & vertical.

P1: Simple process

P2: Integrated process

#deepakntr

4/

3⃣ IMPORT Substitution: "Import substitution has always been an integral aspect of the Company’s business strategy. To take advantage of the positive demand landscape, it will continue to introduce value added downstream products that can replace imports."

-AR2021

4/

3⃣ IMPORT Substitution: "Import substitution has always been an integral aspect of the Company’s business strategy. To take advantage of the positive demand landscape, it will continue to introduce value added downstream products that can replace imports."

-AR2021

#deepakntr

5/

Journey & Evolution of Deepak Group:

👉Deepak Nitrite was incorporated by C.K Mehta in 1970.

👉It was started as a chemical trading business under the name of Deepak Trading during the early 1960s.

👉Gradually got into the chemical manufacturing

#investing

5/

Journey & Evolution of Deepak Group:

👉Deepak Nitrite was incorporated by C.K Mehta in 1970.

👉It was started as a chemical trading business under the name of Deepak Trading during the early 1960s.

👉Gradually got into the chemical manufacturing

#investing

#deepakntr

6/

Current Biz. verticals:

1⃣ Deepak Nitrite:

1. Basic Chemicals

2. Fine & Specialty Chemicals

3. Performance Products

2⃣ Deepak Phenolics

6/

Current Biz. verticals:

1⃣ Deepak Nitrite:

1. Basic Chemicals

2. Fine & Specialty Chemicals

3. Performance Products

2⃣ Deepak Phenolics

#deepakntr

8/

Plant locations along with product details.

Look at location & think kind of RM/by-product/product movement required between manufacturing plants!!

#portfolio #investing #StockMarketindia

8/

Plant locations along with product details.

Look at location & think kind of RM/by-product/product movement required between manufacturing plants!!

#portfolio #investing #StockMarketindia

#deepakntr

9/

Let's 1st discuss 'Deepak Phenolics'

👉It is a wholly-owned subsidiary of the Deepak Nitrite Ltd.

👉Commenced prod. at Dahej in 2019

👉Manufacture Phenol, Acetone & IPA derived from benzene & propylene (crude derivatives)

👉User: pharma., paints, laminates etc.

9/

Let's 1st discuss 'Deepak Phenolics'

👉It is a wholly-owned subsidiary of the Deepak Nitrite Ltd.

👉Commenced prod. at Dahej in 2019

👉Manufacture Phenol, Acetone & IPA derived from benzene & propylene (crude derivatives)

👉User: pharma., paints, laminates etc.

#deepakntr

10/

👉Deepak Phenolics Ltd. (DPL) has domestic market share for phenol & acetone 50%+

👉Forward integration into value-added derivatives

such as IPA

👉Doubling of the IPA plant to 60,000 MTPA is in plan

👉More value-added products is in pipeline in this segment

10/

👉Deepak Phenolics Ltd. (DPL) has domestic market share for phenol & acetone 50%+

👉Forward integration into value-added derivatives

such as IPA

👉Doubling of the IPA plant to 60,000 MTPA is in plan

👉More value-added products is in pipeline in this segment

#deepakntr

11/

So, let's explore the 'Basic Chemical' of Deepak Nitrite:

👉It is high volume & low/moderate margin across organic & inorganic chemicals.

👉High price sensitive, dependence on raw material availability.

👉Entry barrier due to the large scale & efficient operations

11/

So, let's explore the 'Basic Chemical' of Deepak Nitrite:

👉It is high volume & low/moderate margin across organic & inorganic chemicals.

👉High price sensitive, dependence on raw material availability.

👉Entry barrier due to the large scale & efficient operations

#deepakntr

12/

👉This segment not only entails limited margin, but is also exposed to crude price volatility, leading to unpredictable revenue

👉Act as a cashcow

👉The % share in overall revenue is on decreasing trend

👉New product additions/capacity expansion will drive value

12/

👉This segment not only entails limited margin, but is also exposed to crude price volatility, leading to unpredictable revenue

👉Act as a cashcow

👉The % share in overall revenue is on decreasing trend

👉New product additions/capacity expansion will drive value

#deepakntr

13/

Next segment is 'Fine and Specialty Chemicals (FSC)':

👉Niche & specialised products

👉These are specially tailored to the client’s specifications & typically manufactured in low volumes but higher margin

👉Developed in-house using expertise in process engineering

13/

Next segment is 'Fine and Specialty Chemicals (FSC)':

👉Niche & specialised products

👉These are specially tailored to the client’s specifications & typically manufactured in low volumes but higher margin

👉Developed in-house using expertise in process engineering

#deepakntr

14/

FSC

👉It looks to expand product offerings on back of continuous R&D, capacity expansions and growth in across multiple end-user industries, especially Agrochemicals & personal care

👉Efforts towards cost optimisation & adding new products for the pharma segment

14/

FSC

👉It looks to expand product offerings on back of continuous R&D, capacity expansions and growth in across multiple end-user industries, especially Agrochemicals & personal care

👉Efforts towards cost optimisation & adding new products for the pharma segment

#deepakntr

15/

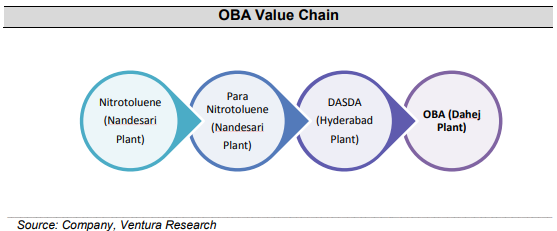

Next & final segment is 'Performance Products (PP)'

👉It has two key products i.e. Optical Brightening Agents (OBA) and Di-amino Stilbene Di-sulphuric acid (DASDA).

👉Fully integrated manufacturer of OBA from toluene to para nitro toluene (PNT) into DASDA & OBA

15/

Next & final segment is 'Performance Products (PP)'

👉It has two key products i.e. Optical Brightening Agents (OBA) and Di-amino Stilbene Di-sulphuric acid (DASDA).

👉Fully integrated manufacturer of OBA from toluene to para nitro toluene (PNT) into DASDA & OBA

#deepakntr

16/

PP:

👉OBA is a brightener commonly used in industries like paper (65%), detergent (20%) and textiles (15%).

👉It faces competition from Archroma and BASF in the domestic market and TFM, Transfar, Archroma & 3V in global markets.

16/

PP:

👉OBA is a brightener commonly used in industries like paper (65%), detergent (20%) and textiles (15%).

👉It faces competition from Archroma and BASF in the domestic market and TFM, Transfar, Archroma & 3V in global markets.

#deepakntr

17/

View on Performance Product (PP) segment by @Tijori1

17/

View on Performance Product (PP) segment by @Tijori1

https://twitter.com/Tijori1/status/1478369818407362563

#deepakntr

18/

Here is our view on above:

18/

Here is our view on above:

https://twitter.com/SampalikCapital/status/1478631969353191424

#deepakntr

19/

Nice depth & contrarian view by @drvijaymalik

19/

Nice depth & contrarian view by @drvijaymalik

https://twitter.com/drvijaymalik/status/1482228439105310724

#deepakntr #deepaknitrate

20/

#results-Q3FY22

EBIT %: Q3FY22 vs (Q3FY21)

BI: 19.9% 🔻 (23.9%)

FSC: 25.8% 🔻 (43.1%)

PP: 27.7% 🔼 (9%)

Phenolics: 17.8%🔻(23.3%)

Note: PP improved as guided by management in Q2FY22 con-call (Tweet#18)

20/

#results-Q3FY22

EBIT %: Q3FY22 vs (Q3FY21)

BI: 19.9% 🔻 (23.9%)

FSC: 25.8% 🔻 (43.1%)

PP: 27.7% 🔼 (9%)

Phenolics: 17.8%🔻(23.3%)

Note: PP improved as guided by management in Q2FY22 con-call (Tweet#18)

#deepakntr #deepaknitrate

21/

#results - Q3FY22

Highlights.

#StocksInFocus #investing #sharemarketindia

21/

#results - Q3FY22

Highlights.

#StocksInFocus #investing #sharemarketindia

• • •

Missing some Tweet in this thread? You can try to

force a refresh