Who's ready for an insane #altseason?

A short thread about how #Bitcoin is right now setting up for a historic altseason and second part of cycle

A short thread about how #Bitcoin is right now setting up for a historic altseason and second part of cycle

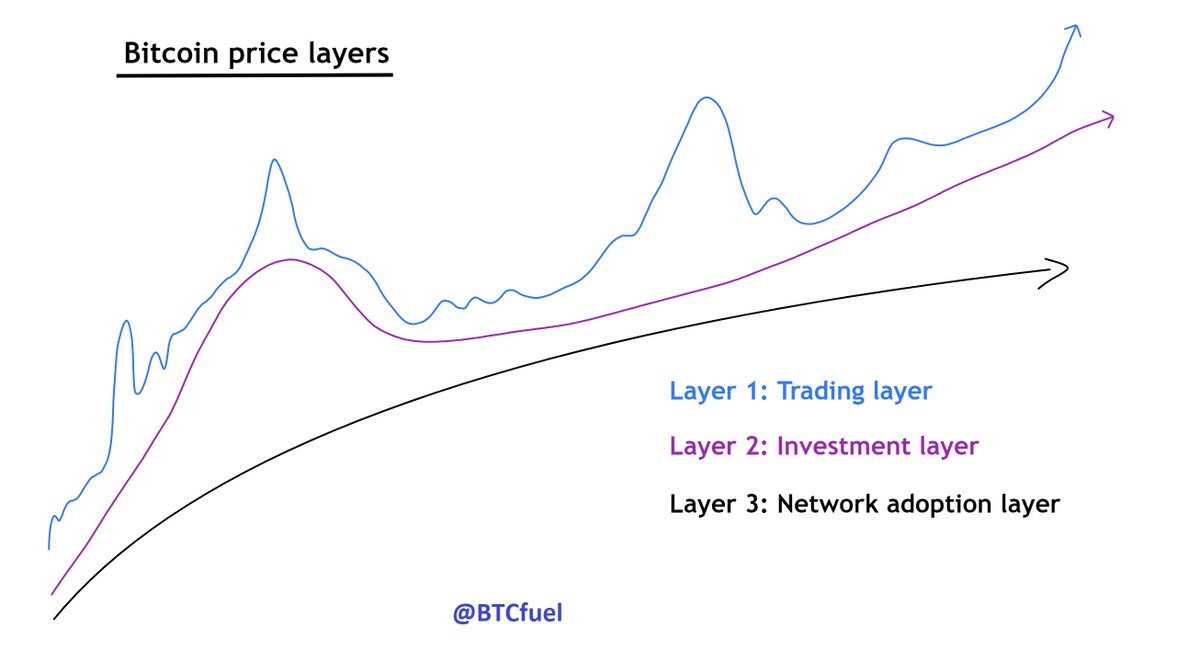

Most people do not realize Bitcoin is still very early in it's cycle. Compared to last cycle, crypto is now between what I call wave 2 and 3. Wave 3 in 2017 happened in the spring of 2017 with an insane altseason and alts outperforming #Bitcoin

https://twitter.com/BTCfuel/status/1482777129465126926

It looks like #Ethereum is confirming this, with an almost exact cycle setup as previous cycle, preparing for a huge altseason

https://twitter.com/BTCfuel/status/1484529630459547650

The OTHERS chart which are the top 125 alts (except from $BTC $ETH and some top alts). It just did an important retest. This is the altseason trigger. This dip is just a higher low in an uptrend for the alts

The OTHERS Dominance chart also shows a breakout retest. Resistance turning support. This altseason will be about the bulk of alts outperforming ETH and BTC

I believe the flippening could happen. This could be close to the peak of this altseason. I see the possibilty that alts will then start correcting and Bitcoin will go for its final leg, and where most altcoins only deadcat bounce in Bitcoin's final leg. (not sure though)

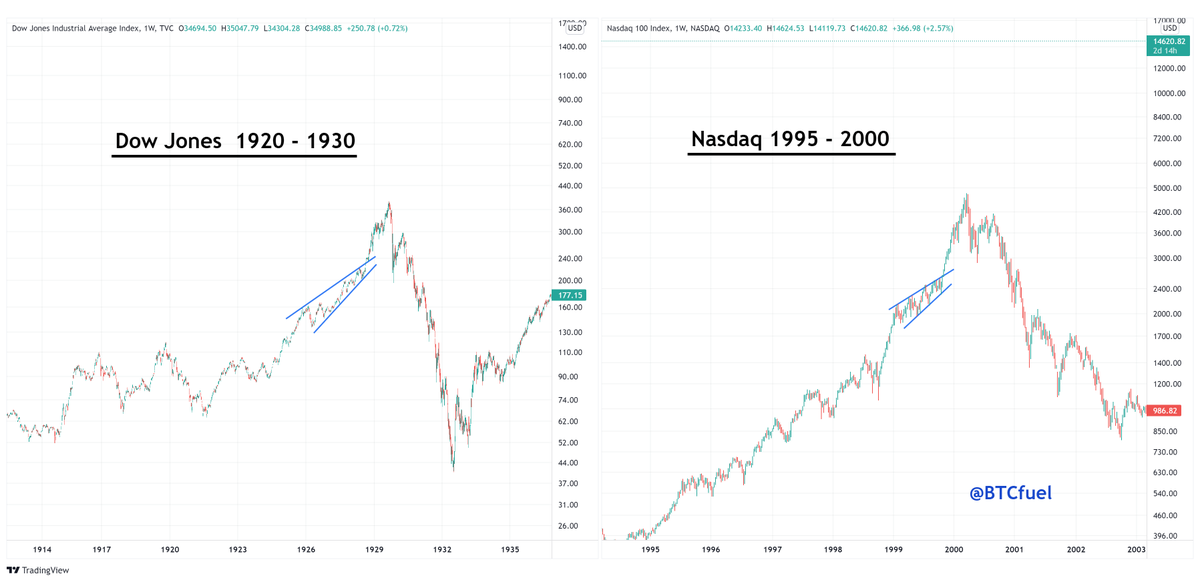

The Dotcom bubble peak was 7 years after WWW launch. #Ethereum was launched 30 July 2015. 7 years later would be 30 July 2022. I believe the altseason my could extent into Sep - Nov. (Because of parabolic bases in ETHBTC chart and ETH temporary dominant)

https://twitter.com/BTCfuel/status/1484527230667706368

The Dotcom Bubble was about 6 Trillion. Adjusted for inflation this would be about 10-20 Trillion nowadays. The big difference now is that buying stocks/crypto is way easier. You can even do it from a phone yourself

https://twitter.com/BTCfuel/status/1484527316202053632

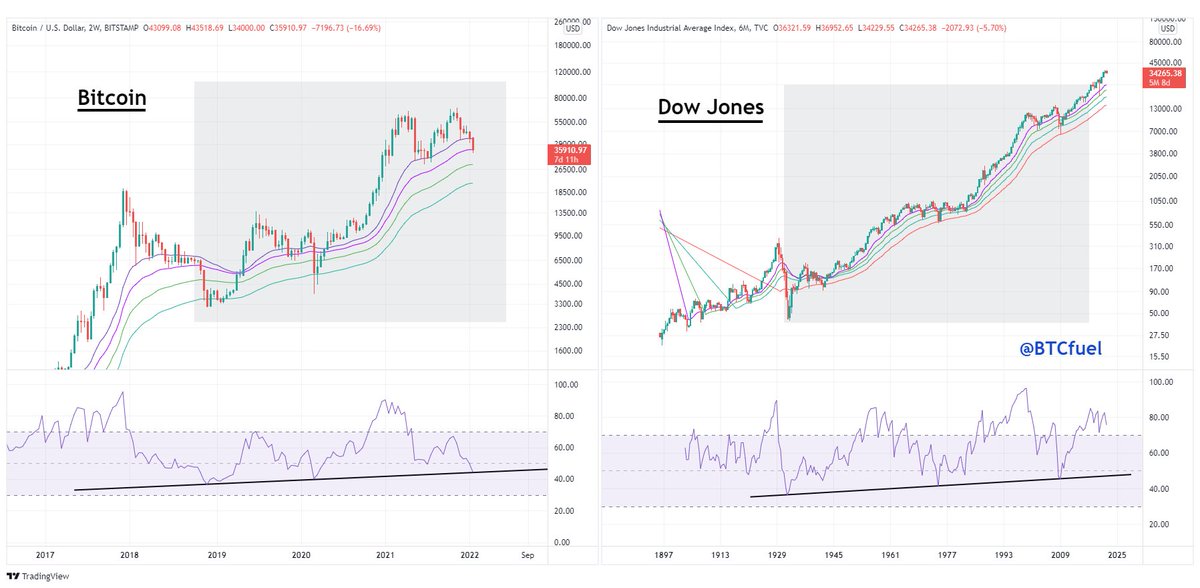

For now I think Bitcoin has almost bottomed out. This is where I think #Bitcoin is in its dip. I believe Bitcoin will recover quicker than most people think right now.

It looks like this dip is the trigger for the next big run, just like the March 2020 crash. When lots of people thought a bear market had started.

Higher timeframe RSI is now on support. #Bitcoin looks very similar to the Dow Jones. Good times ahead!

The end

• • •

Missing some Tweet in this thread? You can try to

force a refresh