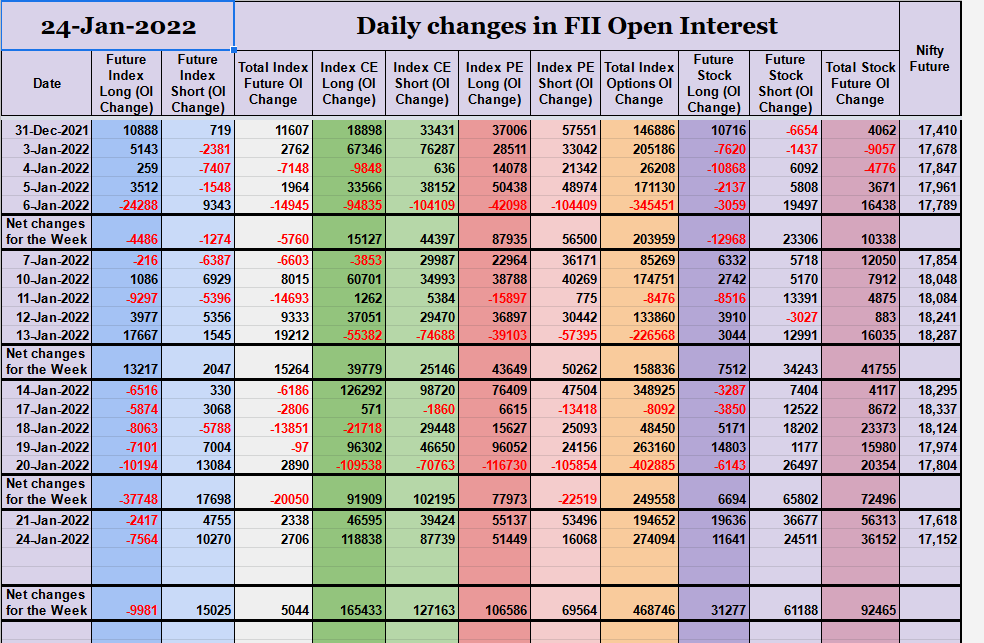

A lot of #OpenInterest traders will look at the high #OI of today in Futures

The #Nifty F addition was 30458 contracts, a high for the series of Jan

The #Banknifty futures addition was 6265 contracts today, not a high but big.

A quick thread on why this is a half- truth.

The #Nifty F addition was 30458 contracts, a high for the series of Jan

The #Banknifty futures addition was 6265 contracts today, not a high but big.

A quick thread on why this is a half- truth.

The futures market of today is just a fraction of the Options market.

Any day the options market beats the Index Futures 100 times & easy.

So if you are only looking at Futures Open Interest , you are reading just 1/100 th of the market

Any day the options market beats the Index Futures 100 times & easy.

So if you are only looking at Futures Open Interest , you are reading just 1/100 th of the market

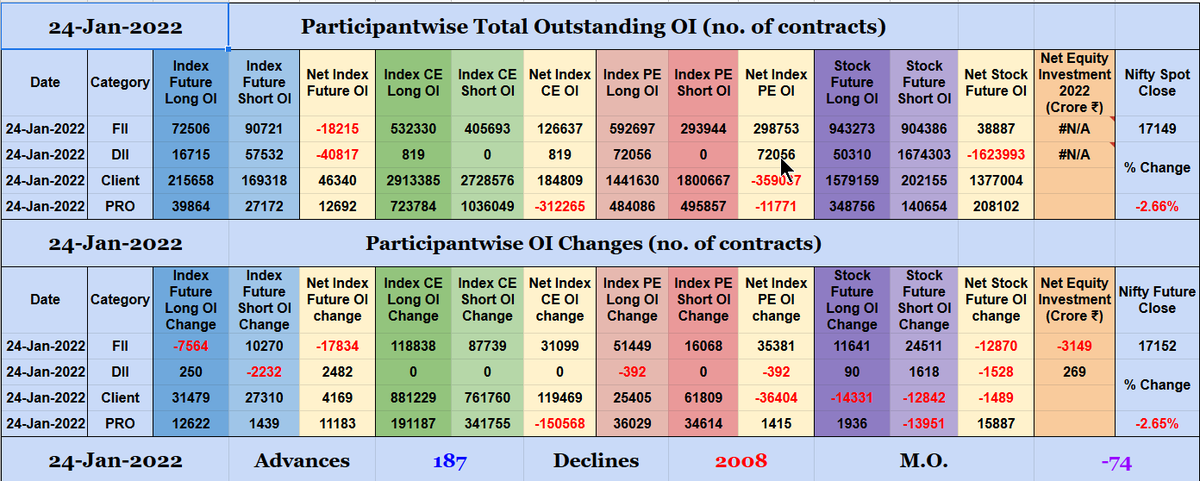

The entire market is not just divided between 4 players

a) FII's

b) Pros's

c) Retail

d) DII's

but is also hedged completely

So a long F in NF is with a short call as a pair.

Another reason you should not focus only on Futures OI

a) FII's

b) Pros's

c) Retail

d) DII's

but is also hedged completely

So a long F in NF is with a short call as a pair.

Another reason you should not focus only on Futures OI

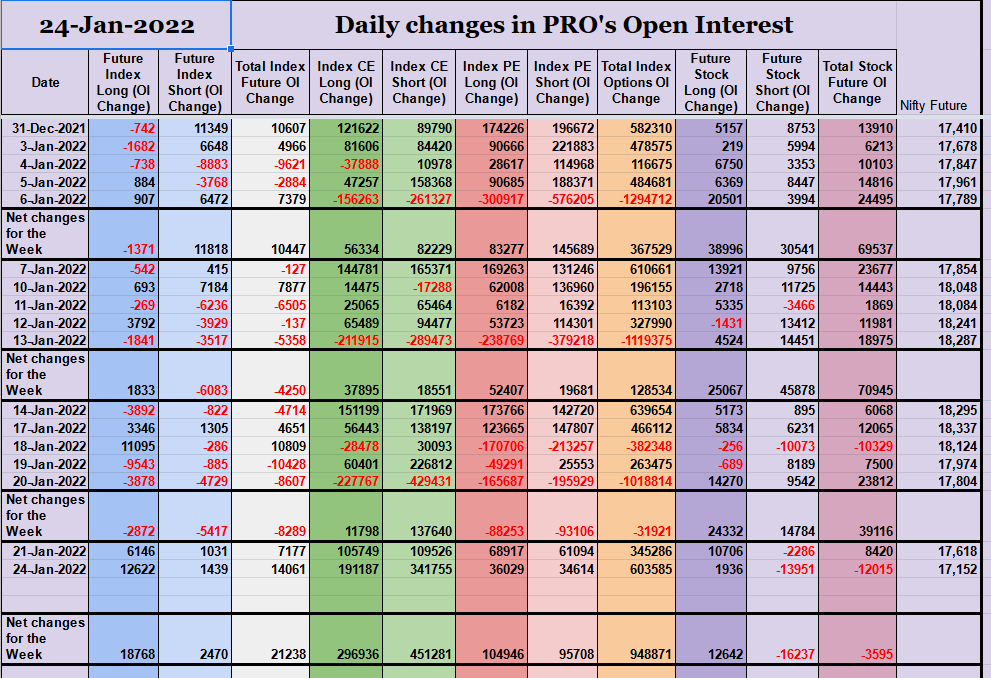

Fii's trade a bigger time frame than Pros.

So if you are looking at next 1- 3 sessions look at what pros do.

So if you are looking at next 1- 3 sessions look at what pros do.

The Above chart will show you that Pros are net long today at close whereas Fii's closed longs and added shorts, Retail is divided half and half almost and DII's don't trade much , but as mentioned previously that is just a half truth.

Stay with me will be clearer...

Stay with me will be clearer...

Here is a break-up of the options market of today

and as you can see Fii's added longs in calls

And Pros went short in calls

You see the hedge?

and as you can see Fii's added longs in calls

And Pros went short in calls

You see the hedge?

People extrapolate the data and justify all they want to see or like to see.

Truth is all these are super traders who trade a Friday to Thursday cycle. That's it . Nothing more

All these hedged and other positions are mostly closed on thursday.

How do we know?

Truth is all these are super traders who trade a Friday to Thursday cycle. That's it . Nothing more

All these hedged and other positions are mostly closed on thursday.

How do we know?

See the reds every 5th day

That is settlement day

Notice there is a drop in Open Interest whch means previous positions are closing.

This happens every Thursday.

This is for Pros

That is settlement day

Notice there is a drop in Open Interest whch means previous positions are closing.

This happens every Thursday.

This is for Pros

Long story short

The derivative market is fast & hedged

These people know what they do & trade in/ out quickly. You will never be able to guess what they do it by looking at data post 5 pm

Focus on your charts, It will tell you much much more about what the market can do next

The derivative market is fast & hedged

These people know what they do & trade in/ out quickly. You will never be able to guess what they do it by looking at data post 5 pm

Focus on your charts, It will tell you much much more about what the market can do next

My team works very hard to put all this data in place every evening.

You will find the charts I shared in the forum section of vtrender.com .

If you want a twitter alert when they are updated, follow @Vtrender on twitter

You will find the charts I shared in the forum section of vtrender.com .

If you want a twitter alert when they are updated, follow @Vtrender on twitter

• • •

Missing some Tweet in this thread? You can try to

force a refresh